Self Help Repossession – Must be “Peaceful” in order for it to be legal.

Guest Editorial

Right and wrong are subjective sides of the argument that do nothing but decrease safety and increase liability! Arguing right and wrong on my team will get you one and one answer only; “Just because you can does not mean you should” as the justification does not have any weight against the elevated risk. It does however reflect the general attitude toward policy and the redirection of ego will only happen once.

The following is an excerpt from our field training manual outlining our Standard Operating Policy on Customer Denial as part of our No Follow, No Chase policy. I sent the entire policy to Kevin so he can attach it for those who want to download. This is only one section and even though it covers a lot, I would still ensure that you add something somewhere outlining never to return when threats or made or inferred and how to handle documenting and never returning to the customers address.

Customer Denial

Self Help Repossession – Must be “Peaceful” in order for it to be legal.

No Means No – The authority to repossess collateral comes from one of two parties who have authority over the property. One party is asking for the collateral to be secured on their behalf, the other is denying that authority. The simple denial of the party expressing immediate control over the property has the immediate domain over the property and a disagreement would have said to occur at the time the controlling party denies the right of the other party to take domain over the property.

Read the Entire “No Follow No Chase Policy” Here!

The goal of this policy is to minimize risks to customers, society, and operators, as well as to reduce the company’s liability exposure. This policy does not exist in isolation; it is part of a broader company ethos that prioritizes Safety, Quality, Integrity, and Respect.

Other key aspects of this policy include hourly rates with performance-based incentives. Recovery of collateral is one part of these incentives. When a team member adheres to any policy that restricts unit recovery—our systems are designed to record such compliance—they will receive the incentive regardless of whether our company is compensated.

Moreover, our team members must disengage from any unit where law enforcement intervenes unless supported by a specific legal directive, such as a writ.

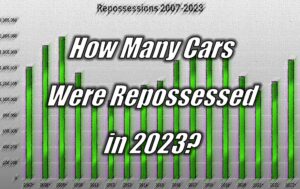

Why does this article matter?

If you’re unaware of the recent news about Steve Perkins’s death in Alabama, I recommend researching it. Consider how a policy like ours could have safeguarded many individuals. From the consumer, officers, agent, their families, and on and on.

This entire thing disturbs me in many ways; enough to compel me to share my thoughts on it as well as our policy. I hope someone finds it useful enough to take to heart and maybe prevent one similar event in the future.

– As a human, I am just saddened for the individuals and their families.

– As an American, the ignorance leading to such a tragedy is disheartening. We are a better nation and the politicization of events like these may be necessary for change but always leaves a scar with unintended consequences.

– As an employee, I’ve seen companies prioritize capital over safety, to no good end.

– As a former deputy/investigator, the footage of the incident (if authentic, and faking video is difficult) suggests a civil rights investigation will follow or should especially considering the predetermining circumstances.

– As a company owner the financial and legal exposure to the finance and towing companies involved is considerable and I am sure all companies will be impacted in some way by these events whether it’s just negative publicity or something far worse.

– As an industry steward, I am embarrassed and quite frankly enraged that we end up having to defend our own company and teams against this type of publicity. As mature owners, we should all be crying foul.

Now for those that will say “you don’t know all the facts.” I say your right, but I am not concerned about the facts, only that there are so many different things that could have prevented many of the opportunities for making bad decisions leading up to the Mr. Perkins death that right and wrong become a subjective stance that does nothing to prevent similar tragedies from happening in the future and that in itself behests another tragedy of Americanism which I severed proudly to defend many years in numerous capacities.

Before moving on, let me make one thing clear, I am not egotistical enough to think for one second that I am always right, have always been in the right and/or bad things cannot happen to me, my team and or our company. Any single bad decision by any one of our people, including myself can lead to a tragedy at any moment. I just hope the policies and guidelines we operate by keep us from having the freedom of making bad decisions when we are not thinking clearly or are involved in a stressful situation. That is after all their underlying purpose.

Now, moving past my personal perspectives.

I’ve stated before, and I reiterate: our associations must engage with individuals from day one in the industry, not just with mature companies and their owners. By the time an agent becomes an owner, the cultural damage is often irreversible.

