~ “I really don’t understand what everyone was complaining about the forwarder for, we are doing good with our contracts and profits.” – Me talking with my wife on the way home from our first Allied Finance Adjusters meeting after about 2 years in business. ~

In my previous article, Ancillary Fees – The Associated Issues with Safety and Quality, I mentioned that we have seen two rate increases from our clients in 10 years. It has not been because of the lack of efforts and/or planning. Our direct clients remind us that increasing our rates will impact our volume (number of assignments) and our forwarder clients (brokers of repossession assignments) are still discussing the first request from 8 years ago. I am sure the vendor relations manager does not mean to take so long getting back to us, he is just that busy.

In that same article, I alluded to the fact that newer companies will likely have better contract rates than the $280 broker average that we signed 10 years ago. This is important as we dive into who profits from the death of mature repossession companies. Keep in mind, if there are winners, there will be losers! We will discuss some of those as well.

Here’s what happens.

Click image to enlarge

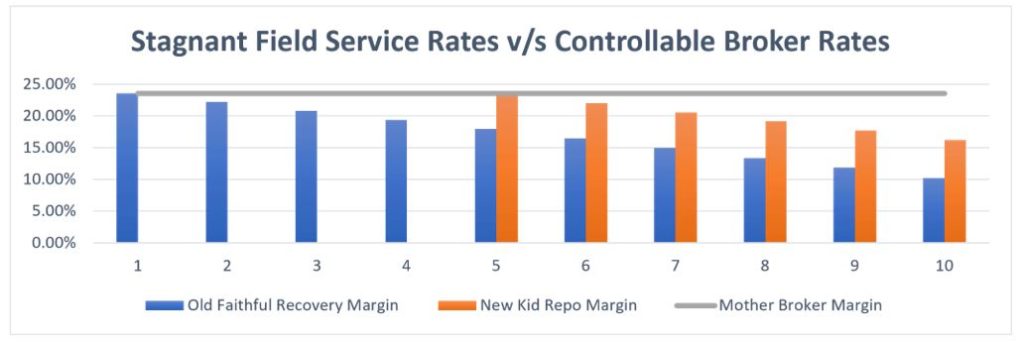

Figure 1 – 10 years of stagnant rates from Mother Broker to Old Faithful and 5 years to New Kid Repo. Mother Broker works just hard enough to keep average bill per recovery from her client (the lien holder) flat against annual inflation. Profit margins take care of themselves with stagnant vendor rates.

Old Faithful and New Kid cannot avoid inflation and with stagnant rates, there is no other outcome except decreased profits with this client over time.

Clients (especially the broker/forwarder) cannot justifiably sign up every field service company wanting a contract. There are costs to managing these relationships, so to have the repo agency under contract and not provide them with enough opportunity increases cost and liability to the client (lien holder or broker/forwarder alike). New companies are sought when issues begin to arise with the current field service repossession companies (brokers/forwarders may be more responsible for this cyclic process than anyone may think). See Curepossession.com, 2020.

It could be pushback against client billing policies, rates, or maybe it’s service related as the field service company is struggling to provide the same consistent service the client is accustomed to. Increased volume or expanding coverage are also reasons a client may look for new vendors. This fact remains; contracts are not handed out because a field service company exists.

The new company gets signed up at a rate consistent with today’s market rates (their margins will be better than the mature company with 10-year-old rates [this is what I did not understand at that first conference] – see Figure 1). The new company sees little work at first (profit margins are better with the older company and they are still reliable) and as they pick up a few pieces of collateral here and there the client gets to evaluate their service, company, and ability to meet supply and demand. How they respond to special requests, assignments, etc. will play a role in whether the vendor manager quits looking or continues the hunt.

Over time, New Kid Repo Company becomes stronger, more reliable, and their service increases. Their profit margins will sustain growth at this point.

The owner of the newer company works hard and it starts paying off. They begin to see additional work from the broker/forwarder clients. Their CSR’s and vendor managers will even comment on how good they are doing and may even vent about that other company, Old Faithful Recovery, down the road. “I don’t know what happened to them,” they will say. The newer owner will not care. They are just thankful for the opportunity. They will begin to hold their head high as they are finally starting to “make it.”

