The post Federal Update From the Repo Alliance first appeared on CURepossession.

]]>The Repo Alliance founding members and members of ARA, Eagle 20 and AFA had a fly in to meet with members of the Senate and The House Of Representatives in Washington D.C.

Information from those meetings have led the Repo Alliance and their lobbyist Van Scoyoc to develop a “Four Pillars” approach to industry Representation benefiting the entire collateral recovery industry. Having this Four Pillar approach will allow our outreach to pursue visibility, partnerships and policy success. This approach will continue some of our work to date, but also branch out into new areas that will position us for further work in Washington, DC, regardless of which candidate wins the presidency and regardless of which party controls Congress. The elements of the Four Pillars are outlined below.

Small Business Outreach: (Pillar One)

One of the key messages we have used as a theme in our discussions is our frustration caused by The small business man being pushed around and dictated to by the Corporate Giants the lenders and their counterparts. We are going to expand our outreach from Banking and Financial committees to Small business committee’s in both the Senate and the House. The inherent nature of this dynamic has shown to resonate loudly with committees that have jurisdiction over policy to protect small businesses, in particular small businesses who are victim of unfair business practices and abuse. Many industries comprised of small businesses who are often pushed around by multi-national lenders and corporations may support our efforts opening a new universe of support on the Hill from which we can draw on.

Nongovernmental Advocacy: (Pillar Two)

Another part of the Repo Alliance advocacy has been to bring real world data to federal agencies in the legislative and the executive branch. We have been able to do this using data derived from the ARA’s member survey as well as data provided by Harding Brooks and industry wide companies in the collateral recovery world. This data has been used to reinforce and validate our message to federal officials. We have come to understand that nongovernmental entities are interested in our plight and want to meet with us in the future.

Further, this new outreach will help develop partnerships with demographics most at risk from bad lender behavior in the auto finance industry. Groups dealing with senior citizens, the Congressional Black Caucus, Veteran groups and others are likely partners. We will use facts to develop these partnerships and move our industry voice forward.

Banking Regulator Outreach: (Pillar Three)

Recently Van Scoyoc and Associates has had informal meetings with credit union regulators and is scheduling talks in banking regulator circles gaining insight into the inner workings of these regulators. We hope to demonstrate that poor oversight of the repossession process by lenders is a systematic problem effecting consumers every day.

The Repo Alliance, ARA and industry members will be reaching out to regulators at all levels to discuss education and new policies to alleviate safety concerns to both the recovery agent and the consumer. We will request regulators to increase oversight of violations, consumer rights and lack of accountability from lenders. Finally, we will urge regulators to require lenders to use agents who have been certified through one of the industry education programs such as the CCRS.

In addition, The Repo Alliance, ARA and members from Eagle group and AFA want to meet with the Federal Trade Commission to address a number of problems that warrant FTC education.

Continued Congressional Outreach: (Pillar Four)

The fourth pillar in our plan is continued congressional outreach along the lines of what we have been doing to this point, given the progress we are making. Senators have indicated they will soon express to the CFPB their belief that the Bureau must take significant measures to crack down on reverse indemnification that threatens consumers. We eagerly await information about the conversation which is forthcoming.

In addition, we will be redoubling our efforts to meet with other senators and representatives. Who have expressed concern when we met with them since the inception of the Repo Alliance. Reengaging them will help use advance ideas at CFPB and in Congress.

Finally, some Republicans who had previously been skeptical to meet with ARA because the CFPB was being challenged in court are free to meet now that the case has been resolved.

Beyond the four pillars there are other topics the Repo Alliance and their major supporter ARA will be moving forward on, look forward to further updates on new directions and projects under taken by your Repo Alliance.

Federal Update From the Repo Alliance – Federal Update From the Repo Alliance – Federal Update From the Repo Alliance

Federal Update From the Repo Alliance – Consumer Financial Protection Bureau – CFPB – Repossess – Repossession – Repossession Agency – Repossessor –

The post Federal Update From the Repo Alliance first appeared on CURepossession.

]]>The post CFPB In Light of Chevron Doctrine Overturned first appeared on CURepossession.

]]>ARA Members, partners and colleagues,

By a 6-3 majority, the Chevron Doctrine (named after the 1984 opinion of the Supreme Court in Chevron U.S.A. Inc. v. National Resources Defense Council, Inc., 467 U.S. 837) has been overturned.

The Supreme Court’s opinion was issued on Friday, June 28 in Loper Bright Enterprises et al v. Raimondo, Secretary of Commerce, et al, now referred to in discussions as Loper Bright.

Put simply, under the Chevron Doctrine, courts had to apply a two part test in assessing the actions of federal agencies. If the statute adopted by Congress was clear on the issue before the court, the court had to follow congressional intent. However, if the statute was ambiguous on, or simply did not address, the issue before the court, the court had to defer to the agency’s interpretation as long as it was reasonable, even though the court would have reached a different interpretation.

With the overruling of the Chevron Doctrine, going forward, generally courts should no longer give mandatory deference to a regulation (either an existing regulation or one promulgated in the future) by a federal agency empowered by Congress to issue regulations under a federal statute.

The opinion is based entirely on Section 7 of the Administrative Procedure Act (the “APA”). Section 7 specifies that courts, not agencies, will decide “all relevant questions of law” arising on review of an agency regulation.

Clearly, the opinion will jeopardize the ability of agencies to promulgate regulations that will likely be upheld by the courts. It is more likely that, going forward, regulations will be challenged either directly in an action against the agency under the APA, or collaterally in a private lawsuit against a defendant whose defense is that it relied on and complied with an agency regulation.

While the demise of Chevron is important for all federal agency actions, the CFPB may face more consequences than many other agencies, given its aggressiveness in interpreting federal statutes and pushing the envelope with respect to its own authority.

It is important to note that Loper Bright does not invalidate previous rulings. The opinion will apply to all non-final cases in which the legality of agency regulations are being challenged and to all lawsuits initiated in the future against any regulations whose legality is in question.

This decision does introduce concerns in the industry and we know industries need certainty to conduct business. It also opens the door for an avalanche of lawsuits challenging regulations directly or in private lawsuits.

Sincerely,

The ARA Board

CFPB In Light of Chevron Doctrine Overturned – CFPB In Light of Chevron Doctrine Overturned – CFPB In Light of Chevron Doctrine Overturned

CFPB In Light of Chevron Doctrine Overturned – Consumer Financial Protection Bureau – CFPB – American Recovery Association – ARA – Repossess – Repossession – Repossession Agency – Repossessor

The post CFPB In Light of Chevron Doctrine Overturned first appeared on CURepossession.

]]>The post Court Ruling Takes the Teeth out of the CFPB? first appeared on CURepossession.

]]>Huge Supreme Court Ruling – Hope You Saw It

GUEST EDITORIAL

No, I’m not talking about the rulings on Trump or Fischer. While those are significant for our country, I’m referring to something that could be even more impactful, especially for small businesses and our industry.

I’m talking about Loper Bright Enterprises v. Raimondo and its potential implications. I mentioned to colleagues a few months back that this case could be a big deal for us when it was being argued.

