Statistical Evidence Transforms Legal Theory into Documented Industry-Wide Pattern

By Wes Carico, Artis Recovery | Author, Georgia Personal Property White Paper

December 2025

Introduction

Recently, I published the Georgia Personal Property White Paper arguing that O.C.G.A. § 44-14-411.1 grants repossession agencies non-waivable statutory possessory lien rights, and that contractual provisions requiring agencies to waive these rights are void and unenforceable.

The paper was an analysis of statutory text, case law, and contract principles. It is and was not legal advice, I’m not an attorney.

The arguments were commonsense and, in your face, but as an industry had never been articulated against legal text and/or theory. Reasons for this is also obvious – cost and simple ability. AI has changed this for better or worse.

Shortly after, Kevin at Curepossessor.com published an industry survey gathering responses from repossession agencies nationwide regarding contractual restrictions, financial impacts, and operational effects. The survey consisted of 10 questions aimed at challenging the assertions in the White Paper.

This article examines how the survey results challenge—or validate—the white paper’s core legal arguments.

The White Paper’s Five Core Arguments

1. Statutory Possessory Lien Rights Cannot Be Waived by Contract

The statute provides that agencies who lawfully repossess vehicles “shall have a lien” for “reasonable expenses” related to personal property handling. The word “shall” is mandatory. The statute contains no waiver provision. Under Georgia precedent (Cook v. Covington Credit, 286 Ga. 144), statutory rights cannot be waived without express legislative authorization.

Prediction: If this analysis is correct, we would expect to see widespread contractual provisions attempting to prohibit or restrict fees the statute permits.

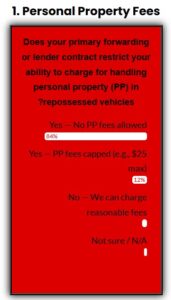

Survey Results – Question 1:

“Does your primary forwarding or lender contract restrict your ability to charge for handling personal property?”

- Majority: “Yes – No PP fees allowed”

- Significant portion: “Yes – PP fees capped (e.g., $25 max)”

- Minority: “No – We can charge reasonable fees”

Analysis: The survey confirms that the majority of agencies operate under contracts that prohibit fees the statute expressly permits. This validates the white paper’s premise that statutory override is occurring systematically, not as isolated incidents.

2. Contracts Obtained Through Economic Duress Are Voidable

Even if waivers were theoretically permissible, Georgia law (O.C.G.A. § 13-5-6) provides that contracts obtained through economic duress are voidable. Economic duress requires: (1) wrongful threats, (2) no reasonable alternative, and (3) involuntary agreement.

Prediction: If economic duress exists, we would expect to see agencies reporting they signed contracts under explicit or implicit threats of account termination, with limited alternatives due to industry consolidation.

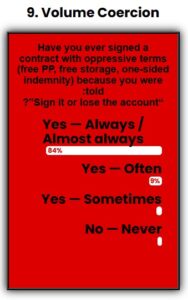

Survey Results – Question 9:

“Have you ever signed a contract with oppressive terms because you were told: ‘Sign it or lose the account’?”

- “Yes – Always / Almost always”: Largest group

- “Yes – Often”: Substantial additional portion

- “Yes – Sometimes”: Many others

- “No – Never”: Very small minority

Analysis: The overwhelming majority report signing under explicit coercion. This is not commercial negotiation between equals—it’s systematic economic duress. The survey provides statistical proof of all three legal elements: wrongful threats (forcing statutory violations), no reasonable alternative (limited major forwarders), and involuntary agreement (overwhelming majority report coercion).

3. Contractual Prohibitions Constitute Tortious Interference

When lenders and forwarders contractually prohibit agencies from exercising statutory rights, they may be committing tortious interference. Elements include: (1) valid right, (2) knowledge, (3) intentional interference, (4) improper means, and (5) damages.

Prediction: If tortious interference is occurring, we would see systematic contractual prohibitions, knowledge of statutory rights, and quantifiable per-transaction damages.

