A couple of weeks ago we provided some data that estimated a total of 1.88 million vehicles were repossessed in the United States last year. So, which states had the highest volume of that? There are a lot of moving parts in that, but as you will see, they make total sense.

As I’ve said before, trying to get firm repossession statistics is like trying to nail Jello to a wall. There is no one data source available that can capture all of the variances in repossession activity. Fortunately, provided with other reasonable data points, we were able to make some reasonable conclusions on the repossession volume for 2024.

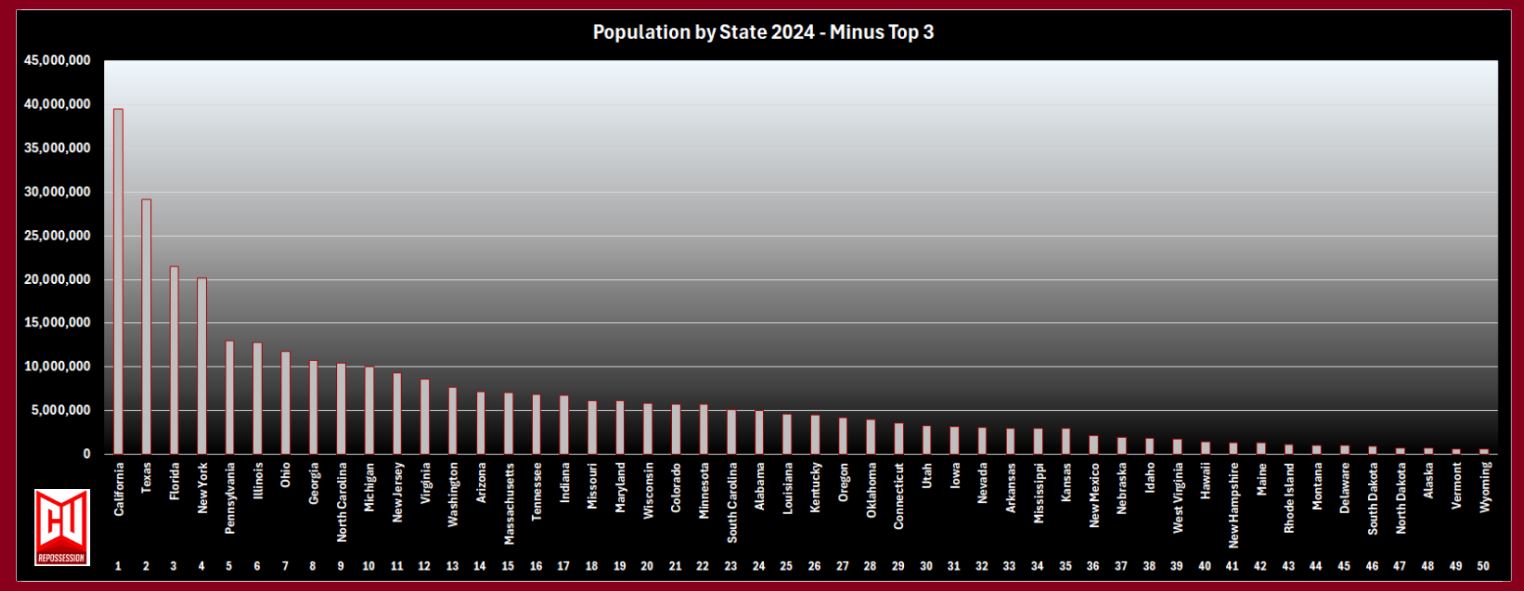

Now, the question is, where were all of these done? This is an equally challenging question due to the massive variances in population, credit quality and actual numbers of vehicles in operation per state.

Assumptions

- Obvious research suggests that the states with the highest volume would be the states with the largest populations. Using that assumption, California would have likely had the highest number of vehicle repossessions in 2024, followed by Texas and Florida, due to their large vehicle registrations and higher delinquency rates.

- It would also seem obvious that states like Vermont and North Dakota would have the lowest counts, given their smaller registered vehicle counts and lower delinquency rates.

