GUEST EDITORIAL

~ “They are always a little smarter when they get back” – My old partner said to me when we worked criminal investigations. He was talking about one of our local thieves who had just returned from prison and this time refused to have a conversation without his attorney. ~

Should consumers pay for services in which their lien holder or broker administering the account for the lien holder determines the services provided by the field service company were “non-compliant” resulting in a “invoice denial”?

Stated differently, should companies be allowed to keep the consumers money when they determine a service was insufficient and refuse to pay the invoice?

~What if failing to pass those credits back to the consumer would have prevented a deficiency balance on the consumer account and avoided late charges and legal fees? ~

Why should it matter? Could companies who offer financial services to consumers use this tactic to boost profits without it being noticed? How?

~ “When you have eliminated the impossible, whatever remains, however improbable, must be the truth” – Sir Arthur Conan Doyle, stated by the character Sherlock Holmes ~

First, we must ask the question “why?” Because to discover the true intent of any one individual or company will not necessarily shed any light onto the motivations of another. The possibilities of why should cause enough concern for industry correction if the true intent to protect the consumer from harm actually exists. The real potential for lenders and forwarders (brokers of repossession assignments) to bill consumers for services for which they never intend to compensate the repossession company for is alive and well, and may be already be harming consumers – taking them for a ride to the tune of millions of dollars a year.

Every single owner of a repossession company keeps an eye out for denied invoices. When we have paid expenses against a billable opportunity only to have it denied for one reason or another, that denial removes revenue directly from profits and causes harm to the financial health of our companies. It is my experience that the chances of an invoice being “denied” are much greater when it comes to working with a broker/forwarder than it is when working directly with the lender (as it relates to this topic there we will not distinguish between denied and unpaid, as both are equally harmful to the company and consumer).

The recent trend in setting strict invoicing standards has got me asking why? Pondering, I recalled sitting around with one of our vendor managers who works for one of the largest broker/forwarders out there. This broker has one of the most aggressive invoice denial rates as compared to the rest in our portfolio. I have mentioned this broker in a previous article “Intentional Destruction or Ignorance – Who Profits When a Mature Field Service Repossession Company Folds.” 1

During the conversation, this vendor manager began discussing “SLAs” (Service Level Agreements) they had with a specific lien holder. This vendor manager was using the SLA to explain the importance of “compliance” around reporting all repossessions within 24 hours (the legal reasons were not discussed, only the contracted promises which become known as “compliance.” Check Box Compliance is an article for another time) The manager also explained that within their SLA’s there are “Pay Back” should the broker/forwarder fail to meet a certain level of “compliance” at the time of review.

The broker writes the lien holder a check when they fail to meet specific promises set in the SLA.

So, let’s “TEE” this up.

Let’s say “I Got Money Financial” has a service level agreement (SLA) with “Mother Broker” and Mother Broker hires “Old Faithful” to provide repossession services. Mother Broker is competing with all kinds of other broker/forwarders as well as field service repossession service companies for I Got Money Financials’ work so Mother Broker is incentivized to drive prices well below market rates.

Mother Broker is also pressured to compete with other demands in the SLA. Regardless of what they are or why they are there, Mother Broker must adopt expectations that are equal to or tighter than other broker/forwarders I Got Money Financial contracts with. All of this is just fine with I Got Money Financial.

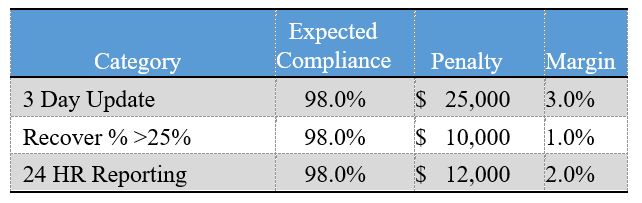

Mother Broker’s SLA Expectation and Penalty table may look a little something like this. You have the expectation, the penalty in dollars, and the margin or points until the next penalty.

So, Mother Broker now has the same goals as their competition: Figure out how to work with the lowest possible rates, increase profits year over year, not impact salaries and/or bonuses of their employees, especially executives. Mother Broker may even have shareholders to impress as well.

As the year rolls along, I Got Money Financial places hundreds of accounts out for repossession. They are assertive with their efforts pushing out accounts at 35 to 40 days past due.

Mother Broker oversees the administration of these accounts and sends I Got Money Financial a bill. Mother Broker pays the invoice and this relationship is great.

Mother Broker is reviewing their “Vendor Compliance” and notices that their recovery percentage with I Got Money Financial is not tracking all that great; their 24 HR Reporting is at 98.3% so they will do ok there, and their 3 day update is 94.7%. At a 22% Recovery Rate, this means that Mother Broker is on pace to “Pay Back” I Got Money Financial $55,000 dollars during review.

Mother Broker works hard and gets the 3 Day Update in line at 95.2% and writes a check to I Got Money Financial to the tune of $30,000. I Got Money Financial receives similar checks from several of their vendors during these compliance reviews.