Survey Results – Multiple Questions:

Question 1: Majority report contractual prohibition

Question 4: Significant portion report $150-$300+ loss per repo

Question 9: Overwhelming majority report coercion

Analysis: All five elements appear satisfied. Agencies have valid statutory rights (element 1). Lenders operate in Georgia and reference personal property in contracts, establishing knowledge (element 2). Contractual prohibitions are written and intentional (element 3). Using economic power to force statutory violations constitutes improper means (element 4). Losses of $150-$300+ per transaction establish quantifiable damages (element 5).

**Clients have no argument about not understanding or knowing GA Law as they not only require the property letters in compliance and contracts as outlined in GA Code, they audit to ensure they have been sent. RDN – the industry’s leading software provider used GA to Beta a product designed for compliance because of the law.

4. “Free Release” Policies Harm Consumers Rather Than Protect Them

The white paper challenged the justification that “free release” policies benefit consumers, arguing instead that prohibiting cost recovery undermines the economic viability of statutory compliance.

Prediction: If this analysis is correct, we would see agencies cutting corners on compliance, delaying statutory notices, and consumers experiencing actual harm rather than benefit.

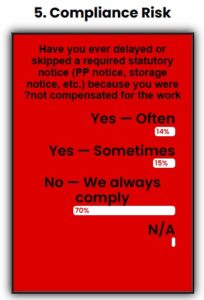

Survey Results – Question 5:

“Have you ever delayed or skipped a required statutory notice because you were not compensated for the work?”

- “Yes – Often”: Substantial number

- “Yes – Sometimes”: Many others

- “No – We always comply”: Minority

Survey Results – Question 7:

“Which consumer harms have you witnessed resulting from ‘free release’ policies?”

- Delayed access to essential items (medications, IDs, tools) – Most common

- Confusing or inconsistent redemption instructions

- Property lost or damaged

- Difficulty contacting correct party for release

- “None – consumers benefit” – Minority response

Analysis: The data contradicts the “consumer protection” justification. When agencies cannot recover compliance costs, they delay or skip required notices. Consumers experience delayed access to essential items, property damage, and procedural confusion. The minority response to “consumers benefit” suggests the claimed justification may be empirically false.

5. Systematic Violations Support Class Action Certification

The white paper argued that uniform contractual prohibitions across multiple lenders create class action viability under standard certification requirements: commonality, typicality, numerosity, and superiority.

Prediction: If class certification is viable, we would see common contractual terms, common harm, numerous potential plaintiffs, and damages calculable on a uniform basis.

Survey Results – Overall Pattern:

- Common restrictions (Question 1: majority prohibited)

- Common harm (Question 4: $150-$300+ losses)

- Numerous plaintiffs (survey responses indicate hundreds)

- Common coercion (Question 9: overwhelming majority)

Analysis: All class certification requirements appear satisfied. The commonality of contractual prohibitions, typicality of harm suffered, numerosity of affected agencies, and superiority of class treatment over individual litigation are all evidenced by the survey data.

**Survey captured over 1200 individual responses.

Where Theory Meets Evidence

Statistical Significance Matters

The white paper could argue what the law should mean. The survey documents what actually occurs.

When the majority report contractual prohibitions on statutory rights, this isn’t isolated contract negotiation—it’s systematic statutory override.

When the overwhelming majority report signing under “sign or lose account” threats, this isn’t normal commercial practice—it’s documented economic coercion.

**Our industry believes it’s normal because of how common it is and the scope of the threat! Imagine living in so much fear you are afraid to call for help – that is the state of this industry today.

When substantial portions report skipping statutory notices due to lack of compensation, this isn’t theoretical harm—it’s actual consumer protection failure.