Even though this case has nothing to do with repossession, as an industry stakeholder I got pretty excited when it was released.

I hope this sparks some conversations within our Associations so we can get expert opinions on what it all means. I’ll take a shot at explaining it from a layperson’s perspective to get the ball rolling.

The Supreme Court just scaled back much of the enforcement power of agencies like the CFPB by overturning the Chevron doctrine. Chevron essentially told courts to defer to an agency’s “expertise, opinion, and interpretation” when laws were ambiguous.

As long as an agency could tie a “Rule” to a vague statute, they could enforce it as if it were law. Courts only needed to find the agency’s argument “reasonable” if challenged, thanks to the deference Chevron granted.

Here’s how it worked in simpler terms:

An agency is created to enforce consumer protection laws. They study potential issues and make rulings to clarify or solidify the code. These rules are then used for enforcement actions against violators.

Some argued Chevron gave the Executive Branch too much power by forcing the Judicial Branch to defer to the Executive’s interpretation. This limited the courts’ ability to hold agencies accountable.

The Supreme Court overturned Chevron to restore balance between the Judicial and Executive Branches.

Now, agencies without clear statutory backing will face tougher challenges in court. The judiciary will rely more on Congress’s explicit will as expressed in legislation. When laws aren’t clear, courts are more likely to scrutinize agency actions to prevent potential overreach.

Let’s consider an example: property fees.

Many states (and possibly federal law) don’t clearly address how to handle a consumer’s property in a repossessed vehicle.

Under Chevron: If the CFPB created a rule saying it’s unfair to hold property for payment, lenders would comply to avoid fines. Challenging this in court was tough because judges had to defer to the CFPB.

Post-Chevron: If fined, lenders can still challenge in court, but now judges will focus more on the actual law and arguments related to the Skidmore doctrine (which isn’t as strong as Chevron).

This doesn’t mean agencies, or their rules disappear, but it does make challenging those hefty fines more appealing. Once courts rule, it sets precedent for future cases. Agencies might be more cautious, seek clearer laws, or reduce penalties to avoid costly and/or losing legal battles.

The implications are huge for our industry and country.

To keep the momentum in our favor, we need to:

- Vote – The people you elect lead the Executive and Legislative Branches.

- Lobby – Our DC lobbyists are more crucial than ever as legislators need to hear from us, not just the alphabet agencies.

As lower courts start applying the new precedent from the Supreme Court the overall implications will become clearer, but we should see some changes in how the CFPB operates as well as how industry stake holders react to their rulings.

In closing, these are just my thoughts as a non-lawyer. I’ve tried to fact-check my understanding, but my main goal is to spark conversation among our industry leaders.

Stay safe, and all the best!

Wes Carico

Artis Recovery

More From Wes:

No Means No!

All In One Billing – Bad Business

Finding Your Bottom Line

Undervaluing Services – No Simple Fix, But the Responsibility Is Obvious

Court Ruling Takes the Teeth out of the CFPB? – Court Ruling Takes the Teeth out of the CFPB? – Court Ruling Takes the Teeth out of the CFPB?

Court Ruling Takes the Teeth out of the CFPB? – Consumer Financial Protection Bureau – CFPB – Repossess – Repossession – Repossession Agency – Repossessor – Lawsuit

The post Court Ruling Takes the Teeth out of the CFPB? first appeared on CURepossession.

]]>The post The ARA Marches on Capitol Hill first appeared on CURepossession.

]]>A Successful Day on Capitol Hill for the Recovery Industry

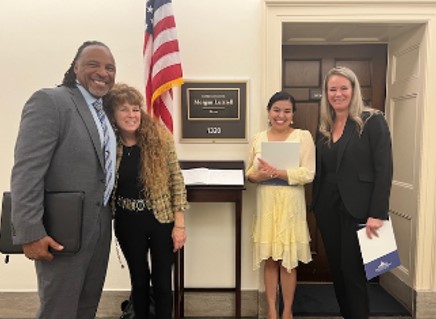

This week, history was made within our industry. Representing the repossession industry, American Recovery Association (ARA), along with our lobbyist Van Scoyoc Associates, went to Capitol Hill to meet with Members of Congress, staffers, and the Consumer Financial Protection Bureau (CFPB) to discuss the many issues the recovery industry is facing, how to prevent unintended consequences to consumers, and ways to boost the auto-finance industry.

This is the first time representatives of the recovery industry have met with Congress in person to bring attention to these issues that concern the agent network. Next steps with Congress and the CFPB are in motion, and we will ensure things keep moving forward. We intend to be back on Capitol Hill again this year.

In attendance were ARA President Vaughn Clemmons and Immediate Past President Dave Kennedy, ARA Vice President and CALR President Marcelle Egley, Texas ARP President Stephanie Findley, Harding Brooks Insurance Vice President Mike Peplinski, and Recovery Agency Owner and ARA member Richard Grosvenor.

The discussions centered around lender indemnification, the consolidation of power in the auto finance industry, and the roles brokers and forwarders play in the industry – specifically how agents aren’t paid unless they repossess a vehicle and how this is to the detriment of our industry.

Violence and the increasing loss of life for those who work in the recovery industry must be stopped. ARA is taking a strong stand on the Hill for you and the industry. We will continue to work ceaselessly for our members and the industry.

The ARA Marches on Capitol Hill – The ARA Marches on Capitol Hill – The ARA Marches on Capitol Hill

The ARA Marches on Capitol Hill – Repossess – Repossession – Repossession Agency – Repossessor – American Recovery Association – ARA

The post The ARA Marches on Capitol Hill first appeared on CURepossession.

]]>The post CALR Introduces Agency Controlled Repo Storage Bill first appeared on CURepossession.

]]>“Any charges payable by the debtor to the repossession agency for the storage of the collateral and personal effects from the date of repossession until release of the property from storage,… shall not be determined by any entity other than the repossession agency.”

Sacramento, CA – April 18, 2024 – Storage fees; only the agency can quote and collect them. How much they are is between the borrower and the agency alone. They are confidential and not to be shared with the lender or forwarder. In a nutshell, that’s what is in California Assembly Bill 2228 sponsored by the California Association of Licensed Repossessors (CALR.)

Read the Bill Here!

CALR was the first state repossession association. Through their decades of efforts, they have developed a strong lobbying presence and legal liaison within the state’s capital and with their regulating authority the Bureau of Security and Investigative Services (BSIS).

It is through this collaboration that they have created structure, laws and licensing that became the blueprint later adopted by Florida and Illinois. It is also through these efforts that they successfully combatted the attempts to codify repossession moratoriums via AB 2501 during the Covid pandemic.

Well, they’re at it again and probably wish I wouldn’t show what they been doing behind the scenes, but here it is.

On February 7th, 2024, California State Representative Carlos Villapuda, a Democrat representing the 13th Assembly District, introduced an amendment to Section 7507.10 of, and to add Section 7507.105 to, the Business and Professions Code, relating to collateral recovery. AB 2228, as introduced, Collateral recovery: notice and disclosure.

As described in the Legislative Counsel’s Digest;

Existing law requires the notice to include, among other things, a disclosure of the charges payable by the debtor to the repossession agency for the storage of the collateral and personal effects from the date of repossession until release of the property from storage.

