Pocketing Santander/Chrysler Capital Increases

EDITORIAL

I don’t go looking for this stuff, it falls in my lap. I just wrote about this problem the other week and now another one comes to light. This time it’s Location Services pocketing the fee increases from Santander/Chrysler Capital for most of the month before then announcing their reduced increase. But of course, they’re not alone.

Kudos

Hats off to Santander/Chrysler Capital for paying $150 for preapproving and paying flatbed and dolly fees of $150. It is definitely encouraging to see major lenders come to understand the expenses involved in the recovery process. This goes a long way to ensure that the agents working their accounts do so diligently, efficiently and safely.

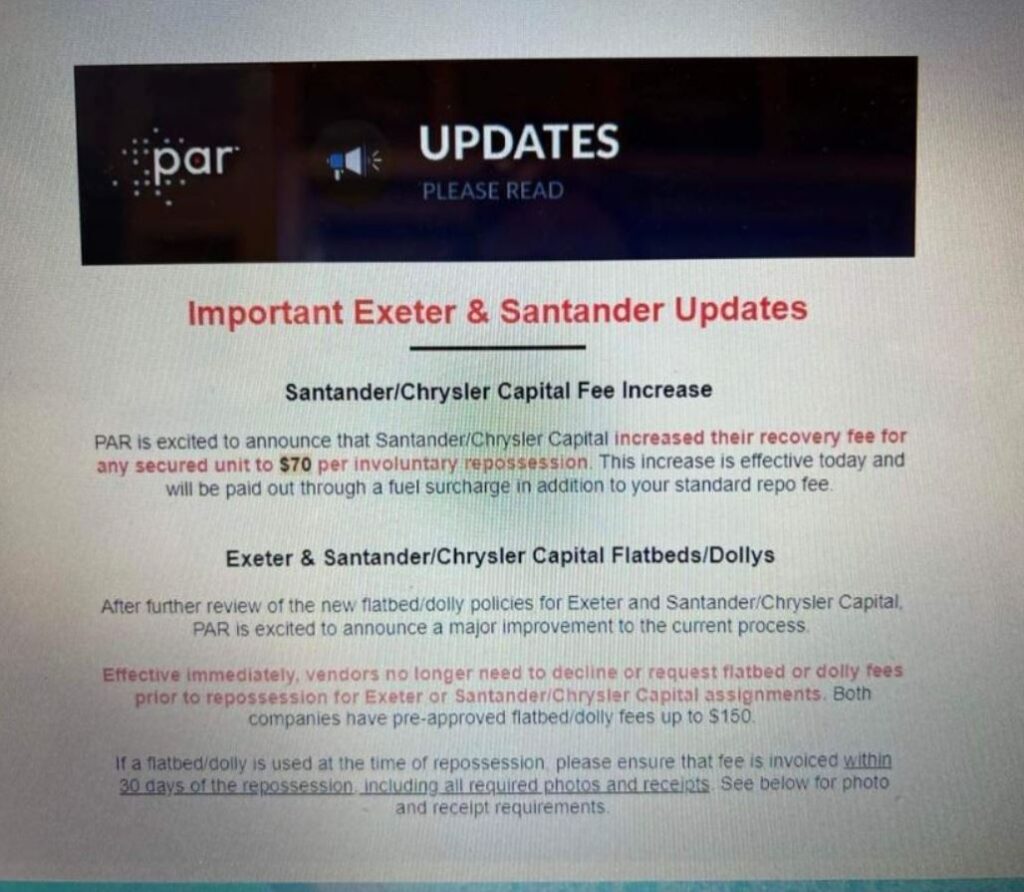

Kudos to PAR. At the beginning of the month, they announced the increase of Santander/Chrysler Capital involuntary repossession fees of $70 in addition to fuel surcharge fee, reportedly $30. Their announcement shows no closed end to this promotion, although it was already announced by Santander/Chrysler as December 31st.

I’ve even heard that PK Willis (ARS) is paying the full fee. In light of my recent writings, this is a pleasant improvement for which they should be commended as well.

