The Bad News and the Other Bad News That Could Be Good News for the Repo Industry

Experian just released their State of the Automotive Finance Market report for Q2 2021. Delinquency in auto loans continues to hold at record lows. Some of Experian’s data trends may explain some of the reasons. For the repossession industry, the long drought of recovery volume continues, but via bad news, there may good news on the horizon.

Confused? Welcome to the party.

First the Bad News

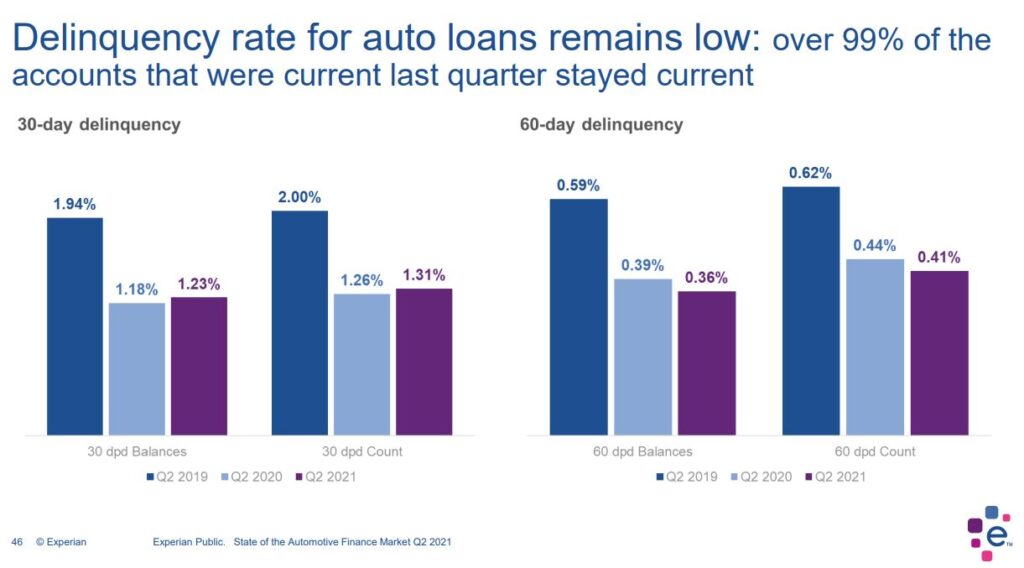

Starting with delinquency, Experian’s report shows that 99% of all auto loans that were current last quarter, remained current. Not really surprising, but when compared to the same quarter last year, 30-day delinquency actually rose, but only 5 basis points from 1.26% in 2020 to 1.31% in unit count. Unfortunately, at the same time, 60-day delinquency decreased 3 basis points from 0.44% to 0.41%.

Keep in mind, during Q2 2020, record numbers of borrowers were protected by deferments. As the result the Q2 2020 numbers were dramatically lower than 2019 at every tranche in delinquency. Cut to 2021 and most of these deferments are over, so where’s the delinquency?

That is a question whose answer has many variables, but it all starts at loan originations. Depending upon FICO band score (A-E), the average loan portfolio default traditionally occurs within the first 18 months. Defaults tend to fall after this period and the lower the score tranche, the longer this term spreads.

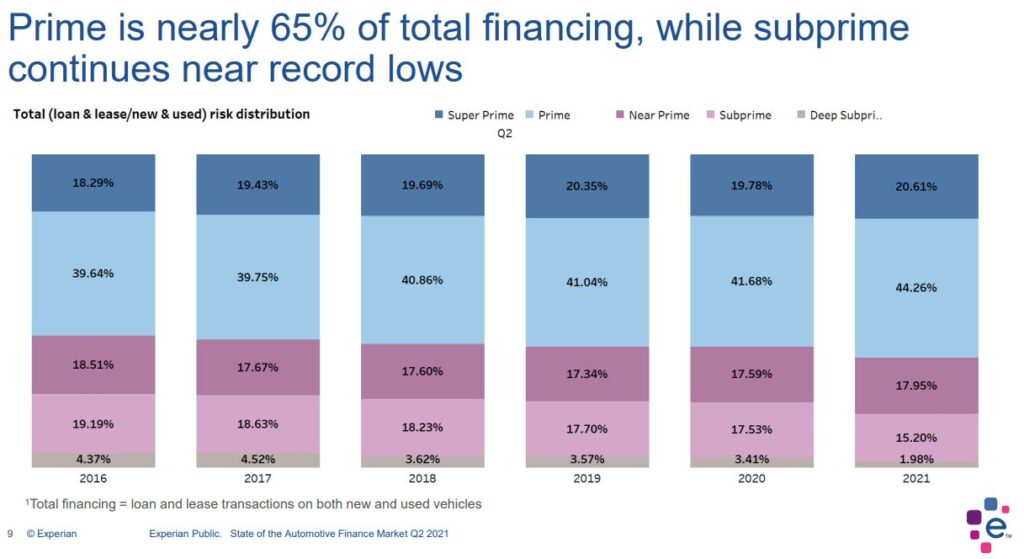

Experian’s data shows that the average FICO score increased 3 points on new car purchases and 10 points on used. That’s your first clue.

Likewise, the show that Prime scores were 65% of all new loans granted, about 5% higher than the previous two years. As a consequence, Subprime loan and lease originations were a five-year low of 15.2% and Deep Subprime almost non-existent at 1.98%. The second clue.

While risk aversion may be driving some of this lower loan originations in Subprime, I would argue that reduced incomes have priced much of the Subprime population out of the market simply through higher Payment to Income Ratios (PTI) and Debt to Income (DTI) Ratios. Extended unemployment benefits may be artificially holding down some delinquency, but I wouldn’t hold too much stock in expecting this to lift soon and even if it did, the impact probably wouldn’t be too meaningful.