When all is said and done the I Got Money Financial has cleared an additional $50,000 off of their repossession efforts. This literally means they are keeping 50K after paying the auctions, subtracting deficiencies, etc. Now, I Got Money Financial has their sights on going after the consumers for the deficiencies.

Not a single cent was refunded to the consumer or posted as a credit to the consumer account. I Got Money Financial just made revenues for services they are charging the consumer for. Get paid by the consumer, do not pay the invoice, or get a “SLA Penalty” check and it is a double win on the books.

Here is how it worked. The expense for the repossession was billed against the consumer account and fees for this service was deducted from the sale proceeds when the vehicle was sold. I Got Money Financial knows that the SLA will produce “X”% in returns at the end of the year (or at least they rely on it doing so). In essence, this means that I Got Money Financial knows they will not pay “X%” of the amount charged to consumers for the billed repossession.

If I Got Money Financial uses harsh invoice denial tactics, it could be said they are charging consumers for 100% of a service they did not intend to pay (they did not pick a particular consumer, just set the stage so they know they can count on some invoices being denied or payments “washed” into revenues).

Now consumers are paying for services where the finance company knew they would be getting back “X%” of what they were charged or keeping “X%” of all billed invoices.

Does it sound a little like laundering or fraud if you consider consumers may end up with inflated deficiency balances or have the finance company keep positive equity based on this tactic.

This is just the repossession side, what about the transport side and auction side? How much do they “pay back” under penalties or loose in denied invoices?

Compliance Agencies, Lawyers, and Regulators are not seeing the potential for abuse because the consumer’s money is “washed” in such a way that there is no direct line to any one consumer account. It is pennies to dollars against all consumer accounts.

You upcharge the cost of the repossession a little to the consumer here, the auction fee a little there, transport fee, key fee and whatever else you can think of and all of the sudden you are billing services to the customer that generate a positive return from the repossession itself.

If the lender is not providing the physical service or at least administrating that service should they be allowed to “upcharge” the service when allocating cost to the consumer? Forced Placed Insurance sound familiar? Exact same concept just spread to a greater number of consumers at lower rates and “washed” a little so as not to be noticed.

Of course, all this could entice I Got Money Financial to be a bit more careless with lending practices as well as a bit overly assertive with their repossession practices. After all, they can make a profit on repossession activities.

When regulators, lawyers, and compliance agencies are looking at these companies, they need to look at what happens in the wash and what are the paybacks on the other side. Should this money not be going back to the consumer since it is the consumer who was ultimately “harmed” when a deficiency takes place in the service?

It is the consumer we are working for at the end of the day as it is their vehicle.

In other words, if you bill a consumer for the account going into “repossession status” and the company that handles the repossession work order fails to meet the update requirements, isn’t it the consumer’s money that is paying for the service and therefore the consumer that’s being harmed by the lack of service?

When lenders and brokers/forwarders bill a consumer for a service and then deny payment to the entity who worked the account – this money becomes revenue (actually a profit because the subcontract invoice is unpaid but the consumer pays for the service).

~These profits are created at the expense of the consumer and if left unchecked can result in the math working in such a way that the harm to the consumer is lucrative. ~

I suspect regulators could change the way this works by mandating that anytime a service payment is denied to the company providing the “actual field service” for the consumer (distinguishing between the broker and field service company is important to prevent the billback profits), the money for this denied service be returned to the consumer or state treasury in the event the company is unable to locate the consumer. In this way, the state can make the consumer whole.

When it comes to SLA billbacks, I suspect it may work much the same way to ensure that companies do not use these methods to increase profits by repossessing a consumer’s collateral. It would be credited to the impacted consumer. Just the cost burden of managing this piece would cause finance companies to abandon the practice altogether.

I wonder just how much money has been charged to the consumer only to be washed in this manner? I do not suspect there is anything illegal with the practice, but does that mean there is no harm in it or does it meant that someone has not asked the right questions about how it works?

What would a class action lawsuit look like with a company that sets up their SLA’s this way? How do these lenders show this on their books anyway? Do they credit it back to consumer accounts which were impacted, or do they just put it in a receivable’s column?

As I said before, all I pondered was the question as to why some brokers/forwarders make invoice denial such a priority? Having the broker/forwarder in the middle to do the actual denial to the field service repossession company would only help muddy the waters and make it harder to prove the intent behind such a practice. When the broker/forwarder catches on or is forced to adopt the same practices because the services we provide are undervalued in the marketplace, the entire practice becomes “normalized” making it even harder to spot.

Everyone is likely to have their own opinion, but it really boils down to whether consumers should be charged for services associated with debt collection that the lien holder will not pay for or will get partially reimbursed for?

Personally, I do not think a consumer should ever be charged for a deficient service so do not get me started about self-checkouts!

Wes Carico,

Nostalgic Towing & Sales, LLC

Facebook Comments