The post GALR 2024 Conference Wraps Up with Record Attendance first appeared on CURepossession.

]]>The Georgia Association of Licensed Repossessors (GALR) 2024 Conference exceeded the expectations of its organizers. “We registered 77 people as of last night,” commented GALR Treasurer Clayton Merritt on the first day of the event, held at the scenic Lanier Islands Resort in Buford, GA. Attendees came from across Georgia as well as from North Carolina, South Carolina, Tennessee, Florida, and Texas, more than doubling last year’s attendance.

Lanier Islands Resort, a 1,200- acre retreat, offers a variety of activities, including golf, water sports, and snow tubing. The Lodge Hotel, where attendees stayed, is an ornately decorated venue featuring a rustic cabin theme, complete with multiple restaurants, bars, and a poolside fire pit. But I digress…

Day 1 Highlights

Day 1 featured a half – day program, starting with GALR’s annual business meeting and elections. No changes were made to the board, as all current members were re-elected to their respective positions.

Following the meeting was a scheduled 2.5- hour locksmith training session led by Jessica Merritt of Artis Recovery. Jessica demonstrated the programming of two universal remotes for different makes and models of vehicles, offering insight into how today’s advanced equipment is used. After the demonstration, she spent over an hour answering attendees’ questions about equipment and how automotive locksmithing can be integrated into repossession services.

Day 2: A Full Schedule of Events

Day 2 was packed from 8 a.m. to 6 p.m. “We apologize, but the program kept expanding,” Clayton Merritt explained, referencing the growing interest and the volume of information GALR felt was essential to share with the industry.

If the goal was to deliver a wealth of valuable information, GALR certainly succeeded. Numerous topics were explored from multiple angles. Contracts, for instance, were examined from an insurance perspective by Jon Pollard and Renee Lowe of Harding and Brooks, a legal perspective during Mark Howk’s session on frivolous lawsuits, and in the Client Panel Discussion. Each session built upon the last, ensuring attendees gained a comprehensive understanding of the subject matter.

If the goal was to deliver a wealth of valuable information, GALR certainly succeeded. Numerous topics were explored from multiple angles. Contracts, for instance, were examined from an insurance perspective by Jon Pollard and Renee Lowe of Harding and Brooks, a legal perspective during Mark Howk’s session on frivolous lawsuits, and in the Client Panel Discussion. Each session built upon the last, ensuring attendees gained a comprehensive understanding of the subject matter.

While it’s difficult to cover every session in detail, GALR acknowledges the invaluable contributions of all participants. “We couldn’t have had a convention without their willingness to share their knowledge,” said GALR President John Newberry of Eagle Eye Recovery.

Here’s a quick look at some of the key sessions and presenters:

- Locksmith Demonstration – Jessica Merritt, Artis Recovery

- Contract Review – Jon Pollard and Renee Lowe, Harding and Brooks Insurance Agency

- Client Panel Discussion

Moderator: Wes Carico, Artis Recovery

Panelists: Bill Sheehan (COO, Trinity Financial Services), Jason Clark (Managing Partner, Resolution Management Group), Jeremy Turner (Director, Vendor Management, Location Services), Keith Daymond (Executive VP, Victory Recovery Services), Ryan Medina (VP Vendor Management, MVRecovery MVTRAC)

- GA Personal Property Law and Frivolous Lawsuits – Mike Howk, JD, Risk Manager, RSIG

- MBSI Software Update – Ray Peloso

- Preventing Breach of Peace – Mark Lacek, Repossession Litigation Consultant

- Improved Relations Between MVTrac & Vendor Network – Ryan Medina, James McGee, Josh Harley, and Johnnie Renfro of MVRecovery MVTRAC

Panel Discussion

“People are worried about getting ambushed,” Clayton Merritt shared when discussing the process of organizing the panel. To ease concerns and build credibility, the format, objectives, topics, and sample questions were sent to the panelists well in advance. This approach allowed for deeper exploration of complex issues, explained Moderator Wes Carico.

The discussion covered several pressing topics, including stagnant rates, contractual language, and agent safety. Each panelist shared insights into how their businesses viewed and addressed these challenges. A few key takeaways emerged:

Wes highlighted the unique role forwarders play in the industry as both clients and competitors. He suggested that repossession companies should observe and emulate forwarders’ successful business practices.

Negotiation was another common theme. Both pricing and contract language, panelists emphasized, can and should be negotiated. “We ‘red-line’ every word of our contracts,” one panelist remarked, stressing the importance of scrutinizing terms. Another panelist reminded attendees of the need to review contracts annually, especially to request adjustments for inflation if such provisions aren’t already built in.

Safety was a major concern for all panelists, who recognized the role of forwarders in keeping dangerous or rogue companies out of the industry. The implication was clear: providing opportunities to these risky organizations not only threatens the industry’s reputation but also diverts funds from legitimate clients (lien holders) and supports potentially harmful activities. Though I’m no expert in liability, this seems to be an area where many in the industry need to tread carefully.

There was also a call for industry software providers to improve their tracking tools for identifying potential risks in high-risk accounts or addresses. “You are their revenue stream,” Wes explained, urging forwarders to push for better solutions. The panel also agreed to explore ways to support the Recovery Agents Benefit Fund (RABF) so Ed Marcum and his team can continue to assist families impacted by their loved ones work in the repossession industry.

Overall, the panel addressed sensitive topics, provided valuable insights, and fostered commitments around safety and industry support.

GALR wanted to extend its deep appreciation to the panelists for their participation and dedication. These five individuals are among the most successful leaders in the industry, and their willingness to share their viewpoints on key issues was a tremendous benefit to everyone in attendance.

Liability in the Industry

Liability was a central theme throughout the conference, with several presenters offering insights from their areas of expertise. Jon Pollard emphasized the importance of reviewing Garage Keepers policies, noting a disturbing trend where Direct Primary Garage Keepers policies exclude coverage for acts of God, such as rain, hail, or wind damage. This exclusion, he explained, negates the purpose of Direct Primary coverage and leaves insureds exposed.

Renee Lowe stressed the need for every repossession company to have a contract in place with its clients, even if it’s just a simple one-page agreement. She also highlighted the importance of ensuring that contracts with brokers or forwarders extend coverage to their clients as well. Both Renee and Jon encouraged attendees to reach out with questions and review contracts. “We can’t give legal advice,” Renee clarified, but she explained they would point out where contract language might negatively affect your coverage.

Mike Howk, RSIG’s Risk Manager and a national expert in repossession law, warned of a troubling new trend: “You cannot insure against a crime.” He explained that if you’re sued and the allegations are purely criminal, your insurance will not cover the case. However, if there’s at least one civil allegation, the insurance will help defend against all claims under a “commonality of defense” principle.

In a side conversation, Ed Marcum further explained that this trend is becoming more common in states where possession laws are being more clearly defined. “It eliminates the common civil allegation of breach of peace,” leaving lawsuits to focus on criminal sections of state code or parts of the FDCPA (Fair Debt Collection Practices Act) considered criminal. He cited a case in California where the insured will likely not be covered, as no civil allegations were made, and the way the law is written leaves no room for one to be added.

As more associations consider sponsoring or proposing legislative changes, this should serve as a cautionary tale: poorly considered legislation can have unintended consequences, so it’s crucial to involve all industry stakeholders in the conversation.

Repossession Litigation Consultant Mark Lacek delivered dynamic content on the importance of policies, documentation, and employee training. He began by holding up a copy of Nostalgic Towing/Artis Recovery’s “No Follow, No Chase” policy recommending everyone adopt a similar policy.

Repossession Litigation Consultant Mark Lacek delivered dynamic content on the importance of policies, documentation, and employee training. He began by holding up a copy of Nostalgic Towing/Artis Recovery’s “No Follow, No Chase” policy recommending everyone adopt a similar policy.

