EDITORIAL

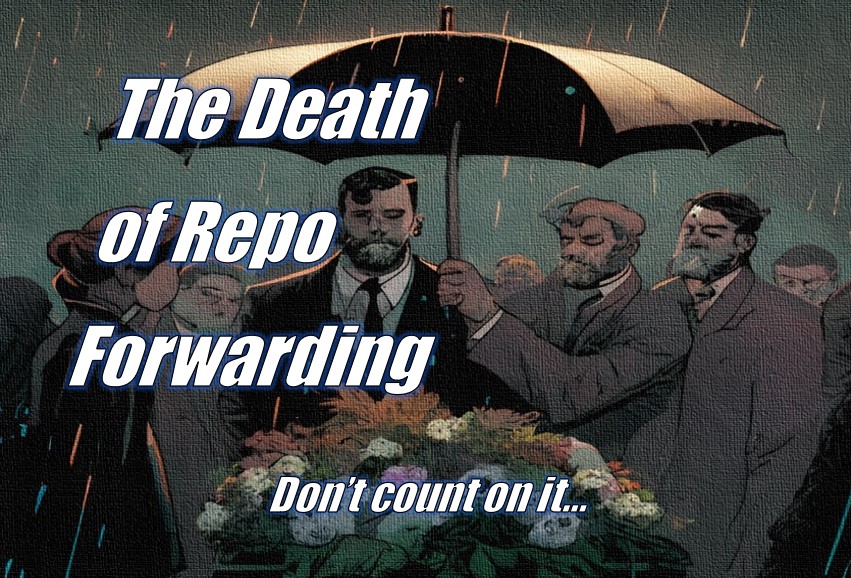

Now that the Consumer Financial Protection Bureau (CFPB) has clarified their position on UDAAP fees charged by repossession forwarding companies, many questions come to mind. I am sure that in the days that followed, most lenders and forwarders have been meeting to discuss how to manage this. But the lingering question of the survival of the forwarding model plays into this. Is this the death of repo forwarding?

In short, I wouldn’t count on it. With the economy veering toward its first recession in almost fifteen years and a bubble formed in auto loan affordability, no one is likely to throw in the towel on the repo forwarding model anytime soon. But with all of the questions created by the CFPB’s declaration, one thing is clear. The old business model won’t work.

In the short term, it does not appear that there has been any major interruption the orderly flow of operations by the lenders. Likewise, I’ve heard of no indication that the assignments coming from the forwarders has slowed down. For now, it looks like lenders have resigned themselves to “biting the bullet” on the “Junk Fee” portion of the bills coming in from the forwarders, or simply taking a risk and doing business as normal.

I seriously doubt that any lender under the CFPB’s supervision is choosing to ignore this. The CFPB has a history of levelling some pretty hefty fines. I imagine there may be some lenders not under CFPB supervision that feel immune to the CFPB’s ruling and to save the internal expenses, are ignoring making any changes to their NOI reporting methods until some other issue comes along to make them. And those issues very well could come along in different forms other than the CFPB themselves.

Examiners of all types, state, FDIC, NCUA, etc., frequently follow the guidance of the CFPB and these “Junk Fees” could at very least, appear as exam finding requiring lender remedy. And worse yet, who knows how the vast and opportunistic network of consumer advocate attorneys across the nation will leverage this proclamation in repossession related cases big and small.

