If rising fuel prices and declining consumer confidence are any indication for what is to come for the American economy, then it isn’t pretty. Gas prices are continuing to climb and consumer confidence is at its lowest level since last February and during the start of the pandemic. The last time consumer confidence was this low was 2017. With enhanced unemployment benefits coming to an end this month, are we heading for a delinquency tsunami?

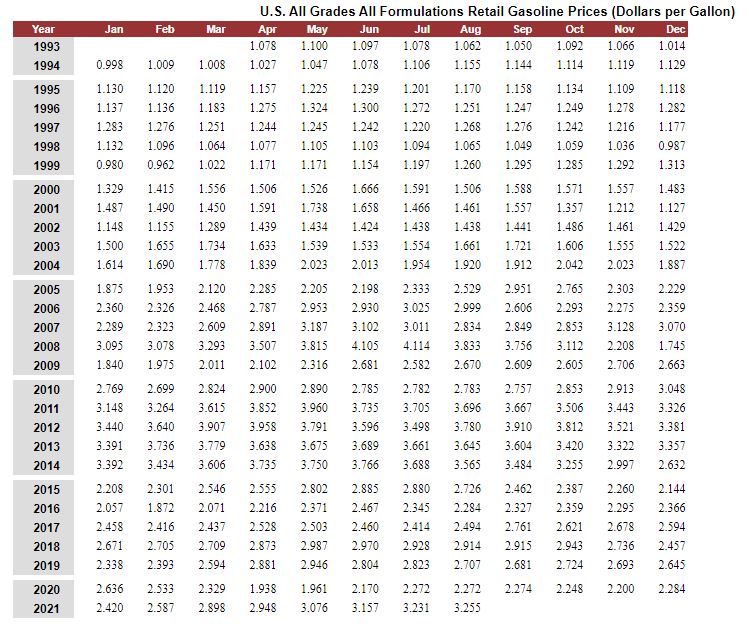

On September 1st, the US Energy Information Administration released their month end August average national gasoline price data. In their U.S. All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon) data, the average price per gallon rose to $3.255. The last time it was this high was October of 2014.

On president Biden’s request, OPEC and the oil producing nations, such as Russia, are increasing their exports into the US, but that was before Hurricane Ida and its effects on Gulf oil production are still unknown. As is, the Hurricane affected states and regions are experiencing gas shortages and there is little reason to believe any relief at the pumps is in sight.

According to the Conference Board, a member driven non-profit that conducts national surveys on consumer confidence, the American public is far from enthusiastic about the directions the economy is heading. According to their survey data on “business conditions”;

Consumers’ appraisal of current business conditions declined in August.

- 19.9% of polled consumers said that business conditions are “good,” which is down from 24.6%.

- 24.0% of consumers reported that business conditions are “bad,” which is up from 20.0%.

Regarding consumers’ perceptions of short-term business conditions, they as well have deteriorated in August.

- 22.9% of inquired consumers expect that business conditions will improve, which is down from 30.9%.

- 17.8% expect now expect that business conditions will worsen, which is up from 11.9%.

The Conference Board Consumer Confidence Index® now stands at 113.8, which is down from 125.1 in July. These numbers represent the lowest levels in Consumer Confidence since last February.

The next foot to fall on the economy is on September 14th when the Bureau of Labor Statistics releases the newest update to the Consumer Price Index (CPI). In august, they reported the CPI at 0.5%, more than twice the Fed’s budget forecast of 0.2%.

With rising fuel prices, we will all doubtlessly see pain in the pumps that will flow through into our wallets. These negative economic trends could very well be the harbinger of rising delinquency in the months to come. While none of this has shown in the recent credit reporting trends, delinquency tends to trail events by anywhere from 60 to 90 days depending upon economic tranche and loan product.

While no one wishes such misfortune on the American populace, for the volume starved repossession industry, it could provide some additional assignments. This is of little help as gas prices rise and lenders continue to insist on paying peanuts for recoveries with no additional fees allowed. And of course there is always the threat of more repossession moratoriums at either the state or federal levels.

For staff strapped collections departments, they could soon find themselves in need of help. With years of low delinquency and little time to train new staff, good luck getting on top of it when it does come.

Of course, this is all theoretical, but the numbers above are real and do have consequences. After all that we’ve been through over the past 18 months, it is indeed a sad state of affairs that the worst may very well be ahead.

Kevin Armstrong

Fuel Prices and Consumer Confidence Point to Economic Trouble Ahead – Fuel Prices and Consumer Confidence Point to Economic Trouble Ahead – Fuel Prices and Consumer Confidence Point to Economic Trouble Ahead

More Stories

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo

National Dealer Association Responds to Senate Repossession Probe

AFSA – Setting the Repossession Records Straight

Borrower Gets Two Life Sentences for Shooting Repossessor

Gunfire During Texas Repo Caught on Video