He also urged attendees to consider how their company’s image could impact potential litigation, recalling a case where a defendant’s company was named “Rambo.” “Who do you think the jury is going to believe?” he asked.

Mark’s overarching message was clear: credibility and image stem from every aspect of a business, including its name, policies, procedures, equipment, attire, and documentation. These elements all contribute to how a company will be perceived in court, even though most cases never go before a jury.

Experts like Mark are often hired to assess a company’s professional and operational standards as they relate to any case. Throughout the conference, the recurring message was that failing to maintain professional standards increases the frequency of claims. Jon Pollard summed it up: “Frequency breeds severity.”

My takeaway – Illegal, improper, or improperly motivated actions lead to claims, poor image and documentation lead to larger payouts directly from your profits!

Fundraising and Fun

GALR also welcomed four new members during the event. The day ended with a lively fundraising e ort that began with a raffle and auction. The real excitement, however, came when an anonymous donor pledged $600 if Ed Marcum, CEO of RABF, would jump into the pool. Ed enthusiastically accepted, declaring, “Anything for the cause.”

This sparked a series of challenges, with several professionals in business attire attracting everyone’s attention by diving into the pool. Credit Acceptance Corp’s Tiny Sebastian and MVRecovery MVTRAC’s Johnnie Renfro wrapped up the plunge, raising an impressive $3,000 combined. The event raised over $11,000 for GALR and the Recovery Agents Benefit Fund (RABF), although the exact allocation was not known at the time of this release.

Networking and Industry Connections

As with any great conference, some of the most valuable exchanges took place during breaks, meals, and evening gatherings. GALR provided an ideal platform for vendors to meet new clients. Clayton Merritt worked closely with client representatives to address coverage gaps, while many new business relationships were formed through casual introductions. This reflects the growing credibility and influence of GALR, especially considering this was only its second annual conference.

While it’s uncertain whether GALR will o er deeper dives into any of the sessions, you can stay updated by following their Facebook page (search for “Georgia Association of Licensed Repossessors”) or visiting their website at https://galr.org .

In Closing

GALR extends its heartfelt thanks to all the participants and speakers for making the 2024 conference a memorable and successful event. A special thank you to the staff at Lanier Islands for providing excellent facilities and support.

Thank you to all the sponsors:

Gold – DRN, MVTRAC, Trinity, Harding Brooks, MBSi Corp, RDN

Silver – Loss Prevention Services

Bronze – Resolvion

Kudos to the entire GALR team for their hard work and dedication in organizing this event. Having attended numerous industry events over my 17- year career, this one struck the perfect balance of education, camaraderie, and business. Well done, GALR!

Wes Carico

Nostalgic Towing

Artis Recovery

GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance

GALR 2024 Conference Wraps Up with Record Attendance – State Repossession Associations – RABF – Recovery Agents Benefit Fund – Repossess – Repossession – Repossession Agency – Repossessor

The post GALR 2024 Conference Wraps Up with Record Attendance first appeared on CURepossession.

]]>The post Court Ruling Takes the Teeth out of the CFPB? first appeared on CURepossession.

]]>Huge Supreme Court Ruling – Hope You Saw It

GUEST EDITORIAL

No, I’m not talking about the rulings on Trump or Fischer. While those are significant for our country, I’m referring to something that could be even more impactful, especially for small businesses and our industry.

I’m talking about Loper Bright Enterprises v. Raimondo and its potential implications. I mentioned to colleagues a few months back that this case could be a big deal for us when it was being argued.

Even though this case has nothing to do with repossession, as an industry stakeholder I got pretty excited when it was released.

I hope this sparks some conversations within our Associations so we can get expert opinions on what it all means. I’ll take a shot at explaining it from a layperson’s perspective to get the ball rolling.

The Supreme Court just scaled back much of the enforcement power of agencies like the CFPB by overturning the Chevron doctrine. Chevron essentially told courts to defer to an agency’s “expertise, opinion, and interpretation” when laws were ambiguous.

As long as an agency could tie a “Rule” to a vague statute, they could enforce it as if it were law. Courts only needed to find the agency’s argument “reasonable” if challenged, thanks to the deference Chevron granted.

Here’s how it worked in simpler terms:

An agency is created to enforce consumer protection laws. They study potential issues and make rulings to clarify or solidify the code. These rules are then used for enforcement actions against violators.

Some argued Chevron gave the Executive Branch too much power by forcing the Judicial Branch to defer to the Executive’s interpretation. This limited the courts’ ability to hold agencies accountable.

The Supreme Court overturned Chevron to restore balance between the Judicial and Executive Branches.

Now, agencies without clear statutory backing will face tougher challenges in court. The judiciary will rely more on Congress’s explicit will as expressed in legislation. When laws aren’t clear, courts are more likely to scrutinize agency actions to prevent potential overreach.

Let’s consider an example: property fees.

Many states (and possibly federal law) don’t clearly address how to handle a consumer’s property in a repossessed vehicle.

Under Chevron: If the CFPB created a rule saying it’s unfair to hold property for payment, lenders would comply to avoid fines. Challenging this in court was tough because judges had to defer to the CFPB.

Post-Chevron: If fined, lenders can still challenge in court, but now judges will focus more on the actual law and arguments related to the Skidmore doctrine (which isn’t as strong as Chevron).

This doesn’t mean agencies, or their rules disappear, but it does make challenging those hefty fines more appealing. Once courts rule, it sets precedent for future cases. Agencies might be more cautious, seek clearer laws, or reduce penalties to avoid costly and/or losing legal battles.

The implications are huge for our industry and country.

To keep the momentum in our favor, we need to:

- Vote – The people you elect lead the Executive and Legislative Branches.

- Lobby – Our DC lobbyists are more crucial than ever as legislators need to hear from us, not just the alphabet agencies.

As lower courts start applying the new precedent from the Supreme Court the overall implications will become clearer, but we should see some changes in how the CFPB operates as well as how industry stake holders react to their rulings.

In closing, these are just my thoughts as a non-lawyer. I’ve tried to fact-check my understanding, but my main goal is to spark conversation among our industry leaders.

Stay safe, and all the best!

Wes Carico

Artis Recovery

More From Wes:

No Means No!

All In One Billing – Bad Business

Finding Your Bottom Line

Undervaluing Services – No Simple Fix, But the Responsibility Is Obvious

Court Ruling Takes the Teeth out of the CFPB? – Court Ruling Takes the Teeth out of the CFPB? – Court Ruling Takes the Teeth out of the CFPB?

Court Ruling Takes the Teeth out of the CFPB? – Consumer Financial Protection Bureau – CFPB – Repossess – Repossession – Repossession Agency – Repossessor – Lawsuit

The post Court Ruling Takes the Teeth out of the CFPB? first appeared on CURepossession.

]]>The post No Means No! first appeared on CURepossession.

]]>Guest Editorial

Right and wrong are subjective sides of the argument that do nothing but decrease safety and increase liability! Arguing right and wrong on my team will get you one and one answer only; “Just because you can does not mean you should” as the justification does not have any weight against the elevated risk. It does however reflect the general attitude toward policy and the redirection of ego will only happen once.

The following is an excerpt from our field training manual outlining our Standard Operating Policy on Customer Denial as part of our No Follow, No Chase policy. I sent the entire policy to Kevin so he can attach it for those who want to download. This is only one section and even though it covers a lot, I would still ensure that you add something somewhere outlining never to return when threats or made or inferred and how to handle documenting and never returning to the customers address.

Customer Denial

Self Help Repossession – Must be “Peaceful” in order for it to be legal.

No Means No – The authority to repossess collateral comes from one of two parties who have authority over the property. One party is asking for the collateral to be secured on their behalf, the other is denying that authority. The simple denial of the party expressing immediate control over the property has the immediate domain over the property and a disagreement would have said to occur at the time the controlling party denies the right of the other party to take domain over the property.

Read the Entire “No Follow No Chase Policy” Here!

