The post Ohio Association of Repossessors Expands Upcoming 2024 Convention first appeared on CURepossession.

]]>Special Thanks to Sponsors for Their Support

On behalf of the Ohio Association of Repossessors (OAR), we are thrilled to announce the expansion of our highly anticipated annual convention, now scheduled for October 14 & 15, 2024. Originally planned as a small, member-focused gathering, the event has garnered significant interest across the repossession industry, transforming into a two-day event packed with exciting opportunities for networking, education, and collaboration.

We extend our appreciation to our generous sponsors; their support ensures that this event will be a memorable experience for all attendees:

- MV TRAC/DRN: Headline Sponsor

- Iron City Recovery: Cocktail Party Sponsor

- Location Services: Breakfast Sponsor

- Primeritus: Lunch Sponsor

- Iron City Recovery: Lanyard Sponsor

- InsightLPR: Snack Sponsor

- Resolvion: Beverage Sponsor

- MBSI: Hurricane Helene Fundraiser Sponsor

- Harding Brooks: Closing Party Sponsor

In addition, we would like to give special recognition to Clearplan, RDN and Royal Key Supply for their generous donation to the RABF (Recovery Agents Benefit Fund) silent auction, and to the American Recovery Association for their continuous support.

As part of our commitment to giving back, 10% of all sales and sponsorships from the event will be donated directly to RABF, helping to support recovery agents and their families in times of need.

How You Can Get Involved: For those interested in contributing to the silent auction or supporting the event, please contact OAR at President@OHIOAR.ORG . We encourage you to act fast, as tickets are limited. To register or learn more about joining the Ohio Association of Repossessors, visit our website at OhioAR.ORG.

We look forward to seeing you there and appreciate your ongoing support of the Ohio Association of Repossessors and the repossession industry.

DEFENDING & PROMOTING THE RIGHTS OF REPOSSESSORS IN OHIO

DEFENDING & PROMOTING THE RIGHTS OF REPOSSESSORS IN OHIO

About The Ohio Association of Repossessors (OAR)

Our mission as the Ohio Association of Repossessors is to foster strong connections among all Ohio repossession agencies. Through advocacy and education, we aim to create unity and advance all Ohio companies, promoting compliance and ethical practices. We strive to create a culture of continuous improvement throughout the repossession industry.

Ohio Association of Repossessors

PO Box 470092

Broadview Heights, Ohio 44147

Ohio Association of Repossessors Expands Upcoming 2024 Convention – Ohio Association of Repossessors Expands Upcoming 2024 Convention – Ohio Association of Repossessors Expands Upcoming 2024 Convention

Ohio Association of Repossessors Expands Upcoming 2024 Convention – State Repossession Associations – Repossess – Repossession – Repossession Agency – Repossessor

The post Ohio Association of Repossessors Expands Upcoming 2024 Convention first appeared on CURepossession.

]]>The post GALR 2024 Conference Wraps Up with Record Attendance first appeared on CURepossession.

]]>The Georgia Association of Licensed Repossessors (GALR) 2024 Conference exceeded the expectations of its organizers. “We registered 77 people as of last night,” commented GALR Treasurer Clayton Merritt on the first day of the event, held at the scenic Lanier Islands Resort in Buford, GA. Attendees came from across Georgia as well as from North Carolina, South Carolina, Tennessee, Florida, and Texas, more than doubling last year’s attendance.

Lanier Islands Resort, a 1,200- acre retreat, offers a variety of activities, including golf, water sports, and snow tubing. The Lodge Hotel, where attendees stayed, is an ornately decorated venue featuring a rustic cabin theme, complete with multiple restaurants, bars, and a poolside fire pit. But I digress…

Day 1 Highlights

Day 1 featured a half – day program, starting with GALR’s annual business meeting and elections. No changes were made to the board, as all current members were re-elected to their respective positions.

Following the meeting was a scheduled 2.5- hour locksmith training session led by Jessica Merritt of Artis Recovery. Jessica demonstrated the programming of two universal remotes for different makes and models of vehicles, offering insight into how today’s advanced equipment is used. After the demonstration, she spent over an hour answering attendees’ questions about equipment and how automotive locksmithing can be integrated into repossession services.

Day 2: A Full Schedule of Events

Day 2 was packed from 8 a.m. to 6 p.m. “We apologize, but the program kept expanding,” Clayton Merritt explained, referencing the growing interest and the volume of information GALR felt was essential to share with the industry.

If the goal was to deliver a wealth of valuable information, GALR certainly succeeded. Numerous topics were explored from multiple angles. Contracts, for instance, were examined from an insurance perspective by Jon Pollard and Renee Lowe of Harding and Brooks, a legal perspective during Mark Howk’s session on frivolous lawsuits, and in the Client Panel Discussion. Each session built upon the last, ensuring attendees gained a comprehensive understanding of the subject matter.

If the goal was to deliver a wealth of valuable information, GALR certainly succeeded. Numerous topics were explored from multiple angles. Contracts, for instance, were examined from an insurance perspective by Jon Pollard and Renee Lowe of Harding and Brooks, a legal perspective during Mark Howk’s session on frivolous lawsuits, and in the Client Panel Discussion. Each session built upon the last, ensuring attendees gained a comprehensive understanding of the subject matter.

While it’s difficult to cover every session in detail, GALR acknowledges the invaluable contributions of all participants. “We couldn’t have had a convention without their willingness to share their knowledge,” said GALR President John Newberry of Eagle Eye Recovery.

Here’s a quick look at some of the key sessions and presenters:

- Locksmith Demonstration – Jessica Merritt, Artis Recovery

- Contract Review – Jon Pollard and Renee Lowe, Harding and Brooks Insurance Agency

- Client Panel Discussion

Moderator: Wes Carico, Artis Recovery

Panelists: Bill Sheehan (COO, Trinity Financial Services), Jason Clark (Managing Partner, Resolution Management Group), Jeremy Turner (Director, Vendor Management, Location Services), Keith Daymond (Executive VP, Victory Recovery Services), Ryan Medina (VP Vendor Management, MVRecovery MVTRAC)

- GA Personal Property Law and Frivolous Lawsuits – Mike Howk, JD, Risk Manager, RSIG

- MBSI Software Update – Ray Peloso

- Preventing Breach of Peace – Mark Lacek, Repossession Litigation Consultant

- Improved Relations Between MVTrac & Vendor Network – Ryan Medina, James McGee, Josh Harley, and Johnnie Renfro of MVRecovery MVTRAC

Panel Discussion

“People are worried about getting ambushed,” Clayton Merritt shared when discussing the process of organizing the panel. To ease concerns and build credibility, the format, objectives, topics, and sample questions were sent to the panelists well in advance. This approach allowed for deeper exploration of complex issues, explained Moderator Wes Carico.

The discussion covered several pressing topics, including stagnant rates, contractual language, and agent safety. Each panelist shared insights into how their businesses viewed and addressed these challenges. A few key takeaways emerged:

Wes highlighted the unique role forwarders play in the industry as both clients and competitors. He suggested that repossession companies should observe and emulate forwarders’ successful business practices.