The CFPB

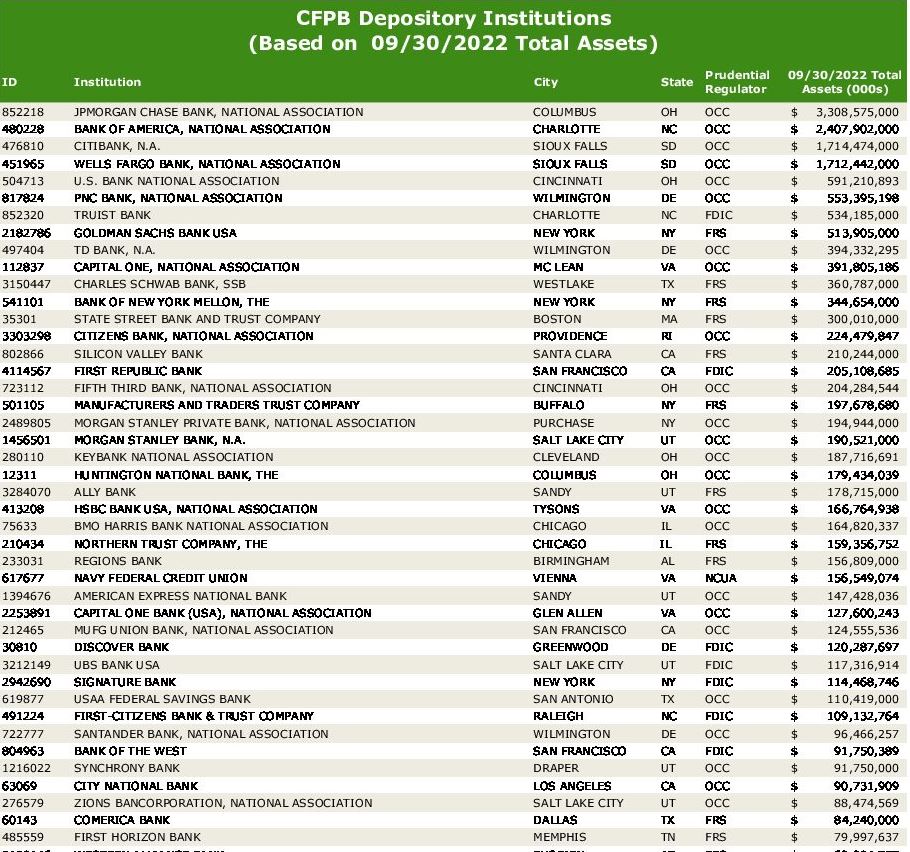

Let’s start with the CFPB’s reach. The CFPB examines over 100 financial depository institutions and non-bank entities. In addition, last year, they’ve expanded their supervision via a previously dormant authority that includes the supervision of non-bank entities and loan service providers for those lenders. This is a significant portion of the auto lending world.

Click Here to See The Full List

As exemplified by their actions against Nissan Motor Acceptance for allowing repossession agencies to charge personal property fees in October of 2020, their reach can expand into every aspect of the repossession industry should they so desire. So, for anyone thinking that this can’t affect their repossession or forwarding company, that is probably wishful thinking.

The Problem for Agencies

For many agency owners, the CFPB’s UDAAP forwarder repossession fees proclamation creates an assumption that the “direct assignment” model will increase in volume, and it could, but I’ll get into that shortly. For some agency owners, there is the assumption that they will be able to increase their fees once freed from the fixed forwarder fees, and it could, but that’s another issue that I’ll also cover later.

I know many out there may have assumed that this could spell the end of the forwarding industry. And if that were the case, I suspect that how good this is for an agency could depend greatly on their current reliance on repossession forwarders. If it is anywhere near where it was when I did my September 2020 “State of the Repossession Industry Survey”, it is significant and at least 50% by now.

One major problem that this could create is a simple fact that some of you won’t like. Many, if not most of you, are not great salespeople or marketers. There, I said it. The reason for this is a simple lack of practice. Decades of over reliance on the forwarders to spoon feed your agencies assignments has given many of you little motivation and no practice to do so.

With that said, if you have not been doing so all along, it would be wise, to make the effort. There are still many credit unions, community banks and buy here pay here dealers with whom you can strike up a good relationship. Afterall, the relationships between the lenders and their repossession agent networks was for the vast majority of the history of auto lending, a close one.

Unfortunately, absent the ability to market themselves well and develop direct relationships, many small agencies could go out of business without their forwarding partners. Their overreliance on the forwarding companies and inability to effectively market their companies could be a death blow. Let’s face it, the forwarding model is something many agencies cannot survive without.