Quantified Damages Transform Liability Analysis

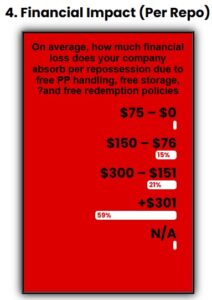

Question 4 results:

- Significant portion: $150-$300+ per repossession

- Moderate portion: $76-$150 per repossession

- Some: $75 or less per repossession

These aren’t vague claims of unfairness. These are specific, quantified, per-transaction losses.

Example calculation:

- Agency processing 1,500 repos/year (my size company)

- Average loss of $200 per repo

- Annual damages: $300,000

- Over 3-year statute of limitations: $900,000

Multiply across a class of 200 agencies: $180,000,000 in base damages.

Add statutory enhancements, punitive damages, and attorney’s fees available under various state consumer protection statutes, and the exposure becomes substantial.

Consumer Harm Is Documented, Not Theoretical

The white paper predicted that prohibiting cost recovery would cause operational shortcuts and consumer harm. The survey confirms this prediction.

Question 5: Agencies admit delaying or skipping required notices when not compensated.

This means consumers don’t receive timely statutory notice. Redemption timelines don’t start properly. Due process protections collapse.

Question 7: The majority report witnessing consumer harm, with delays to medications and essential items being most common.

The policies claimed to “protect consumers” appear to be causing the harm the statutory framework was designed to prevent.

Implications of the Correlation

The White Paper Was Predictive

Five major arguments, all validated by independent survey data:

- ✓ Statutory rights systematically overridden (Question 1)

- ✓ Economic duress exists (Question 9)

- ✓ Quantifiable damages per transaction (Question 4)

- ✓ Consumer harm, not benefit (Questions 5, 7)

- ✓ Class certification requirements satisfied (all questions)

When theoretical legal analysis predicts patterns that independent empirical data then confirms, the underlying legal framework gains significant credibility.

Multiple Overlapping Liability Theories

The survey doesn’t just support one claim—it supports several:

Contract Law:

- Void provisions (statutory rights non-waivable)

- Voidable contracts (economic duress)

- Unconscionability (one-sided terms under coercion)

Tort Law:

- Tortious interference (all elements documented)

- Conversion (systematic destruction of security interests)

- Economic duress (wrongful threats, no alternatives)

Statutory Claims:

- Consumer protection violations (actual consumer harm documented)

- Unjust enrichment (benefit without payment)

Regulatory Concerns:

- Pattern and practice violations

- Systematic statutory override

- Deceptive trade practices

Each theory stands independently. Together, they create substantial cumulative exposure.

The Operational Reality

Question 6 asked about operational problems resulting from “free release” policies:

- Storing personal property in personal vehicles (liability risk)

- Early disposal due to capacity constraints (consumer harm)

- Delayed or incomplete inventory (compliance failure)

- Absorption of certified mail/postage costs (economic burden)

- Unpaid mileage and labor for redemption (cost shifting)

These responses reveal the mechanics of how statutory override translates into real-world harm. Agencies can’t afford proper storage, so property goes in personal vehicles. They can’t afford proper inventory, so documentation suffers. They can’t afford certified mail, so notices get delayed or skipped.

This operational breakdown is the direct result of prohibiting the cost recovery the statute was designed to permit.

The Financial Dimension

Per-Transaction Liability Accumulates

If the white paper’s analysis is correct and these contractual provisions are void:

Every transaction creates new liability:

- $150-$300 per repo (survey average)

- Thousands of transactions per year

- Multiple years of operation

- Hundreds of potential plaintiffs

Conservative example:

- 100,000 repos/year (single large lender portfolio)

- $150 average loss per repo

- Annual exposure: $15,000,000

- Three-year period: $45,000,000

- Before statutory enhancements or punitive damages

The survey provides the formula. The volume provides the multiplier. The exposure compounds daily.

Time Is a Factor

Every day these contracts remain in force, new transactions occur under provisions the white paper argues are void and the survey suggests are systematically coercive.

If the legal analysis is correct, each transaction adds to the cumulative liability total.

