FEES

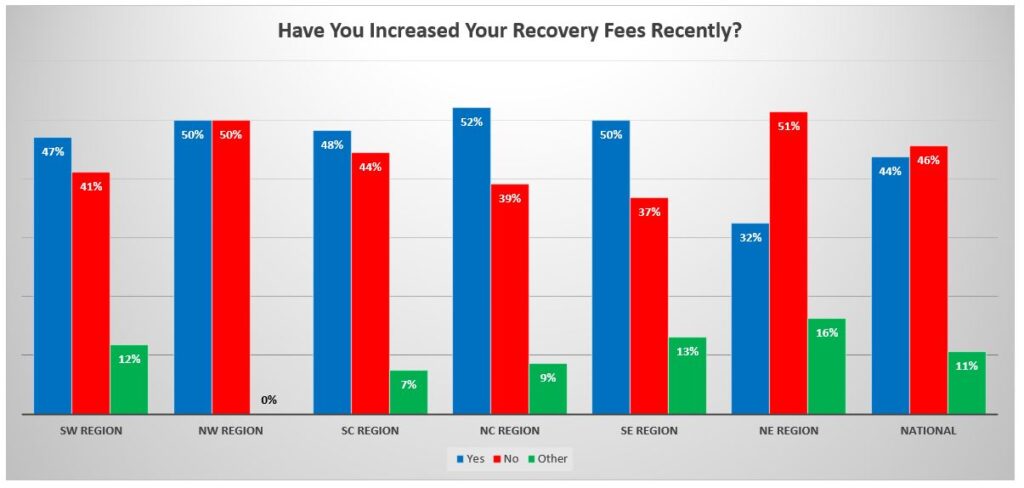

This is an area of major concern for all and, while there has been much discussion on social media about companies raising their fees during the lockdown, what and how are somewhat diverse. Overall, 44% stated that they have or are raising their fees with 46% saying they won’t and the 11% responding as “Other” provided answers that primarily stated that they were considering it or aren’t sure.

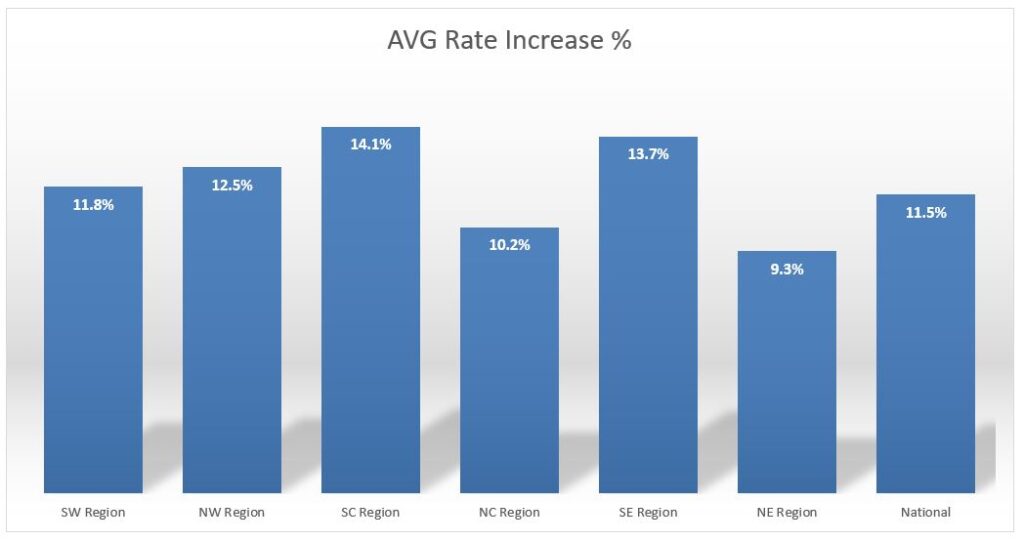

Of those responding affirmatively to the question of raising fees, they weighted national average increase was only 11.4%.

