A lot has gone down over fees in the repossession industry in the past year. Demands for fuel surcharges and past due forwarder payments have illustrated a more united industry willing to fight for fair fees. This progress has not gone unnoticed by the lending community as a growing number are going around the forwarders and broadcasting to the repossession industry.

If you are a frequent CURepossession.com reader, you have doubtlessly noticed a recent surge in announcements by Vaughn Clemmons, ARA President. At the forefront of these announcements have been the full disclosure of additional dolly and flatbed fees that lenders are willing to pay. Fees that all too often forwarders will tell agencies the lenders are unwilling to pay.

Quite obviously, someone is not telling the truth.

Passthrough

As I’ve written about in recent months, many, if not most lenders have already accepted the reality that the cost of operations, mostly fuel, has required their additional payment of fuel surcharges. They have come to appreciate that in order to keep a healthy agent network engaged with servicing their assignments in a timely, diligent and professional manner, they need to pay more than the same paltry year 2000 $325 fee.

Unfortunately, at the same time, they keep going through the same forwarding companies. And all too often, some of these forwarding companies, and not all, do not see these as “passthrough fees” to the agencies as the lenders intended. And perhaps the lenders just aren’t clear enough with the forwarders on this.

We’ve already seen by example how California based forwarder ARS for one, is reportedly receiving fuel surcharge fees from Bank of America. But ask anyone working for ARS and they’ll tell you that ARS does not pay fuel surcharges. On the same hand, I have been informed that LPS does not either.

And while Santander has approved fee increases for flatbed/dolly fees with its agents, to date only two forwarders have relayed the Santander news to its agent network. One has given an increase and the other has not.

I’d recently had correspondence with a disgruntled employee of a major forwarder who’d provided me a recording of one of their company meetings. Being a private business meeting and recorded without authorization, I can not share it, but the companies CFO shared a little insight into their business model when she stated that their goal was to not pay over $450 for any recovery.

Pretty straight forward, but we all know the reality of what they bill the lender. Anything from $750 to $900 a repossession made up of $450 repo, $350 skip, $30 a day storage, dolly fees, keys, etc. In the meanwhile, the agency gets $325 to $375 for the recovery and they’re damned lucky get dolly or flatbed fees, let alone storage.

That is a lot of fee income going straight to the forwarder. A lot of fee income that the lenders either directly or indirectly expected to or intended to be paid to the agency to ensure good recovery ratios and professional and compliant service.

So, where’s the disconnect?

Transparency

If you haven’t noticed, until recent, there hasn’t been much in the form of wide scale public communication between the major lenders and the repossession industry over the years. These are conversations that have, with the exception of agencies doing direct work for the lenders, been conversations between the forwarders and the lenders.

And of course, the forwarders sit silent on this topic. They don’t want to paint themselves into a corner with public statements for fear they need to make adjustments to address their own internal income issues.

These forwarders have been entrusted to implement the lenders fee allowances to assure a more compliant and efficient recovery. But with recovery rates wallowing at 20-30% and agencies refusing to work their assignments through these forwarders, it appears as though their objectives are not being achieved.

At fault are forwarding companies who are often not transparent with their agent networks as to what the lenders will or will not pay. Why; because some of them view these as fee income for themselves.

This lack of transparency has created a slush fund for the middle men and fostered an environment of mistrust between the lenders and agent networks. A mistrust that has created reputational issues hindering the lender’s primary goal; recovery.

Of course, there has been great discourse from the agent networks over these practices. Discourse that appears to have gained the attention of the nation’s largest auto lenders.

Breaking Down the Wall

I’d recently had the opportunity to discuss the recent ARA broadcasts on dolly and flatbed fees with new ARA President Vaughn Clemmons. Him being new to the position, I was wondering what he was doing that was prompting lenders like Credit Acceptance Corporation and Exeter Finance to make such public statements with clear statements to the industry on what they will pay for repossession dolly and flatbed fees.

According to Vaughn; “I believe lenders are being prompted by a shift in the industry, largely due to the Industry Standards conversations led by the ARA this past year, a lot has to do with the lenders being willing to understand from the agent’s perspective. The ARA receives multiple calls each week from lenders willing to engage in the spirit of greater transparency.”

What surprised me, was that he claims to be doing nothing. They are coming to him. He even claims that he receives anywhere from 10-12 calls a day from lenders desiring to clear the air and create some transparency in their fee standards. While Vaughn sees this as progress, he acknowledges that it is only the start and that there are other areas of fee income that need addressing such as storage and personal property.

As tribal and fractured as the repossession industry can be, I believe we can all appreciate his efforts and I for one applaud both Vaughn and the lenders for helping to bridge these massive gaps in communication.

Knowledge Builds Trust

As mentioned earlier, lenders pay for a service. And if they’re not receiving that service as expected, they will look for it elsewhere. I can only assume that they are not getting what they want from the forwarders and are arming the repossession industry with one of the greatest weapons on the planet; knowledge.

Knowledge intended to be used to push back against the forwarders who claim that those same lenders won’t pay those fees or who misstate what will be paid in order to ignore those fees being intended to be “passthrough” fees and not shared by the forwarder.

That same knowledge helps rebuild a trust largely lost behind the wall of the forwarding model. That trust has always been the cornerstone of the lending process. It was not that long ago that lenders did their own recovery work and when they couldn’t get it themselves, they would call their agents from the field and standby during the recovery.

While those days are long gone, that trust can be rebuilt. But it can only be rebuilt through transparent communication surrounding fees. There is no reason that an honest and compliant forwarding company cannot coexist in full disclosure of fees with their lender clients and their agent network. If not, there should be no room for them.

All auto lenders function from advertising to funding to repossession under strict Federal and state requirements for disclosure such as TILA, the UCC and FDCPA just to name a few. Recovery agencies operate under the repossession laws of their states as well as the compliance mandates of their forwarders on behalf of the lenders. And since there are no similar regulations or regulatory bodies to supervise and guide them, is it too much to ask that the forwarding companies provide some transparency.

A Time to Pull Together

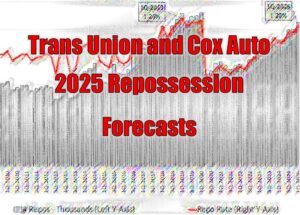

Delinquency is on the rise, no question about it. How bad will things get or how much repossession volume will come from it is yet to be seen. But before any of this comes to a boil, perhaps it’s time for the lending world and the repossession industry to reconnect and break down the wall of mistrust that’s been festering for all these years.

Yes, this is me, the “Just say NO” guy. And perhaps I’m getting soft in my old age, but perhaps there is a chance that compromise can be found and that everyone can learn to thrive and prosper under a cohesive and respectful environment of trust. And perhaps these olive branches of information can be the building blocks of just such a future.

It’s too early for such a thing, but wouldn’t it be nice if one day I was able to publish fee charts by lenders showing just what everyone pays and for what services? That’s what an honest lender/agent relationship would look like.

Kevin Armstrong

Publisher

Facebook Comments