See the Full Experian Presentation Here!

Now the Good News Via Bad News

This new normal is really astounding considering all that the economy and populace have gone through over the last year. While none of this is good news to the repossession industry, there is a wild card sitting out there that could send everything off the rails. Inflation.

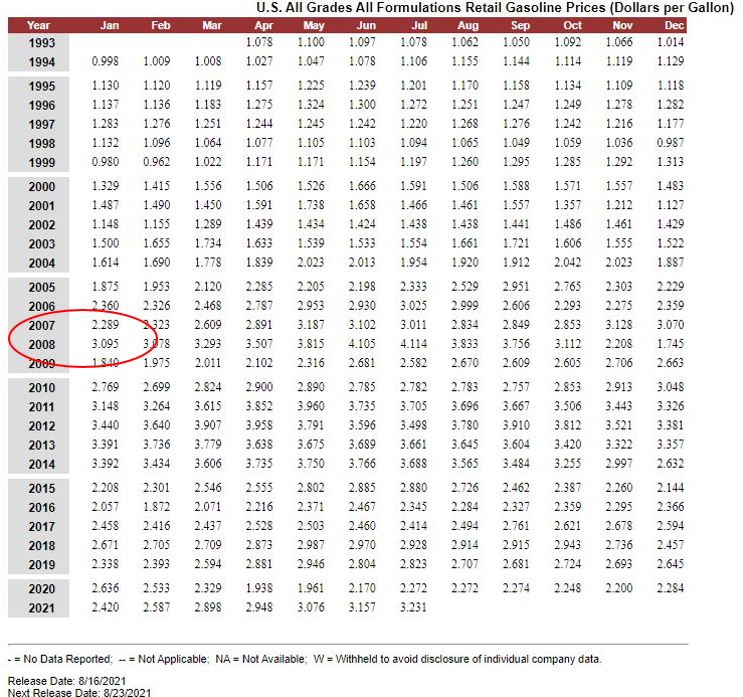

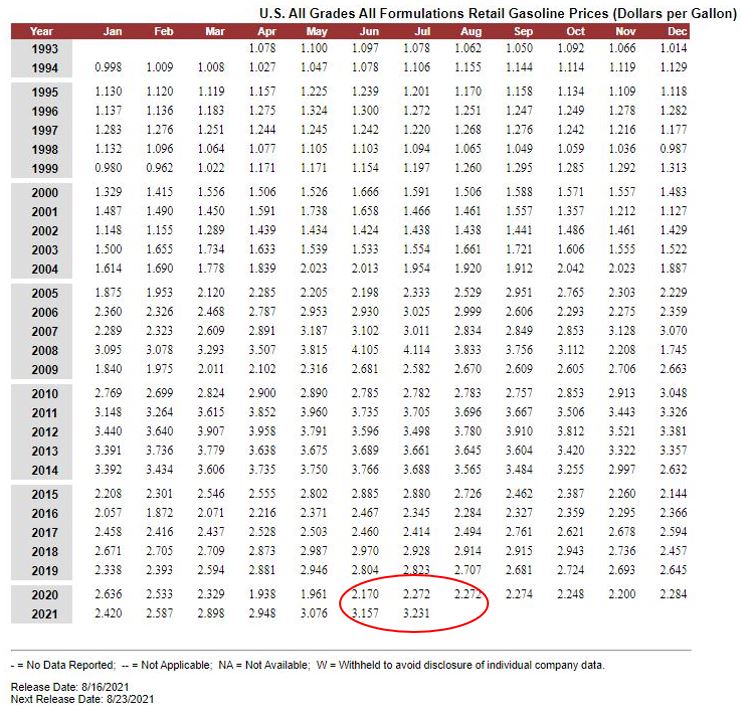

Gas prices were a factor that created inflation and a wave of layoffs that triggered the housing meltdown in 2008. According to the US Energy Information Administration (EIA), in January 2008, the average price of fuel, all grades, was $3.095. This was an .80 cent increase over the same time in 2007, a 35% increase.

Cut to 8/13/21 data and we have a national gas price average of $3.231 per gallon. At the same time in 2020, it was $2.272. That’s a $0.96 cent per gallon increase, 42% higher. Keep in mind, people weren’t driving much at this time last year, but if you look back to January, when our fine outstanding President took over, gas was on average $2.42 a gallon. Over this seven months it has risen $.81 cents a gallon.

On August 11th, Reuters reported that President Biden had shown concern of this inflationary trigger and had requested OPEC increase oil production. This, of course, is all the while he is killing oil production here in the US. Predictably, OPEC and others rejected his plea. As the result, you can expect that gas prices will continue to rise.

Although we are in completely uncharted economic waters, this very well may trigger inflation and with it, tighter wallets and higher unemployment.

Provided the government doesn’t intervene with more radical handout programs, delinquency may not be far behind. Will they institute more repossession moratoriums or pass more legislation intended to hamper repossession activity? Well, that is a whole different conversation.

Conclusion

Good news for the repossession industry? Yes and no. Rising gas prices obviously create economic instability which could increase repossession volume. But this also hurts the repo industries operating expenses. In a lender driven, low fee and no ancillary fee environment, this is unsustainable.

If or when this does occur, it is imperative that agents refuse work from lenders or forwarders who will not accommodate substantial increases in fees to address this, as well as all of the other expenses for technology and compliance that have been sucking the industry dry for years. Agencies have been closing all over the country and this could push more under if not dealt with directly and with a united resolve.

Don’t expect the lenders to wake up one morning and give a damn. They will only care when no one will pick up the cars. That is your only leverage and it is long past time it was used on a large scale.

Just Say No!

Kevin Armstrong

Facebook Comments