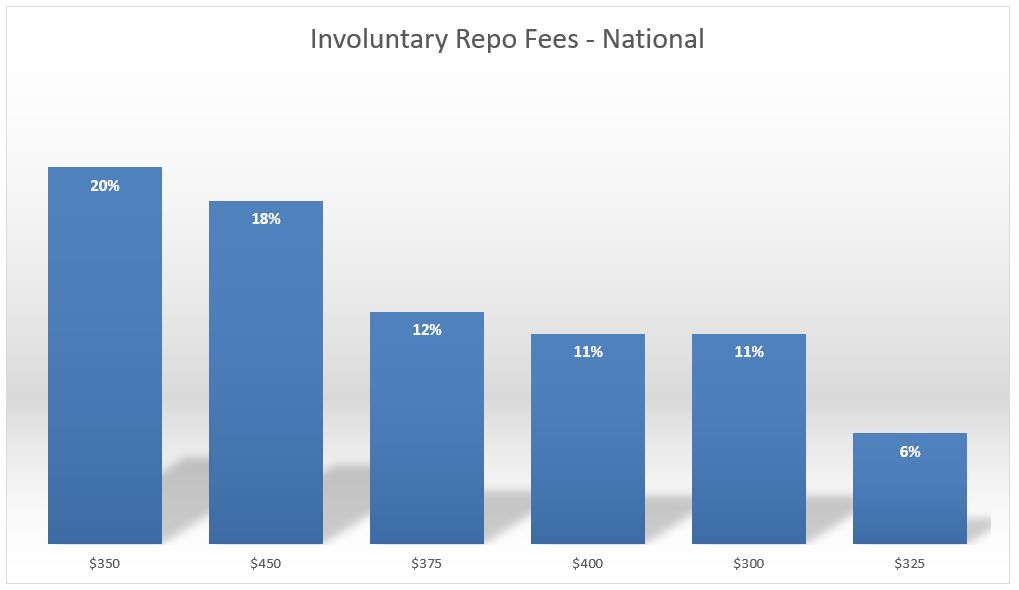

Involuntary repossession fees were reported to currently be a weighted national average of $368.05. Surprisingly, this was regionally lower in the South West Region, where operational expenses are much higher than in the areas that quoted the higher fees. That said, what rationale for the reported fees is in question, since agencies often work on multiple pay scales for different forwarders and direct lenders.