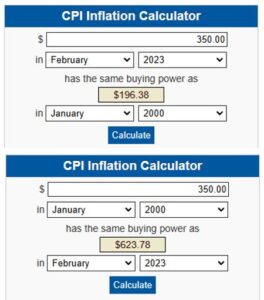

Now as far as raising fees. I suspect that will occur. At very least, there may be some improvements in storage fees now that the forwarders can no longer bill for charges that they didn’t pay the agencies. But there is a one hurdle to raising fees. The CFPB’s statement on the average repossession costing $350.

They are correct, but they’re reinforcing on to the lenders that this is adequate and the norm. It completely ignores the fact that this fee has been held at this level for over twenty years by the forwarding model. I repeat, the average repossession fee has remained unchanged for over 20 years.

They are correct, but they’re reinforcing on to the lenders that this is adequate and the norm. It completely ignores the fact that this fee has been held at this level for over twenty years by the forwarding model. I repeat, the average repossession fee has remained unchanged for over 20 years.

The average $350 fee has the current value of $196.38 when compared to the year 2000 according to the US Bureau of Labor Statistics. Adjusted for inflation, it would have to be $623 in order to have the same spending power. Sad but true and I don’t see it reaching that level anytime soon.

With the CFPB’s $350 statement, a form of precedence has been set, a standard that will be frequently held up as the norm. That could become a frequent talking point that comes back to haunt the industry for years.

The Middleman

Obviously, the forwarding industry has been going through a lot of changes. Any assumption that their assignment volume from lenders would just dry up as the result of all this appear to be wrong from what I have been told. According to two forwarding company CEO’s that I have spoken with, they have received no blow back and it’s business as usual, and actually still on the rise.

While I am not privy to the conversation going on between the forwarders and lenders, I’ve heard of no discourse or animosity for their prior billing practices. Lenders from all that I have heard, are simply modifying their fee reporting on their notices of intent to dispose of collateral (NOI).

That is not to say that all is well in forwarding world. The CFPB’s ruling has stripped the forwarding companies of a lot of income charged to the borrowers and unpaid to the repo agencies. Fees like storage, surcharges and other fees that likely padded their incomes significantly. Even with increases in volume likely to come, the profit margins per recovery will be taking a hit.

In the short term, I have heard of no forwarding companies contemplating any major changes to the forwarding model of old. But to survive a changing market and to be more competitive, it may require revisions to their business models.

With reduced income there may come a point where there are layoffs and internal cost cutting measures but the forwarding model is far from dead. They still provide services that the lenders and repossession agencies need.

Forwarders already have established vendor management departments to satisfy the lenders requirements. These are skills and staff that at this point, the lenders likely have little or none of and probably won’t staff up for. Compliance management of a repossession agent network is something that the lenders would gladly pay out of pocket for.

Skip tracing is another service that forwarders provide as well and are not likely effected by the CFPB’s decree which speaks specifically of repossession related fees. Those forwarders with a strong remarketing arm could do well in the incoming swell of repossessions likely to hit this summer. While these revenue streams help, they are unlikely to make up for all of the extra income lost.

One way or another, most forwarding companies will survive. Most, but probably not all. As far as lenders migrating away from this relationship anytime soon, I wouldn’t count on any major changes unless the forwarding model becomes a greater expense burden on the lenders than would be if they brought those same services back under their own roofs.

The Hardest Hit

As far as the lenders go, some may eventually jump ship from the forwarders and dip their toes deeper into the direct assignment model to comply with the CFPB’s declaration without having to absorb the forwarder portion of the fees. But I would wager that few are adequately staffed to jumped in much deeper than they currently do if at all. In the short term, from what I’ve been hearing most are just billing the borrower for the agent paid fees and sucking up the difference.