Negotiation was another common theme. Both pricing and contract language, panelists emphasized, can and should be negotiated. “We ‘red-line’ every word of our contracts,” one panelist remarked, stressing the importance of scrutinizing terms. Another panelist reminded attendees of the need to review contracts annually, especially to request adjustments for inflation if such provisions aren’t already built in.

Safety was a major concern for all panelists, who recognized the role of forwarders in keeping dangerous or rogue companies out of the industry. The implication was clear: providing opportunities to these risky organizations not only threatens the industry’s reputation but also diverts funds from legitimate clients (lien holders) and supports potentially harmful activities. Though I’m no expert in liability, this seems to be an area where many in the industry need to tread carefully.

There was also a call for industry software providers to improve their tracking tools for identifying potential risks in high-risk accounts or addresses. “You are their revenue stream,” Wes explained, urging forwarders to push for better solutions. The panel also agreed to explore ways to support the Recovery Agents Benefit Fund (RABF) so Ed Marcum and his team can continue to assist families impacted by their loved ones work in the repossession industry.

Overall, the panel addressed sensitive topics, provided valuable insights, and fostered commitments around safety and industry support.

GALR wanted to extend its deep appreciation to the panelists for their participation and dedication. These five individuals are among the most successful leaders in the industry, and their willingness to share their viewpoints on key issues was a tremendous benefit to everyone in attendance.

Liability in the Industry

Liability was a central theme throughout the conference, with several presenters offering insights from their areas of expertise. Jon Pollard emphasized the importance of reviewing Garage Keepers policies, noting a disturbing trend where Direct Primary Garage Keepers policies exclude coverage for acts of God, such as rain, hail, or wind damage. This exclusion, he explained, negates the purpose of Direct Primary coverage and leaves insureds exposed.

Renee Lowe stressed the need for every repossession company to have a contract in place with its clients, even if it’s just a simple one-page agreement. She also highlighted the importance of ensuring that contracts with brokers or forwarders extend coverage to their clients as well. Both Renee and Jon encouraged attendees to reach out with questions and review contracts. “We can’t give legal advice,” Renee clarified, but she explained they would point out where contract language might negatively affect your coverage.

Mike Howk, RSIG’s Risk Manager and a national expert in repossession law, warned of a troubling new trend: “You cannot insure against a crime.” He explained that if you’re sued and the allegations are purely criminal, your insurance will not cover the case. However, if there’s at least one civil allegation, the insurance will help defend against all claims under a “commonality of defense” principle.

In a side conversation, Ed Marcum further explained that this trend is becoming more common in states where possession laws are being more clearly defined. “It eliminates the common civil allegation of breach of peace,” leaving lawsuits to focus on criminal sections of state code or parts of the FDCPA (Fair Debt Collection Practices Act) considered criminal. He cited a case in California where the insured will likely not be covered, as no civil allegations were made, and the way the law is written leaves no room for one to be added.

As more associations consider sponsoring or proposing legislative changes, this should serve as a cautionary tale: poorly considered legislation can have unintended consequences, so it’s crucial to involve all industry stakeholders in the conversation.

Repossession Litigation Consultant Mark Lacek delivered dynamic content on the importance of policies, documentation, and employee training. He began by holding up a copy of Nostalgic Towing/Artis Recovery’s “No Follow, No Chase” policy recommending everyone adopt a similar policy.

Repossession Litigation Consultant Mark Lacek delivered dynamic content on the importance of policies, documentation, and employee training. He began by holding up a copy of Nostalgic Towing/Artis Recovery’s “No Follow, No Chase” policy recommending everyone adopt a similar policy.

He also urged attendees to consider how their company’s image could impact potential litigation, recalling a case where a defendant’s company was named “Rambo.” “Who do you think the jury is going to believe?” he asked.

Mark’s overarching message was clear: credibility and image stem from every aspect of a business, including its name, policies, procedures, equipment, attire, and documentation. These elements all contribute to how a company will be perceived in court, even though most cases never go before a jury.

Experts like Mark are often hired to assess a company’s professional and operational standards as they relate to any case. Throughout the conference, the recurring message was that failing to maintain professional standards increases the frequency of claims. Jon Pollard summed it up: “Frequency breeds severity.”

My takeaway – Illegal, improper, or improperly motivated actions lead to claims, poor image and documentation lead to larger payouts directly from your profits!

Fundraising and Fun

GALR also welcomed four new members during the event. The day ended with a lively fundraising e ort that began with a raffle and auction. The real excitement, however, came when an anonymous donor pledged $600 if Ed Marcum, CEO of RABF, would jump into the pool. Ed enthusiastically accepted, declaring, “Anything for the cause.”

This sparked a series of challenges, with several professionals in business attire attracting everyone’s attention by diving into the pool. Credit Acceptance Corp’s Tiny Sebastian and MVRecovery MVTRAC’s Johnnie Renfro wrapped up the plunge, raising an impressive $3,000 combined. The event raised over $11,000 for GALR and the Recovery Agents Benefit Fund (RABF), although the exact allocation was not known at the time of this release.

Networking and Industry Connections

As with any great conference, some of the most valuable exchanges took place during breaks, meals, and evening gatherings. GALR provided an ideal platform for vendors to meet new clients. Clayton Merritt worked closely with client representatives to address coverage gaps, while many new business relationships were formed through casual introductions. This reflects the growing credibility and influence of GALR, especially considering this was only its second annual conference.

While it’s uncertain whether GALR will o er deeper dives into any of the sessions, you can stay updated by following their Facebook page (search for “Georgia Association of Licensed Repossessors”) or visiting their website at https://galr.org .

In Closing

GALR extends its heartfelt thanks to all the participants and speakers for making the 2024 conference a memorable and successful event. A special thank you to the staff at Lanier Islands for providing excellent facilities and support.

Thank you to all the sponsors:

Gold – DRN, MVTRAC, Trinity, Harding Brooks, MBSi Corp, RDN

Silver – Loss Prevention Services

Bronze – Resolvion

Kudos to the entire GALR team for their hard work and dedication in organizing this event. Having attended numerous industry events over my 17- year career, this one struck the perfect balance of education, camaraderie, and business. Well done, GALR!

Wes Carico

Nostalgic Towing

Artis Recovery

GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance

GALR 2024 Conference Wraps Up with Record Attendance – State Repossession Associations – RABF – Recovery Agents Benefit Fund – Repossess – Repossession – Repossession Agency – Repossessor

The post GALR 2024 Conference Wraps Up with Record Attendance first appeared on CURepossession.

]]>The post Repo Storage Capacity – Ultimately the Lenders Problem first appeared on CURepossession.

