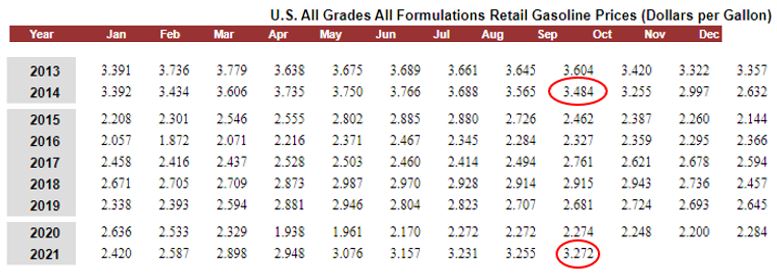

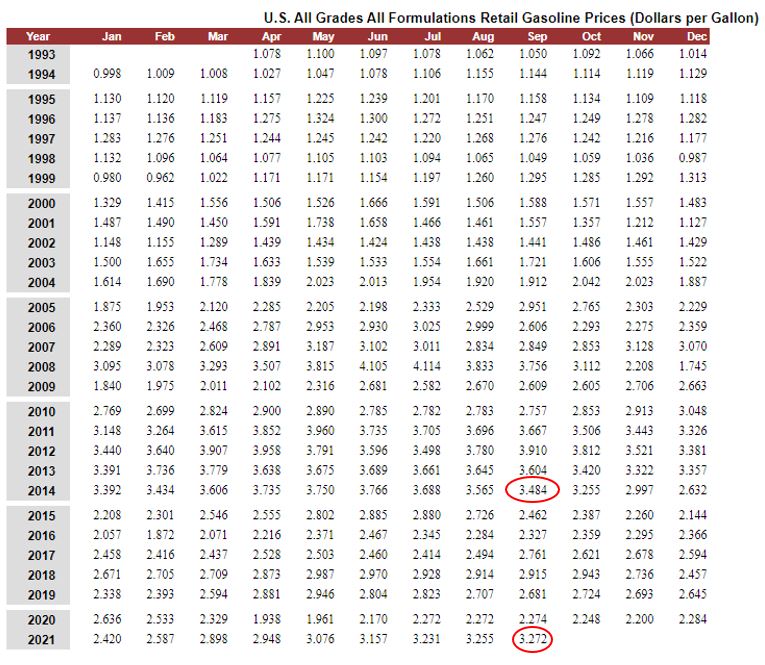

Average price per gallon now $3.27, ninth straight monthly rise

I said it at the beginning of the month, and since it’s slipping again, I’ll say it again. If rising fuel prices and declining consumer confidence are any indication for what is to come for the American economy, then it isn’t pretty. The last time gas prices were this high was September 2014 and the last time consumer confidence, now down to 109.3 (down from 115.2 in August) was last February. While nationally August auto delinquency rates only rose 3 basis points to a still low 0.34% last month, signs of increasing economic strain continue their crawl toward a probable rise in delinquency and increases in repossession volume.

Seven years ago, the last time gas prices were this high, gas prices were slowly coming down from a high of $3.95 a gallon from three years earlier. Now, according to the US Energy Information Administration, it has risen for a ninth month straight. The coincidence in in high gas prices during a Joe Biden presence in the White House is hard not to notice as in a matter of nine months, we’ve gone from 100% energy independence to begging OPEC and Russia for oil.

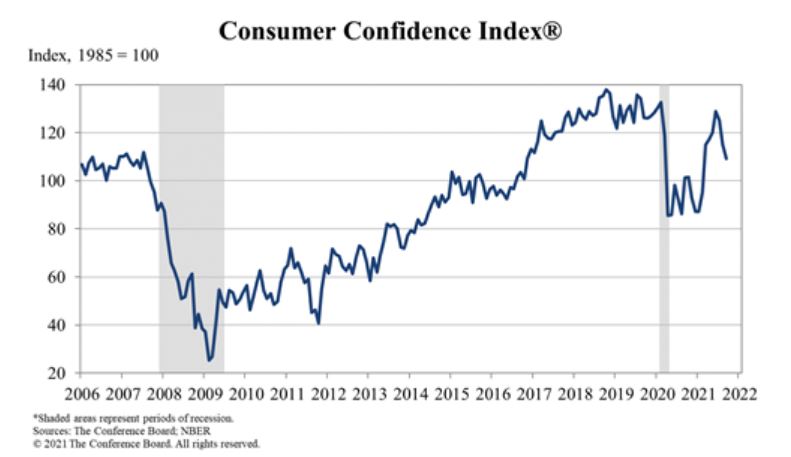

This has not been lost on the consumer whose confidence has again slipped to a seven-month low. According to the Conference Board, a member driven non-profit that conducts national surveys on consumer confidence, the American public’s concern about the direction the economy is heading continues to sour.