This bill would prohibit any of those disclosed charges from being determined by any entity other than the repossession agency. The bill would also provide that any charges payable by the debtor to the repossession agency for the storage of the collateral and personal effects from the date of repossession until release of the property from storage and the disclosure of those changes are confidential, except under specified circumstances. Because a violation of these requirements would be a crime, the bill would impose a state-mandated local program.

This bill is clearly an attempt at stopping repossession forwarding companies from charging storage fees that the repossession companies do not bill or get paid for.

From a consumer standpoint, it is only fair that they only be charged for fees that were genuinely charged by the actual repossession agency and not a padded fee that goes straight into the pockets of the forwarders. If you recall, it was just over a year ago that the CFPB stated that anything billed above what the lender actually paid for the repossession or services is an unfair, deceptive and abusive practice (UDAAP.)

“Examiners found that the servicers engaged in unfair acts or practices when they charged estimated repossession fees that were significantly higher than the costs they purported to cover. The relevant contracts permitted the servicers to charge consumers default-related fees based on actual cost, but here the fees significantly exceeded the actual cost. Charging the fees caused or was likely to cause substantial injury in the form of concrete monetary harm.”

AB 2228 clearly takes aim at this UDAAP that passes unearned expenses on to borrowers for vehicle and personal property storage fees from forwarding companies. While the liberal dominated California state house is not necessarily a repossession industry friendly body, it is a consumer-friendly body. And if it benefits the consumer in their eyes, it stands a fair chance of passing but there are some hurdles.

Time will tell, but it’s another great example of the power of a state repossession association by CALR. Great job.

Kevin Armstrong

Publisher

CALR Introduces Agency Controlled Repo Storage Bill – CALR Introduces Agency Controlled Repo Storage Bill – CALR Introduces Agency Controlled Repo Storage Bill

CALR Introduces Agency Controlled Repo Storage Bill – – CALR – CALR – Repossess – Repossession – Repossession Agency – Repossessor

The post CALR Introduces Agency Controlled Repo Storage Bill first appeared on CURepossession.

]]>The post Credit Acceptance Corp. Takes The Lead in Repossession Safety first appeared on CURepossession.

]]>Credit Acceptance will review the situation and if the threat has merit, we will pay the full involuntary repossession amount.

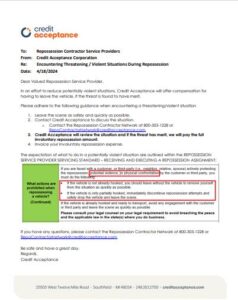

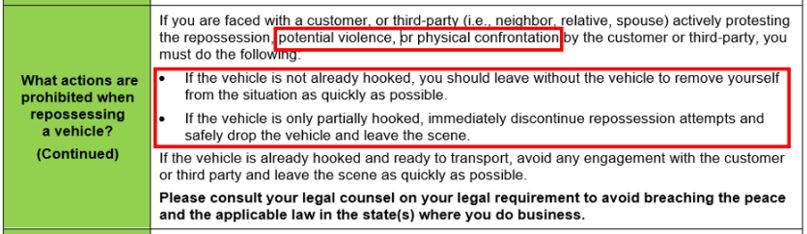

No lender wants blood on their hands over a stupid car and Credit Acceptance Corporation (CAC) has taken a bold and noble move to do all they can to avoid it. In an April 18th memo distributed to their agent network, they have agreed to pay full involuntary repossession fees to agents for leaving the scene of a repo to avoid the potential for violence or physical confrontation.

More repossession agents were murdered in 2023 than in any year on record. In addition, there were more stabbings, beatings and gunshot wounds than can even be counted since most go unreported. In response, the repossession industry has been gearing up with conflict avoidance training, body armor, cameras and in some areas, firearms. But one lender has taken their own measures to do all that they can to avoid these in their own way.

On April 18th, Credit Acceptance Corporation (CAC) issued a memo to their agent network titled; “Encountering Threatening / Violent Situations During Repossession.” In its contents it proposes;

In an effort to reduce potentially violent situations, Credit Acceptance will offer compensation for having to leave the vehicle, if the threat is found to have merit. Not only does it say that they will compensate, but it also says that they will pay the full involuntary repossession amount.

Read or Download the Memo Here!

This is probably the most dramatic lender created policy to address repossession violence in the history of the industry. Never before to my knowledge has a lender, least of all, a large subprime lender with massive repossession volume, taken such a huge step in improving agent safety in the field.

This is probably the most dramatic lender created policy to address repossession violence in the history of the industry. Never before to my knowledge has a lender, least of all, a large subprime lender with massive repossession volume, taken such a huge step in improving agent safety in the field.

It has long been complained that contingent repossessions, where the agent does not get paid unless they recover the vehicle, are the largest contributor to agent breaches of the peace and major factors in agents pushing their luck with often deadly consequences.

While the repossession industries war against contingent repossession assignments is mostly lost, this is a massive step toward encouraging agent safety through compensation for avoiding dangerous confrontations.

Credit Acceptance Corporation (CAC) has been a constant target of the CFPB over their subprime lending practices who they claim are predatory as they have very high default rates. Regardless, CAC manages to maintain strong profits because they maintain strong yields despite these losses all while providing credit to many who would otherwise have no options. They provide a valuable service to those same people, the majority of which do not default.

I, for one, as well as the American Recovery Association (ARA) in a recent email blast, applaud CAC in taking this monumental policy move. While none of us may never know if or whose lives were saved by this move, it is the greatest policy change toward agent safety that I have seen in my many years.

This measure, coupled with the aforementioned safety measures being implemented may not be capable of stopping all violent confrontations in the repossession industry, but they should be the boilerplate template for borrower and agent safety across the nation.

I can only hope that other lenders will see the merit in this policy and adopt the same. No one in their right mind wants blood on their hands over a repossession. It’s just a stupid car and not worth anyone’s life.

CAC took the bold first step. Now, lets see who’s the next to step up.

Kevin Armstrong

Publisher

Credit Acceptance Corp. Takes The Lead in Repossession Safety – Credit Acceptance Corp. Takes The Lead in Repossession Safety – Credit Acceptance Corp. Takes The Lead in Repossession Safety

Credit Acceptance Corp. Takes The Lead in Repossession Safety – Repossess – Repossession – Repossession Agency – Repossessor – Repossession Violence – Repossession History

The post Credit Acceptance Corp. Takes The Lead in Repossession Safety first appeared on CURepossession.

]]>The post Repossessions – 2023’s Third Biggest CFPB Complaint first appeared on CURepossession.

]]>CFPB releases 2023 Consumer Response Annual Report

Last month, the Consumer Financial Protection Bureau (CFPB) announced their intention to begin collecting repossession data from a select number of lenders to get a better understanding of their repossession practices. Perhaps we now know why.

On March 29th, the CFPB released their 2023 Consumer Response Annual Report. Within the report, which gathered an approximate 1,657,600 consumer complaints over the period of January 1 to December 31st, 2023, repossession related complaints accounted for the third most common complaint.