Here is what most of us missed. Old Faithful is the most profitable company that broker/forwarder has working for it. That owner is struggling to run a 10% margin at the end of the year, stopped paying themselves two years ago and prays every day that something does not happen to finish eating the other 10% (see Figure 1).

Click image to enlarge

Figure 2 – The longer the field service company works with the broker, the greater the profits the broker makes from that company if they keep the rates stagnant. Why is it important for brokers to replace rather than give rate increases? How destructive is this behavior to the industry? How much liability does this purposeful behavior create for the lien holder and broker when companies sacrifice safety and ignore regulations trying to survive? You decide.

Remember – this works adversely to the company. The increased profits the broker is keeping in this example is inflation adjustments (other cuts and service cost increases increase the severity of the issue) not being passed to their vendors. This will eventually lead to instability and destruction of their vendors (or “Partners” as some brokers refer to their vendors). This could be true in any industry where a broker is injected into the service stream.

~ At 23% margins, New Kid needs 20 repossessions to put a set of tires on a truck verses the 30 repossessions it will take Old Faithful running around 16% margins at the 5-year mark. ~

In a couple years the Old Faithful will finally close their doors and you will look at your books and begin to think about risk vs. reward. You have gotten on your feet now and understand that around 5% of your invoices sent to your broker/forwarder clients are denied for the smallest reason; the $1 here and rapid pay fees there are really starting to impact your bottom lines. Inflation has driven up fuel and you can no longer get your oil changed in your trucks for $150.

You are getting a ton of work though. At $1 to accept an assignment, is it worth taking that assignment you have seen 6 times already? You are hyper-focused on updates, checking and re-checking portals, and those damn impounds are a headache. You cannot seem to keep your local credit unions happy. You find your team missing the new assignments from these directs as every email address a broker/forwarder can get is now blown up with automated junk system messages (on average 600 emails a day now).

You will start talking with your vendor managers and start discussing raises. You will run through the conversations in your head, on paper, and with other owners. You can see where this will end if you do not get ahead of it now and all you have to do is show that vendor manager that you can improve that recovery rate, update compliance, or whatever action item they said you need to work on.

This is your breakover point. Your service is as good as it will ever be; Equipment newest in town and everyone wants to work for you or with you. Without increases from your broker/forwarder, clients or other strategies to ensure these clients have limited impacts on your recovery volume, you will start to suffer the same fate. In just a couple years you will recall this article and wonder what happened to the author’s company.

The broker/forwarder will never make as much money off the back of your company than they will in the throes of your company’s death. As you close your doors, those thousands of dollars in invoices become additional profits as they will go unpaid by the broker/forwarder and count toward their bottom-line profit.

It is obvious that brokers/forwarders profit from stagnant rates (see Figure 2). In the last couple of years alone, I have had one of our vendor managers brag (and laugh) about paying companies $250 for an involuntary repossession in Jacksonville, Florida. Those companies are not likely paying attention to regulations, safety and liability. An attorney could make an effective argument against that broker/forwarder if one of those company’s employees becomes injured as a result of working under such pressures (they may not win the argument, but how much would it cost to argue it? Would it likely force the broker/forwarder to settle?).

Just the other day, we had another vendor manager slip and tell us that “they will look for the first reason to deny an invoice” when discussing invoices that we resubmitted ($7K in 2019 for this one broker/forwarder btw – around a 15% denial rate for the year – we did not do a lot for them in 2019 and will “partner” even less with them in 2020). Invoice denial is a strategy employed by brokers/forwarders to ensure profitability and year over year profits. Not everyone associated with the broker/forwarder understands how it impacts their profits, but the person setting the global vision sure understands the importance of denying payment for services rendered. It impacts their bottom line and thus any bonuses they receive.

Clients are constantly adjusting their business practices to ensure profit margin consistency and growth. Lien Holders have a slew of options and can literally, and easily, pass inflation and other business costs directly to their consumer base or downstream to the field service company and/or forwarder.

Brokers/Forwarders have fewer options than the lien holder. They can and very often do offset costs by passing them downstream to the field service company. This, on top of stagnant rates, is a double blow to the field service company. Examples may be the 3-day update demand in their portal (passed directly to their client satisfying their SLA (Service Level Agreement) promise and avoiding annual service penalties). Separating releases into individual pages and requiring single uploads is another labor saving pass-through for the broker/forwarder as well as the lien holder, with the cost for that paperwork handling shouldered by the field service company.