The goal of this policy is to minimize risks to customers, society, and operators, as well as to reduce the company’s liability exposure. This policy does not exist in isolation; it is part of a broader company ethos that prioritizes Safety, Quality, Integrity, and Respect.

Other key aspects of this policy include hourly rates with performance-based incentives. Recovery of collateral is one part of these incentives. When a team member adheres to any policy that restricts unit recovery—our systems are designed to record such compliance—they will receive the incentive regardless of whether our company is compensated.

Moreover, our team members must disengage from any unit where law enforcement intervenes unless supported by a specific legal directive, such as a writ.

Why does this article matter?

If you’re unaware of the recent news about Steve Perkins’s death in Alabama, I recommend researching it. Consider how a policy like ours could have safeguarded many individuals. From the consumer, officers, agent, their families, and on and on.

This entire thing disturbs me in many ways; enough to compel me to share my thoughts on it as well as our policy. I hope someone finds it useful enough to take to heart and maybe prevent one similar event in the future.

– As a human, I am just saddened for the individuals and their families.

– As an American, the ignorance leading to such a tragedy is disheartening. We are a better nation and the politicization of events like these may be necessary for change but always leaves a scar with unintended consequences.

– As an employee, I’ve seen companies prioritize capital over safety, to no good end.

– As a former deputy/investigator, the footage of the incident (if authentic, and faking video is difficult) suggests a civil rights investigation will follow or should especially considering the predetermining circumstances.

– As a company owner the financial and legal exposure to the finance and towing companies involved is considerable and I am sure all companies will be impacted in some way by these events whether it’s just negative publicity or something far worse.

– As an industry steward, I am embarrassed and quite frankly enraged that we end up having to defend our own company and teams against this type of publicity. As mature owners, we should all be crying foul.

Now for those that will say “you don’t know all the facts.” I say your right, but I am not concerned about the facts, only that there are so many different things that could have prevented many of the opportunities for making bad decisions leading up to the Mr. Perkins death that right and wrong become a subjective stance that does nothing to prevent similar tragedies from happening in the future and that in itself behests another tragedy of Americanism which I severed proudly to defend many years in numerous capacities.

Before moving on, let me make one thing clear, I am not egotistical enough to think for one second that I am always right, have always been in the right and/or bad things cannot happen to me, my team and or our company. Any single bad decision by any one of our people, including myself can lead to a tragedy at any moment. I just hope the policies and guidelines we operate by keep us from having the freedom of making bad decisions when we are not thinking clearly or are involved in a stressful situation. That is after all their underlying purpose.

Now, moving past my personal perspectives.

I’ve stated before, and I reiterate: our associations must engage with individuals from day one in the industry, not just with mature companies and their owners. By the time an agent becomes an owner, the cultural damage is often irreversible.

Consider this analogy: Imagine only reaching out to train and influence people who call themselves nurses, doctors, and surgeons.

As owners, there’s a slight presumption of knowledge from our team members and society. However, if owners have been influenced to place capital above professionalism, disrespect and unsafe practices could be translated by anyone as a roadmap to success. This can lead to the undermining and discounting of any values associations attempt to provide vis-a-vis policies, practices, and education.

Allowing and seeking agent members is a great way for associations to gain insight into their member companies as the agent member will reflect the hiring practices and culture of the companies they represent. This insight can help associations quickly identify and address companies misusing the association name, reputation, and influence.

As for a company wondering about your team members attending association events I say; If you’re unwilling to take your team member to an association meeting, you probably should not be employing the team member.

Like most things of good intentions, it started soundly enough, but compliance has been hijacked and turned into a sham to conceal liability.

Site inspections are a particular frustration. They can become preoccupied with tangential concerns, like fire extinguisher presence or car locking protocols, neither of which truly speak to a company’s culture. The efforts often degenerate into marketing ploys and potential legal snares.

Imagine a courtroom scenario where a lender/broker must justify their relationship with a company involved in a tragedy:

Attorney: “Why did you believe this company was legitimate and why did you continue to have a relationship with them?

Lienholder/Broker: “Well they had a fire extinguisher, a shredder, demonstrated their computers were password protected, and they had a fence with some cameras.”

Attorney: “Did their employees have any training?”

Lienholder/Broker: “Oh yes, they have training for their employees it’s through….”

Attorney: “I see and did this employee have any training that was working this assignment?”

Lienholder/Broker: “I am not sure as we do not look at each assignment and who is running it.”

Attorney: “So you don’t care if a team member who is running the assignment is trained; only that the company shows some training history, correct?”

Lienholder/Broker: “Well…..”

Attorney: “Ok, fine, so the company has a history of some of their people taking some “standardized” training, did you review their policies?”

Lienholder/Broker: “Well….”

Attorney: “Ok, so you got a copy of their policies and stuck them in a folder……”

This hypothetical conversation illustrates that real due diligence goes beyond checking boxes and how today’s “compliance” is truly a rainmaker for attorneys worth a fraction of what their education cost.

Building genuine relationships is the only real way to know if a company has a culture aligned with your expectations.

Historically, companies like Allied Finance before switching to a brokerage model and Remarketing Solutions before being bought out, understood that true knowledge of vendors comes from personal interaction, not paperwork. If those involved in cases similar to Steve Perkins case had personally visited the repossession company, they might have sensed potential issues.

In conclusion, associations and state organizations thinking about legislation to reign in brokers or rogue companies, consider placing bi-annual inspections by an employee of the broker/lender accompanied by personal visits to truly vet companies. Ensure language exists that prohibits the company from placing the cost in any way on the field service company or this will become just another way for larger companies to keep competition out of their markets.

Lienholders and brokers alike will have a tough time hanging on to rogue companies when they are forced to meet with them and then testify in court and/or explain to their shareholders why they thought it was such a good idea to hire them.

As for me and our team, No Means No, and any rejection on behalf of the person who has authority and domain of the collateral should be respected and documented.

For us, upholding this simple principle can avoid legal disputes and enhance the safety and profitability of our company and the industry. If ever faced with a direct “Do not return…,” we will view it as a cease and desist rather than to risk further confrontation.

We will track all communications, and if there’s any hint of danger, we will inform the client and tell them to proceed legally. Be warned, we will be sure to document any safety concerns and in the event of injury to a customer and/or fellow repossessor during a subsequent repossession attempt, the information will be there for the responsible parties to be held accountable.

**Side note, as you research this article you will find that this first incident is not the end of this horrible story. We cannot always prevent everything, but we can reflect and adjust helping limit the number potential negative outcomes until the odds are as good as we can make them.

~ Stay Safe

Wes Carico

Nostalgic Towing/Artis Recovery

Should you be interested in more information about employee handbooks, policies, and other ways to protect your company, team, and society, join your state and or national associations. If you’re worried about doing that, give me a call, I won’t spoon food you if you’re not serious about getting it right, but I’ll help whoever has a legitimate desire to run a better business.

No Means No! – No Means No! – No Means No! – No Means No! – No Means No! – No Means No! – No Means No! – No Means No! – No Means No!

No Means No! – Repossession Violence – Repossession History – Repossess – Repossession – Repossession Agency – Repossessor

The post No Means No! first appeared on CURepossession.

]]>The post All In One Billing – Bad Business first appeared on CURepossession.

]]>Guest Editorial

It’s been said by many for years and it’s true. Anytime you attempt to bundle multiple services into a single line item you drive the value of the included services to zero.

Once the pain point of seeing the line item disappears, the associated psychological value also disappears, and the actual service becomes absorbed by the billed item. It becomes expected as part of the core service if the trend continues to long and to pluck this service back out or associate cost to it becomes nearly impossible.

Try It! Start calculating storage on day 1 and apply a discount to every invoice for the number of obligated free days before billing your client.

Two things will happen, you will start feeling the pain of how much you’re “giving” away to support their annual bonuses and the client will understand you are paying attention to it. They will complain and want you to stop the practice.