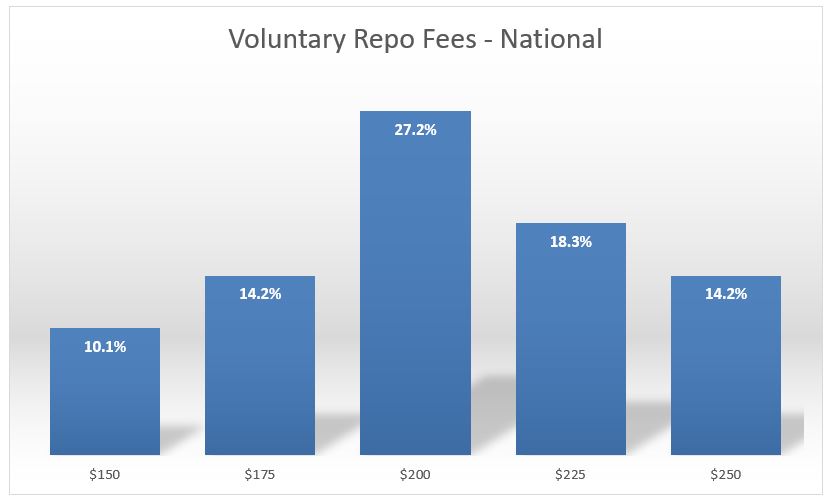

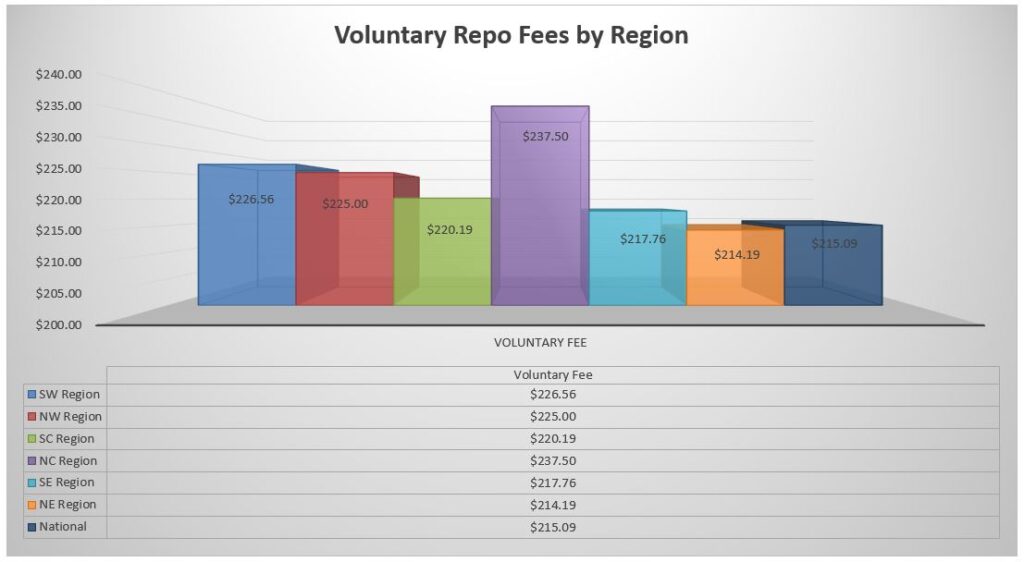

The national weighted average fee for a Voluntary Repossession is at $215.09.

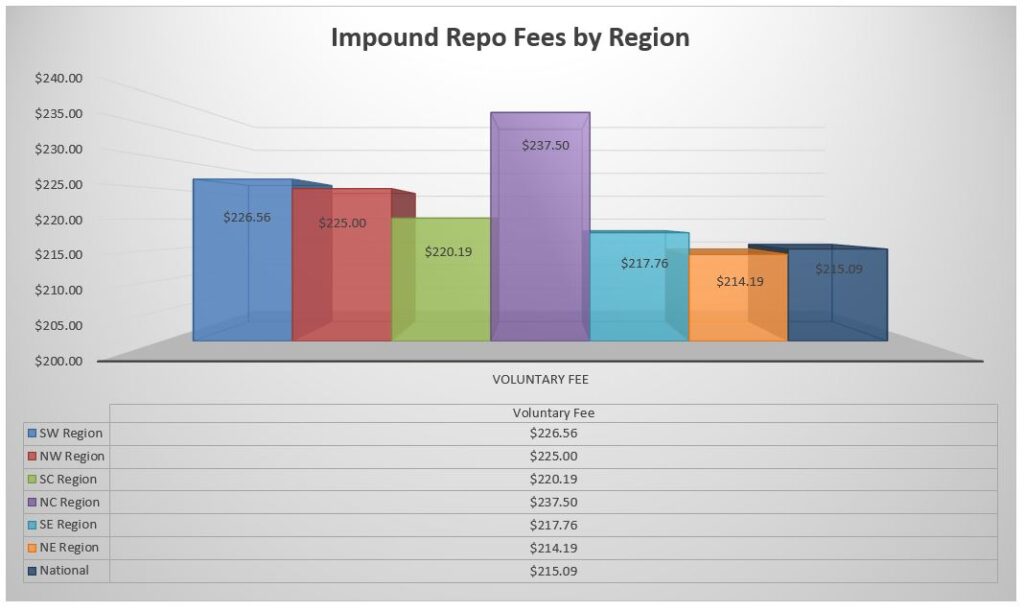

The national weighted average fee for an Impound Repossession is at $289.50.

