5% Increase Over 2024 Projected

Two weeks ago, we shared with you the Repossession Volume of the Top Six Auto Loan ABS Lenders for 2025 by analyst industry expert Bill Ploog. As illuminating as this was, it was only for the ABS loans. Bill has now provided us additional insights from Trans Union and Cox automotive on all auto loans. The forecast for the remainder of 2025 is even higher than for 2024.

The Rest of The Repossession Volume

Bill Ploog is a data wizard who creates reports for investors involved in the auto loan backed securities (ABS). Just as some background, ABS are financial securities backed by pools of auto loans, created through a process called securitization, where lenders sell their loans to issuers who package them into portfolios for investors. Lenders, including banks, credit unions, and automotive captives (e.g., GM Financial, Ford Credit), originate these loans and often act as issuers.

In Bill’s takes the publicly available data from the SEC’s site, which is loan level detailed, and extrapolates into meaningful data for investors and that is no small feat. It is some meaty and thick data which to look up manually would be extensively exhausting.

This data is actually superior to anything else available to the public on any auto loan pools who require no similar reporting requirements. And this leaves us having to rely upon other data sources to review and prognosticate the state of the current auto loan repossession volumes.

Fortunately, Bill has some great insights on this as well and, after some great discussions, he has provided me his detailed analysis on the entire US auto loan market and what we can expect to see for the rest of 2025.

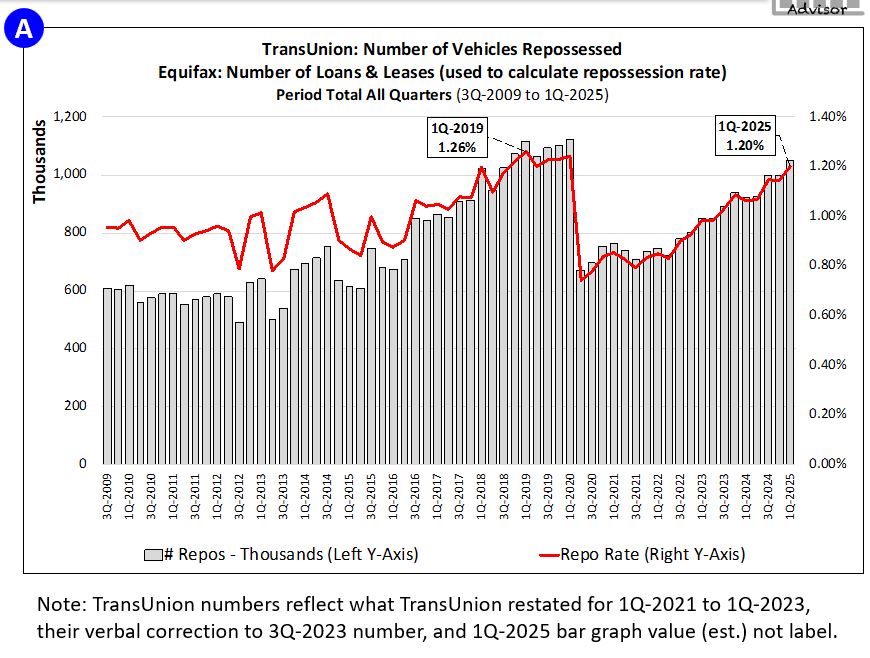

Historical Quarterly Repossession Numbers & Rates

1Q-2025 repo rate approaching pre-pandemic high sustained in 1Q-2019

Image: A

- Total auto loan & lease repos by quarter

- Data source:

- # Repos (TransUnion)

- # Loans / Lease (Equifax)

- Total repos:

- 3Q-2009: 610K

- Peak 1Q-2020: 1,123K

- 1Q-2025: 1,050K

- Period end loans /leases:

- 3Q-2009: 63.9M

- Peak 1Q-2020: 90.4M

- 1Q-2025: 87.3M

- Repo rate for quarter, not annualized

- Repo volume and rate steadily increasing since pandemic pause in 1Q-2020

- Data source:

