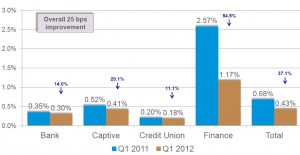

June 21, 2012 – In Experian’s 1st Quarter “State of the Automotive Finance Market” report, it was reported that in the first quarter of 2012, auto repossessions were down 37.1% or, 25bp lower than they were in the first quarter of 2011. This coupled with a 19bp improvement in 30-day delinquencies paints a picture of yet another thin year for both the repossession and the auto collections industries.

June 21, 2012 – In Experian’s 1st Quarter “State of the Automotive Finance Market” report, it was reported that in the first quarter of 2012, auto repossessions were down 37.1% or, 25bp lower than they were in the first quarter of 2011. This coupled with a 19bp improvement in 30-day delinquencies paints a picture of yet another thin year for both the repossession and the auto collections industries.

Experian – Auto Repossess Rates Down 37% from Last Year

June 21, 2012 – In Experian’s 1st Quarter “State of the Automotive Finance Market” report, it was reported that in the first quarter of 2012, auto repossessions were down 37.1% or, 25bp lower than they were in the first quarter of 2011. This coupled with a 19bp improvement in 30-day delinquencies paints a picture of yet another thin year for both the repossession and the auto collections industries.

June 21, 2012 – In Experian’s 1st Quarter “State of the Automotive Finance Market” report, it was reported that in the first quarter of 2012, auto repossessions were down 37.1% or, 25bp lower than they were in the first quarter of 2011. This coupled with a 19bp improvement in 30-day delinquencies paints a picture of yet another thin year for both the repossession and the auto collections industries.

Facebook Comments