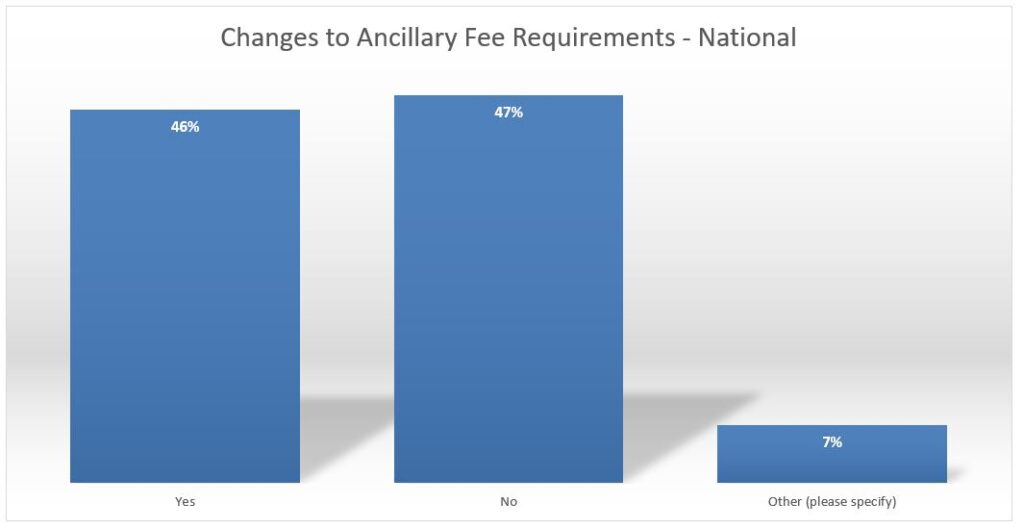

Ancillary Fees, a long lost source of agency income, appears to be another area where agency owners are split on whether or not they will change. As in the previous question, 7% of respondents are on the fence and seem mostly desiring to reinstate these fees.

Amongst the fees those who stated they will require payment of, Personal Property and vehicle storage charges to the lender are areas that they appear to be most desiring of enforcing. As far as vehicle storage to the borrower goes, these were most often being charged regardless.

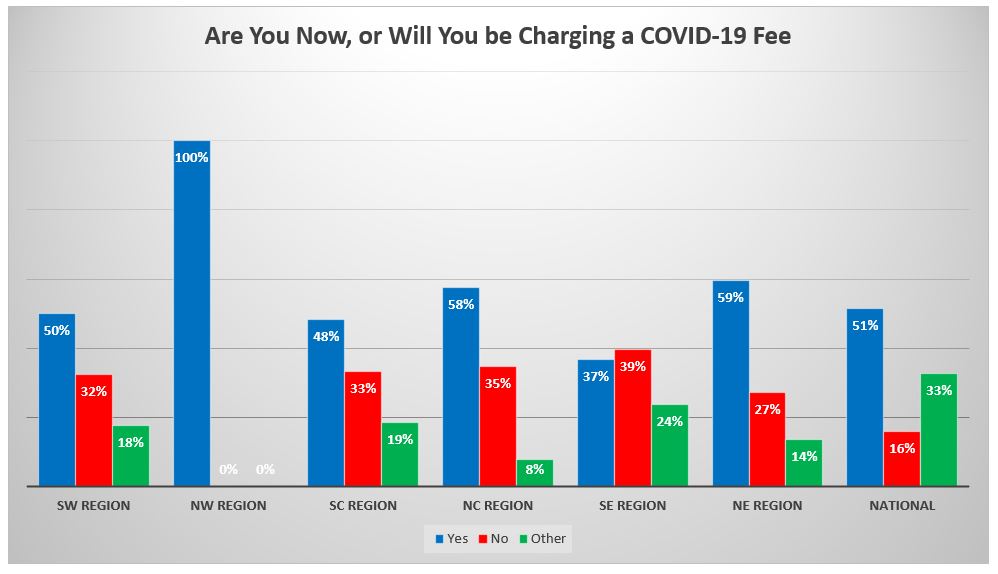

With the increased risks of contacting the COVID-19 virus, costs of PPE and associated risks in the field, 51% of respondents claimed that they will be instituting a COVID-19 Fee and the majority of the “Other” replies were in consideration.

Of the proposed COVID-19 Fees, the weighted national average is $34.71 per repossession.

Click on the below to proceed to the other sections

Facebook Comments