]]>GUEST EDITORIAL

The repo industry is facing an increasingly challenging issue: limited storage capacity for repossessed cars. While this may seem like a problem for repossession agencies alone, it ultimately affects the lenders, who need the vehicles recovered. This article delves into the root causes of this issue, the economic impact on repossession agents, and how repossession service providers are adjusting.

Background on the Problem

The current landscape for repossession agencies is marked by rising repo volumes and a smaller pool of agencies due to the impact of the pandemic on the industry. Regarding the issue of storage capacity, several factors are driving this issue:

- Skyrocketing Land Costs: Industrial Outside Storage (iOS) properties are in high demand but remain scarce. Demand from ecommerce companies and the logistics companies that support them, has really had an impact.

- Regulatory Challenges: Many properties face non-conforming use issues, making it difficult to develop or repurpose land for storage purposes. Municipalities often resist such use due to perceived low tax benefits, security issues and aesthetic concerns, thus creating an additional layer of complexity.

These dynamics create a complex environment where the scarcity and high cost of storage space are significant hurdles for the repossession industry.

The Real Costs

Last year, a study across members from 15 state repossession associations provided quantitative insight into the “all in” costs of storing repossessed cars. This includes not only the cost of the space itself, but many other costs (insurance, security, maintenance, etc..) that are directly related. Of course, there are regional differences, but here are some of the findings:

- Monthly Cost per Parking Space: The average cost is $134.60, with some areas seeing costs as high as $507.90 per space per month.

- Daily Cost per Parking Space: The average daily cost is $4.13, topping out at $13.93 per day per space.

When these costs are applied to actual repossessions, the financial impact becomes evident. For example, if a lender’s average days on lot is 15 days, it costs $61.95 on average for every repo the agent completes. Multiply that across an entire portfolio, and the numbers become substantial. The longer vehicles stay on the lot, the lower the profitability for agents, creating a ripple effect that impacts lenders. It is in everyone’s best interest, lender and agent, to move the units off the lot quickly. For lenders that recognize this fact, and have focused on speeding up the process, average time on lot is generally less than 10 days.

Agency Adjustments That Impact Lenders

We have seen a definite increase in the level of financial sophistication at repossession agencies over the past few years. Combine this trend with the general shortage in repossession capacity in the industry and you end up in the current situation where the better agencies can pick and choose the business they will take. The storage capacity challenge is throwing more fuel on to the fire. As result, agencies are:

We have seen a definite increase in the level of financial sophistication at repossession agencies over the past few years. Combine this trend with the general shortage in repossession capacity in the industry and you end up in the current situation where the better agencies can pick and choose the business they will take. The storage capacity challenge is throwing more fuel on to the fire. As result, agencies are:

- Adjusting their profitability calculations to incorporate an appropriate “load” for storage costs especially when average days on lot exceeds the norm.

- Refusing work from lenders that pay low fees and/or don’t move cars off the lot quickly. For those lenders, their business likely ends up with lower performing agents.

- Even if accepted by strong agents, it is often viewed as filler work or work that is of lower priority.

- Frequently reprioritizing cases based on profitability based on expected storage capacity that day, week, etc..

- Passing up LPR recoveries, which often carry a lower fee, if storage space is very limited at that time.

While a lesser issues, storage limitations extends to personal property as well.

There are no easy answers to this issue. The lenders and forwarders that don’t help find solutions will likely see their assignments be less of a priority.

Ready to take the next step? Click here to request a free repo check up.

Repo Storage Capacity – Ultimately the Lenders Problem – Repo Storage Capacity – Ultimately the Lenders Problem – Repo Storage Capacity – Ultimately the Lenders Problem

Repo Storage Capacity – Ultimately the Lenders Problem – Repossess – Repossession – Repossession Agency – Repossessor – Forwarder – Resolvion – Resolvion

The post Repo Storage Capacity – Ultimately the Lenders Problem first appeared on CURepossession.

]]>The post Resolvion’s Claudia Plascencia Elected President of NAF Association first appeared on CURepossession.

]]>Resolvion’s Claudia Plascencia Elected President of the National Automotive Finance Association Executive Committee

FOR IMMEDIATE RELEASE

Charlotte, NC – Resolvion is proud to announce that Claudia Plascencia, our Senior Vice President, has been elected as President of the National Automotive Finance Association’s (NAF Association) Executive Committee. This prestigious appointment, announced during the 28th annual Non-Prime Auto Financing Conference in Fort Worth, Texas, highlights Claudia’s significant contributions to the industry and her dedication to advancing the industry.

Claudia Plascencia is a seasoned professional with extensive experience in automotive finance and recovery solutions. Her commitment to industry excellence has have earned her recognition as a leader in the field. Previously honored among Women in Collections and Recoveries and Women in Remarketing, Claudia’s leadership abilities and inclusive approach are well-regarded throughout the industry.

“Claudia’s exceptional leadership abilities, unwavering dedication, and profound commitment to the auto finance and repossession industry have resulted in her deserving achievement of this prestigious position. Her strategic vision and inclusive approach will undoubtedly foster innovation and drive meaningful progress for the entire industry,” said Mike Thomas, Resolvion’s CEO.

Jennifer Martin, NAF Association Executive Director, echoed these sentiments, stating, “I am thrilled to welcome Claudia to her new role. Her leadership, vision, and dedication will undoubtedly steer our association toward continued growth and excellence. I look forward to working closely with her to serve the needs of our members and advance our shared goals.”

The NAF Association emphasized the pivotal role of its executive committee in guiding strategic direction, overseeing key initiatives, and representing the interests of its members. Claudia’s experience and industry standing will help lead the association to new heights of success and impact.

About Resolvion

Resolvion is a leading provider of skip tracing and repossession management services, dedicated to delivering innovative solutions and exceptional customer service. With a commitment to industry excellence, Resolvion partners with financial institutions to mitigate losses and enhance recovery rates. For more information, visit https://www.resolvion.com.

For media inquiries, please contact:

Jose Mendiola

954-931-2848

Resolvion’s Claudia Plascencia Elected President of NAF Association – Resolvion’s Claudia Plascencia Elected President of NAF Association – Resolvion’s Claudia Plascencia Elected President of NAF Association

Resolvion’s Claudia Plascencia Elected President of NAF Association – Forwarder – Repossess – Repossession – Resolvion – Resolvion

The post Resolvion’s Claudia Plascencia Elected President of NAF Association first appeared on CURepossession.

]]>The post The Real First Forwarder Dedicated to Repossession Safety first appeared on CURepossession.

]]>“The only thing that I know, is that I know nothing.” Socrates

EDITORIAL

Last week I wrote an article proclaiming that American Recovery Service (ARS) was the first repossession forwarder to take “the Next Step in Dedication to Repossession Safety.” Well, that turned out to be outright wrong. Sometimes profound gestures done by the humble can be easily overlooked.

As previously written about, Credit Acceptance Corporation (CAC) was the first to take the bold move to do what they could to help prevent violent and often deadly confrontations during repossessions by agreeing to pay full, involuntary repossession fees to agents for leaving the scene of a repo to avoid the potential for violence or physical confrontations. I asked who would step up next only to find myself pleasantly surprised that it wasn’t a lender but a forwarder.