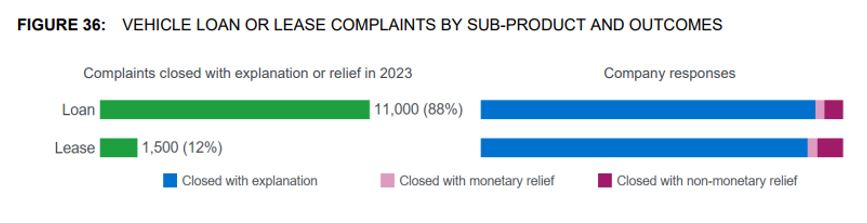

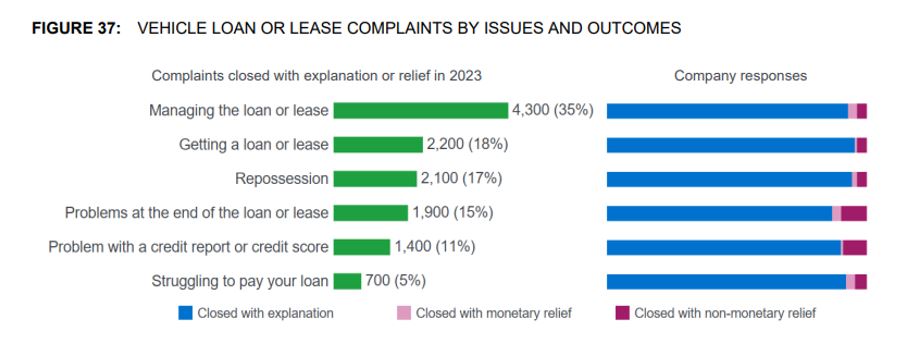

Reported in section 4.7 (page 51), The CFPB reported that in 2023, they received approximately 17,700 vehicle loan or lease complaints. In response, the CFPB sent 13,000 (73%) of these complaints to companies (lenders) for review and response. Another 21% were referred to other regulatory agencies and another 6% were found not to be actionable.

As of March 1, 2024, 0.1% of vehicle loan or lease complaints were still pending with the consumer and less than 0.1% were still pending with the CFPB.

Read the Entire Report Here!

Vehicle loan or lease complaints closed with explanation or relief volume increased in 2023. The January 2023 spike in complaints was mainly driven by the CFPB’s enforcement action against Wells Fargo that, in part, addressed CFPB concerns about its repossession mismanagement, incorrect payment processing, and failure to ensure guaranteed asset protection (GAP) product refunds to consumers (Figure 38). The spike in August complaints was partly due to a portfolio transfer between two companies, leading to various servicing issues for consumers.

For example, following transfer, consumers reported incorrect payment histories, unauthorized add-on and repayment agreements, and unauthorized charges. In some cases, these servicer errors resulted in late fees and repossessions.

In 2023, the monthly average for the top issue, Managing the loan or lease, increased 77% compared to the monthly average for the prior two years (Figure 39)

Consumers reported vehicle repossessions without notice. Other consumers stated that they were never offered the opportunity to reclaim the vehicle after paying off or catching up on their loan (known as redemption or reinstatement) following the repossession of their vehicle.

Some consumers argued that their car was repossessed despite on-time payments or protections they should have been given pursuant to the Servicemembers Civil Relief Act (SCRA). Some consumers expressed frustration that they were actively working with their lender on a new repayment plan that better fit their financial needs; nevertheless, they found their car repossessed.

Some company responses recommended that the consumer reach out to the towing company responsible for carrying out the repossession. In other company responses, the companies indicated they could not provide any further assistance, asserting that all available options had been exhausted.

Consumers’ complaints detailed incorrect loan balances and difficulties with payment processing. Consumers reported late fees on their account despite on-time payments.

Consumers also expressed confusion about deficiency balances after receiving insurance claim payments, or voluntarily surrendering, or reselling vehicles. Company responses typically stated that balances were correct and provided explanations of additional fees or interest requirements.

Companies sometimes explained remaining balances that occurred due to a lack of full balance coverage on the part of insurance companies or following repossession or resale. In some instances, companies did admit to delays in payment processing and appropriately adjusted balances.

Related Articles;

CFPB Orders Repossession Data from Lenders

Repossessions – 2023’s Third Biggest CFPB Complaint – Repossessions – 2023’s Third Biggest CFPB Complaint – Repossessions – 2023’s Third Biggest CFPB Complaint

Repossessions – 2023’s Third Biggest CFPB Complaint – Repossess – Repossession – Repossession Agency – Repossession – Consumer Financial Protection Bureau – CFPB

The post Repossessions – 2023’s Third Biggest CFPB Complaint first appeared on CURepossession.

]]>The post CFPB Orders Repossession Data From Lenders first appeared on CURepossession.

]]>CFPB sets their sites on repo fees, forwarding, LPR, GPS and assignment data

The Consumer Financial Protection Bureau (CFPB) had been pretty quiet about repossessions for a while, but it looks like they’re back with a vengeance. Late last month they issued a bulleting announcing their order to nine large lenders to provide data on repossession fees, LPR, GPS and forwarder use just to name a few.

On a February 23rd in a CFPB blog titled “Our auto finance data pilot” it was announced that they are piloting a new program targeted at collecting auto lending data from nine of the nation’s largest auto lenders. These lenders, whose names are not included, are reported to represent a cross-section of the auto finance market.

On a February 23rd in a CFPB blog titled “Our auto finance data pilot” it was announced that they are piloting a new program targeted at collecting auto lending data from nine of the nation’s largest auto lenders. These lenders, whose names are not included, are reported to represent a cross-section of the auto finance market.

The CFPB reports that they intend to collect data from them in order to build a quality data set that provides insights into lending channels and loan performance. Of specific interest to them is the area of Loan Performance, which seems to focus on the repossession process itself.

Drilling Into the Repossession Process

Amongst the loan performance-related questions posed to these lenders on their sample order are very specific questions regarding repossession practices and efforts that really drill down into the details on their repossession activities between the period of January 1, 2018, through December 31, 2022.

Below are just some of the many questions;

- whether the repossession assignment was issued to a repossession forwarding company (if applicable);

- whether the repossession assignment was issued to one repossession agent or to more than one repossession agent, including agents working for repossession forwarding companies or LPR networks (if applicable) [Any accounts you place on a repossession forwarding company hot list must be included in the “more than one” category if the repossession forwarding company allows multiple repossession agents to recover the vehicle based on that hot list];

- whether the repossession was completed using LPR or an LPR network (if applicable) [This question asks if the specific automobile in question was physically recovered through the use of LPR technology. If you place the account with a repossession forwarding company that uses LPR but LPR was not used for this account, do not include it here];

- whether repossession was completed with the use of a SIGPS device (if applicable);

- if the repossession was completed with the use of a SIGPS device, whether any starter-interrupt functionality was used at any point in the process (if applicable);

- date the borrower redeemed the vehicle (if applicable);

- amount borrower paid to redeem the vehicle (if applicable);

- date on which disposal was completed;

- total dollar amount recovered from disposal;

- total amount of fees paid to third parties in connection with the repossession or voluntary surrender of the vehicle;

- total amount of fees paid to third parties in connection with the disposal of the vehicle;

- total amount of fees charged to the borrower in connection with the repossession or voluntary surrender of the vehicle;

Read the Entire Lengthy Sample Order Here!