Wes Carico

Nostalgic Towing & Sales, LLC

GALR Member

About the Georgia Association of Licensed Repossessors

The Georgia Association of Licensed Repossessors (GALR) is an organization comprised of collateral recovery agency owners/employees/industry vendors. Our goal is to educate our members, financial institutions, law enforcement, and communities with regard to business requirements and ordinances set forth by the cities and counties in the state of Georgia.

The purpose of the association is to strengthen understanding between recovery agency owners, law enforcement, financial institutions, regulatory agencies, and the consumer. GALR will provide continuing education

to our members, financial institutions, and law enforcement officials. Education platforms will focus in the fields of professionalism, business principles, public relations and innovations in the industry.

Related Articles;

GALR Intends to Follow the AIR Lead

Georgia Association of Licensed Repossessors Annual Conference

All In One Billing – Bad Business – All In One Billing – Bad Business – All In One Billing – Bad Business

All In One Billing – Bad Business – Repossess – Repossession – Repossession Agency – Repossessor – Georgia Association of Licensed Repossessors

The post All In One Billing – Bad Business first appeared on CURepossession.

]]>The post Finding Your Bottom Line first appeared on CURepossession.

]]>Editorial

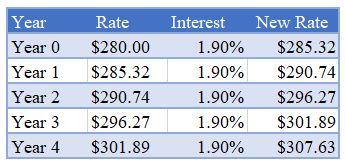

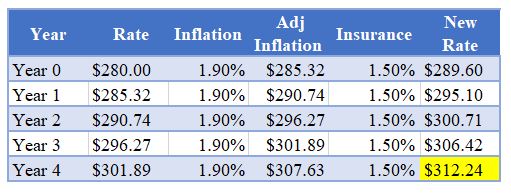

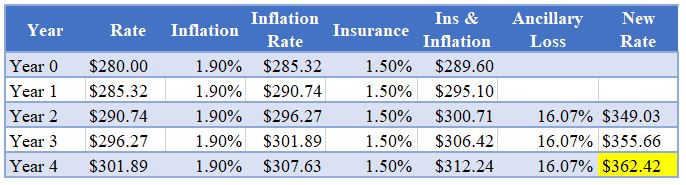

One of the more common thoughts regarding industry pricing involves “standard” rates. The only way to legally establish these rates is through legislation, and we could write an entire article about why that’s a bad idea.

You can never go wrong by improving your business skills and gaining a better understanding of your own business. Capitalism will naturally handle the ebbs and flows of profit when we become more responsible business owners.

There are two basic cost centers: “Fixed” and “Flex.” Fixed costs are the expenses that do not change based on the number of recoveries, such as lot rent, phone bills, lights, truck payments, insurance, and more. Flex costs are associated with the number of recoveries or assignments, such as payroll and fuel. You can place the administrative staff’s basic hourly rate in the fixed center if you prefer (although we place all payroll in our flex center, but we’ll discuss that shortly).

Calculate your fixed cost by dividing it by the number of units (just use data from last month for now). Now, do the same with flex costs. Your flex cost will increase your gross expenses with every car you recover, while your fixed cost remains constant and is spread across all units. Your average fixed cost is easily influenced by missing or hitting goals. Because you included fuel and administrative payroll in the flex center, it will also fluctuate based on the number of recovered units, although not as significantly.

Now you have two numbers. The crucial one is the flex number. This represents roughly how much every car will cost to recover. If your number is $150, when you pick up a car at $275, you’ve already spent $150, leaving you with $125 to cover your gross fixed cost.

Take your total fixed cost and divide it by this number (let’s use $10,000 as an example): 10,000 / 125 = 80. At $275, you need to pick up 80 units just to break even. If you pick up 100 units that month at $275, you’ll keep a substantial $2,500 for your efforts.

If you divide that by 40 hours a week, you’re making roughly $15 an hour (likely much less because owners typically work 70+ hours a week) for the risk, trouble, and aggravation of dealing with net 45 to net 60 payment terms.

I won’t add to the depression by discussing damage claims, lawsuits, and other boring business management issues. Instead, let’s figure out how to determine what you should be charging.

Remember, our flex cost remains constant unless you reduce pay or become more efficient in routing and recovery (reducing the number of assignments you manage is a great way to lower CSR costs, by the way).

So, let’s focus on the fixed aspect. Assuming your fixed cost is $10,000 and your flex is $150 per unit, you want to make $10,000 per month for yourself and set aside 10% every month for contingencies/emergencies. Take your receivables for the same month (let’s use $22,000), and since we picked up 80 units before, divide 22,000 by 80: $22,000 / 80 = $275 (it won’t be that clean, I promise).

We’ll come back to those numbers in a moment. Now, add your $10,000 salary to your monthly expenses of $10,000 for a total of $20,000 in fixed costs. You want the 10% to come off every unit’s base price, so we aim to increase what we bill by 10% ($275 * 10% = $27.50). Since you’re only keeping $125 per unit, let’s divide 22,000 by 125 (22,000 / 125 = 176). Now, we can put the numbers together to find our bottom line: $150 + $27.50 + $176 = $353.50.

Any gross receivable for any unit under this amount will make it harder for you to turn a profit since it’s based on an average of recoveries at a $275 rate. Voluntaries, impounds, unbilled items, denials, or uncollected payments all impact this and should be considered when evaluating this loss potential. We refer to these as “Loss Leaders” and send them to our competition.

One more tip: when dealing with base recovery rates below this mark ($275 in our example), ensure you have ample ancillary opportunities to make up the difference. For example, you may only work assignments for one lienholder for this client due to associated key contracts, etc.

Here’s the beautiful thing: you don’t care how it’s billed—whether it’s mileage, keys, redemption fees, storage, or client aggravation fees. When dealing with brokers directly, steer the conversation towards, “You tell me what the opportunity is to reach my number (never disclose this number), and I’ll bill it how you want it.”

One more tip: when dealing with base recovery rates below this mark ($275 in our example), ensure you have ample ancillary opportunities to make up the difference. For example, you may only work assignments for one lienholder for this client due to associated key contracts, etc.

The same math applies to individual clients; just take a couple months receivables and divide by the number of recoveries these receivables represent. This will get your average pay per recovery for the client. ~It’s about what they are paying, you cannot operate on what you are promised.

How did you do, was your guess as good as your math? Are you being fed “Loss Leaders” by your competitors? How can you reverse this trend?

Your cost is going to closely resemble your competitor as will your bottom. When math is used instead of emotion or the latest number on the street, Capitalism will handle the profit issue for you and no rate standardization was needed.

~ Happy Hunting,

Read the Entire Georgia Association of Licensed Repossessrs Newsletter Here!

Wes Carico

Nostalgic Towing & Sales, LLC

GALR Member

Finding Your Bottom Line – Finding Your Bottom Line – Finding Your Bottom Line

Finding Your Bottom Line – Repossess – Repossession – Repossession Agency – Repossessor – Georgia Association of Licensed Repossessors

The post Finding Your Bottom Line first appeared on CURepossession.

]]>The post 2022 – Top Ten Stories first appeared on CURepossession.

]]>

With 2022 coming to an end, it’s that time of year when we tend to look back at the year as it was. I know, you’re probably thinking, “here’s another one of those stupid best of the year articles” that drags out old news for holiday season filler content. Well, I guess it is, but rather than just wax on about my own views of the past year, I thought I’d rather share with you the stories that you, the readers viewed the most in order of site volume.

So, away we go!

#10 – Hard times for repo forwarding founder

#10 – Hard times for repo forwarding founder

Okay, I confess. This article was a little facetious. No, Patrick Willis, founder of ARS is probably not going broke. It was just an odd article to find.

It’s rare that the repossession industry gets the opportunity to see the wealth that was built on a forwarding operation. And to be perfectly honest, Patrick Willis’ income comes from real estate development and other forms of investment.