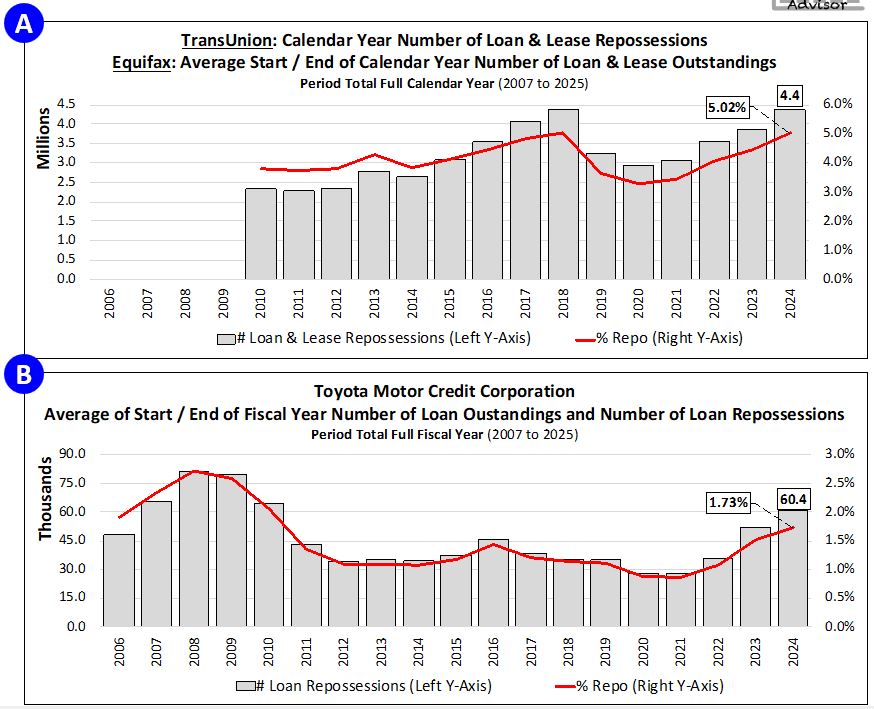

Historical Annual Repossession Numbers & Rates

Image: A

- Entire U.S. industry

- Full-year data prior to 2010 not found

- Sources: TransUnion (# repos) / Equifax (# outstandings)

- 2024 rank: # 2 of 15 years

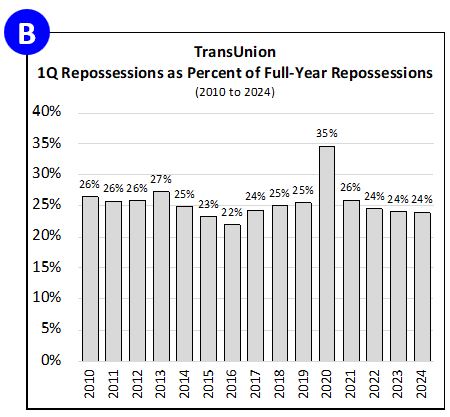

Image: B

- Toyota Motor Credit Corp’s only

- Fiscal year ends in March

- Start of fiscal year shown

- Example: Fiscal year Apr-2024 to Mar-2025 reflected under 2024

- 2024 rank: # 6 of 19 years

- Toyota publishes significantly more repo data than any other lender

Industry-wide repossession rates at pre-pandemic levels …

Toyota’s repo transparency is unmatched in industry … 2024 repo rate only surpassed by 2006 – 2010 levels

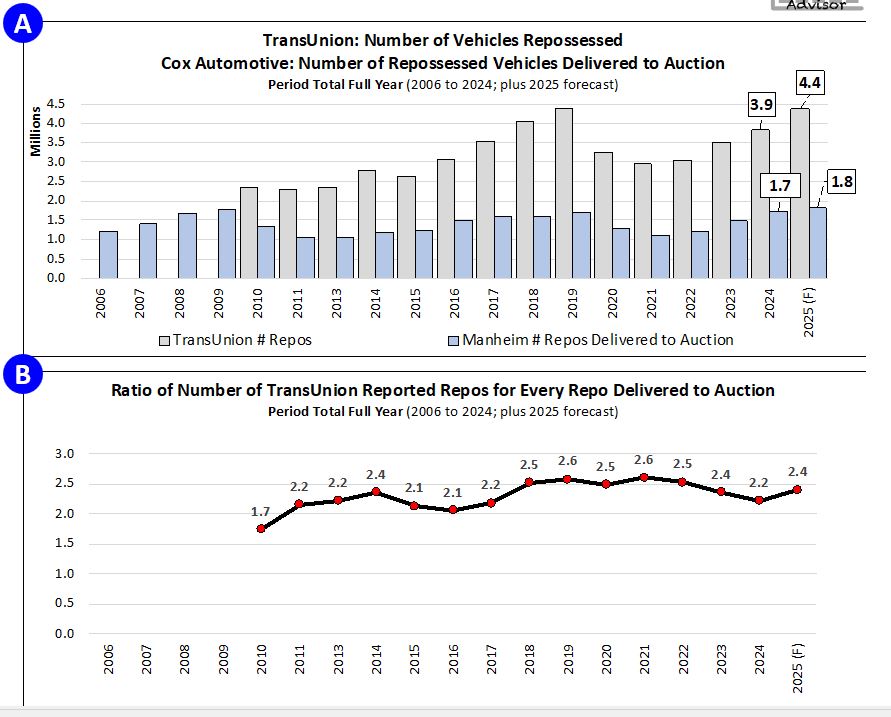

Total Auto Loan & Lease Repossessions (Annual Numbers)

