CFPB Orders Repossession Data From Lenders

CFPB sets their sites on repo fees, forwarding, LPR, GPS and assignment data

The Consumer Financial Protection Bureau (CFPB) had been pretty quiet about repossessions for a while, but it looks like they’re back with a vengeance. Late last month they issued a bulleting announcing their order to nine large lenders to provide data on repossession fees, LPR, GPS and forwarder use just to name a few.

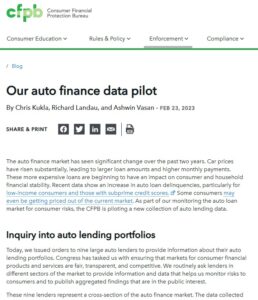

On a February 23rd in a CFPB blog titled “Our auto finance data pilot” it was announced that they are piloting a new program targeted at collecting auto lending data from nine of the nation’s largest auto lenders. These lenders, whose names are not included, are reported to represent a cross-section of the auto finance market.

On a February 23rd in a CFPB blog titled “Our auto finance data pilot” it was announced that they are piloting a new program targeted at collecting auto lending data from nine of the nation’s largest auto lenders. These lenders, whose names are not included, are reported to represent a cross-section of the auto finance market.

The CFPB reports that they intend to collect data from them in order to build a quality data set that provides insights into lending channels and loan performance. Of specific interest to them is the area of Loan Performance, which seems to focus on the repossession process itself.

Drilling Into the Repossession Process

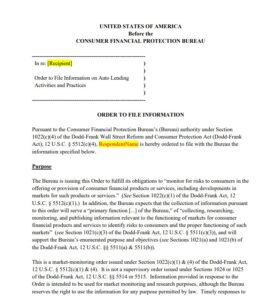

Amongst the loan performance-related questions posed to these lenders on their sample order are very specific questions regarding repossession practices and efforts that really drill down into the details on their repossession activities between the period of January 1, 2018, through December 31, 2022.

Below are just some of the many questions;

- whether the repossession assignment was issued to a repossession forwarding company (if applicable);

- whether the repossession assignment was issued to one repossession agent or to more than one repossession agent, including agents working for repossession forwarding companies or LPR networks (if applicable) [Any accounts you place on a repossession forwarding company hot list must be included in the “more than one” category if the repossession forwarding company allows multiple repossession agents to recover the vehicle based on that hot list];

- whether the repossession was completed using LPR or an LPR network (if applicable) [This question asks if the specific automobile in question was physically recovered through the use of LPR technology. If you place the account with a repossession forwarding company that uses LPR but LPR was not used for this account, do not include it here];

- whether repossession was completed with the use of a SIGPS device (if applicable);

- if the repossession was completed with the use of a SIGPS device, whether any starter-interrupt functionality was used at any point in the process (if applicable);

- date the borrower redeemed the vehicle (if applicable);

- amount borrower paid to redeem the vehicle (if applicable);

- date on which disposal was completed;

- total dollar amount recovered from disposal;

- total amount of fees paid to third parties in connection with the repossession or voluntary surrender of the vehicle;

- total amount of fees paid to third parties in connection with the disposal of the vehicle;

- total amount of fees charged to the borrower in connection with the repossession or voluntary surrender of the vehicle;

Read the Entire Lengthy Sample Order Here!

As you can see from their laundry list, the data has the potential to be the most detailed data pool on the repossession process ever. What they do with it is another question.

UDAAP Issues

It’s been just over a year since the CFPB issued their Winter 2023 Supervisory Highlights Junk Fees Special Edition, aka; “Junk Fees Special Edition” when they touched on the consideration that excessive repossession fees could be considered a unfair, deceptive and abusive practice (UDAAP).

In section 2.2 titled “Auto Servicing”, in section 2.2.3 titled “Charging estimated repossession fees significantly higher than average repossession costs”, they stated;

Examiners found that, where servicers allowed consumers to recover their vehicles after repossession by paying off the loan balance or past due amounts, servicers charged a $1,000 estimated repossession fee as part of the amount owed. This estimated repossession fee was significantly higher than the average repossession cost, which is generally around $350. By policy, the servicers returned the excess amounts to the consumer after they received the invoice for the actual cost from the repossession agent.

Examiners found that the servicers engaged in unfair acts or practices when they charged estimated repossession fees that were significantly higher than the costs they purported to cover.

Looking for greater clarity, I managed to establish some dialogue with the CFPB’s Office of Public Affairs Spokesperson, Tia Elbaum, who stated that; We’re concerned about servicers that charge fees above the actual applicable cost to the company, whether the company at issue is the lender or the repossession management company.

As far as I know, all of their interest in the matter seemed to have died following this. What I had assumed to be a statement with significant ramifications to the repossession industry turned out to be a big ‘Nothing Burger.’

Well, that is until now.

Keeping in mind that it took them a year to get this far and will take them months to acquire the data and more months to analyze it to make any further statement, it might be another year until this grows legs and has the potential to go anywhere.

By then, who knows, we may have a new President. And with a new President comes firings and the CFPB is prone to draw such an action as it did before. And after that, there will probably be new appointments who may have little or no interest in pursuing this.

Time will tell.

Kevin Armstrong

Publisher

Facebook Comments