Patrick comes from old school repo blood and started his empire with one small agency decades ago. While he has amassed a small fortune

ARS, like most forwarding companies, are lightning rods for industry discourse. To their credit, they are one of the industries biggest contributors to the Recovery Agents Benefit Fund and the Vendor Relations VP, Dave Baker even sits on the RABF Board of Directors.

But that doesn’t mean that their name didn’t come up a lot in 2022 as evidenced by a scathing guest editorial by ARS cofounder John Lewis and the number nine most read article of 2022.

#9 – An agency letter to ARS – I don’t think so…

#9 – An agency letter to ARS – I don’t think so…

Guest editorials are always one of the most read. This one, came on the heels of John Lewis’s article titled “ARS Founder Speaks Out on Repossession Fees” and echoes the ever-persistent issue of fees.

This contribution came from Jason Karns, General Manager at Quality Recovery Service. His direct and to the point editorial well illustrated his opposition to the fee structure of American Recovery Service (ARS).

Perhaps the most powerful statement in it to me was; “How in the world can ARS still offer the same low-ball fee they did in 2009? It’s an Insult.:”

#8 – Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

#8 – Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

I was a little surprised that this story wasn’t bigger than it was. It could just be a matter of timing as this announcement by the Alliance of Illinois Repossessors (AIR) was late in the year and didn’t get the benefit of later re-reads as some of the top three have.

Regardless, it did show a monumental stand against lender/forwarder demands for free storage by one of the newer state repossession associations that, by December at the time of this writing, , the same proposal was being taken into consideration by all of the other nine state associtaions .

How this all pans out across the nation is hard to say, but the AIR had already flexed their collective muscle in demanding fuel surcharges earlier in the year as well as demanding Primeritus pay up in their past due invoices. Both of which they were successful in achieving.

The AIR claims to be responsible for over 85% of all repossession activity in the state of Illinois and holds a greater amount of leverage than probably any other state at this point. They spearheaded the fuel surcharge initiative and are leading the way with storage as well.

While still relatively new, the AIR is without a doubt, the strongest of the state repossession associations that has ever existed. Their storage mandate is now being taken up by eight other state associations as well. This is growing quick and every agency owner should know by now, and there is no excuse for sitting on the side;lines now! those who who are putting this up for vote still.

#7 – A fly on the wall – Ally discusses new repossession strategy

#7 – A fly on the wall – Ally discusses new repossession strategy

Scouring through Ally Bank’s investor meeting transcript, I’d stumbled across a veiled reference to their adoption of a new repossession strategy that they had hoped would help to fend off delinquencies. This was, at least, the excuse for an increase in delinquency that was brought up by one investment writer.

Their stated intent to give borrowers just a little more time to pay became a source of speculation from both me and Scott Jackson who suggested that perhaps Ally intended to cease their repossession assignment strategy and opt for the legal process of replevin.

Reasonable minds differ, which we did and I later responded in an editorial of my own which we’ll get to later.

#6 – Assignment declines and low recovery ratios – A simple solution

#6 – Assignment declines and low recovery ratios – A simple solution

As previously mentioned, guest editorials tend to be some of the most heavily read. This one from Jeremy Cross, of International Recovery Systems, almost made the top five. In his writing. Jeremy pointed out some of the ever-growing problems persisting in the industry, inflation, staffing and fees.

Jeremy lays out a fairly simple solution to help combat these issues. One that already made the list. It seems to have caught on; Storage,

#5 – Pricing Risk to Prevent Loss

#5 – Pricing Risk to Prevent Loss

Wes Carico of Nostalgic Towing has continued to provide some of the most informative and most read editorials through the years and definitely hit the mark with this one. Wes addressed many of the problems plaguing the industry such as non-payment for fees, adjusting rates to account for slow pays or no pays, and negotiating with forwarders.

A re-read of Wes’s articles would be time well spent for any agency owner from time to time. While Wes is busy working on his new Orca repossession workflow and business management application, I hope to hear something new from him before long.

#4 – Anatomy of a Repossession Death

#4 – Anatomy of a Repossession Death

This story was brought to me by industry experts Mark Lacek and Ron Brown, who both found themselves serving as expert witnesses in the wrongful death case in the May of 2019, case of 71-year-old Albert Nduli of Houston who was run over during a recovery.

This article took a while to write because there were a lot of lessons to be learned in it. Lessons that could save lives and businesses. I still feel that the story of this tragedy should be required reading by all agents, owners, lenders and forwarders.

#3 – The mythical repossession explosion, and the real data

#3 – The mythical repossession explosion, and the real data

Over the summer, click bait alleging that repossession volume was soaring ran through the internet through various news sources. While the industry was still suffering from a repossession volume drought, these catchy headlines didn’t seem to hold any veracity to me. So, I dug into the data.

What I did find, was that delinquency was showing signs of growth at the end of Q2, 2022, it was at that point, still far lower than even the pre-pandemic period, which wasn’t that high to start with. Taking the existing growth trends, I forecasted that we wouldn’t get back to pre-pandemic delinquency levels until the end of Q1, 2023.

Well, it’s already been a couple of months since I wrote this and we’ve already surpassed my projecrions. I think it’s safe to say, the dam cracks opeen by March. I’m not sure how the industry will handle the staff issues, but I still feel that a serious volume surge is coming.

#2 – Another FINAL NOTICE to Primeritus

#2 – Another FINAL NOTICE to Primeritus

As well documented, Primeritus had a rough year. But not as rough as the agencies who’d been waiting for past due invoices to get paid. Some as much as $75K and as long as a year.

This didn’t sit well with first, the Alliance of Illinois Repossessors announcement making a final demand for all invoices 45+ days past due to be paid no later than Friday September 9, 2022. This was later followed by the Georgia Association of Licensed Repossessors (GALR) who made a similar demand.

Other announcements from the TexasARP, CALR and a joint memo with Primeritus by the ARA, but this article appears to have had a greater impact, or at least garnered greater attention.

On a side note, the AIR reported that Primeritus did meet their demands and last I heard, progress was made in Georgia. But there was never any admission of how much in past due invoices was owed or how much was paid out.

#1 – Replevin vs. Repossession – A snowballs chance

#1 – Replevin vs. Repossession – A snowballs chance

As previously mentioned in number seven, I had written a response to Scott Jackson’s editorial titled “Be Careful What You Wish For” suggesting that Ally Bank may opt to cease involuntary repossessions and refer all delinquency for replevin/claim and delivery.

I’m not sure that I really countered all of Scott’s points in my editorial, but I feel that did a decent job of illustrating the negative financial impact that such a course of action would create.

I’m honestly a little surprised this was as heavily read as it was. Perhaps it just picks up good search engine clicks. After all these years of writing this stuff, I am still often wrong about what will bring in traffic.

Left Out

When I first saw the results, I was taken back by some of the stories that didn’t make the list. Especially many of the guest editorials and association contributions. These articles get a lot of views and reads each and I’m sure that if I added the combined views for every contribution from Ron Brown and the Eagle XX Group, the ARA or The Alliance of Illinois Repossessors, they would easily exceed any of these articles.

I look forward to sharing all of your editorials, press releases and announcements in the coming year, so if you have something to share with the industry, just reach out to me at editor@cucollector.com.

On to 2023!

As big a year as 2022 was, with rising delinquency and a probable recession coming next year, I expect that 2023 will be huge. I would like to thank you all again for your support and wish you all the most successful year the repossession industry has seen in decades.

Thank you all again and,

Kevin Armstrong

Publisher/Writer

2022 – Top Ten Stories – Repossession – Repossession History

The post 2022 – Top Ten Stories first appeared on CURepossession.

]]>The post Pricing Risk to Prevent Loss first appeared on CURepossession.