As you can see from their laundry list, the data has the potential to be the most detailed data pool on the repossession process ever. What they do with it is another question.

UDAAP Issues

It’s been just over a year since the CFPB issued their Winter 2023 Supervisory Highlights Junk Fees Special Edition, aka; “Junk Fees Special Edition” when they touched on the consideration that excessive repossession fees could be considered a unfair, deceptive and abusive practice (UDAAP).

In section 2.2 titled “Auto Servicing”, in section 2.2.3 titled “Charging estimated repossession fees significantly higher than average repossession costs”, they stated;

Examiners found that, where servicers allowed consumers to recover their vehicles after repossession by paying off the loan balance or past due amounts, servicers charged a $1,000 estimated repossession fee as part of the amount owed. This estimated repossession fee was significantly higher than the average repossession cost, which is generally around $350. By policy, the servicers returned the excess amounts to the consumer after they received the invoice for the actual cost from the repossession agent.

Examiners found that the servicers engaged in unfair acts or practices when they charged estimated repossession fees that were significantly higher than the costs they purported to cover.

Looking for greater clarity, I managed to establish some dialogue with the CFPB’s Office of Public Affairs Spokesperson, Tia Elbaum, who stated that; We’re concerned about servicers that charge fees above the actual applicable cost to the company, whether the company at issue is the lender or the repossession management company.

As far as I know, all of their interest in the matter seemed to have died following this. What I had assumed to be a statement with significant ramifications to the repossession industry turned out to be a big ‘Nothing Burger.’

Well, that is until now.

Keeping in mind that it took them a year to get this far and will take them months to acquire the data and more months to analyze it to make any further statement, it might be another year until this grows legs and has the potential to go anywhere.

By then, who knows, we may have a new President. And with a new President comes firings and the CFPB is prone to draw such an action as it did before. And after that, there will probably be new appointments who may have little or no interest in pursuing this.

Time will tell.

Kevin Armstrong

Publisher

CFPB Orders Repossession Data From Lenders – CFPB Orders Repossession Data From Lenders – CFPB Orders Repossession Data From Lenders

CFPB Orders Repossession Data From Lenders – Repossess – Repossession – Repossession Agency – Forwarder – Consumer Financial Protection Bureau – CFPB – License Plate Recognition

The post CFPB Orders Repossession Data From Lenders first appeared on CURepossession.

]]>The post The Breaking Point first appeared on CURepossession.

]]>

EDITORIAL

Last month we reported on a Florida repo company who were so busy, members were having to wait weeks to pick up their personal property. In September we posted an Editorial from a well-known agency owner who reported that had reached the maximum capacity for vehicle storage on their lot and had to shut down recoveries until they had some redemptions or transports. These are symptoms of something warned about during the pandemic that has created an industry operating on the edge of the breaking point.

It’s been a long time since repossession volume has been this high. Business is booming for most everyone. But how can agencies sustain these levels when their lot and staff sizes are limited by fees that have come nowhere near keeping up with inflation?

You Were Warned

During the pandemic, when repossession assignments forced as much as 25% of the industry to close their doors, it was warned that in the future when volume returned, lenders would have difficulty finding agencies. While their issues are somewhat different, Harley Davidson Financials’ CEO aired that complaint just last May.

It has also been long warned that the elimination of storage and personal property fees was causing an erosion of income that was crippling agencies’ abilities to grow or increase staff levels. And of course, we have for over a decade warned that the stagnant repossession fee environment created by the nation’s largest lenders were unsustainable and at some point, would cause service coverage issues.

Well, that time has come. The examples provided are not one-off stories from isolated companies or flaws in management. These are solid and respectable repossession agencies whose only flaw is that the current fee income model has kept them from being able to grow their businesses to manage the volume.

Personal Property Fees

No matter what industry you are in, no one wants to look outside their office window and see an uninvited news crew and a reporter coming to their door. Well, that’s exactly what happened to the 25-year veterans at Specialized Towing and Transportation of Jacksonville, Florida back in November.

The issue that brought this about was borrowers having to wait extended periods of time to pick up their personal property. While the interviewing press could care less about why the situation exists, it is really the most important of the story because it is a problem that cannot be cured without changes.

Image a simple repo company that picks up an average of ten cars a day. That’s 70 a week, about 280 a month. Most have personal property and all of that property must be inventoried, removed and stored.

Vehicle redemptions and borrowers picking up personal property are easily the second most dangerous part of the repossession process. So, for safety reasons, borrowers must make appointments to do so. Using a simple 15-minute appointment window and allowing 6 hours a day to do so, the very most that can be managed is 24 appointments a day. That’s just above the daily recovery volume and manageable.

Now, imagine that repossession volume increases and you can easily see how that capacity is diminished.

Hire more staff. That’s the easy answer, but how? No one gets paid for these tasks anymore.

As it is, many agencies are buying large shipping containers to handle the overflow of personal property that must be stored up to 60-days in most cases and much of it is never recovered. There is no income in storing these and no income in having a full-time employee conducting these transactions.

All of this is paid for directly out of the repossession fee and there is no magic sweet spot in volume that can keep up with this.

While Specialized Towing was highlighted, I guarantee you that they are not alone. This is a problem that no one wants to talk about but is growing.

There is a cost for every service and the base repossession fee is proving to be insufficient to provide it efficiently. So, as long as the CFPB says that agencies can’t charge borrowers for their property and as long as the lenders refuse to do so as well, this problem will persist.

Vehicle Storage

Imagine if you can, driving back to your lot with a car on the lift, pulling onto the lot and having nowhere to park it. Sounds crazy, but it is a real problem. Back in September, ARA Board Member and President of International Recovery Systems of Kennett Square, PA, wrote an editorial titled; “The Good, the Bad and the Ugly of a Packed Repo Lot” where he lamented this very problem having occurred to them.

While proud of the never-before-seen volume of repossessions conducted safely by his staff, Jeremy was forced to face the problem that he knew was coming. The same problem he’d been preaching every chance he could to anyone that would listen. They’d reached their maximum capacity and until they could release or transport more vehicles, they couldn’t put new cars on the lot.

Shutting business down even for one night to clear room is lost revenue for the business and lost revenue for the employees. That is income that cannot be recaptured. All of that while still having to provide storage on the previous repossessed vehicles for free!

As Jeremy well-articulated; The obligation of providing storage for free or at very least below market rates has created a bottle neck that is difficult to maneuver out of. “Well Jeremy why don’t you just get another storage yard and keep pulling in cars?” I would be happy to answer that question.

First issue since Covid large investors have recognized the market for outside storage sites due to the needs of companies like Amazon, FedEx and UPS for example. Like the housing market these investors gobbled up as much existing land as they could thus increasing the value to purchase raw land more than a million dollars per acre to purchase, or tens of thousands of dollars to rent. These rates effectively push out smaller businesses who can’t compete.