- With an assumed 1.88 million repossessions nationwide, we then must lean into other data sources to build some reasonable estimates of the actual numbers by state. Many of these numbers from 2024 are not yet available but are reasonably stable enough for analytical purposes of estimate.

Data Sources

- Repossessions: We maintain the assumed estimated 1.88 million repossessions for 2024.

- 90+ DPD: With a 23.14% auto loan proportion to 2021 90+ days past due (DPD) rates, and scaled to 1.88 million total repossessions.

- Average FICO Scores: Sourced from Experian and FICO data for 2024, reflecting state averages as of Q3 2024 where available, otherwise approximated from trends.

- Registered Vehicles: From 2022 Federal Highway Administration’s Highway (FHWA) data, as 2024 data isn’t fully available yet. The total for 2022 was 283,400,986 vehicles.

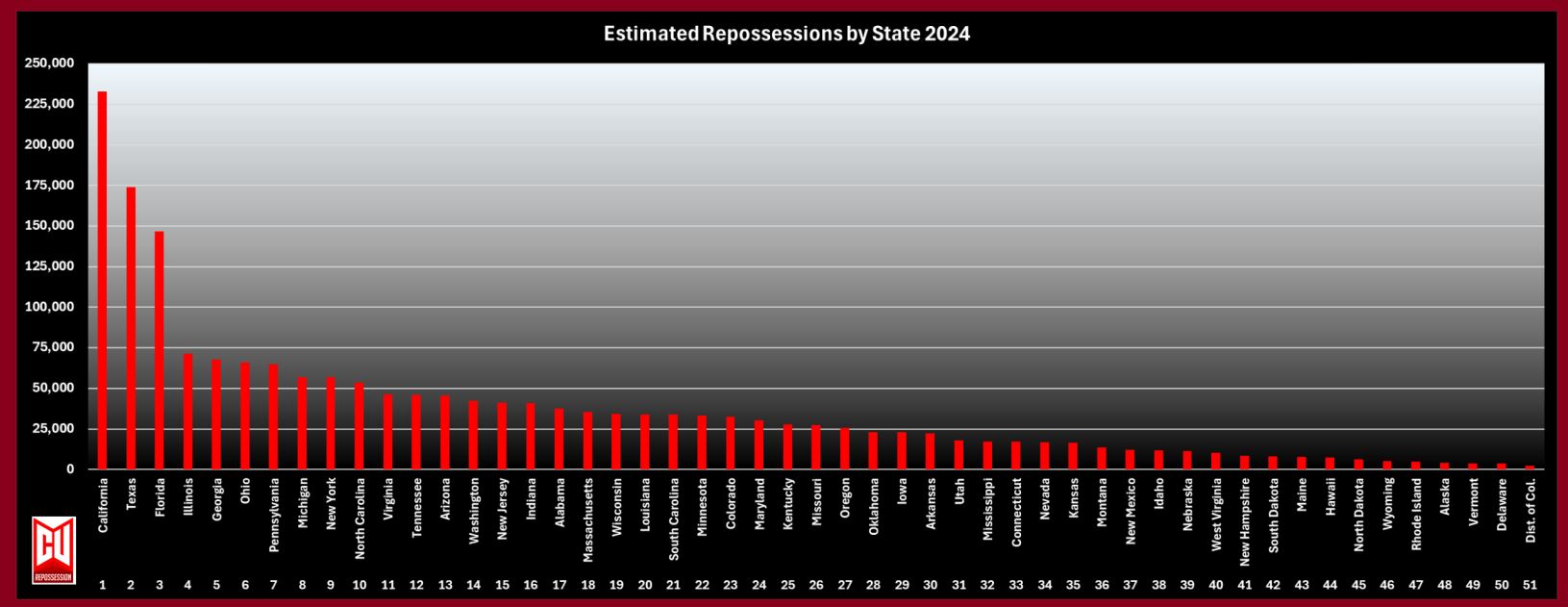

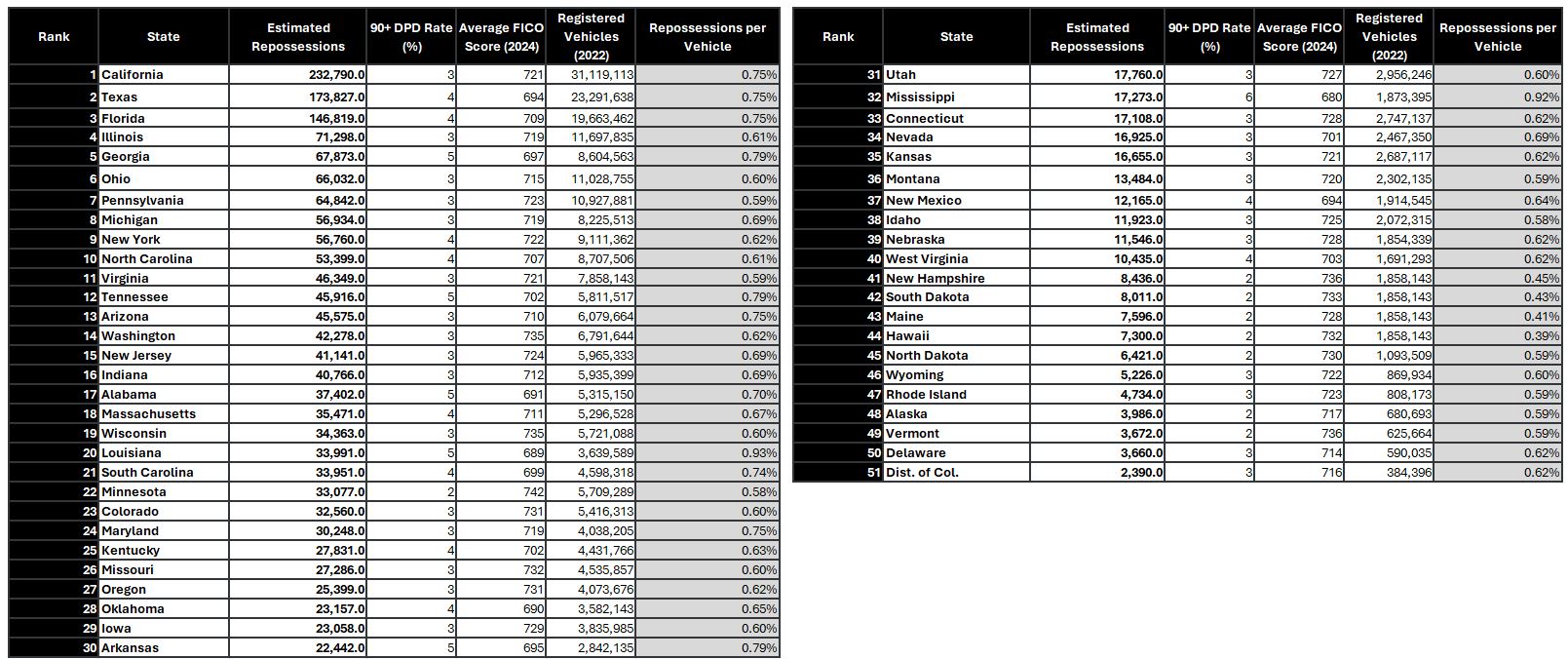

Estimated Repossessions by State

Based on the analysis, and assuming a total of 1.88 million repossessions for 2024, here are the highest ranked states for repossession volume:

