Severe Auto Loan Delinquency the Worst Since 2006

“In March, 1.88% of auto loans were severely delinquent, the highest rate for March, dating back to at least 2006.” Cox Automotive

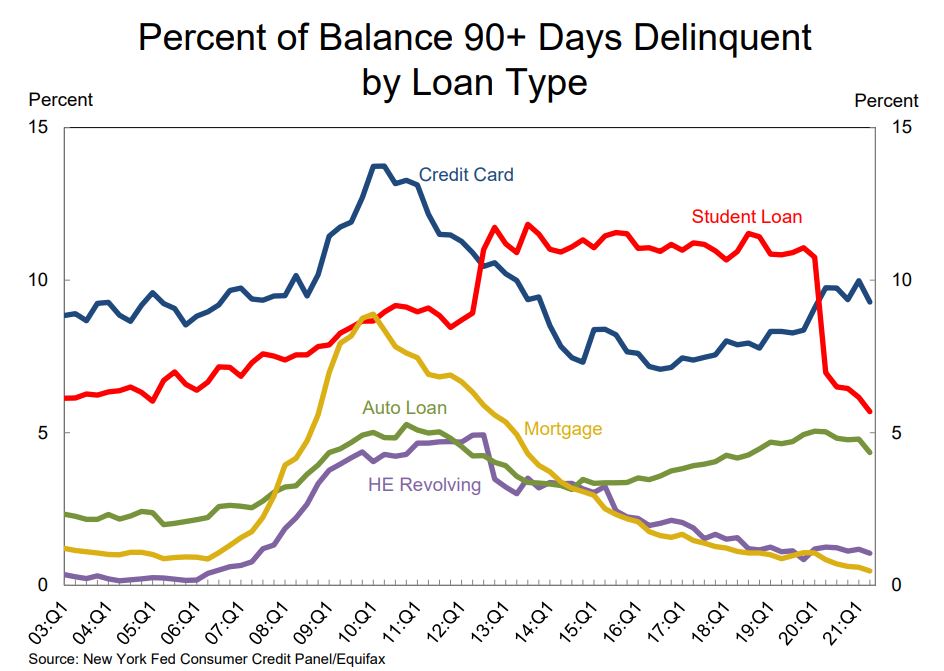

As the delinquency numbers for the 1st quarter of 2024 begin coming to light, red flags illustrating the severity of economic strain on consumers are becoming hard to deny. But when the numbers begin to resemble the onset of the Great Recession, there is serious reason for concern for the public and the repossession industry could find itself challenged to keep up.

For decades, delinquency has followed a somewhat predictable pattern. The fourth quarter showed the highest delinquency levels of the year, and the first quarter provided some relief until the second quarter when it would resume its climb.

Well, according to Jonathan Smoke, Cox Automotive’s Chief Economist and their economic and industry insights team, that predictable pattern did occur. But perhaps not enough to make anyone feel the rising levels of auto loan delinquency have cooled down.

Perhaps no statement in Smoke’s detailed Auto Market Weekly Summary is more cause for concern than his comparison of March 2024’s severe delinquency ratio being the highest rate for that month since 2006. This was the lead up to the Great Recession.

Below is the section of his weekly report related to auto loan delinquency.

Auto Market Weekly Summary

Monday April 15, 2024

Auto Loan Performance Mixed as Delinquencies Fell and Defaults Rose

Auto loan performance saw mixed trends in March, as delinquencies declined but defaults increased. 60-day+ delinquencies fell for the first time in eleven months but were up 8.5% year over year.

In March, 1.88% of auto loans were severely delinquent. That was down from 2.04% in February and was the highest rate for March, dating back to at least 2006. 7.25% of subprime loans were severely delinquent in March, down from 7.99% in February, but also at the highest rate for March dating back to at least 2006.

The subprime severe delinquency rate was 50 basis points higher year over year, while the aggregate was 13 BPs higher. The delinquency rate was high throughout 2023 but did not lead to a similarly record level of defaults. However, defaults increased in March by 8.5% from February and were up 33.4% year over year. Defaults of subprime auto loans increased by 13.9% and were up 28% year over year. The annualized default rate for March was 3.40%, which was 26 basis points higher than February and higher than the 2.90% annualized default rate in March 2019. The year-to-date default rate is 3.23%, which is equivalent to the default rate in 2010.

JONATHAN SMOKE

Chief Economist

Jonathan Smoke leads Cox Automotive’s economic and industry insights team, which tracks key metrics and trends impacting both the wholesale and retail markets for vehicles informed by the proprietary data from the company’s businesses and platforms. For 28 years, Smoke has focused on translating data and trends into relevant actionable insights for the industries that represent the biggest purchases that consumers make in their lifetimes: real estate and automotive. Smoke joined Cox Automotive in 2017.

Why This Matters

As mentioned, the first quarter tends to have the lowest levels of delinquency of the year. This tends to be the starting point for the rest of the year’s climb.

While Mr. Smoke does not quote the source of this data, both he and Cox Automotive are highly credible sources of data and information for the entire auto industry. I would not be at all surprised that we begin seeing similar headlines emerge over the next few weeks.

Interest rates are high, gas prices are on the rise again and inflation remains persistent and stubborn. The American public is dealing with economic headwinds most have never seen in their lives.

Considering that March’s auto delinquency resembles the beginning of the Great Recession, we very well may be in for some monumental levels of default over the rest of the year. While repossession volume is steady and strong, it is looking like this is just the beginning.

Kevin Armstrong

Publisher

More Stories

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo

National Dealer Association Responds to Senate Repossession Probe

AFSA – Setting the Repossession Records Straight

Borrower Gets Two Life Sentences for Shooting Repossessor