Second, let’s assume I can find that deal and purchase, mortgage rates are between 7-9% depending on the type of commercial loan. A twenty-year mortgage on a 1-million-dollar loan with 8% interest is almost 10k a month of a fixed expense. That fixed expense doesn’t care how many cars you’re doing, and that bill is due for the next 240 months.

Finally, how does it get paid for? Today things are pretty good repo prices are becoming closer to what they should be. Some clients are paying record bonuses to have their cars picked up which is great. We as agents are happy for those “pennies from heaven”, but we know it is temporary. Agents like myself can’t commit to long term infrastructure builds on temporary wins.

Again, the base repossession fee coupled with lender demands for free storage are creating conditions that make even the best managed repo agencies incapable of sustaining operations at the current volumes.

The Root Cause

Question: How can a business sustain growth without the capital to expand?

Answer: It can’t.

In order for a repossession company to expand its business to keep up with increased volume that exceeds its current capacity, it must acquire additional storage space and staff. But like everything else in the current era, the cost of both has risen exponentially.

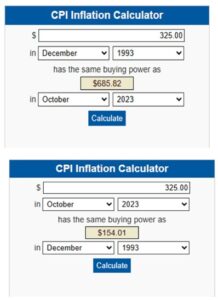

I think it’s been just over a year since I’ve beaten the dead horse of the $325 fee and I know that there has been some improvement, but last December when I checked, that persistent $325 fee that held solid for almost thirty years, should have been $603.45.

I think it’s been just over a year since I’ve beaten the dead horse of the $325 fee and I know that there has been some improvement, but last December when I checked, that persistent $325 fee that held solid for almost thirty years, should have been $603.45.

Fast forward one year and it is now worth $685.82. To add insult to injury, that $325 has the buying power of $154.01 now. So, before anyone goes and congratulates themselves for getting $450 a repossession, remember these numbers as the realistic value for your goods and services.

Also remember, that until about ten years ago, there were still other incomes that came with the repossession, like storage and personal property fees. Contingency assignments have become so mainstream that it almost seems like people have forgotten they even existed. That or like storage and property fees, they’ve just given up complaining.

Unlike the rest of the world, the repossession industry continues to operate under fee structures that has barely risen in twenty years. More critical to the cost of serviceNot only have they barely risen, but fees that used to be important elements of the operational income have ceased to exist.

This model has existed now for going on two decades. The lender’s hyperfocus on fee will continue to exist until they can no longer get what they want at that price point. Only then will they move the needle and only as much as they must to get what they want.

The national associations have been beating the drum in protest of the state of repossession and ancillary fees for years now, and they have made valiant efforts at both the lender and forwarder levels, their efforts have yielded minimal results at best.

I still encourage you all to join one of these fine associations. But membership in an association will never replace the value of fighting back against these conditions at the agency level. While unity provides greater strength, it is still incumbent on the agency owner to know and demand the true value of their service.

Blame the forwarders all you want, but like the repossession industry, they are competing against each other to gain assignment volume for the lenders. The price point is the primary driver of which forwarder gets the volume.

Don’t expect lenders to care that the repossession industry has reached the breaking point. They will only care when they can no longer get what they need,

and not one second more.

Kevin Armstrong

Publisher

The Breaking Point – The Breaking Point – The Breaking Point

The Breaking Point – Repossess – Repossession – Repossession Agency – Repossessor

The post The Breaking Point first appeared on CURepossession.

]]>The post The Eagles Soar in Lucky 13th Grand Gathering first appeared on CURepossession.

]]>The members of Eagle Group XX and the Eagle Group USA Referral Network gathered at the DFW Hyatt in Dallas Texas on October 27th and 28th for the first all member conference in the 14-year history of the group.

Members from both groups gathered for a welcome reception after the Eagle Group XX annual business meeting, stories were told, songs were sung, and friendships made and renewed.

Members, including two Eagle Group XX Emeritus members, Millard Land and Billy Whittenton, coming from across the United States and as far away as Hawaii enjoyed a reception hosted by Texas Eagle Group XX member Stephanie Finley and her Dallas Manager Chris Campbell.

After dinner the Eagle Group XX/USA Hospitality Suite opened where the Eagles had the opportunity to meet with and thank the sponsors of this years “Grand Gathering of the Eagles”, Mike Peplinski and Renee Low, and Jon Pollard of Harding Brooks Insurance Agency. “Gathering” kicked off Saturday morning after a Harding Brooks hosted breakfast with a welcome to all members of the Eagle Group XX and USA members by Mike Peplinski and it was brought to everyone’s attention that no one wore a name tag as the purpose was that the members should meet and introduce themselves to each other. The Eagle Group XX member from Alabama, Andy Cowan, commented, “We are the Eagles, we don’t need no stinkin name tags”, which brought laughter and applause from all attendees.

Since this was the first time the entire group had met as one, the members of Eagle Group XX, many who were charter members, introduced themselves to the USA members and briefly spoke as to how they had benefited from membership and the camaraderie of the group.

Mike Peplinski brought the group up to date on the current state of insurance in the recovery industry and Renee Low gave an outstanding presentation on Wrongful Repossessions and how to lessen your liability by “Striking Hard, Striking Fast, and Showing No Mercy”.

Eagle Group XX Members Tim Koskovics and Rich Whittaker gave excellent presentations on professionalism in the industry and recovering odd and unusual items which pay very good fees.

Stephanie Findley brought the members up to date on the status of the Repo Alliance and how important it was to have a voice in Washington DC. She also announced that there would be an auction at the “Eagles Grand Banquet” to raise money for the Repo Alliance.

After an outstanding lunch again hosted by Harding Brooks George Badeen brought the group up to date on the current activities of Allied Finance Adjusters, pointing out that they will continue to provide members with the $1,000,000.00 Dishonesty Policy and continue to publish a hard copy directory as well as the quarterly industry publication “Professional Repossessor”. It appears from George’s presentation that AFA continues to grow in numbers while remaining a steadfast trade association dedicated to its recovery agency members.

George Badeen’s presentation was followed by the guest speaker from California based Eagle Group XX Affiliate Sponsor DisplayRide, Abdul Kasim advised the group on the safety camera vest and how it can be utilized to create a safer environment for field personnel as well as his unique dash cam with over 6000 uber vehicles building an unsurpassed data base.

The final presentation was by invited guest speakers Markham Hodges and all the way from England one of the key developers of LPR, Henrick Kjellin both representing Up4Repo and describing their LPR system which uses Android Phones to capture data instead of expensive cameras.

Ron Brown presented information related to how many assignments were referred to members from the home office with the projected dollar volume which represented over $750,000.00 directed to Eagle group members The discussion ended with the Eagle Groups strategic plans for growth as well as what was on the horizon to garner more well-paying clients in 2024.

The meeting closed with distribution of silver coins being presented to the ones traveling the greatest distance to attend the meeting,

Krystal and Paul Kalili from Hawaii, the newest member of Eagle Group XX, Dick Frame, and one to Mike Peplinski as a thank you for hosting this momentous event. There was then a drawing for $100.00 which was won by Eagle Group USA member David Galbadon of Georgia.

