Credit Acceptance Corp. Takes The Lead in Repossession Safety

Credit Acceptance will review the situation and if the threat has merit, we will pay the full involuntary repossession amount.

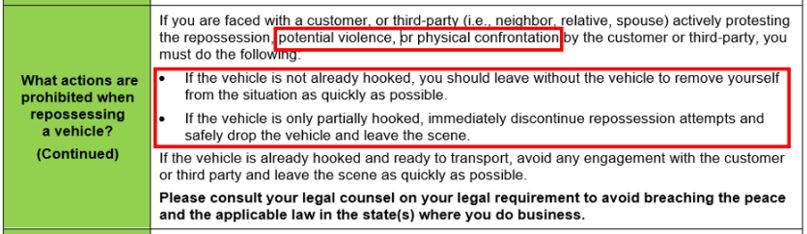

No lender wants blood on their hands over a stupid car and Credit Acceptance Corporation (CAC) has taken a bold and noble move to do all they can to avoid it. In an April 18th memo distributed to their agent network, they have agreed to pay full involuntary repossession fees to agents for leaving the scene of a repo to avoid the potential for violence or physical confrontation.

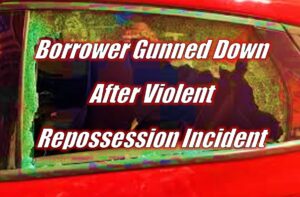

More repossession agents were murdered in 2023 than in any year on record. In addition, there were more stabbings, beatings and gunshot wounds than can even be counted since most go unreported. In response, the repossession industry has been gearing up with conflict avoidance training, body armor, cameras and in some areas, firearms. But one lender has taken their own measures to do all that they can to avoid these in their own way.

On April 18th, Credit Acceptance Corporation (CAC) issued a memo to their agent network titled; “Encountering Threatening / Violent Situations During Repossession.” In its contents it proposes;

In an effort to reduce potentially violent situations, Credit Acceptance will offer compensation for having to leave the vehicle, if the threat is found to have merit. Not only does it say that they will compensate, but it also says that they will pay the full involuntary repossession amount.

Read or Download the Memo Here!

This is probably the most dramatic lender created policy to address repossession violence in the history of the industry. Never before to my knowledge has a lender, least of all, a large subprime lender with massive repossession volume, taken such a huge step in improving agent safety in the field.

This is probably the most dramatic lender created policy to address repossession violence in the history of the industry. Never before to my knowledge has a lender, least of all, a large subprime lender with massive repossession volume, taken such a huge step in improving agent safety in the field.

It has long been complained that contingent repossessions, where the agent does not get paid unless they recover the vehicle, are the largest contributor to agent breaches of the peace and major factors in agents pushing their luck with often deadly consequences.

While the repossession industries war against contingent repossession assignments is mostly lost, this is a massive step toward encouraging agent safety through compensation for avoiding dangerous confrontations.

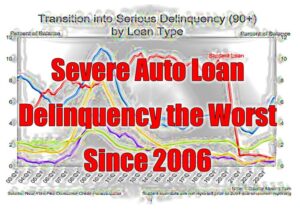

Credit Acceptance Corporation (CAC) has been a constant target of the CFPB over their subprime lending practices who they claim are predatory as they have very high default rates. Regardless, CAC manages to maintain strong profits because they maintain strong yields despite these losses all while providing credit to many who would otherwise have no options. They provide a valuable service to those same people, the majority of which do not default.

I, for one, as well as the American Recovery Association (ARA) in a recent email blast, applaud CAC in taking this monumental policy move. While none of us may never know if or whose lives were saved by this move, it is the greatest policy change toward agent safety that I have seen in my many years.

This measure, coupled with the aforementioned safety measures being implemented may not be capable of stopping all violent confrontations in the repossession industry, but they should be the boilerplate template for borrower and agent safety across the nation.

I can only hope that other lenders will see the merit in this policy and adopt the same. No one in their right mind wants blood on their hands over a repossession. It’s just a stupid car and not worth anyone’s life.

CAC took the bold first step. Now, lets see who’s the next to step up.

Kevin Armstrong

Publisher

Facebook Comments