Image A

- Total auto loan & lease repos by year … sources:

- TransUnion

- Vehicles reported repossessed to TransUnion (sold, reinstated, redeemed, co-obligor de-duplicated)

- Cox Automotive

- Repossessed vehicles delivered to physical auctions (Manheim + non-Manheim) for wholesale sale onsite / offsite

- Neither set of numbers comprehend quantity of repossession assignments

- TransUnion

Image B

- Ratio of repossessed vehicles to repossessed vehicles delivered to auctions for resale

Comparison of total repossessions to repossessed vehicles delivered to physical auction for wholesale sale …

Frequently quoted Cox Automotive repossession numbers represent a fraction of actual repossessions

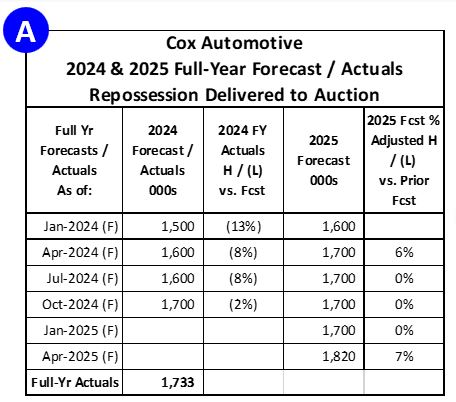

Estimate of 2025 Repossessions

Image: A

- Cox Automotive (Cox) 2024/2025 repossession forecast 2024 actuals reported by Cox.

- Cox underestimated FY-2024 repo vol in each forecast published in 2024

- Apr-2024 forecast of 2024 repo vol was 15% below FY-2024 actuals

- Cox increased its FY-2025 forecast 7% to 1,820K repos in its Apr-2025 forecast

- 5% higher than FY-2024 actuals

- Applying FY-2024 ratio of total repos to repos deliveries to auctions (2.2) … FY-2025 repos would end up at 4.0M based on Cox’s Apr-2025 forecast

Image: B

- Applying 2022 to 2024 trend (24%) to 2025:

- 1Q-2025: 1,050K actual repos reported

- FY-2025: Estimated 4.4M repos if 1Q-2025 equates to 24% of FY-2025 repos

- 4M is 13% higher than FY-2024 actuals (3.9M)

- Created using TransUnion data

- Apr-2025, Cox increased its FY-2025 forecast 7% to 1,820K repos (5% higher than FY-2024 actuals)

- Apply FY-2024 ratio of total repos to repos deliveries to auctions (2.2) … FY-2025 repos estimated at 4.0M

The Halfway Point

June is just about behind us and with that comes the end of the first half of the year. This is a data point that almost cements what is left to come for repossession volume for the remainder of the year.

After the first quarter’s numbers, it became clear that the usual reduction in repossession volume that occurs was far less than in previous years and this set the stage for what was expected; a continued climb in repossession inventory and activity.

In conversation, Bill and I both agree that the Cox Automotive estimates are far below reality and that the Trans Union data, while more concise, still misses a lot of activity that does not report to them. Unfortunately, there is no one perfect method of acquiring this data, so it does require multiple sources.

RDN’s provided data for the end of 2024 and Q1 2025, far exceeded any of the other data sources and is superior in most ways as it also tracks assignment volume from which we can derive recovery ratios which are becoming an even more import yardstick of efficiency in assignment and recovery strategies. I am hoping RDN will share these with me at the end of the quarter.

If anyone would like to subscribe to Bill’s data, I strongly suggest that you reach out to him at his LinkedIn profile at Bill Ploog, WCP Consulting, LLC. Even if you don’t subscribe to his data reports, his posts on LinkedIn are always illuminating.

Thank you again Bill!

Kevin Armstrong

Publisher

Related:

Repossession Volume of Top Six Auto Loan ABS Lenders for 2025

Are Lenders Masking the True State of Auto Loan Delinquency?

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control