I congratulated their bold and noble move and inquired as to who would follow their lead and hoped to see another lender hollow their lead. I wasn’t expecting a forwarder. And that forwarder turned out to be American Recovery Service (ARS). But I was wrong.

While still awesome and very commendable, I was in error when I proclaimed them the first forwarder to make the gesture toward agent safety. A few days later I found a major national repossession forwarding company who made this policy decision back in August of 2023!

Unfortunately, I never got the memo.

On August 24, 2023, Resolvion sent the below memo.

Dear Agent Partners,

I trust this email finds you well. We would like to take a moment to revisit and reinforce the Breach of Peace protocol here at Resolvion. It is of utmost importance that, while conducting your services, your agency refrains from engaging in any activities that could potentially be interpreted as a “breach of peace.”

In the event that a situation arises where there is even a possibility of a breach of peace, we kindly request that your driver immediately disengages from the situation and safely drops the unit. This proactive step is essential in preventing any further escalation of the circumstances.

Furthermore, we kindly ask that you promptly provide a statement of facts to your dedicated vendor management team detailing the situation that occurred. Additionally, placing a note on the respective account would be greatly appreciated.

I want to emphasize that Resolvion is committed to supporting you in these instances. Should the decision be made to drop the unit due to the potential breach of peace, Resolvion will ensure that the repossession fee is honored.

Please remember that your safety is of paramount concern to us. If you have any inquiries, concerns, or require any clarifications regarding the Breach of Peace protocol, please do not hesitate to reach out to us. We are here to provide the necessary guidance and support.

Thank you for your attention to this matter. We appreciate your commitment to upholding the highest standards of professionalism and safety in all your operations.

Best regards,

Resolvion Vendor Management

VendorMgt@resolvion.com

Tel: 866-606-7007 X 578

As we’re all aware, 2023 was the deadliest year in the repossession industries history. By August 24th, when this memo went out, stabbing shootings and armed encounters on repossession agents were on the rise and we had already seen two of the eventual seven agents killed that year. Resolvion was clearly reading the room.

Who knows how many agents’ lives were saved injury or death. It’s unmeasurable. You don’t know what you don’t know.

No car is worth getting killed over and I congratulate Resolvion for taking proactive changes in protocol in response evolving circumstances. I would be more surprised if it wasn’t them. There are some great people there.

Belated congratulations Resolvion for being the pioneer in recognizing the inherent dangers posed by the pressure of contingent repossession assignments. Your humility is the source of your oversight. But humility is a virtue.

You started something without even knowing it. Two forwarders and one lender. This will become the industry standard eventually. Who is next?

Kevin Armstrong

Publisher

The Real First Forwarder Dedicated to Repossession Safety – The Real First Forwarder Dedicated to Repossession Safety – The Real First Forwarder Dedicated to Repossession Safety

The Real First Forwarder Dedicated to Repossession Safety – Repossession Violence – Repossess – Repossession – Repossession Agency – Repossessor – Forwarder – Resolvion – Resolvion

The post The Real First Forwarder Dedicated to Repossession Safety first appeared on CURepossession.

]]>The post Resolvion Announces New CEO first appeared on CURepossession.

]]>Resolvion Welcomes Mike Thomas as New Chief Executive Officer

FOR IMMEDIATE RELEASE

Charlotte, NC, April 1, 2024 – Resolvion, a premier provider of repossession management solutions, is pleased to announce the appointment of Mike Thomas as its Chief Executive Officer. With a distinguished career in the financial services sector, Thomas brings to Resolvion a wealth of experience, notably from his successful tenure from 2015 to 2020, initially as SVP of Operations and CIO and ultimately CEO, at Primeritus Financial Services, a leading firm in the repossession management industry.

At Primeritus, Thomas was a pivotal part of the executive team leading the company through years of industry leading levels of client performance, enhanced operational efficiencies, and significant growth. His strategic leadership was characterized by an intense focus on client scorecard performance, operational excellence and technological innovation, which together propelled the company forward in a highly competitive landscape.

Prior to his tenure at Primeritus, Thomas’s career spanned a variety of leadership roles where he excelled in operations, information technology, and strategic planning. His extensive background is marked by a consistent track record of driving operational improvements, leveraging technology to enhance business outcomes, and leading teams through transformational change.

His expertise in both operations and IT has been a critical factor in his ability to deliver outstanding results across the organizations he has led. Mike Levison, Vice Chairman of the Board at Resolvion, expressed his enthusiasm for Thomas’ appointment, stating, “Mike Thomas’ arrival at Resolvion marks a significant milestone for our company. His exceptional track record, deep understanding of our industry, and strong background in operations and IT make him uniquely qualified to lead our company into the future. We are extremely excited to have him on board and are confident in his ability to guide Resolvion to achieve new levels of success.“

Reflecting on his new role, Mike Thomas commented, “I am thrilled to join the Resolvion team and eager to contribute to its continued growth and success. The opportunity to leverage my experience to further enhance Resolvion’s offerings and customer service is incredibly exciting. I look forward to working with the company’s very talented team as we strive to set new standards in the repossession management industry.”

Resolvion is one of the nation’s leading loss mitigation management firms with a team of 300 associates serving a growing base of over 200 clients, including 40 of the top 50 auto finance providers. The company’s services include recovery, skip tracing, license plate recognition, heavy equipment repossession, impound, and remarketing. Resolvion, along with its 600+ recovery agents, handle nearly one million cases annually using our leading technology platform and a comprehensive compliance program which includes monitoring and training.

Resolvion is headquartered in Charlotte, NC, with additional operations in Atlanta, GA, Carlsbad, CA and Shelton, CT. For more information, visit: www.resolvion.com .

For more information, please contact: Michael Levison

Michael.levison@resolvion.com /404-849-9515

Resolvion Announces New CEO – Resolvion Announces New CEO – Resolvion Announces New CEO

Resolvion Announces New CEO – Forwarder – Repossess – Repossession – Repossession – Resolvion

The post Resolvion Announces New CEO first appeared on CURepossession.

]]>The post Resolvion Announces Universal Acceptance Release for Wombat and RDN first appeared on CURepossession.

]]>Charlotte, NC, December 19, 2023 – Resolvion—an industry leader in national repossession management, skip tracing, remarketing, license plate recognition, heavy equipment, and specialty recovery—announced today their universal acceptance release integration between their proprietary database, Wombat, and RDN.

At the heart of this integration is the consolidation of two essential databases into one streamlined process for our agents. Where agents previously had to operate out of these two databases separately, this integration allows them to exercise all the necessary functions through RDN, and that information is then transferred to the Wombat database for our specialists to access.

This new integration proves beneficial for specialists as well by eliminating the need for them to enter cases into both Wombat and RDN. This allows cases to flow directly into RDN for agents to accept, effectively bypassing the need to accept them in Wombat first for the case to be moved to RDN.