Dipping into other profitable revenue streams is another way forwarders increase profits and offset inflation. For example, brokering the key service – demanding their vendors take lower rates so they have room to take a cut off the top. Also, charging vendors for paying their invoices in a reasonable amount of time or denying invoices for any reason they can find is yet another popular technique.

SLA reviews also provide an opportunity for forwarders to re-negotiate their prices with the lien holders.

To counter these strategies, field service companies can: Plan A – increase revenue. Mix up your client base and/or increase ancillary billing. Plan B – cut costs! Service, equipment down grades, or maybe even hold off purchasing safety equipment. Options are so limited; companies are forced into survival mode.

The point is, the mature repossession company has zero tools to adjust against inflation with the extinction of ancillary pricing to the customer and is mostly reliant on their clients to make responsible business decisions where revenue streams are concerned. As forwarders get more involved in brokering transportation and locksmith services this noose tightens. Again, the forwarder’s first look at your invoice is to find an opportunity to deny it.

So, who loses?

Society loses when any mature company closes its doors. A reliable, stable, community job provider is gone. Jobs and revenues are lost locally. Employees and their families lose as the former employees are now looking for a job.

Consumers (debtors) suffer as the new company, in its infancy, is more likely to have issues around damage and/or service. The new company may even be working through the same problem employees the mature company had identified and weeded out of the industry, exposing the debtor to risk that was previously eliminated. (Is this Part of The Manufactured Crisis? Article Coming Soon!)

Insurance Companies have additional exposure as the newer company is still learning. New Kid Repo company owners and managers are new and untested. They have not developed strategies and policies around training and oversight. Conversely, Old Faithful company may start skimping where they should not or may be overly assertive in order to stave off falling profit margins and non-contingent fees (another liability bomb for lien holders and brokers/forwarders where attorneys have yet to really pick at the low hanging fruit).

Lien Holders themselves lose as their chances of finding a mature company to work with directly is severely limited. New companies are thought to present too much liability and cause too many issues and risk. Knowing how stagnant rates impact mature companies, this risk may not look so bad now.

Don’t get me wrong, I don’t have an issue with the brokers/forwarders. I believe the broker/forwarder has outsmarted regulators, the lien holders and the field service companies in strategy. They have become the standard without any real knowledge and the protector without either knowledge or liability.

If this industry wishes to remain largely self-regulated, these companies must start acting more responsibly. Crippling their vendors with profit stealing polices and “stop gap compliance” is only going to lead to governmental regulation though laws and lawsuits.

Lien Holders who keep rates stagnant with their field service companies while passing inflation and operating costs to their consumers are doing the exact same thing.

Failing to pass inflation offsets downstream will force your vendors to make operational adjustments. When the vendor’s tools to offset inflation and other costs are so locked down by the client’s “stop gap compliance” then the responsibility of these operating adjustments can be directly linked to the client’s decisions.

The more the client controls the billables, the easier the causation link may become.

Will these issues cause insurance companies to evaluate company contracts for unacceptable risk like they do driving histories for company drivers? Could this lead to policy increases for contracting with lower paying clients?

When will attorney’s start making the causation leaps between the individual repossession company and the broker/forwarder for accidents and other lawsuits?

Will a regulatory agency solution be to create a regulation or seek passage of a law that limits a broker from keeping more than “X%” of any fees charged to a consumer? Maybe it will be to ensure that consumers are not billed when lien holders choose to outsource the administration of their repossession assignments. This would be similar to what lien holders do when they outsource debt collection. Will the CFPB or other regulatory agency insist on fee transparency and itemization to ensure UDAAP’s (Unfair Deceptive Abusive Acts and/or Practices) are not being hidden under general line items.

I suspect some of these concerns and ideas have just not been thought about yet, but when the “cat” is finally out of the bag and people start discussing these concerns, maybe, just maybe the next generation of field service repossession companies will have a better chance of surviving.

The lienholders, consumers and society benefit from the protections an experienced repossession company provides. Regrettably, these experienced repossession companies are being driven out of business, consumers are being put at risk, and an entire industry is impacted by irresponsible decisions made upstream of the field service repossession company’s influence. It is also undeniable that some companies not only profit from this cycle, but benefit from The Manufactured Crisis (coming soon) itself.

Wes Carico

Nostalgic Towing & Sales, LLC