The reality is, like the repossession agencies, most lenders have become far too dependent on the repossession forwarders. Few, if any, are adequately staffed to manage repossession at the current volume let alone possess the same skill sets to manage a direct assignment model. With monetary pressure created by rising rates, liquidity will likely be a big obstacle to hiring, so, in the short term, abandoning their repo forwarders is unlikely.

Regardless, as a basic best practice, ALL LENDERS, owe it to themselves to test the water. Do a champion challenger comparison between an equal number of direct assignments and forwarded assignments. Grade them on speed of recovery, recovery ratios, service level agreements or more. For a great example of this score carding, you should go take a peek at Resolvion’s article “Vendor Scorecarding Techniques to Improve Collateral Recovery Results.”

As bad as the liquidity and monetary pressures are, the biggest issue that could arise for lenders under the CFPB’s supervision is recompensating overpaid fees. Should the CFPB require them to do an audit for a specific period of time and refund to borrowers those excess forwarder fees that were paid for repo redemptions and reinstatements, this could cost millions of dollars.

But possibly the biggest threat to all lenders is the CFPB’s statement that the forwarders portion of fees are an UDAAP. The simple act of having used those numbers could be used as an argument that the notices of intent to dispose of the repossessed vehicle sent to the borrowers and could be ruled as improper by a debtor sympathetic court. These issues could start small and result in waiving a deficiency balance and credit reporting or could become the source of class action lawsuits.

This could get dragged into allegations of FDCPA and FCRA violations as well. The CFPB really opened a nasty Pandora’s box of risk for everyone with this statement.

New Billing Models

I had initially imagined that the forwarders would immediately begin exploring different billing models to reduce or minimize the new expense to their lender clients. So far, I have heard of none, but should they go down that road, I can imagine that some of these models might emerge.

Flat Forwarder Fees – One idea that I consider, might be that the forwarders get paid a flat fee from the lenders for the assignment. To supplement this, they could, don’t laugh, charge the agencies a flat fee for recoveries or assignments. But if the agencies increase their fees to accommodate that, it could perhaps appear disingenuous and equally a violation. The funny part of this idea is the agencies having to pay the forwarders invoices. I doubt that the forwarders will be allowed to manage the transactions between the lenders and the agents due to the issues that arose from them having done it in the past, but I could be wrong. Their reputations may have taken a big hit with the CFPB and perhaps some lenders because of all of this. With the CFPB stating that they can only quote to the borrower what the agent paid, logic would tell us that the lenders would want to see the agency bills directly. This is a solution that two forwarding companies have told me that they adopted immediately. This is transparency and an honest and step in the right direction.

Commission – Another billing model that I thought might get tossed around is that the forwarders receive a commission on the agencies billing to the lender. This idea creates a similar problem to the flat fee in that it not only encourages agencies to add to their billing but does so with encouragement of the forwarder.

Lender Pays – With a change from the new model of lenders paying forwarder fees would come a reversal of fortune. How long until we hear the forwarders complain about agents being 90-120 days past due on payments or having invoices declined over minor accounting issues? I guess what comes around goes around, but two wrongs don’t make a right, even if it is funny.

Whatever direction all of this goes, it is pretty clear to me that this long imbalanced business relationship between lender, forwarder and agency is in the midst of major transformation toward required transparency. And the lack of transparency is what caused all this mess in the first place. I had hoped that someone in the forwarding or lending world would have stepped forward to remedy this issue on their own before things came to this, but it just didn’t work out that way. But now, transparency is the requirement.

Now that we have a better understanding of the spirit of the CFPB decision, perhaps the repossession industry, lenders and forwarders alike, can find a new balance. And in that, a business model and practices that are transparent and fair to the consumer. This is far from an unreasonable request. It’s the law.

Kevin Armstrong

Publisher

Related Articles;

CFPB Provides Clarity on UDAAP Repossession Fees

CFPB’s Response to Questions on UDAAP Repo Fees

CFPB Labels Repossession Forwarding Fees as UDAAP?

CFPB; How is this not an UDAAP?

Facebook Comments