Houston, TX – 19 February 2021 – An agent gets an advanced alert on a repo assignment only to arrive and find the vehicle lifted and strapped by a competitor. Any rational person would leave, but nope, not on this night.

The photo and story were provided by a reader who preferred to remain anonymous and in all fairness, so are the names of the alleged parties, but many of you will be able to figure it out on your own.

On an evening in January, an agent of Repossession Agency “B” arrived at an apartment complex where they received a live hit on a reported forwarder assigned account. Backing into the vehicle, the borrower emerged and while showing no opposition soon bore witness to the arrival of a second recovery truck from Repossession Agency “A”, who was following up on it from a lead provided by an LPR service provider, but also alleged that the assignment was direct from the lender.

Rather than leave, the agent from Repossession Agency “A”, apparently chose to back into the already secured and lifted vehicle, lifting it by the rear wheels completely into the air. And all of this while the borrower watched.

Heated words were exchanged and eventually Repossession Agency “B” prevailed, but what remains is an ongoing problem as dangerous and pernicious as double assignments.

This is just one of many stories emerging out of Houston and other cities where agents responding to LPR hits and leads are, and have been, engaging in altercations over recovery rights. This is really nothing new, but the frequency of these incidents seems to be on the increase and the volatility of the conflicts rising with it.

As if agents in the field didn’t have enough dangers to contend with as posed by the ever-present angry borrowers, the growing risk posed by over-aggressive agents and camera car drivers in the field seems to be running rampant across the nation.

Obviously, the sight of this incident would make a lender’s skin crawl and a consumer rights attorney salivate. One could find it hard to imagine an agency owner approving of this behavior, but regardless, it does seem to be a reoccurring issue in the field.

This problem is nothing new. I wrote about this in 2019 in an editorial titled “The LPR War in the Field.” Instead of getting better, it seems to be getting worse.

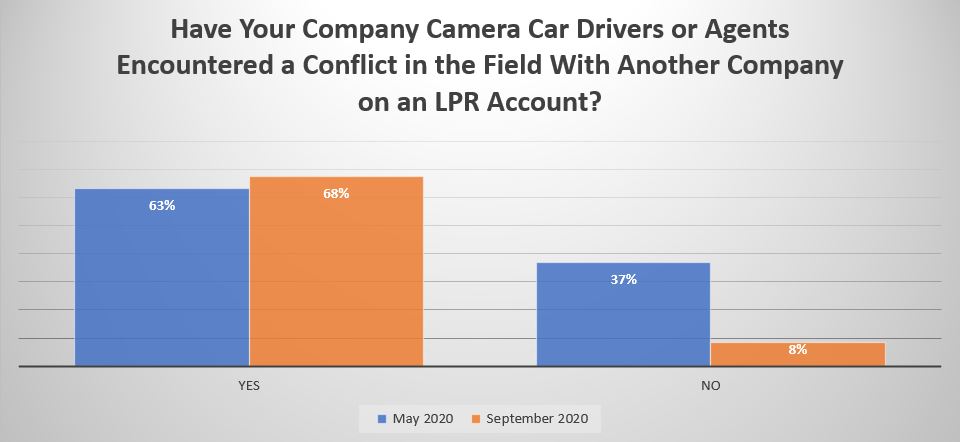

In our May 2020 “State of the Repossession Industry Survey” – LPR, we first posed the question; “Have Your Company Camera Car Drivers or Agents Encountered a Conflict in the Field With Another Company on an LPR Account?” In May, 63% of the respondents confided that they had at one point or another. In September’s Survey, 68% responded affirmatively to the same question.

No one will argue against the simple proposition that competition is good for business, but when competition crosses the line into litigious and dangerous activity, something must change.

Facebook Comments