As Danny Mullen, Resolvion Vice President of Operations states, “The seamless integration of Wombat with RDN transforms complexity into simplicity, creating a synergy that not only streamlines processes, but elevates efficiency to new heights.”

RDN’s VP of Business Development at RDN Clearplan, John Sibbit shares the same sentiment in saying, “At RDN, we’re all about making it fast, simple and easy for our users so they can focus their time and energy on what matters most. This integration takes the hassle out of case management by reducing duplicative work, which will help drive both efficiency and performance.”

This integration has been fully implemented and is now live for all agents and specialists.

About Resolvion: Resolvion is one of the nation’s leading loss mitigation management firms with a team of 300 associates serving a growing base of over 200 clients, including 40 of the top 50 auto finance providers. The company’s services include recovery, skip tracing, license plate recognition, heavy equipment repossession, impound, and remarketing. Resolvion, along with its 600+ recovery agents, handle nearly one million cases annually using our leading technology platform and a comprehensive compliance program which includes monitoring and training. Resolvion is headquartered in Charlotte, NC, with additional operations in Atlanta, GA, Carlsbad, CA and Shelton, CT. For more information, visit: www.resolvion.com.

About Resolvion: Resolvion is one of the nation’s leading loss mitigation management firms with a team of 300 associates serving a growing base of over 200 clients, including 40 of the top 50 auto finance providers. The company’s services include recovery, skip tracing, license plate recognition, heavy equipment repossession, impound, and remarketing. Resolvion, along with its 600+ recovery agents, handle nearly one million cases annually using our leading technology platform and a comprehensive compliance program which includes monitoring and training. Resolvion is headquartered in Charlotte, NC, with additional operations in Atlanta, GA, Carlsbad, CA and Shelton, CT. For more information, visit: www.resolvion.com.

Resolvion Announces Universal Acceptance Release for Wombat and RDN – Resolvion Announces Universal Acceptance Release for Wombat and RDN – Resolvion Announces Universal Acceptance Release for Wombat and RDN

Resolvion Announces Universal Acceptance Release for Wombat and RDN – Resolvion – Forwarder – Repossess – Repossession

The post Resolvion Announces Universal Acceptance Release for Wombat and RDN first appeared on CURepossession.

]]>The post The Death of Repo Forwarding? first appeared on CURepossession.

]]>Now that the Consumer Financial Protection Bureau (CFPB) has clarified their position on UDAAP fees charged by repossession forwarding companies, many questions come to mind. I am sure that in the days that followed, most lenders and forwarders have been meeting to discuss how to manage this. But the lingering question of the survival of the forwarding model plays into this. Is this the death of repo forwarding?

In short, I wouldn’t count on it. With the economy veering toward its first recession in almost fifteen years and a bubble formed in auto loan affordability, no one is likely to throw in the towel on the repo forwarding model anytime soon. But with all of the questions created by the CFPB’s declaration, one thing is clear. The old business model won’t work.

In the short term, it does not appear that there has been any major interruption the orderly flow of operations by the lenders. Likewise, I’ve heard of no indication that the assignments coming from the forwarders has slowed down. For now, it looks like lenders have resigned themselves to “biting the bullet” on the “Junk Fee” portion of the bills coming in from the forwarders, or simply taking a risk and doing business as normal.

I seriously doubt that any lender under the CFPB’s supervision is choosing to ignore this. The CFPB has a history of levelling some pretty hefty fines. I imagine there may be some lenders not under CFPB supervision that feel immune to the CFPB’s ruling and to save the internal expenses, are ignoring making any changes to their NOI reporting methods until some other issue comes along to make them. And those issues very well could come along in different forms other than the CFPB themselves.

Examiners of all types, state, FDIC, NCUA, etc., frequently follow the guidance of the CFPB and these “Junk Fees” could at very least, appear as exam finding requiring lender remedy. And worse yet, who knows how the vast and opportunistic network of consumer advocate attorneys across the nation will leverage this proclamation in repossession related cases big and small.

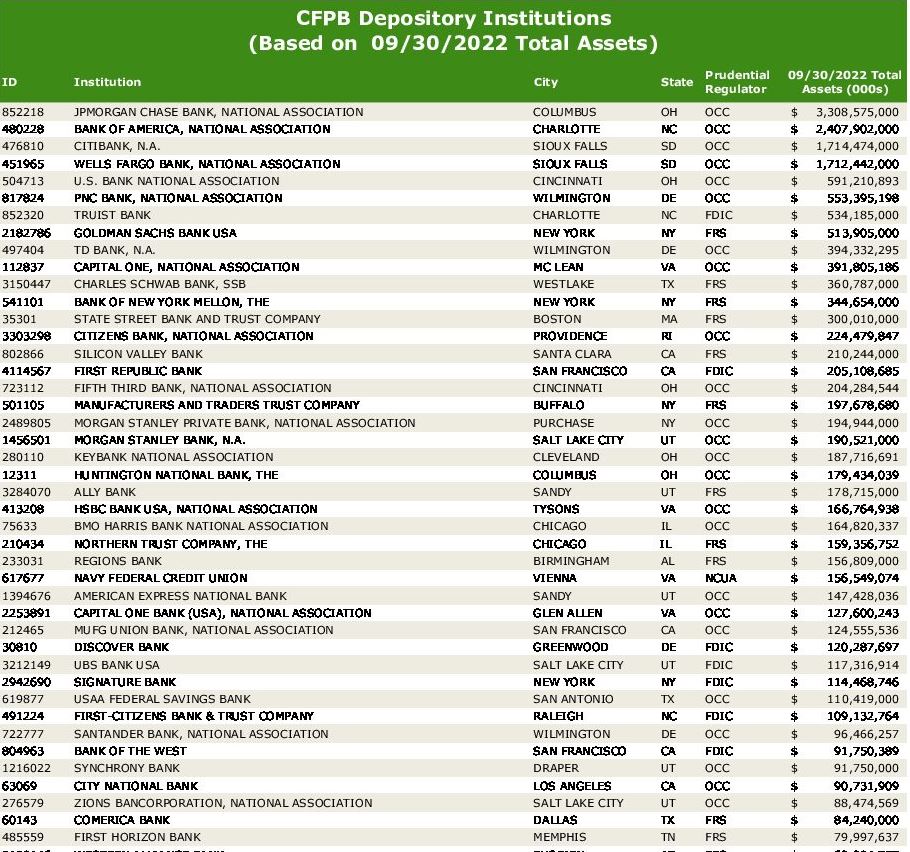

The CFPB

Let’s start with the CFPB’s reach. The CFPB examines over 100 financial depository institutions and non-bank entities. In addition, last year, they’ve expanded their supervision via a previously dormant authority that includes the supervision of non-bank entities and loan service providers for those lenders. This is a significant portion of the auto lending world.