]]>

“Palm Strike’s main superpower is the stupidity of his enemies.” – Charlie Jane Anders, The Magazine of Fantasy & Science Fiction, July/August 2014

GUEST EDITORIAL

To reference a current topic, we can all relate to, I focus some of the material in this article to the current issues surrounding the broker Primeritus in hopes of refocusing on a larger issue within our industry, not to pile on to a bad situation or disparage them. Everyone should note that even though Primeritus is in the spotlight, it isn’t one broker (aka forwarder), it is many of them.

It’s not just brokers either. Like most, we insist that “one off” clients pay before release. Customers of our clients are pay as you go as well. The reasons are similar.

To draw a better business example though, let’s consider how insurance works from a very basic view. Insurance companies understand risk assessment very well and they are the leaders in pricing against it.

When claims are higher for whatever reason, policy prices will be increased to avoid the risk of loss.

When inflation raises prices then the cost of insurance payouts will also increase resulting in profit loss. As a result, all policies will likely cost more.

A regional/area-based example can be seen in areas with higher deer populations. Higher claim rates because of animal density can lead to higher policy prices in these areas/regions.

How much experience you have in business, in the industry, or driver/operator driving experience and history as well as the amount of the total paid out claims over the last “x” years will impact your individual premiums providing an account level risk pricing strategy.

ALL BUSINESSES PRICE AGAINST RISK!

Walmart, for example, will have considered the cost of shoplifting into the pricing model for their products. Now consider how the prosecution or lack thereof impacts retail pricing. The impacts may be felt more locally where shoplifting is concerned, but the overall product pricing is impacted when losses climb no matter the reason.

So, what does any of this have to do with Primeritus?

Simple. PRICE AGAINST RISK! Try considering additional variables when pricing contracts or accounts.

**HERE IS THE SECRET BROKERS DO NOT WANT YOU TO KNOW**

You control the price of your product or service, they do not!

You Ask: Yea but….

I Say: But what? Read on!

When you have poor credit and go to get a loan, how does a bank price against that risk? They “quote” a higher interest rate, or they do not let you have any credit.

No credit, no problem, cash accepted at the dealership, right?

Pay as you go is a perfect way to reduce risk without raising prices.

Tip: Can brokers survive on pay before release? I do not think in the 10 plus years of doing business with Secure Collateral I have ever released a car where the repossession fee and any pre-approved charges weren’t paid. Storage and some other minor stuff may be settled later, but they carry the lowest receivables of anyone in our book.

Remember, releasing without payment is extending “credit” to a client. Each of us should understand how much credit we are willing to extend to any one client as well as what the past due cut off is. We should also understand how much credit our business can stand before we start to suffer.

We started focusing on this concept more closely a few years back when a broker whom I will not name took us for well over $20k.

Tracking what has been paid, denied, and ignored are extremely important to ensure clients stay within credit parameters and problems are recognized early on.

Tip: Clients are altering contracts in every single assignment by setting different expectations. It may be called an update, additional information, etc., but the adjustment to your overall contract for that assignment just took place when the contract is sent over with additional expectations.

Your agency can do the same thing. Adjust the price and expectations of every order before beginning any work on it. Clients beg you to do it already.

Don’t believe me?

“Any additional fees must be pre-approved before working the assignment.”

How many assignments do you receive with that or a similar statement?

Brokers opened Pandoras Box with refining the contract on a per account basis years ago and because of the variations in pricing and expectations of their clients they cannot ever close it.

The overall goal is to communicate your expectations around pricing and payment before working or picking up the collateral.

When we believe the contracted rate is no longer profitable or the risk of a particular account is too high because of any number of variables, we send an update outlining our expectations and await approval.

Here is one example most can relate to:

“Flatbed Fee Needs Approved In The Amount Of $xxx.xx For AWD/4X4” or similar verbiage.

This example considers the extra risk of additional equipment/manpower.

Other variables to consider when focusing on contract/account level risk factors may include:

- Skip Accounts/Multiple Addresses

- Client Denial Rate

- Failure to Pay/Credit Score

- Indemnity Clauses

- Current Fuel Prices

- Legal Processes (Military Bases/Indian Reservations, Etc.)

As you can see, the list can get lengthy, and focus points may differ for each company as well as each client.

When the approval comes, great.

Tip: Accounts that close without approval are going to your competitor. What happens when your competition ingests too many of these loss leaders? See the last article I wrote for possibilities.

Here are a couple more examples we use:

- Pay before release

- Your program with our company requires your agreement that all invoices due for this service will be paid prior to the release of the collateral. This can be done at the time of release or by overnighting payment the day before the release appointment.

- Rate Adjustment

- Your program with our company requires an additional fee be approved in the amount of $”X.XX.” The fee is contingent on recovery and is due in addition to any other approved or contracted fees.

Tip: A NON-CONTINGENT fee is better than a close fee. I do not care what you call it. Non-contingent means NO CONDITION. The account can even remain open, but a non-contingent fee is due when it is approved!

You may have to educate your clients as their CSR’s will often approve a non-contingent fee only to have it denied because you never ran the account. The approval should have been contingent on 1st run of the account if that was their intent when they approved the fee.

Wording is extremely important and will modify the existing conditions of the contract. Clients attempts to seal or modify the contract with verbiage in the additional information can be binding if these changes are the last negotiations considered. Teach your team to evaluate these statements carefully.

We have learned, the real hat trick is not how to adjust your flat rates or get increases on your contracts – you really do not care. The real challenge is how to manage all the credit limits, quotes, and different client expectations when deploying this strategy. Failing to consider the cost in managing a client’s program this way can lead to larger losses if you’re not careful.

How does one track all this information and consistently quote accounts, track approvals, and ensure billing captures the revenue opportunities while tracking how much a client owes or denies? Well, I wrote about that secret back in the winter of 2020 and I will just say things are progressing nicely, but we won’t get into that now.

Tip: What is cheaper for the broker?

- To simply stop working for them?

- To have you accept the account, assess it, and send back a request to alter the pricing and/or expectations?

- To have you decline the account outright?

With the cost of starting and maintain a new repossession company soaring (the brokers really overplayed the compliance hand) there just aren’t too many new places to find new repossessors, so option 1 isn’t looking promising for brokers at all.

Few brokers have any automated ways to manage inbound fee requests from their vendor network, so they spend real dollars for real people to manage them. So, option 2 will likely cost them actual dollars as well as cause a problem with their recovery rates/times and once the price of dealing with this strategy is realized, the smart ones will negotiate new contracts with their vendors to decrease cost and speed up recovery times.

Option 3 is what systems with the “decline” option is built for and is their cheapest & best option. Their software just recycles the order and goes to the next person on the list.

For example, ALS encourages this behavior and tells you to just decline orders that pay below an acceptable rate for your company. Once declined, Wombat will just move to the next most affordable contractor (cheapest) until it prices at a point where the assignment is accepted. The result is; we just keep paying the CSR cost to manage their assignment program for them.

Seriously, we pay our CSR to reject the assignment just so Wombat (or other industry software) can send it to the next agent and get it handled for the lowest possible rate.

Without managing your assignment requests a different way, brokers pay nothing to have you manage their assignment programs.

Changes cost brokers money when they can just ignore the change request and eliminate the expense while we pay the cost to manage their program.

Don’t believe me?

Think about why your updated coverage maps are no longer ever implemented?

What do these systems really care about? Performance or profits?

I suspect the last answer varies but is likely revealed in the indifference to how much you are being paid. When pay is good and increase requests are respected, it’s likely performance based, otherwise, it’s profit driven. These are the clients where we should consider risk-based account assessment.

We are paying to manage the assignment program either way, so we might as well get the most bang for our buck, right? Price the assignment against the risk of loss and ask for the additional fees, set it off to the side while you wait on a response and focus on better profit opportunities.

Tip: Consider thinking about clients, accounts, and addresses each having profit opportunity and focus on the best ones. The worst ones will sit idle and be backup in the event work slows.