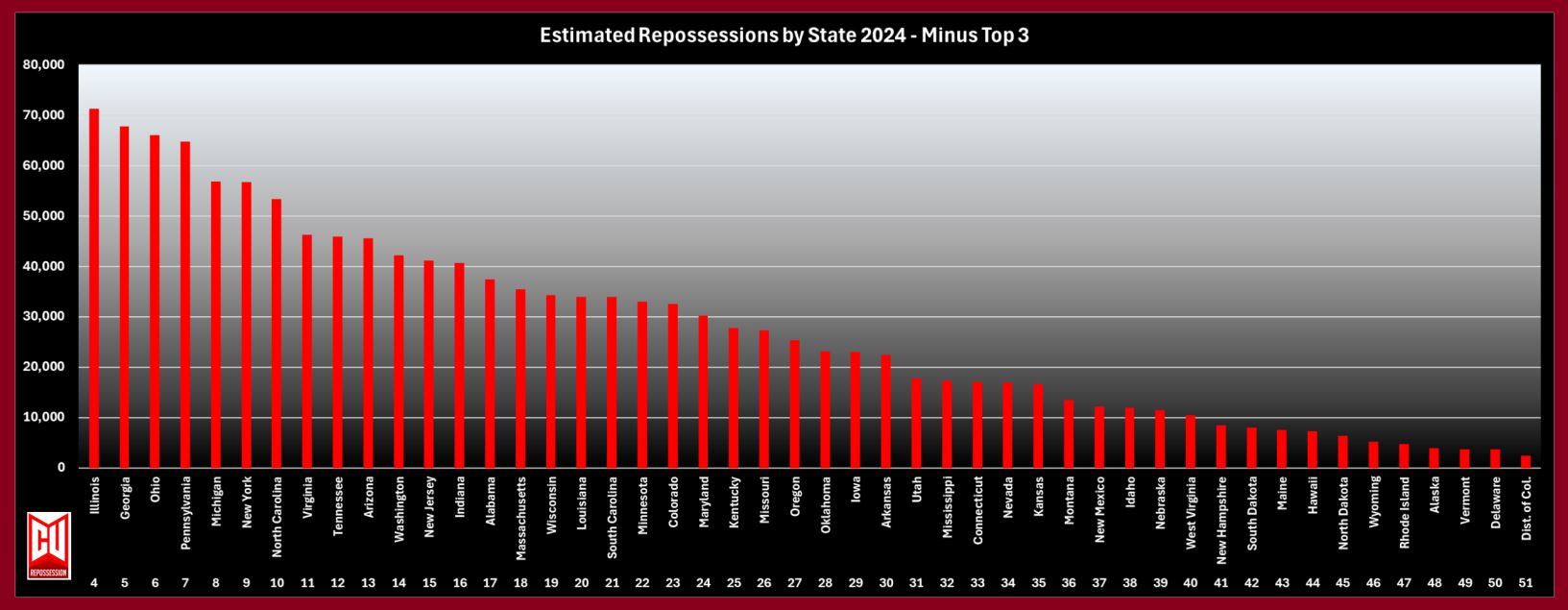

No Big surprises here when you look at the chart of populations by state. Until you get into the small and mid-sized states, the volume follows pretty much the same order.