Click Here to See The Full List

As exemplified by their actions against Nissan Motor Acceptance for allowing repossession agencies to charge personal property fees in October of 2020, their reach can expand into every aspect of the repossession industry should they so desire. So, for anyone thinking that this can’t affect their repossession or forwarding company, that is probably wishful thinking.

The Problem for Agencies

For many agency owners, the CFPB’s UDAAP forwarder repossession fees proclamation creates an assumption that the “direct assignment” model will increase in volume, and it could, but I’ll get into that shortly. For some agency owners, there is the assumption that they will be able to increase their fees once freed from the fixed forwarder fees, and it could, but that’s another issue that I’ll also cover later.

I know many out there may have assumed that this could spell the end of the forwarding industry. And if that were the case, I suspect that how good this is for an agency could depend greatly on their current reliance on repossession forwarders. If it is anywhere near where it was when I did my September 2020 “State of the Repossession Industry Survey”, it is significant and at least 50% by now.

One major problem that this could create is a simple fact that some of you won’t like. Many, if not most of you, are not great salespeople or marketers. There, I said it. The reason for this is a simple lack of practice. Decades of over reliance on the forwarders to spoon feed your agencies assignments has given many of you little motivation and no practice to do so.

With that said, if you have not been doing so all along, it would be wise, to make the effort. There are still many credit unions, community banks and buy here pay here dealers with whom you can strike up a good relationship. Afterall, the relationships between the lenders and their repossession agent networks was for the vast majority of the history of auto lending, a close one.

Unfortunately, absent the ability to market themselves well and develop direct relationships, many small agencies could go out of business without their forwarding partners. Their overreliance on the forwarding companies and inability to effectively market their companies could be a death blow. Let’s face it, the forwarding model is something many agencies cannot survive without.

Now as far as raising fees. I suspect that will occur. At very least, there may be some improvements in storage fees now that the forwarders can no longer bill for charges that they didn’t pay the agencies. But there is a one hurdle to raising fees. The CFPB’s statement on the average repossession costing $350.

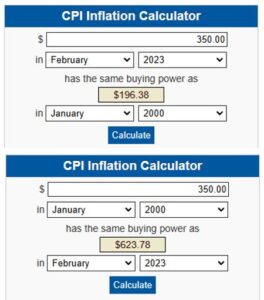

They are correct, but they’re reinforcing on to the lenders that this is adequate and the norm. It completely ignores the fact that this fee has been held at this level for over twenty years by the forwarding model. I repeat, the average repossession fee has remained unchanged for over 20 years.

They are correct, but they’re reinforcing on to the lenders that this is adequate and the norm. It completely ignores the fact that this fee has been held at this level for over twenty years by the forwarding model. I repeat, the average repossession fee has remained unchanged for over 20 years.

The average $350 fee has the current value of $196.38 when compared to the year 2000 according to the US Bureau of Labor Statistics. Adjusted for inflation, it would have to be $623 in order to have the same spending power. Sad but true and I don’t see it reaching that level anytime soon.

With the CFPB’s $350 statement, a form of precedence has been set, a standard that will be frequently held up as the norm. That could become a frequent talking point that comes back to haunt the industry for years.

The Middleman

Obviously, the forwarding industry has been going through a lot of changes. Any assumption that their assignment volume from lenders would just dry up as the result of all this appear to be wrong from what I have been told. According to two forwarding company CEO’s that I have spoken with, they have received no blow back and it’s business as usual, and actually still on the rise.

While I am not privy to the conversation going on between the forwarders and lenders, I’ve heard of no discourse or animosity for their prior billing practices. Lenders from all that I have heard, are simply modifying their fee reporting on their notices of intent to dispose of collateral (NOI).

That is not to say that all is well in forwarding world. The CFPB’s ruling has stripped the forwarding companies of a lot of income charged to the borrowers and unpaid to the repo agencies. Fees like storage, surcharges and other fees that likely padded their incomes significantly. Even with increases in volume likely to come, the profit margins per recovery will be taking a hit.

In the short term, I have heard of no forwarding companies contemplating any major changes to the forwarding model of old. But to survive a changing market and to be more competitive, it may require revisions to their business models.

With reduced income there may come a point where there are layoffs and internal cost cutting measures but the forwarding model is far from dead. They still provide services that the lenders and repossession agencies need.

Forwarders already have established vendor management departments to satisfy the lenders requirements. These are skills and staff that at this point, the lenders likely have little or none of and probably won’t staff up for. Compliance management of a repossession agent network is something that the lenders would gladly pay out of pocket for.

Skip tracing is another service that forwarders provide as well and are not likely effected by the CFPB’s decree which speaks specifically of repossession related fees. Those forwarders with a strong remarketing arm could do well in the incoming swell of repossessions likely to hit this summer. While these revenue streams help, they are unlikely to make up for all of the extra income lost.

One way or another, most forwarding companies will survive. Most, but probably not all. As far as lenders migrating away from this relationship anytime soon, I wouldn’t count on any major changes unless the forwarding model becomes a greater expense burden on the lenders than would be if they brought those same services back under their own roofs.

The Hardest Hit

As far as the lenders go, some may eventually jump ship from the forwarders and dip their toes deeper into the direct assignment model to comply with the CFPB’s declaration without having to absorb the forwarder portion of the fees. But I would wager that few are adequately staffed to jumped in much deeper than they currently do if at all. In the short term, from what I’ve been hearing most are just billing the borrower for the agent paid fees and sucking up the difference.

The reality is, like the repossession agencies, most lenders have become far too dependent on the repossession forwarders. Few, if any, are adequately staffed to manage repossession at the current volume let alone possess the same skill sets to manage a direct assignment model. With monetary pressure created by rising rates, liquidity will likely be a big obstacle to hiring, so, in the short term, abandoning their repo forwarders is unlikely.

Regardless, as a basic best practice, ALL LENDERS, owe it to themselves to test the water. Do a champion challenger comparison between an equal number of direct assignments and forwarded assignments. Grade them on speed of recovery, recovery ratios, service level agreements or more. For a great example of this score carding, you should go take a peek at Resolvion’s article “Vendor Scorecarding Techniques to Improve Collateral Recovery Results.”

As bad as the liquidity and monetary pressures are, the biggest issue that could arise for lenders under the CFPB’s supervision is recompensating overpaid fees. Should the CFPB require them to do an audit for a specific period of time and refund to borrowers those excess forwarder fees that were paid for repo redemptions and reinstatements, this could cost millions of dollars.

But possibly the biggest threat to all lenders is the CFPB’s statement that the forwarders portion of fees are an UDAAP. The simple act of having used those numbers could be used as an argument that the notices of intent to dispose of the repossessed vehicle sent to the borrowers and could be ruled as improper by a debtor sympathetic court. These issues could start small and result in waiving a deficiency balance and credit reporting or could become the source of class action lawsuits.

This could get dragged into allegations of FDCPA and FCRA violations as well. The CFPB really opened a nasty Pandora’s box of risk for everyone with this statement.