Consider this analogy: Imagine only reaching out to train and influence people who call themselves nurses, doctors, and surgeons.

As owners, there’s a slight presumption of knowledge from our team members and society. However, if owners have been influenced to place capital above professionalism, disrespect and unsafe practices could be translated by anyone as a roadmap to success. This can lead to the undermining and discounting of any values associations attempt to provide vis-a-vis policies, practices, and education.

Allowing and seeking agent members is a great way for associations to gain insight into their member companies as the agent member will reflect the hiring practices and culture of the companies they represent. This insight can help associations quickly identify and address companies misusing the association name, reputation, and influence.

As for a company wondering about your team members attending association events I say; If you’re unwilling to take your team member to an association meeting, you probably should not be employing the team member.

Like most things of good intentions, it started soundly enough, but compliance has been hijacked and turned into a sham to conceal liability.

Site inspections are a particular frustration. They can become preoccupied with tangential concerns, like fire extinguisher presence or car locking protocols, neither of which truly speak to a company’s culture. The efforts often degenerate into marketing ploys and potential legal snares.

Imagine a courtroom scenario where a lender/broker must justify their relationship with a company involved in a tragedy:

Attorney: “Why did you believe this company was legitimate and why did you continue to have a relationship with them?

Lienholder/Broker: “Well they had a fire extinguisher, a shredder, demonstrated their computers were password protected, and they had a fence with some cameras.”

Attorney: “Did their employees have any training?”

Lienholder/Broker: “Oh yes, they have training for their employees it’s through….”

Attorney: “I see and did this employee have any training that was working this assignment?”

Lienholder/Broker: “I am not sure as we do not look at each assignment and who is running it.”

Attorney: “So you don’t care if a team member who is running the assignment is trained; only that the company shows some training history, correct?”

Lienholder/Broker: “Well…..”

Attorney: “Ok, fine, so the company has a history of some of their people taking some “standardized” training, did you review their policies?”

Lienholder/Broker: “Well….”

Attorney: “Ok, so you got a copy of their policies and stuck them in a folder……”

This hypothetical conversation illustrates that real due diligence goes beyond checking boxes and how today’s “compliance” is truly a rainmaker for attorneys worth a fraction of what their education cost.

Building genuine relationships is the only real way to know if a company has a culture aligned with your expectations.

Historically, companies like Allied Finance before switching to a brokerage model and Remarketing Solutions before being bought out, understood that true knowledge of vendors comes from personal interaction, not paperwork. If those involved in cases similar to Steve Perkins case had personally visited the repossession company, they might have sensed potential issues.

In conclusion, associations and state organizations thinking about legislation to reign in brokers or rogue companies, consider placing bi-annual inspections by an employee of the broker/lender accompanied by personal visits to truly vet companies. Ensure language exists that prohibits the company from placing the cost in any way on the field service company or this will become just another way for larger companies to keep competition out of their markets.

Lienholders and brokers alike will have a tough time hanging on to rogue companies when they are forced to meet with them and then testify in court and/or explain to their shareholders why they thought it was such a good idea to hire them.

As for me and our team, No Means No, and any rejection on behalf of the person who has authority and domain of the collateral should be respected and documented.

For us, upholding this simple principle can avoid legal disputes and enhance the safety and profitability of our company and the industry. If ever faced with a direct “Do not return…,” we will view it as a cease and desist rather than to risk further confrontation.

We will track all communications, and if there’s any hint of danger, we will inform the client and tell them to proceed legally. Be warned, we will be sure to document any safety concerns and in the event of injury to a customer and/or fellow repossessor during a subsequent repossession attempt, the information will be there for the responsible parties to be held accountable.

**Side note, as you research this article you will find that this first incident is not the end of this horrible story. We cannot always prevent everything, but we can reflect and adjust helping limit the number potential negative outcomes until the odds are as good as we can make them.

~ Stay Safe

Wes Carico

Nostalgic Towing/Artis Recovery

Should you be interested in more information about employee handbooks, policies, and other ways to protect your company, team, and society, join your state and or national associations. If you’re worried about doing that, give me a call, I won’t spoon food you if you’re not serious about getting it right, but I’ll help whoever has a legitimate desire to run a better business.

Facebook Comments