Brokers are not the only entities allowed to have “preferred” vendors, clients, or whatever. Manage like your broker does!

If your concerned if it will impact your recovery percentage; it will and I ask, does it matter when the risk of loss is high, or the client is indifferent to the risk/cost you are exposed to?

Failure to pay (for whatever reason – missed, delayed or denied) or terminating the billable opportunity, have the same business impact; Costs against expected revenue streams that failed to produce profits! (AKA LOSS)

So, as I get and AGREE with much of the Primeritus conversation, I believe we should continue to expand the focus on solutions that can provide sustainable increases for field service providers.

Brokers are determined not to lose money on an Individual assignment or SLA, so pricing in a way that allows them to stay in front of losses will work in most cases. If the broker can get in front of the cost and get permission for the billable from their client, they will not care to approve the request and in most cases, they can even upcharge the request leading to another billable opportunity for themselves.

Exceptions exist when competition for work is great and/or your competitor’s pricing is lower, and their service is as good as yours. LPR can also pose a problem because the recovery happens immediately or soon after assignment acceptance with little opportunity to adjust the rate from your contracted rate (risk factors such as AWD vehicles should be considered in your LPR contract for this reason).

As it relates, we are still working with Primeritus because we are pricing more around other risk variables such as credit than we did before. The effects include reducing the amount of risk a particular client can have on our company and increasing the risk exposure to our competitors.

Primeritus’ program accounted for over 20% of our inbound volume when we first started focusing in on decreasing the risk their program brought our company. Their receivables showed nearly half of what the state of Illinois referenced in their letter, but now they pose very little risk and their receivables are not 100%, but they are no longer our number one concern.

If you’re wondering how we did this, you know from the last article we were completely ok with allowing the work to pass to our competitors (risk assessment at the client level). The reduced workload led to our team focusing in on healthier business relationships while we continued to work with Primeritus’ managers and accounts payable over the last few months.

Side Note: Primeritus’ team members have all been very frank about the issues they have been challenged with as they continued to clean up errors (some ours) and catch up on outstanding invoices.

Primeritus has been much better than the previously mentioned broker that took us for over $20k a few years back and for that I am thankful and respectful.

In closing:

The important piece is to consider risk of loss into your pricing as well as actual cost when negotiating rates or implementing an account level risk assessment strategy. So, why not consider placing a client on pay as you go and/or increasing a client’s rates at the account level when they get behind on payments until their business model redeems itself. Push the account aside and await the approval while you focus on healthier relationships. The work will be there if you need it.

Declining the account or cutting the client off has more negative implications for your company than it will for theirs and the work will not be available if you determine you need it.

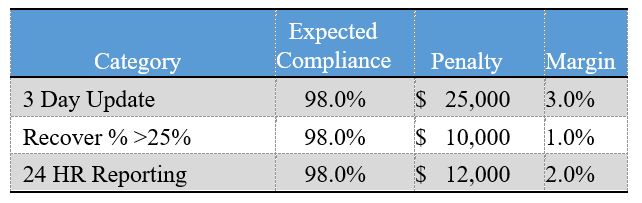

Quoting accounts based on risk assessment passes the cost of managing the assignment back to the broker and in the end, it will be cheaper for them to increase your rates. The penalties in the SLA’s with their clients for not meeting recovery percentages and time expectations can be very costly.

Consider all the variables and do not be afraid to ask for any fees you consider important.

Negotiations end in pricing when you accept what has been offered. Counter the offer based on Risk Assessment.

Many clients will accept our counters, but want the fees categorized a certain way when billed so we include language that tells them to let us know how to itemize the fee in the approval if they have specific instructions.

It’s better for your profits to allow your competition to have the accounts that do not meet your risk tolerance.

For Example: Reduced rate recoveries are practically non-existent with our lower priority clients. Many voluntaries and impounds pay more than the involuntary rates as we negotiate a new rate after acceptance as they require a lot more involvement and manpower on most occasions. The impounds and voluntaries that do not get the price adjusted go directly to our competitors.

Finally – Brokers control because we passively accept what they offer and judge them for running their businesses based on profits rather than a notion of right and wrong (myself included). Hope it helps and yell if we can ever be of any assistance to any of you.

A more comprehensive list of verbiage we use when requesting additional fees can be found at http://goorca.io for anyone interested.

Wes Carico,

Nostalgic Towing

More from Wes;

Get the increase, cut the contract, or close the doors

Ancillary Fees – The Associated Issues with Safety and Quality

Undervaluing Services – No Simple Fix, But the Responsibility Is Obvious

Framing the Conversation – Increases Are All About the Numbers, Not The Virus

Repossession Obsession – Questions Consumers, Legislators and Lawyers May Want to Start Asking

Pricing Risk to Prevent Loss – Orca – Fight for Fair Fees

The post Pricing Risk to Prevent Loss first appeared on CURepossession.

]]>The post Get the increase, cut the contract, or close the doors first appeared on CURepossession.

]]>

The current momentum at which the industry is moving toward desperation is real!

“We must be aware that momentum born of old habits and destructive behaviors might be momentum, but it’s momentum slammed into reverse.”

Craig D. Lounsbrough

GUEST EDITORIAL

I wrote several articles a couple years ago with the intentions of adding different viewpoints about the more troubling areas of the industry. Much of it was self-discovery and reassurance that the plan we were going to work toward as a business was the correct way to be heading. It seemed our industry was making clear progress prior to COVID. ARA and TFA merged to combine efforts around making a difference. There was focus on education, safety, legislation, and more. Personally, I felt good about the direction we were headed.

The frustration prior to that period seems to have returned and the momentum we had appears lost.

Clients (brokers of all types especially since they control such a large market share) should consider the disastrous positions they are putting themselves in. What happens when only 50 companies survive across the US (Anyone else turn down that offer a 2 or so years ago? How is your business today?). Intentional or not, who ends up with the leverage then? Will lienholders just price losses into their upfront cost? You cannot frontload 100% loss (Can the retail theft increase in CA provide insight here?).

Owners should run the math sooner rather than later and there is no way that clients do not understand it better than they acknowledge (they have departments of people who are good at math.)

This is very basic, but it will clearly demonstrate how a single undervalued contract can destroy your business. Especially a volume-based contract.

Add all your cost for payments, rent, insurance, employees x40 hours x minimum wage x 4.3 wks. + comp + taxes for monthly fixed payroll (overtime is flex for us). Average your monthly fuel, bills (phone, electric, water), overtime/bonuses, owner payroll and add that to your fixed. Divide by your average recoveries

We will be using 450 as our starting monthly number (just a fraction over 100 units per week) for recoveries and $120,000 in costs (these relatively close to numbers I have ran in the past at different times.)

These are averages. It’s a goal post to judge profits against. Tracking flex numbers like payroll and fuel per recovery on a weekly basis is highly recommended to zero to a more accurate number.

Always go about your math the same way and you will get a solid idea from month to month. Graphing in Excel or the like can show you trends, etc.

**Hint – Use the desired income number instead of the actual income number for owner payroll if you’re not making what you want or intended. This will show you where your rates need to be.

Total cost = $120,000 / 450 = $267 Per Unit – $267 is your minimum receivable (not billable, not all line items are paid) average for any client.

**Hint – Want to make 30% profits, add 30% to the $267 ($347 is your number).

Remember, you need cash coffers to handle emergencies, keep you flush during the ebbs and flows of volumes (your running 30 to 60 net on receivables against weekly expenses in most cases), so consider that when deciding what you need to set your mark at. Below 10 to 15% may cause issues unless you have personal income to tap into when needed.

Now, you have 3 ways of impacting this number.