New Billing Models

I had initially imagined that the forwarders would immediately begin exploring different billing models to reduce or minimize the new expense to their lender clients. So far, I have heard of none, but should they go down that road, I can imagine that some of these models might emerge.

Flat Forwarder Fees – One idea that I consider, might be that the forwarders get paid a flat fee from the lenders for the assignment. To supplement this, they could, don’t laugh, charge the agencies a flat fee for recoveries or assignments. But if the agencies increase their fees to accommodate that, it could perhaps appear disingenuous and equally a violation. The funny part of this idea is the agencies having to pay the forwarders invoices. I doubt that the forwarders will be allowed to manage the transactions between the lenders and the agents due to the issues that arose from them having done it in the past, but I could be wrong. Their reputations may have taken a big hit with the CFPB and perhaps some lenders because of all of this. With the CFPB stating that they can only quote to the borrower what the agent paid, logic would tell us that the lenders would want to see the agency bills directly. This is a solution that two forwarding companies have told me that they adopted immediately. This is transparency and an honest and step in the right direction.

Commission – Another billing model that I thought might get tossed around is that the forwarders receive a commission on the agencies billing to the lender. This idea creates a similar problem to the flat fee in that it not only encourages agencies to add to their billing but does so with encouragement of the forwarder.

Lender Pays – With a change from the new model of lenders paying forwarder fees would come a reversal of fortune. How long until we hear the forwarders complain about agents being 90-120 days past due on payments or having invoices declined over minor accounting issues? I guess what comes around goes around, but two wrongs don’t make a right, even if it is funny.

Whatever direction all of this goes, it is pretty clear to me that this long imbalanced business relationship between lender, forwarder and agency is in the midst of major transformation toward required transparency. And the lack of transparency is what caused all this mess in the first place. I had hoped that someone in the forwarding or lending world would have stepped forward to remedy this issue on their own before things came to this, but it just didn’t work out that way. But now, transparency is the requirement.

Now that we have a better understanding of the spirit of the CFPB decision, perhaps the repossession industry, lenders and forwarders alike, can find a new balance. And in that, a business model and practices that are transparent and fair to the consumer. This is far from an unreasonable request. It’s the law.

Kevin Armstrong

Publisher

Related Articles;

CFPB Provides Clarity on UDAAP Repossession Fees

CFPB’s Response to Questions on UDAAP Repo Fees

CFPB Labels Repossession Forwarding Fees as UDAAP?

CFPB; How is this not an UDAAP?

The Death of Repo Forwarding? – Fight for Fair Fees – UDAAP – Repossess – Repossession – Repossession Agency

The post The Death of Repo Forwarding? first appeared on CURepossession.

]]>The post ARA – Open Industry Storage Survey Results first appeared on CURepossession.

]]>To The Repossession Industry and ARA Membership,

The American Recovery Association (www.repo.org) recently completed a survey of the industry about vehicle and lot storage costs. The American Recovery Association (ARA) is examining this entire category of expenses that includes everything from rent, security, insurance, and staffing. Vehicle storage is a big expense category, and it is a common to all of our members.

Also, and more importantly, revenue from vehicle storage has been shrinking due to lower negotiated daily storage fees and free storage periods. A recent uptick in arson attacks at recovery agent lots has been another hit to already thinning insurance carriers and increasing premiums.

Our survey revealed the following:

- 71% of respondents have between 1-3 vehicle storage lots, and over 50% of those agents lease their lots

- 40% of agents who lease their lots reported that their rents increased by more than 10% in the last 2 years

- Two thirds of all agents responded that their lots can accommodate a maximum of 200 cars at any time

- 80% of respondents reported that, on average, vehicles remain on their lots between 10-30 days

Lot rents are increasing at a rate that is outpacing inflation. If even some of our member contracts provide for between 10-30 days free storage, agents are falling short of covering this expense.

A statistic that the ARA is all too familiar with is the fact that the industry has seen 25% of its agents have shuttered up. Those that remain likely possess smaller storage lots that they don’t own, and with their rents going up, clients are keeping cars on agents lots longer than they have in the past.

The combination of smaller lot capacity and vehicles remaining on lots longer will create a bottle neck of services for the agents. A time will come that agents will reach a capacity and not be able to put new repos on the lot.

Imagine a business that cannot perform its core function due to the necessity of providing support function without supporting revenue. That is a death blow to a healthy operation.

The ARA endeavors to provide valuable information to the industry. As we enter the next phase of our economic journey, we all have questions and concerns about the overall capacity of the recovery industry to fully serve the needs of our clients in a period of higher default. While it is unlikely that we will see an entry of new recovery shops, the ARA sees some potential solutions:

- Expand existing agent lot capacity, since the likelihood of new agencies starting up is low

- Accelerate the movement of recovered collateral from recovery agent lots

- Address fair storage fees, and eliminate free storage from contracts

The ARA thanks its members and the industry for their participation in this survey. The sole purpose of this survey is to put numbers to what we already know and provide that data to the industry at large.

We are committed to building a sustainable and profitable business model that benefits every stakeholder in our industry and, it is our opinion, a conversation about this topic and daily storage rates is paramount if things are going to change. We are aware that without an open discussion about how to accomplish this goal, we will see even more agencies depart our space.

Very truly yours,

Joel Kennedy

Executive Director

Related Articles;

ARA Statement – Arson at Repossession Lots

An Open Letter to Exeter Finance

ARA meets with Primeritus over past due invoices

ARA deepens commitment from Resolvion

ARA – Wrongful Repossession & Owning Liability

ARA – Open Industry Storage Survey Results – American Recovery Association – ARA – Repossess – Repossession – Repossession Agency – Repossessor

The post ARA – Open Industry Storage Survey Results first appeared on CURepossession.

]]>The post ARA – Open Industry Storage Survey Results first appeared on CURepossession.

]]>

A Letter from ARA Executive Director, Joel Kennedy

To The Repossession Industry and ARA Membership,

The American Recovery Association (www.repo.org) recently completed a survey of the industry about vehicle and lot storage costs. The American Recovery Association (ARA) is examining this entire category of expenses that includes everything from rent, security, insurance, and staffing. Vehicle storage is a big expense category, and it is a common to all of our members.

Also, and more importantly, revenue from vehicle storage has been shrinking due to lower negotiated daily storage fees and free storage periods. A recent uptick in arson attacks at recovery agent lots has been another hit to already thinning insurance carriers and increasing premiums.

Our survey revealed the following:

- 71% of respondents have between 1-3 vehicle storage lots, and over 50% of those agents lease their lots

- 40% of agents who lease their lots reported that their rents increased by more than 10% in the last 2 years

- Two thirds of all agents responded that their lots can accommodate a maximum of 200 cars at any time

- 80% of respondents reported that, on average, vehicles remain on their lots between 10-30 days

Lot rents are increasing at a rate that is outpacing inflation. If even some of our member contracts provide for between 10-30 days free storage, agents are falling short of covering this expense.