Shame

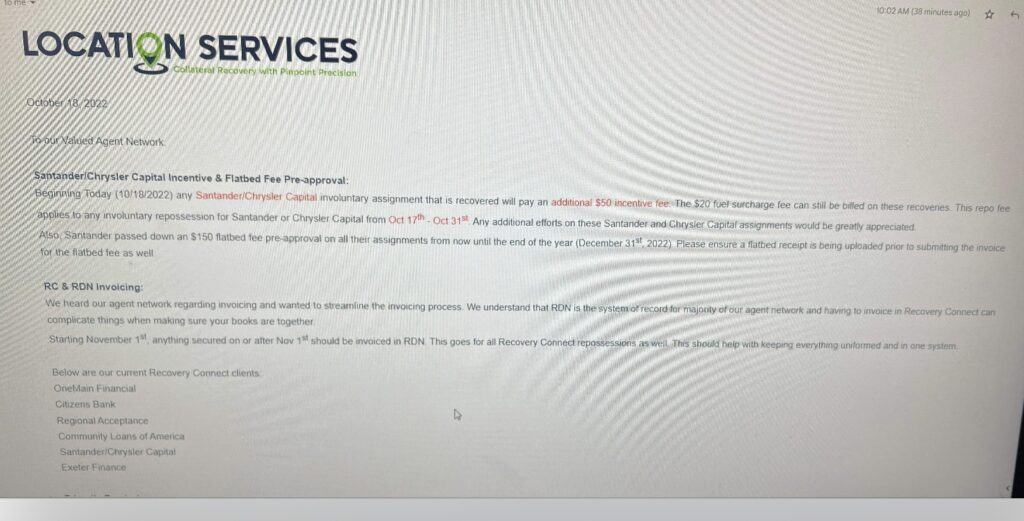

On the other hand, Location Services made no such announcement until October 18th and effective the 17th. Adding insult to injury, the $70 was cut back to $50 and the fuel surcharge down to $20. Perhaps I’m wrong, but is Location Services pocketing the additional $70 on each recovery up to this date and $20 until the end of the month when they state the promotion ends? But of course, we all know it doesn’t end at the end of October. Why, because Santander/Chrysler Capital already shared it with everyone!

This is all a contradiction to their own client’s desire. Santander/Chrysler Capital announced this incentive as being in effect until the end of the year through an ARA announcement on this very sight less than two weeks ago and I’m pretty sure they know it.!

While they also are consistent in reporting the same $150 flatbed and dolly fees, their delay in announcing the promotion and subsequent diminished offering is very disappointing to their agent network who are very aware of this.

And while I mention Location Services, at least they offered something. I have been advised by extremely reliable sources that most of the other forwarders assigning Santander/Chrysler Capital work have yet to even announce this fee increase promotion or the flatbed dolly fee preapprovals for $150.

Transparency

So again, a major lender comes to recognize that in order to achieve improved assignment acceptance and recovery results they must pay accordingly. And still once again, the forwarding industry, for the most, gives the repossession industry the middle finger and pockets all or some of it.

It is clear that that the lending industry expects these fees to pass through to the repossession agency. It is just plain sad that the forwarding industry holds such low regard to the people doing the work in which they profit from that they attempt to obfuscate and filter the true fees and incentives offered by their clients. Something of a stab in the back to all involved.

As I’d mentioned before, there needs to be greater transparency in fees from lender to forwarder and from forwarder to agent. This is the only way to overcome the incredible mistrust that the forwarding industry has earned from the repossession industry over the last decade. This continued skimming from the agency network is causing reputational damage amongst the very people that they need to survive.

I honestly don’t go looking for this stuff. This is what the repossession industry is heated about.

Last week I’d made mention of there perhaps being some form of olive branches from the lenders being extended by their sharing openly their incentive programs. Well, it doesn’t appear as though the majority of the forwarding industry cares or is willing to change their ways.

Repossession volume will doubtlessly increase over the next year and with it, the opportunity for everyone to prosper. Denying the lender’s intentions and skimming from the agent networks will come to bite them when the volume is high enough to easily say no and their acceptance and recovery volume plummets. And with the post pandemic industry at least 20% smaller than before, that time may come quicker than they think.

Kevin

Related Articles:

Finding fee transparency through the forwarder wall

Santander Aids in Strengthening Industry Standards

Credit Acceptance Corporation – The next to step up

IMPORTANT revisions to CAC dolly and flatbed fees

ARA – Open Industry Storage Survey Results

An Open Letter to Exeter Finance

ARA meets with Primeritus over past due invoices

Facebook Comments