EDITORIAL

Perhaps the people at Del Mar Recovery Solutions don’t think the repossession industry is smart enough to pass the USAA Complaint Training Certification test? Or perhaps they are just going through the regulatory motions required of them to maintain a client like USAA Bank? Otherwise, I can’t imagine why they would be providing the answers right at the bottom of the test.

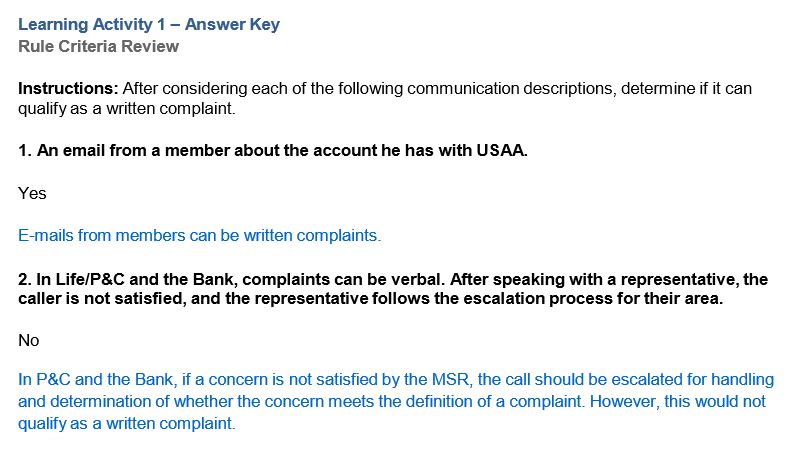

A reader signing up with Del Mar Recovery was going through the usual laborious process of filling out forms, drug testing and background checks for qualifying for USAA Bank repossession assignments, when they came across the USAA Complaint Training Certification course and test. After reading the study materials, our reader followed through and took the tests only to discover at the end of the test on page 13, all of the answers were there!

Our reader advised me, that they called Del Mar Recovery Solutions and spoke to a vendor relations person about this apparent error and was surprised when they said “that’s okay. Don’t worry about it.”

Based upon the story provided and the test itself, It’s pretty clear that Del Mar Recovery’s efforts to comply with USAA’s agency vetting process are rather tongue in cheek and in their defense, with the slow overhaul being done at the CFPB by acting Director Mulvaney, who knows if this process will be required by them before too long anyhow.

I can hardly blame Del Mar for allowing this to exist. They need as many repossession agencies signed on as they can get and don’t want to be going back and forth with agencies and their employees retaking tests. And while I’m pretty sure that USAA won’t be too happy about it being known to all, I doubt that prior to this being disclosed that anyone in the vendor management department was genuinely behind this process either.

Regardless of who and why, this is a good example of what happens when Regulators and political bureaucrats overburden the banking industry and force it down the food chain to the vendors. It becomes a disingenuous process that encourages ambivalence to the intent and creates just another “check here” box to move on to the next step.

While some regulatory relief could be coming from the new era of the CFPB, I find it unlikely that the regulators or banking industry themselves will let go of their enhanced interrogation vetting processes. It’s just not what they do.

Facebook Comments