A statistic that the ARA is all too familiar with is the fact that the industry has seen 25% of its agents have shuttered up. Those that remain likely possess smaller storage lots that they don’t own, and with their rents going up, clients are keeping cars on agents lots longer than they have in the past.

The combination of smaller lot capacity and vehicles remaining on lots longer will create a bottle neck of services for the agents. A time will come that agents will reach a capacity and not be able to put new repos on the lot.

Imagine a business that cannot perform its core function due to the necessity of providing support function without supporting revenue. That is a death blow to a healthy operation.

The ARA endeavors to provide valuable information to the industry. As we enter the next phase of our economic journey, we all have questions and concerns about the overall capacity of the recovery industry to fully serve the needs of our clients in a period of higher default. While it is unlikely that we will see an entry of new recovery shops, the ARA sees some potential solutions:

- Expand existing agent lot capacity, since the likelihood of new agencies starting up is low

- Accelerate the movement of recovered collateral from recovery agent lots

- Address fair storage fees, and eliminate free storage from contracts

The ARA thanks its members and the industry for their participation in this survey. The sole purpose of this survey is to put numbers to what we already know and provide that data to the industry at large.

We are committed to building a sustainable and profitable business model that benefits every stakeholder in our industry and, it is our opinion, a conversation about this topic and daily storage rates is paramount if things are going to change. We are aware that without an open discussion about how to accomplish this goal, we will see even more agencies depart our space.

Very truly yours,

Joel Kennedy

Executive Director

ARA – Open Industry Storage Survey Results – American Recovery Association – ARA

Related Articles;

ARA Statement – Arson at Repossession Lots

An Open Letter to Exeter Finance

ARA meets with Primeritus over past due invoices

ARA deepens commitment from Resolvion

ARA – Wrongful Repossession & Owning Liability

The post ARA – Open Industry Storage Survey Results first appeared on CURepossession.

]]>The post Is this incentive program a UDAAP violation? first appeared on CURepossession.

]]>

GUEST EDITORIAL

Well let me see if I fully understand this new Wells Fargo Incentive Program. To quote from an article published by ARA President, Vaughn Clemmons, “This past week, Scott Darling shared news about an initiative that Wells Fargo presented to all of their nationwide forwarding vendors last week.” This was the very first time we were introduced to the program.

Read More!

Is this incentive program a UDAAP violation? – ARA – CFPB

The post Is this incentive program a UDAAP violation? first appeared on CURepossession.

]]>The post Is this incentive program a UDAAP violation? first appeared on CURepossession.

]]>

“bonuses or employment status to unrealistic sales goals or to the terms of transactions may intentionally or unintentionally encourage illegal practices” – CFPB Bulletin dated NOV 28, 2016

GUEST EDITORIAL

Well let me see if I fully understand this new Wells Fargo Incentive Program. To quote from an article published by ARA President, Vaughn Clemmons, “This past week, Scott Darling shared news about an initiative that Wells Fargo presented to all of their nationwide forwarding vendors last week. This was the very first time we were introduced to the program.

For ALL assignments (vol, Invol, impound) placed between August 15 and November 15, Wells Fargo is offering an additional $500 per recovery in 44 states plus DC. This fee does not include the $40 fuel surcharge currently in place, mileage needed, and/or flatbed if requested. Excluded States: Arizona, California, Idaho, Nevada, Oregon, Utah, Washington”

So, if a consumer calls up Wells Fargo and offers to voluntarily surrender a mortgaged vehicle, Wells Fargo will pay the recovery agent their normal voluntary Repossession Fee ($125.00-$275.00) plus an additional $500.00 to recover that vehicle, totaling $625.00 to $775.00.

If it is an involuntary repossession and the normal fee would be between $325.00 to $475.00 plus the $500.00 bonus means Wells Fargo is paying a fee totaling $825.00 to $975.00.

I would question where this $500.00 is coming from and who will ultimately pay it.

Why suddenly can Wells Fargo afford to pay the repossessor tantamount to more than double what they have been paying for a repossession? If they can pay this amount now, why could they not pay it in the past? Has Wells Fargo finally realized the truth in what I have heard Eagle Group leader Ron Brown say for many years, “If you pay peanuts, you get monkeys”? Is Wells Fargo tired of hiring monkeys?

The most crucial question I query is who is paying the $500.00. Normally, all repossession charges are passed on to the consumer in the creation of a deficiency balance which allows the lender to collect it from the consumer or charge it off as a loss.

I can clearly understand how field agents would ignore lower paying clients and give Wells Fargo assignments priority. I also know that the agents might take extra risks and put out an extra effort to secure Wells Fargo vehicles. $500.00 is a lot of money in today’s inflationary environment.

In the case of the voluntary surrender and the involuntary recovery the consumer is being forced to pay $500.00 more than what the actual charges would have and should have normally been.

If this charge is being passed on to the consumer, I would be surprised if the CFPB did not view this action as a UDAAP violation.

To quote from a CFPB Bulletin dated NOV 28, 2016;

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) issued a bulletin today warning supervised financial companies that creating incentives for employees and service providers to meet sales and other business goals can lead to consumer harm if not properly managed. Tying bonuses or employment status to unrealistic sales goals or to the terms of transactions may intentionally or unintentionally encourage illegal practices such as unauthorized account openings, unauthorized opt-ins to overdraft services, deceptive sales tactics, and steering consumers into less favorable products. The CFPB bulletin outlines various steps that institutions can and should take to detect, prevent, and correct such production incentives so that they do not lead to abuse of consumers.

“Tying bonuses and job security to business goals that are unrealistic or not properly monitored can lead to illegal practices like unauthorized account openings and deceptive sales tactics,” said CFPB Director Richard Cordray. “The CFPB is warning companies to make sure that their incentives operate to reward quality customer service, not fraud and abuse.”

Banks and other financial companies use incentives to encourage their employees and service providers to accomplish business objectives. Incentives can range from financial bonuses and other monetary compensation to benchmarks that affect whether an employee or service provider will remain employed or retained at all. These programs commonly reward employees or services providers for selling or referring new products or services to existing customers, signing up new customers, selling products and services at higher prices, or meeting target amounts for debt collections.

Although they are not unique to the financial sector, these incentives are used in many consumers financial markets, such as credit cards, mortgages, checking accounts, and debt collection. Reasonable incentives that are properly overseen can benefit consumers and enhance an institution’s overall performance. Consumers may receive improved customer service or companies may be able to attract and retain more high-performing employees. However, incentives that are not carefully managed may encourage and reward behaviors by employees and service providers that harm consumers. “

I think this offer by Wells Fargo to pay a fair wage is great, but I feel it should be allocated as a wage increase rather than an incentive bonus and all involved should remember that old saying, “It is easy to give, quite harder to take back”.

Respectfully Submitted,

Hotel Charlie Alpha

Is this incentive program a UDAAP violation? – ARA – CFPB

The post Is this incentive program a UDAAP violation? first appeared on CURepossession.

]]>