According to their Consumer appraisal of current business conditions;

- 19.3% of polled consumers said that business conditions are “good,” which is down from 20.2%. In July it was 24.6%

- 25.0% of consumers reported that business conditions are “bad,” which is up from 24.1%. In July it was 20%

Regarding consumers’ perceptions of short-term business conditions, they as well have deteriorated since August.

- 21.5% of inquired consumers expect that business conditions will improve, which is down from 23.1% In July it was 30.9%.

- 17.6% now expect that business conditions will worsen, which is up from 17.4%. In July it was 11.9%

The Conference Board Consumer Confidence Index® now stands at 109.3, which is down from 125.1 in July. These numbers represent the lowest levels in Consumer Confidence since last February and should this trend continue, it could spell for real trouble come Christmas time. Consumer confidence is used as a canary in a coal mine for indicators of future consumer spending, which, if people are saddled with rising inflation, will spend less.

It was just last week that S&P Dow Jones Indices and Experian released their August 2021 Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate was actually one basis point lower at 0.39%. However, auto loan delinquency indices were the outlier showing up at 0.34%, a mere three basis point increase.

But some are still optimistic about future economic growth. According to yesterday’s news from Reuters, economic activity has cooled in recent months as the boost from pandemic relief money faded and infections flared up, driven by the highly contagious Delta variant of the coronavirus. Labor and raw material shortages have also chipped away at growth.

“But given that wave seems to be cresting, there’s hope confidence just hit its nadir,” said Robert Frick, corporate economist at Navy Federal Credit Union in Vienna, Virginia. “Assuming predictions of Delta dropping hold true, this setback may be a three-month trough during the recovery rally.”

Also sitting on the horizon is the political bickering in Washington over extending the federal government’s borrowing capabilities are also casting a cloud. Treasury Secretary Janet Yellen told lawmakers on Tuesday that the government could run out of cash by October 18th unless the U.S. Congress raises the debt limit, which is being opposed by the GOP as the Dem’s try to push through their massive $3.5T social spending bill.

Treasury Secretary Yellen warned that a debt default would be a “disastrous” event that would trigger a “financial crisis and calamity.” read more

There are so many variables in play at this moment in time that almost anything is possible. But assuming that the debt ceiling is raised and the gas prices continue to rise and consumer confidence further dips, the economy is probably headed for trouble anyhow.

Remembering that delinquency rates tends to trail economic strain by as little as 30 days and as much as 120 on average, it is possible that that “blip” was the first crack in this long and unprecedented delinquency drought. With early signs of rising delinquency and inflation, can a return to normal delinquency and repossession volumes be far behind?

That is really difficult to say. Don’t forget who is in congress and the White House and neve forget the draconian anti-repossession bills presented in congress over the last year and half. Even if delinquency should erupt, it’s hard not to imagine our zealous congressional leaders allowing their constituents suffering the natural consequences of a sudden economic calamity.

Having been given lenders a hall pass to offer all of the loan modifications that they wanted during the pandemic, without regulators hindering them, lenders could very well go back into that trick bag to stave off the inevitable.

Perhaps a slow crawl in delinquency would be better for the repossession industry than a tsunami that catches everyones attention and the headlines. Sudden actions cause sudden reactions and we’ve all seen how that goes over the last eighteen months. Personally, I suspect it is still a little early, but the stars are lining up for some serious delinquency by the end of the fourth quarter.

No one wishes for a financial collapse. However, after years of record low delinquency, repossession moratoriums, massive loan forbearances to hold back loan defaults and an unprecedented ten-year absence of a normal stabilizing recession (typically 5-7 years apart), a return to stable delinquency rates would be very welcome to most in the collections, repossession and remarketing world.

Of course, rising gas prices are no good for anyone, but with stagnant repossession fees and slow repossession volume, it is especially hard to work on a contingent basis.

Grab your popcorn. The next few months could be interesting.

Kevin

More Stories

Tragedy Strikes Benchmark Recovery Family – Help Needed!

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo

National Dealer Association Responds to Senate Repossession Probe

AFSA – Setting the Repossession Records Straight