If the analysis is incorrect, the risk lies with the agencies pursuing claims.

But the survey data makes the “incorrect analysis” scenario less likely, as independent empirical evidence has validated each major prediction.

How Important Is This Survey

For Legal Analysis

The convergence of theoretical legal analysis and empirical evidence is significant.

Legal arguments often proceed from statutory interpretation and precedent, predicting how principles should apply to factual scenarios.

When independent data collection then confirms those predictions, it suggests the legal analysis correctly identified real-world patterns rather than theoretical possibilities.

For Industry Understanding

The survey reveals operational realities that contract language obscures.

Contracts say “agencies agree” to terms. The survey reveals overwhelming majority signed under threat of account loss.

Contracts say nothing about consumer impact. The survey reveals majority report consumer harm.

Contracts are drafted as voluntary commercial agreements. The survey suggests they function as coercive adhesion contracts.

For Market Dynamics

The survey exposes power imbalances that standard contract analysis might miss.

When the overwhelming majority report signing under “sign or lose account” threats, the market isn’t functioning as traditional contract theory assumes.

When majority report losses of $150-$300+ per transaction, the “agreed” terms transfer substantial value from one party to another through mechanisms that survey respondents describe as coercive.

For Regulatory Consideration

If the survey accurately reflects industry conditions, regulatory questions arise:

- Are small businesses being systematically coerced into waiving statutory rights?

- Are state statutory frameworks being overridden by private contracts?

- Are consumers experiencing harm from policies claimed to protect them?

- Does the pattern constitute systematic violation of state consumer protection statutes?

These are questions regulators typically investigate when presented with evidence of systematic harm.

Conclusion

The Georgia Personal Property White Paper made five core arguments about statutory interpretation, contract validity, tort liability, consumer protection, and class action viability.

The industry survey provided data that validates each argument:

- Systematic contractual override (predicted and confirmed)

- Economic coercion (predicted and confirmed)

- Quantifiable damages (predicted and confirmed)

- Consumer harm (predicted and confirmed)

- Class action elements (predicted and confirmed)

This correlation doesn’t prove the white paper’s legal conclusions are correct—only courts can make that determination.

But it does suggest the white paper accurately identified real patterns rather than theoretical possibilities.

The question now is what happens when legal theory, empirical evidence, and substantial financial exposure converge.

That question will likely be answered through some combination of voluntary contract modification, regulatory investigation, and litigation.

The white paper provided the framework. The survey provided the evidence. The next chapter will reveal whether that evidence is sufficient to change industry practice.

Resources

- Georgia Personal Property White Paper: https://curepossession.com/galr-personal-property-white-paper

- Industry Survey Results: https://curepossession.com/lender-forwarder-repossession-contracts-survey

- O.C.G.A. § 44-14-411.1 (Georgia Personal Property Statute)

About the Author:

Wes Carico is a repossession industry analyst, author of the Georgia Personal Property White Paper, and a principal of Artis Recovery.

Contact: https://ccarico.com

This article is provided for informational purposes and does not constitute legal advice.

Related Articles and More from Wes:

The Repossession Contract Reckoning

The Georgia Personal Property Problem: Why Your Contract May Be Forcing You to Break the Law

Professional Standards in Repossession Volume I – A Book Review

Why I Took the Recovery Masters Course – and Why You Should Too

Use of Force in Repossession – The Line That Keeps You Safe

Can I Defend Myself or Others?

Get the increase, cut the contract, or close the doors

Ancillary Fees – The Associated Issues with Safety and Quality

Undervaluing Services – No Simple Fix, But the Responsibility Is Obvious

Framing the Conversation – Increases Are All About the Numbers, Not The Virus

Repossession Obsession – Questions Consumers, Legislators and Lawyers May Want to Start Asking

More Stories

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong

Snitching vs. Standing on Principle: Calling Out Bad Actors in the Repossession Industry

Lender Interference in Georgia Repossessions