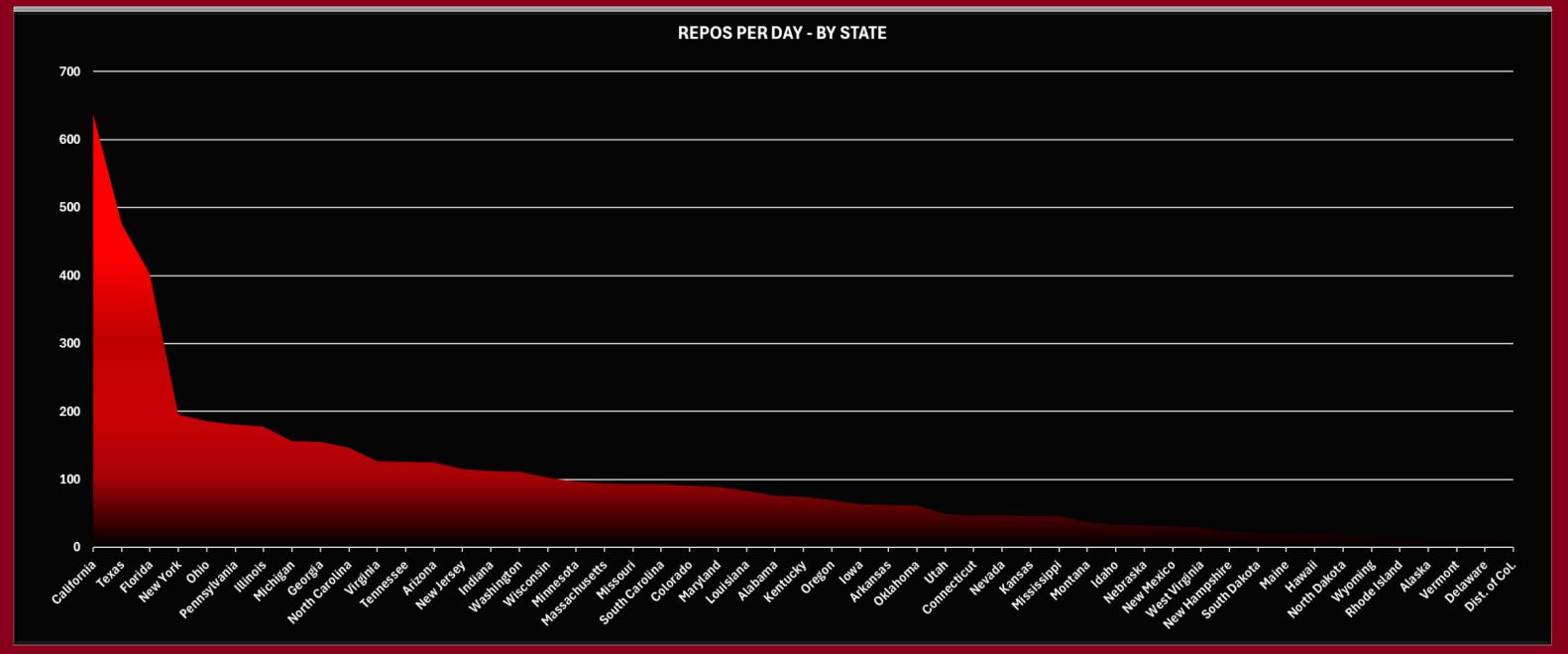

Here’s what this looks like on a per day, per day basis like done on the previous report.

Conclusions

I’m sure the top five didn’t surprise anyone. But when you examine the variances between a state like California or Texas, where an average of 23 cars are repossessed a day and compare them to some of the smaller states, like Hawaii 0.8 and Rhode Island 0.5 and you can get a feel for the scale of activity.

What this doesn’t tell us is how many are done per day per agency. That is an even greasier pole to climb, but one I’m working on and will have that to you before too long.

As I always caveat, there is no one perfect method to gather this data. It is only with leaning into known data and cross applying it that we can create some consistent methods of measurement. It’s not perfect, but it is a start.

To be open and up front, I do use AI modeling to develop this data. It vastly improves production times and I do provide the methods and links to data sources below.

Kevin Armstrong

Publisher

Related:

2024 Repossession Volume – 17 Years of Crisis and Comeback

Methodology Recap

- Repossessions: Calculated as (Registered Vehicles * 0.2314 * 90+ DPD Rate / 100), then scaled to 1.88M total.

- 90+ DPD Rate (%): From Experian Q3 2021, representing percentage of auto loans 90+ days past due.

- FICO Scores: Approximated from 2024 data (Experian/FICO).

- Registered Vehicles: 2022 FHWA data.

- Repossessions per Vehicle: Estimated Repossessions / Registered Vehicles.

Observations

- High DPD, High Ratio: Mississippi (6.2% DPD, 0.004075 ratio) and Louisiana (5.0% DPD, 0.004138 ratio) show high delinquency and repossession rates per vehicle, aligning with lower FICO scores (680, 689).

- Low DPD, Low Ratio: Vermont (1.5% DPD, 0.003671 ratio) and Hawaii (2.1% DPD, 0.002457 ratio) have lower delinquency and repossession rates, supported by higher FICO scores (736, 732).

- Discrepancy: California’s high repossession count (143,614) but moderate ratio (0.004616) reflects its massive vehicle population, while its 3.3% DPD is average.

Data Limitations

- 2021 DPD rates may not perfectly reflect 2024 conditions, though scaling adjusts totals.

- FICO scores are estimates for some states, potentially affecting correlation analysis.

- Ratios may underrepresent risk in states with lower loan penetration.

Key Citations

- Table MV-1 – Highway Statistics 2022

- D.C., Southern States See Highest Rate of Late Auto Payments – Experian

- Average Auto Loan Debt Grew 5.2% to $23,792 in 2023 – Experian

- Car Repossessions Surge 23% as Americans Fall Behind on Payments – Bloomberg

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control