Only trained and insured professionals should be allowed to repossess, especially in a licensed state.

Doral, FL – January 9, 2026 – I’ve been preaching this for years but still it persists. Car dealers should not be allowed to repossess vehicles. Here’s just another example of why not.

It was almost one whole year ago when an unnamed borrower watched his Range Rover getting towed away from his home at three in the morning. Back in June of 2024, he had purchased it from a local dealer, Dynamic One, LLC and put down $80,000 and was paying $2,850 a month for it and it was current.

Confused, he called the police who told him it was repossessed. But according to the borrower, under the terms of the dealer agreement, the SUV couldn’t be repossessed unless it was down four payments.

But the dealer told him that he had a lapse of insurance which was the cause for repossession. A lapse he disputed and later provided police proof.

According to the borrower, the dealership never let him know where his vehicle was or how to reinstate or redeem it.

Fast forward to August of 2025 and the man filed a stolen vehicle report with the police who conducted an investigation. On January 9th of 2026, Jorge Gonzalez Ferrer, 39, and Juvenal Medina Castillo, 41, with Dynamic One LLC. Turned themselves in.

Both men were arrested on charges of organized scheme to defraud, grand theft and obtaining goods with an invalid vehicle title. They are being held in the Turner Guilford Knight Correctional Center on $16,000 bonds as of Thursday morning. But as Venezuelan nationals they also face immigration holds.

EDITOR’S NOTE: There seems to be a lot of information missing from this story, but it appears as though the dealership was a “But Here Pay Here” (BHPH) dealer. The loan terms are pretty questionable, after all, when was the last time you saw an auto loan contract stating that they couldn’t repossess a vehicle unless it was four months delinquent?

Of course, these men are innocent until proven guilty but based on the charge of obtaining goods with an invalid vehicle title, I would guess that they never perfected title on it in the first place. Either way, it is just another dealer repo gone wrong.

Only trained and insured professionals should be allowed to repossess, especially in a licensed state. This loophole for amateur hour has resulted in many deaths through the years and really needs to be closed.

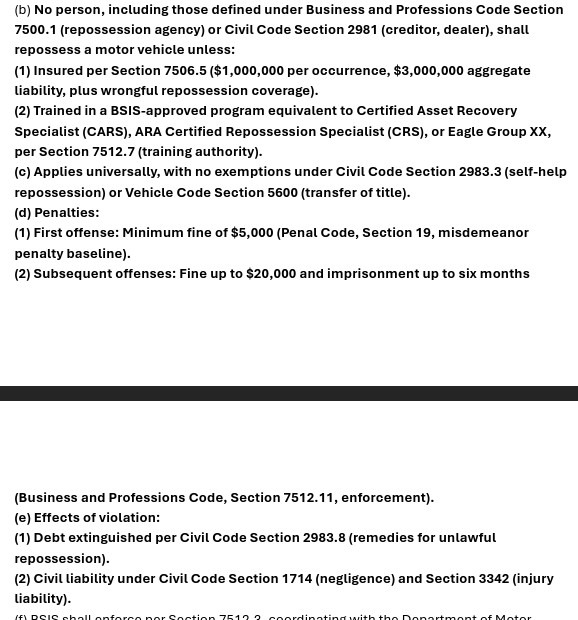

I have created proposed legislation to do just that and have provided it to many state association leaders, but no one seems to even want to consider it.

More Stories

Repo Agent Wrestles Shotgun from Borrower

Breaking the Routine – Finding the Sweet Spot in Weekend Recoveries

Repo Rampage in Rural Texas

ARA Served Letter of Inquiry by Senator Warren

Arrest Made for Attempted Murder of Repossession Agent

Detroit Repo Shooter Sentenced