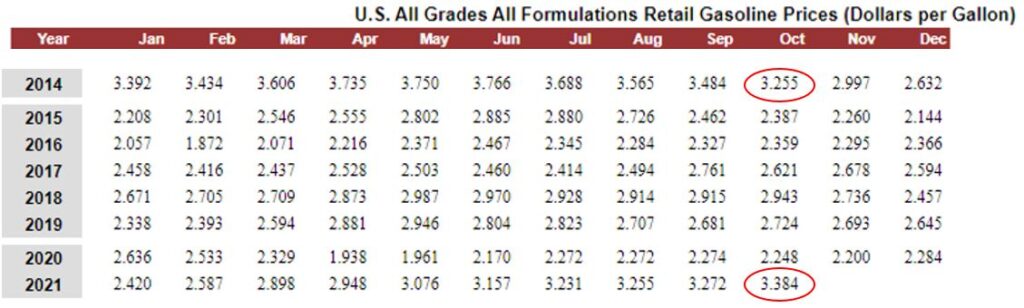

Average price per gallon now $3.38, tenth straight monthly rise

Get ready for some financial misery. Gas prices are up again with no end in sight. There is nothing short term or “transitory” about it, inflation is heating up and the pain at the pumps is about to trickle down into very aspect of the public’s lives. With yet another rise in national auto loan delinquency and another dip in consumer confidence, it’s getting pretty hard to doubt that a severe recession is coming and with it some old school repossession volume.

I’ve been playing “Chicken Little” for a few months now and unfortunately, my warnings are beginning to bear fruit. September of 2014 was the last time gas prices were this high, but then, they were on their way down from an April 2012 high of $3.95. With California averages hovering over $4.50 a gallon and rising, this appears as though things are about to get even uglier, especially since the White House’s only answer to this seems to be “buy electric cars and use public transit”.

S&P Dow Jones Indices and Experian released data through September 2021 for the S&P/Experian Consumer Credit Default Indices held amazingly steady for September in overall delinquency, but auto defaults creeped up one basis point to 0.35%. It’ll be interesting to see Experian’s end of 3rd Quarter state of auto lending presentation to see if the 30-day tranche of delinquency is showing any signs of significant growth

It was seven years ago the last time gas prices were this high. At that time, they were slowly coming down from a high of $3.95 a gallon from three years earlier. Now, according to the US Energy Information Administration, it has risen for a tenth straight month with no end in sight. This coupled with the supply chain issues will likely be like gas on the fire (no pun intended) to inflation.

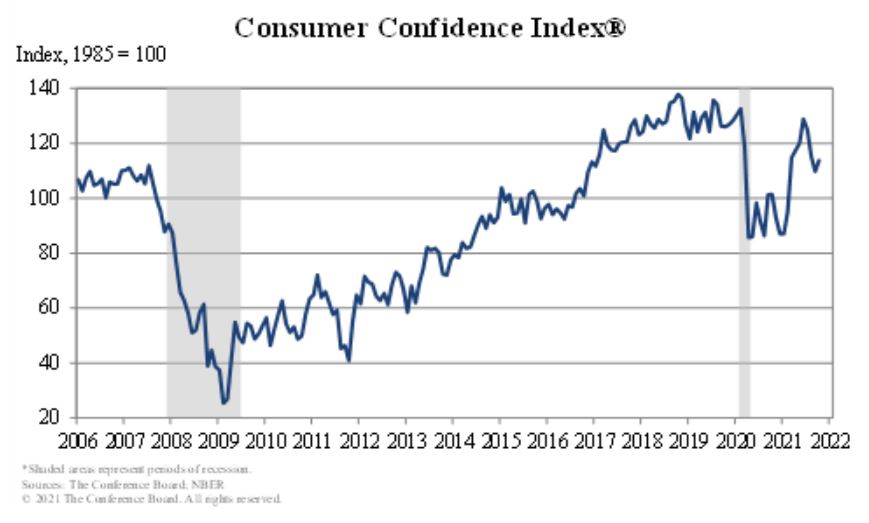

Regardless of the rise in fuel prices, inflation and supply chain drama, the Conference Board’s monthly survey showed mixed results. The Conference Board is a member driven non-profit that conducts national surveys on consumer confidence.

According to their September Consumer appraisal of current business conditions;

- 18.6% of polled consumers said that business conditions are “good,” which is down from 19.3% in September and 20.2% in August. In July it was 24.6%

- 24.9% of consumers reported that business conditions are “bad,” which is only slightly down from 25.3% in September and 24.1% in August. In July it was 20%

Regarding consumers’ perceptions of short-term business conditions, they show some slight improvement since last month.

- 24.3% of inquired consumers expect that business conditions will improve, which is up from 21.7% in September, 23.1% in August and in July, 30.9%.

- However, 21.1% now expect that business conditions will worsen, which is up from 17.6% last month, 17.4% in August and 11.9% in July.

The Conference Board Consumer Confidence Index® now stands at 113.8, which is up from last month’s 109.3, but still down from 125.1 in July. These numbers represent the lowest levels in Consumer Confidence since last February and should this trend continue, it could spell for real trouble come Christmas time. Consumer confidence is used as a canary in a coal mine for indicators of future consumer spending, which, if people are saddled with rising inflation, will spend less.

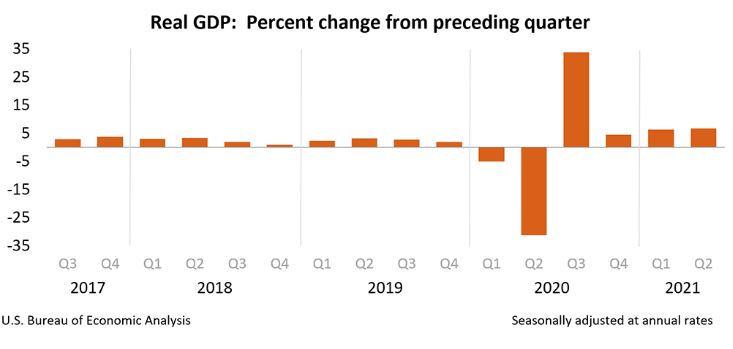

So, is a recession coming? That may be harder to tell than it used to be.

According to Investopedia; “A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region. It had been typically recognized as two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators such as a rise in unemployment. However, the National Bureau of Economic Research (NBER), which officially declares recessions, says the two consecutive quarters of decline in real GDP are not how it is defined anymore. The NBER defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

So far, according to the Bureau of Economic Analysis, who have yet to release the Q3 data, the GDP has actually continued to improve. Then again, that was during Q2. Rising gas prices and food prices are bound to suck the discretionary income from millions as long as they continue to rise. Time will tell as it’s next data release is tomorrow, October 28, 2021 at 8:30 A.M. EDT.

While the cooling GDP, delinquency numbers and consumer sentiment aren’t playing out yet, it is kind of difficult to believe that a serious dumpster fire isn’t smoldering already.

No one wants to see economic harm to the economy and the American public. But some repossession volume would at least help pay for all of that fuel that agencies are burning while they chase around contingent assignments with twelve bad addresses and stagnant fees. If not, it could be the death of yet more repossession agencies.

Stay safe!

Kevin

Pain at the pumps and a recession looming in the horizon