The evening concluded with the “GRAND BANQUET OF THE EAGLES” which consisted of a fabulous meal and afterwards the auction conducted by the famed auctioneer, Mr. George Badeen, raised $10, 575.00 for the Repo Alliance. The grand bidder and winner of the prized bottle of “Frank Sinatra Special Jack Daniels” Eagle Group XX engraved bottle was Eagle Group XX member Corey Rowson of Pathfinder Recovery in Virginia with a bid of $6000.00.

Here are a few comments from the attendees:

Chris Terreault – AssetzBiz

A very special thank you to both Ron Brown and Mike Peplinski as well as everyone that contributed and traveled to this very successful event! It was a pleasure meeting some of the Eagle Group USA members. I find that the passion, energy and focus of fellow Eagles is a very contagious spirit that motivates me. The networking with other Eagles is invaluable and I always learn so much from other Eagles whether it be where they have succeeded or even when they have tried something that did not work. I already gave a special thanks to Ron Brown but how can any of us ever thank this person enough? Ron, your commitment to the Eagles, your insight, your work ethic and your willingness to help others is truly unparalleled. We are all extremely lucky to have your support! Thank you, Thank you, Thank you!

Peggy Chapman – Speedy Recovery

I am always truly humbled to be part of Eagle Group XX. The only group I have ever been involved with that I truly believe they care and would do all they could to help with anything. All for one and one for all says it all.

Paul Kalili / Krystal Kalili – BB Towing Asset Recovery

We loved it. Got to meet faces to emails and phone calls. Blessed to be part of an amazing group.

David Gabaldon – Barrett Gabaldon Georgia Collateral Recovery Bureau Inc.

It was a very pleasurable experience and got to meet a lot of great people that have the same passion for this business as I do. There was a wealth of knowledge and experience in that room that can’t be bought. I feel privileged to be a part of this great group.

John Campbell – Southern Kentucky Auto Recovery

Being new to the group it was awesome meeting everyone, and the warmest of welcomes that I received was just out of this world. Thank you, Mr. Brown, for the time you put in to make all of this happen. The demonstrations and blocks of instruction were top notch. I believe this is probably one of the best decisions we have made to progress our business.

Walter Justice – Alert Recovery

I received the most information from meeting all the Eagle USA members. also, a big shout out to Harding Brooks they put on an unbelievable presentation. lots of information we are bringing back to our office.

Keith Burger – Recovery Zone

Anything, Anytime, Anyplace – Professionally has been my moto all of my life! Never has it been defined so succinctly! I am humbled to have been in attendance with the Icons and Leaders of this industry. Quite refreshing to realize there are more people like myself out there!

Emily Hemmings – Quick Recovery Services, Inc.

Ron, I want to thank you for the opportunity to have all Eagles attend. I have had some things weighing on my heart lately and being in attendance was confirmation for what I was searching for. I’m forever grateful to be a part of such a special group of people. “What’s right is right, and what’s wrong is wrong” are words I personally live by. To hear you speak that out loud Saturday, was the Lord’s way of showing me…I am right where I belong.

For information on joining the Eagle Group USA Referral Network contact Ron Brown at Rbrown@CSI-ARM.com or call on the Eagle Group XX Hotline 800-411-1844

The Eagles Soar in Lucky 13th Grand Gathering – The Eagles Soar in Lucky 13th Grand Gathering – The Eagles Soar in Lucky 13th Grand Gathering

The Eagles Soar in Lucky 13th Grand Gathering – Eagle Group XX – Eagle Group XX – Repossess – Repossession – Repossession Agency – Repossessor

The post The Eagles Soar in Lucky 13th Grand Gathering first appeared on CURepossession.

]]>The post Is the CFPB Looking at This Possible UDAAP Violation? first appeared on CURepossession.

]]>Guest Editorial

It has been brought to my attention by numerous members of our industry that several clients and forwarding entities may be setting themselves and the agencies that handle their recovery assignments up for a visit from the CFPB to investigate a possible UDAAP violation aa well as a price fixing violations by requesting that agencies provide a flat recovery fee that encompasses voluntary as well as involuntary recoveries with no consideration for required ancillary expenses or mileage.

Before we explore the possibility of violations, first let us look at the definition of UDAAP to have a clear understanding of what might constitute a violation.

UDAAP is the is an acronym that refers to Unfair, Deceptive, or Abusive Acts or Practices by those who offer financial products or services to consumers. UDAAPs are illegal, according to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The rules about UDAAPs were created by the Consumer Financial Protection Bureau (CFPB). Enforcement is shared by the CFPB and the Federal Trade Commission (FTC).

Defining and outlawing UDAAPs were among the many steps that financial regulators took following the financial crisis. It was during this time that financial regulators created new laws and regulations to protect consumers and boost consumer confidence in financial transactions. The most notable piece of legislation was the Dodd-Frank Wall Street Reform and Consumer Protection Act.

An unfair practice is one that harms consumers financially and that consumers cannot reasonably avoid. The harm does not have to involve a large amount of money. Under the law, unfair practices do not benefit consumers or market competition which would make the potential for harm a valid trade-off.

The Consumer Financial Protection Bureau has a key role when it comes to UDAAPs. Dodd-Frank gives the agency the authority to make rules about these practices. The act also includes the authority to enforce any actions that prevent the “unfair, deceptive, or abusive acts or practices” related to consumer offerings and transactions for financial products and services if the entity falls within the CFPB’s jurisdiction.

Then we have the FTC who looks at price fixing schemes. The CFPB also grants enforcement authority to the Federal Trade Commission. Just like the other agency, the FTC ensures that financial products and service providers adhere to consumer protection laws by being truthful and ethical in their offerings and practices. As such, it is responsible for investigating complaints, enforcing regulations, and taking any action against entities that violate the law. This includes issuing fines and penalties, and even prosecuting offending service providers.

Regulators including the CFPB, FTC and State Regulators routinely evaluate financial products and services for potential sources of consumer harm.

The fines assessed by the CFPB are not small. The CFPB ordered three American Express subsidiaries to refund about $85 million to around 250,000 customers after determining there were UDAAP violations.

So how would the request for an all-out “average flat fee” instead of a fee based on the actions required on each individual assignment be considered a UDAAP violation?

If you have an involuntary assignment on a 2022 Chevrolet 3500 truck located 100 miles from your office which requires dollies and then a flatbed to transport it to your lot where you are required to cut a set of push button fob keys, under the “average flat fee: program you would charge the same fee to handle a voluntary assignment where the consumer is located 10 miles from your office and provides you the key.

It is clearly obvious that this “averaging procedure” bills the high-end assignment less while billing the low-end assignment more. The perceived UDAAP violation is the working class consumer, living only ten miles away, who voluntarily surrendered their vehicle and provided keys should have only paid X is now paying X PLUS while the other consumer, living 100 miles away, requiring use of dollies and a flatbed to transport as well as requiring a set of fob keys is paying X MINUS, it is clearly the perception that the X MINUS consumer is being subjected to an unfair business practice by being required to pay more than what the actual expenses should have been.

The only conceivable way this procedure would be fair and feasible would be if the lender paid the entire fee and did not include it when computing the deficiency balance which is charged back to the consumer or that state law, as several states have adopted, states there can be no deficiency balance on repossessions.

