Before I get started on this article I would be remiss if I did not first recognize those brave and compassionate recovery agents who have gone to Houston to help in the aftermath of hurricane Harvey. I thank you for your efforts and pray for your safe return to your own home soon. I also continue to send prayers to those agents affected by Hurricane Harvey. Now, to my reasons for writing this article.

Many of us “oldsters” out there will remember the TV show, Dragnet, that starred detective Joe Friday, and his famous line that is in the heading of this article. I wrote this article trying not to offended anyone but, since the recent editorial about contingency and certification I felt it proper to respond with some facts, which may offend a few, but it’s important to set the record straight.

I feel the editorial was misaligned with my comments and I felt it important to point out details about the C.A.R.S. National Certification Program, and about an article written by me two or three years ago about contingency. In short, I wrote, “Contingency, in and of itself is not the primary culprit. The problem lies in the fact that (some) lenders contract contingency services at the same rate as non-contingency services.”; and that is still the feeling I have. Contingency paid at a commensurate rate to do the work involved is OK. Contingency at a reduced rate can create a situation where a recovery agent could make a poor decision and create a confrontational situation that might lead to a law suit and/or an insurance claim.

Now, let’s look at some facts and comparisons regarding professional certification and what RISC does.

- RISC was created to assist all who service repossession assignments; the recovery agency owner and the agents who “work the streets.” RISC is not a members-only organization! We are partnered with the entire industry.

- RISC, formed in 2002, was the first to offer an industrywide compliance certification.

- RISC is the owner and proctor for the Certified Asset Recovery Specialist (C.A.R.S.) National Certification Program which was created and presented to the collateral recovery industry and the lending community in 1999.

- The C.A.R.S. Program has been “vetted” and tested for 17 years by the collateral recovery industry and the lending industry.

- To date, over 8,000 recovery agents have been certified through the C.A.R.S. Program.

- RISC has created 11 Continuing Education courses to compliment the C.A.R.S. Program and to date there are over 1500 graduate.

- The C.A.R.S. Program meets all the requirements of Florida Statute, 493 for licensure of “E” and “EE” applicants and for recovery agencies, the only program to achieve this.

- The C.A.R.S. Program meets all the requirements of Illinois’ 225 ILCS 422, Collateral Recovery Act for the licensure of recovery agents and recovery agencies.

- The C.A.R.S. Program is accepted in all 50 states as the premier certification program for collateral recovery specialists.

- The C.A.R.S. Program has been tested successfully in courts across the country.

- The C.A.R.S. Program is endorsed by attorneys for both defense and plaintiff’s.

- RISC also offers and administers both the Skip-Tracers National Certification Program, written by Alex Price, a nationally known expert on skip-tracing, and the Certified Commercial Recovery Agent National Certification Program, written by Mark Lacek, a practitioner and expert on commercial repossessions.

- RISC also offers the RISC Compliance and Operations Manual to assist recovery agency owners meet the many compliance mandates by lenders and the CFPB.

- RISC has streamlined the lot inspection process which now satisfies 30 lenders under contract with RISC and will perform over 6000 lot inspections this year. That means one (1) inspection satisfies 30 clients.

- RISC now fully vets some 2500 recovery agencies nationwide. Consider how much time and money is saved by creating this standard process. One place to provide compliance docs for lenders to access.

- RISC provides business documents to help the recovery agency owner manage, grow, and protect his/her business.

- Both I and Stamatis are qualified to render expert opinions in Wrongful Repossession litigation in both state and federal court and have used this experience in developing Continuing Education courses and in providing advice to members of the collateral recovery industry.

To compare the “old” and vetted (RISC and the C.A.R.S.) vs the new (other training programs), let’s take a look at the new (other training programs):

- One new program has tested 300 people over a 3-year period, and this program is not accepted in any state that statutorily mandates professional certification.

- Another new program has only two clients accept it as it has been offered for only one year and it is also not accepted in any state that statutorily mandates professional certification.

- And another two-year-old program, has a “check the box” test and can be done in 30 minutes; and it is the same test being resold over and over again, and it is also not accepted in any state that statutorily mandates professional certification.

In summary, I have simply stated the facts as I see them and when comparing the products and services provided by the C.A.R.S. Program and RISC, we believe that clients mandating the C.A.R.S. Program has clearly made the right choice. Please consider these “facts” in building your business for the long-term. Considering the longevity, acceptance by the recovery and lending industry, and the courts, we believe the C.A.R.S. Program is the wiser choice.

So, ask yourself, was there a need for additional programs?

In closing, I have sincerely tried to present the facts. Please take a moment to look at those facts and don’t be swayed by factions and efforts that further divide the industry. The C.A.R.S. Program as an Industry Standard is a benefit to all.

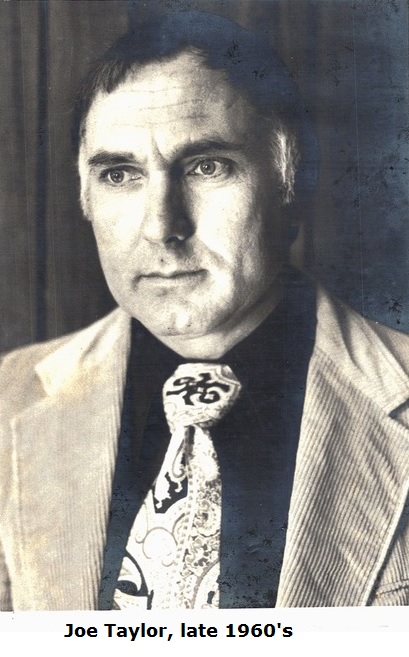

Joe Taylor

More Stories

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong

Snitching vs. Standing on Principle: Calling Out Bad Actors in the Repossession Industry

Lender Interference in Georgia Repossessions