FORWARDERS

Everyone’s favorite gripe. Regardless, for many agencies, these are a major source of their assignment volume, but according to the survey responses, most are taking a serious look at the benefit of them, and for a number of obvious reasons.

According to the respondents, 50% have cancelled some of their forwarding contracts during the downtime and 7% claim to have cancelled all of them while another 6% claim to not work for any forwarders. With the recent push from some forwarding companies to attempt to push agencies back into the field with new lower fees and often in areas where involuntary repossession may not be deemed locally as an “essential duty”, it is probable that forwarding companies may find the agent pool dramatically reduced.

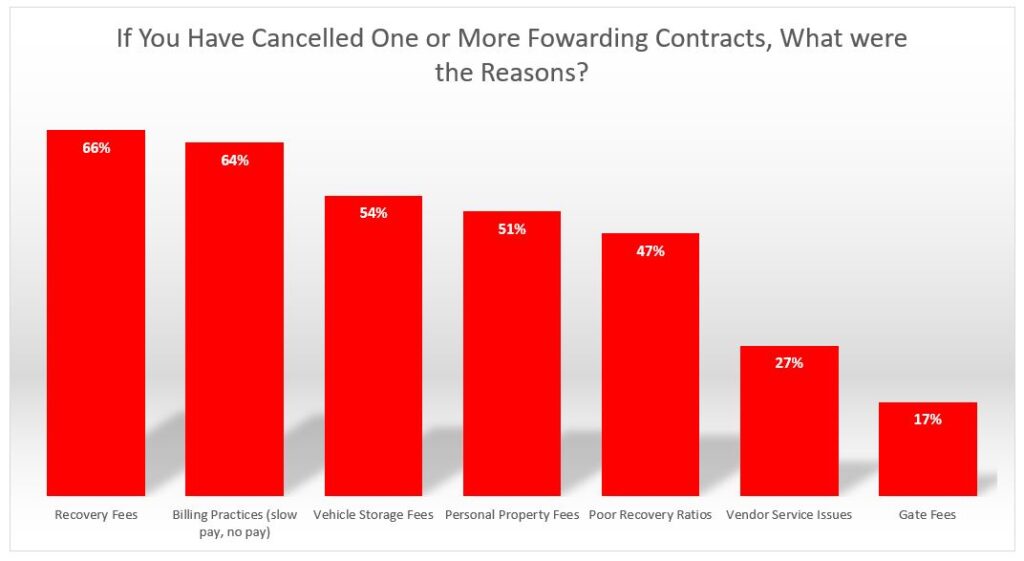

Recovery fees were the most obvious and largest reason for the cancellation of these forwarder relationships with slow payment processes a close second.

55% of all respondents claim to receive 50% or more of their repossession assignments through one or more forwarding companies with 33% receiving less than 30%. Overall, the weighted average forwarder volume was 44.7%.

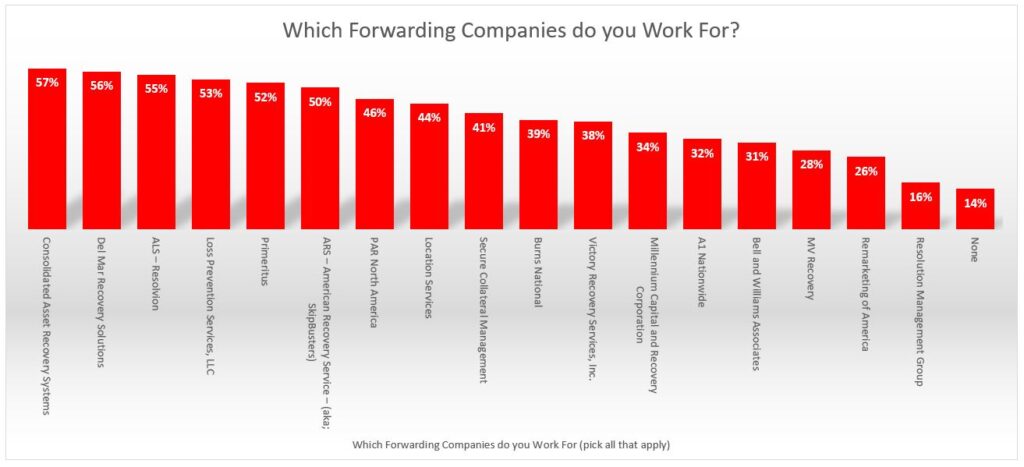

The most common forwarder that agencies reported to work for, was Consolidated Asset Recovery Systems at 57% with Del Mar and ALS Resolvion close second and thirds. While these two companies merged in November of 2019, it is difficult to know how many respondents were still referring to these separately. In our next survey, we will combine both under the name “Resolvion”.

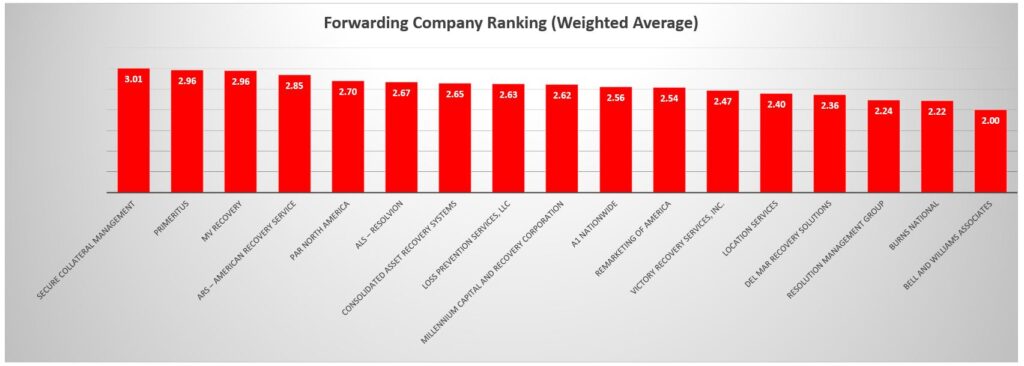

On a scale 1 = Poor, 5=Excellent, Secure Collateral Management, while only the ninth highest in agency partnership, scored best in agency satisfaction with a weighted national score of 3.1. Primeritus and MV Recovery were a tied second at 2.96 while only maintaining participation levels of 52% and 28% respectively. Despite Consolidated Asset Recovery Systems’ highest participation ranking, they only ranked seventh in agency satisfaction.

Click on the below to proceed to the other sections

Facebook Comments