1 – DIVISOR – Pull more units without raising costs, especially flex (hard to do when the volume is low – remember Pat Altes Podcast from Jan 13th, delinquencies are at an all-time low for many lenders (and we are coming into tax season). Altes, JP (Host). (2022, 01 13). BOYCOTT! DRN’s Jeremiah Wheeler’s Thoughts on the Great LPR Shutdown. Repo America with J. Patrick Altes. https://podcasts.apple.com/us/podcast/boycott-drns-jeremiah-wheelers-thoughts-on-the-great/id1504301559?i=1000547812226

2 – COST – Lower your cost (sell trucks, close offices, cut down on payroll by working your own lots). Watch flex cost closely.

3 – INCOME – Increase receivables (obvious, ask for increases, find new revenue streams, or increase the ever-decreasing ancillary).

Let’s focus on the divisor (number of units). Let’s increase our recoveries by just 10 units per week (@ 4.3 wks. avg. per month that is 43 additional units).

Total Cost = $120,000 / 493 = $244 Per Unit – That’s a $23 per unit increase.

Here is where you will lose everything in a quickness if you do not cut your loosing contracts!

Now, let’s say your costs remained roughly the same and your pulling 9.5% less units (using the same 450 we subtract 43.)

Total Cost = $120,000 / 407 = $295 – That’s a $32 per unit loss.

That’s $9 more on the loss side with the same swing to the negative (I will let you explore why.)

Remember, you must figure receivables, not what you billed – look at deposits and minus impound fees.

Take your total deposits and divide by the average number of recoveries. Look each month for a year and then get an average for the year. This will show a good sampling and help with understanding the income lag.

There are months when payments from clients come to a crawl. Large payments then come in a month or so later. This can cause small data samples to hide the truth if you’re sampling on a peak or valley month. You’re looking for the mid or mean, just use the same one every time.

Once you have your global average, breaking income down by client is the only way to truly understand what you are averaging for that client (it does not show labor involved in fighting denials, complicated service expectations, etc., but it’s a start). Depending on how you keep up with income this may be more of a challenge than not.

Is your deposit average higher than your needed or target average?

After a certain point, the momentum to the downside gets faster and faster for every car you pick up at a loss. Now, add the extra insurance exposure, storage costs, claims, 3rd party management costs (auctions, transporters, customers, etc.) for every looser you recover, and watch these recoveries crush your business faster than you can cancel your insurance.

If the contract is lower than your average, then it’s real trouble. If it is lower than your desired target, then every loser takes you further away from your goal.

Every expense item your company has will increase on average as volume goes down and for every “recovery you pick up” at a loss, it compounds the issue.

Normal times meant normal attrition. Companies close as new ones grow. Times are not normal. Add quick inflation, supply chain issues, a resigning workforce where workers are demanding higher pay (hmm, correlation, you decide), and LOW VOLUME on top of 10- to 15-year-old rates and normal just got canceled!

I do think this is the basis for the major frustrations field service company owners have right now. There simply is not any more time for most of the companies out there. It’s; get the increase, cut the contract, or close the doors.

The other miss out there right now is around LPR. The additional expenses invested into LPR depend greatly on that capital paying off by increasing the number recoveries. You’re doubling your hourly payroll, adding about 1/3 to your capital equipment cost, and increasing risk exposure when implementing purposeful scanning programs.

Because the expense is increased, the divisor must be larger than normal to be profitable against a normal rate. Clients are reducing these rates which makes the issue worse. Companies that were profitable using this model two years ago are incurring losses at tremendous rates because of the increased costs against reduction in volume on lower priced contracts, the missing ancillary, and inflation.

Now it’s not hard to see why it is painful to know that the data you invested is not only being given to your competitor without any meaningful compensation but is increasing their billable volume while you’re struggling to make your bottom numbers. It is a big issue and Vinnie in his podcast with Patrick Altes has a point when he speaks about diluting the value with the way in which the data is now being marketed. Altes, JP (Host). (2022, 01 20). BOYCOTT! Why A Major Florida LPR Scanner Is Shutting Off His Cameras, w/Vinnie Payne. Repo America with J. Patrick Altes.

LPR providers are unintentionally encouraging companies not to invest by diluting the value of the data. Why scan when I am going to benefit for free?

We had the conversation a few years ago after buying 4 brand new cars and equipping them with new camera systems. Gross receivables went up and profits went down. We haven’t run cars since, but we still have cameras on our trucks – it just didn’t make sense to pass up the opportunity.

We will have to turn those off if all the related contracts indicate a net negative as demonstrated above (most brokers price the LPR below normal rates and things are already moving in the wrong direction.)

Proudly, we are a DRN provider. I have a lot of respect for the way DRN, Motorola (thanks for keeping me connected in my public service days), MV TRAC and Jeremiah have supported field service companies. However, I do believe that the previous information supports the idea that the decisions on how the data is marketed and the lack of thought to downstream impacts along with brokering the relationship between the field service company and forwarder lined up the crosshairs on LPR and DRN more specifically, not the field service company. Altes, JP (Host). (2022, 01 13). BOYCOTT! DRN’s Jeremiah Wheeler’s Thoughts on the Great LPR Shutdown. Repo America with J. Patrick Altes.

Owners are only pulling back the curtains!

Once brokers became your primary revenue stream (no matter their industry), we became closer partners than you realized.

Rates from all recovery programs (voluntary, involuntary, LPR, etc.) must meet target for every recovery or the program/client may not have any participants/vendors by attrition (companies closing, understanding profits, or just avoiding poor programs altogether.)

It’s just math.

Not emotion nor demand, just business and as owners we must get better at it.

A couple final thoughts.

1 – Add the 2020 inflation rate and then the current inflation rate to your average deposits before COVID. This is the minimum you need to be at now to get close to the same amount of profit for 2019.

2 – There have been several conversations about “collusion,” “price fixing,” etc. as of late. Math is math and the fact that everyone is facing similar circumstances at the same time should not be a surprise for anyone and frightening people away from the conversation is just bullyish.

3 – If you’re not doing the work, your competition is and the more work they have at a loss, the tougher it will be for them to remain competition.

4 – Working together to educate and train one another is not “price fixing or colluding” no more than me sharing the above information is.

Hope it helps someone, but if not, it was a good reminder for me. Need help with the concepts or data, give me a yell.

Regards!

Wes Carico,

Owner – Nostalgic Towing

Get the increase, cut the contract, or close the doors – Fight for Fair Fees

The post Get the increase, cut the contract, or close the doors first appeared on CURepossession.

]]>The post Undervaluing Services – No Simple Fix, But the Responsibility Is Obvious first appeared on CURepossession.

]]>

~ “No one is ever going to love you more than you love yourself.” Controversial folklore, but it is the perfect summary of what happens in this industry that is either directly or indirectly artificially lowering the value of the services provided by the Field Service Repossession Company and this article may well be more of a note to self than anything else.~

GUEST EDITORIAL

Replace “love” above with “pay” and as an entrepreneur you will understand exactly what I am talking about. No one is ever going to pay you more than you pay yourself!

Keep in mind we are discussing the value of our service, so this article focuses on the value of you, your business, and your business services so by definition this is all about the money. If that is a problem, STOP reading now.

Before we can fix a problem, we must define the variables so time to call some “balls and strikes” around fault, blame, and responsibility. For most of us, me included, this will force us to “put our big boy pants on” to quote my mother when I was a child.

THE PITCH

“Among X companies surveyed….” – The problem with pay in the repossession industry: Forwarders (brokers of repossession assignments) is likely the number 1 answer.

BALL – 1

Now I have not taken any formal surveys, but many of the Field Service Repossession Companies would state that brokers/forwarders are to blame. Many of the arguments have merit, but to lay the entire issue at the feet of the broker implies that the broker/forwarder controls our business and there is nothing we can do about it.

There is plenty we can do about it and some of today’s approaches will have positive impacts. The consolidation of ARA and TFA with the idea of bringing the forwarders into the conversation is a perfect example. Agree with it or not, it is a different approach and helping these clients understand the industry better will assist them in properly pricing their services to lien holders.