Now let us look at why the FTC might be interested in this “Flat Fee’ procedure as a possible “Price Fixing” scheme. This is an issue which I have been interested in for a long time as for several years it has been a common practice for large clients and forwarding entities to dictate a fixed price if you wanted their business.

Our National Trade Associations were fined heavily several years back for recommending rates to the industry members, just recommending rates. Now we have multiple entities that demand recovery agencies work for a fixed rate and then the forwarding agencies pass those “fixed rates” on to their clients who in turn pass them to the consumer in the deficiency balances.

They will tell you to post your own rates but also remind you they will use the lowest rate so if you do not meet or beat that low rate you do not get the account. This is perceived by many as a way of “fixing the price” across the nation as the forwarder or large lender can dictate prices high or low for the agency’s services and pass them on to the working-class consumer.

The Bottom Line

The financial crisis of 2007-2008 brought to light many failures of the financial system. One of these was the lack of transparency and accountability of certain financial institutions. The Dodd-Frank Act helped establish rules to protect consumers and ensure that lenders, banks, and other financial service providers including forwarding entities and recovery agencies deal with consumers fairly and ethically.

Both the CFPB and the FTC are responsible for ensuring that these entities live up to the rules. If you are demanding this “Averaging Flat Fee” or working assignments under this “Averaging Flat Fee” it may be perceived by the working-class consumer that they are a victim of UDAAP in which case it is very easy for them to file a complaint with the CFPB or FTC.

Ron L. Brown

Facilitator, EAGLE GROUP XX/USA

Related Articles;

CFPB, Junk Fees, UDAAP, Who Cares?

CFPB Labels Repossession Forwarding Fees as UDAAP?

CFPB Provides Clarity on UDAAP Repossession Fees

CFPB; How is this not an UDAAP?

CFPB’s Response to Questions on UDAAP Repo Fees

Is the CFPB Looking at This Possible UDAAP Violation? – Is the CFPB Looking at This Possible UDAAP Violation? – Is the CFPB Looking at This Possible UDAAP Violation?- Is the CFPB Looking at This Possible UDAAP Violation? – Is the CFPB Looking at This Possible UDAAP Violation?

Is the CFPB Looking at This Possible UDAAP Violation? – Is the CFPB Looking at This Possible UDAAP Violation? – Eagle Group XX – Eagle Group XX – Consumer Financial Protection Bureau – CFPB – Forwarder – Repossess – Repossession – Repossession Agency – Repossessor – Fight for Fair Fees

The post Is the CFPB Looking at This Possible UDAAP Violation? first appeared on CURepossession.

]]>The post RSIG Editorial – Vehicle Data Responsibility, A Can of Worms first appeared on CURepossession.

]]>Vehicle data responsibility – who is or isn’t responsible for the debtor’s personal nonpublic information in a repossessed vehicle is becoming a hot topic lately. Rumor has it that at least one national trade association has approved an app to clear this data, pushing the state associations to make it the duty of every recovery agency in their respective states to do so and their approved app to be the tool. It sounds like money to be made somewhere; it just doesn’t mean you will be the one making that money. It does not make sense why any recovery agent knowingly wants to open this can of worms.

I searched, but until recently, I was unable to find anywhere the placing of responsibility on the recovery agency’s doorstep to clear the debtor’s personal information from a repossessed vehicle. Nope, not the FCC, FTC, UDDAP, or even the good old CFPB has it as a recovery agent’s responsibility. That was not until Illinois, pushed by their state recovery association, recently passed legislation making it so.

What seems to be missing here is any forethought being given to the fact that this idea will be saddling every recovery agent with more liability, which, as we all know, they don’t need. This additional liability has not been previously considered by the debtor’s lawyers, who will salivate at the mouth on this one. Nor have the actuaries at the few participating insurance companies in this industry had reason to calculate it into their rating system.

After all, before the Illinois legislature made the recovery agent responsible, a recovery agent most likely would never have been in the picture. You had no control of the final disposition of the vehicle, no ownership of the car; at best, you are merely a temporary transporter or holder of the vehicle.

On most occasions, you don’t possess the vehicle’s key or the magical software needed to remove all that valuable data, so there is nothing to make you responsible. On the other hand, the lender has control, ownership, and most of the time access to the key, making them the most likely responsible party.

Now I read that the state associations are moving to make recovery agents wholly accountable for all that nasty personal information in their state.

Let’s examine the pros and cons:

Pro’s for the recovery agents

- Ummm, sorry, I can’t think of one. If you can convince a client to let you bill for something, that then becomes your sole obligation, not theirs. We all know how that works! I have spoken about vehicle data privacy with several large lenders and forwarders who implied they would look at this the same as your electric, telephone, and insurance bills: just one of your business costs. One chuckled as he said they would no longer have reason to pay for keys since the recovery agent would be legally mandated to make them one. He may have been joking because he thanked them for taking this gorilla off their backs.

Making it the lender’s responsibility would make more sense; they would need you to perform these services. That way, you could probably charge a fee or two.

CONS for recovery agents

- LIABILITY – that’s a big one; I assume you have enough worries about litigious debtors and their lawyers. Will your insurance carrier cover the claim when it happens? The big question there, and if they do, will your premiums go up or better yet will you be non-renewed or will yet another carrier get out of the market because they didn’t understand the business? Remember that your insurance company has not even looked at this new exposure. I don’t have a crystal ball, but experience tells me you have premium increases, possibly large ones, in the future. And then we have those pesky loss runs to worry about.

- COST – According to the information I saw, you must use an app approved by the American Recovery Association to provide you with a Certification of Completion for each vehicle where you delete the information. At a cost, of course, since you must use their approved app. Most manufacturers have included a function to delete private personal information in the later model vehicles; however, how will you get the mandated Certificate of Completion if you use the free manufacturer’s method? I am sure those connected with the software app will provide those Certificates free of charge – won’t they?

- HIRING – additional employees to handle the deletions or pay overtime for employees already on staff. What happens when an employee gets busy and releases vehicle(s), failing to use the app to remove the information? How about that angry, disgruntled employee who fails to delete any data?

Ultimately, as a repossessor it should come down to is this going to benefit/serve you or be a detriment to you increasing your liability and your costs? If it does increase your liability and your costs, do you see a way forward of protecting yourself and not having those increased costs even further shrink your bottom line? If the answer to those questions are No – then why would you or the state or national trade group who is supposed to be advocating for you support or push this forward?

Recovery Specialist Insurance Group (RSIG)

RSIG Editorial – Vehicle Data Responsibility, A Can of Worms – RSIG Editorial – Vehicle Data Responsibility, A Can of Worms – RSIG Editorial – Vehicle Data Responsibility, A Can of Worms – RSIG Editorial – Vehicle Data Responsibility, A Can of Worms

RSIG Editorial – Vehicle Data Responsibility, A Can of Worms – Repossess – Repossession – Repossession Agency – Repossessor – Recovery Specialist Insurance Group – RSIG – Consumer Financial Protection Bureau – CFPB

The post RSIG Editorial – Vehicle Data Responsibility, A Can of Worms first appeared on CURepossession.

]]>