The post Time Running Out To Win a Dynamic Slide In Unit first appeared on CURepossession.

]]>

There are only a few days left until the drawing for the Dynamic Slide In Unit is done at the American Towman Baltimore Tow Show exposition! You don’t need to be present to win, but you do need to buy some tickets to get your chance and to support the Recovery Agents Benefit Fund! Go online any time until 3pm on Saturday the 23rd and buy your raffle tickets online to support the RABF!

RABF has been helping repossessors and their families since 2002 and 2024 is already in the top 3 years of having the most paid out since the beginning of the fund and the year isn’t over yet.

To date the RABF has helped over 135 families disbursing over three quarters of a million dollars in assistance to repossession industry families in need of our support.

Will you step up, take a chance to win a Dynamic Slide In Unit and support the Recovery Agents Benefit Fund?

Scan the QR code below or click this link to buy your tickets now!

All federal, state and/or local taxes, fees, and surcharges are the sole responsibility of the prize winner. Charity makes no representation or warranty concerning the appearance, safety or performance of any prize awarded.

About the Recovery Agents Benefit Fund

About the Recovery Agents Benefit Fund

To date the Recovery Agents Benefit Fund has RABF has helped over 135 families disbursing over three quarters of a million dollars assisted over 120 families with disbursements totaling over $677,000. This amazing accomplishment would not be possible without the support of the repossession industry.

Giving to and supporting the RABF can happen in many different ways and the Board of the RABF and our advisory committee sincerely thanks every person, company, and organization that finds it in their heart and business culture to help. Organizations like Recovery Specialist Insurance Group, Allied Finance Adjusters Conference Inc and American Recovery Association host events annually that provide the RABF opportunities to fundraise and for attendees to give back.

At these events there are often auction events or raffles where companies and individuals like DRN, Dynamic Towing & Equipment, Miller Industries, Martin Giles from Atlanta Wrecker Sales, Detroit Wrecker Sales, Midwest Auto Auctions, BB Towing & Recovery in Hawaii, and others, donate items for auction or raffle which are what drive the donations from these annual events.

Recovery Agents Benefit Fund

(A 501(c)(3) Charitable Organization)

PO Box 4102

Manassas, VA 20108

Tax ID: 26-4434353

Phone: 703 ● 365 ● 0409 Fax: 703 ● 365 ● 0753

Time Running Out to Win a Dynamic Slide In Unit – Time Running Out to Win a Dynamic Slide In Unit – Time Running Out to Win a Dynamic Slide In Unit

Time Running Out to Win a Dynamic Slide In Unit – RABF – Recovery Agents Benefit Fund – Recovery Specialist Insurance Group – RSIG – Repossess – Repossession – Repossession Agency – Repossessor

The post Time Running Out To Win a Dynamic Slide In Unit first appeared on CURepossession.

]]>The post Repo Taxes in Texas – A Risk to Lenders and Agencies Alike first appeared on CURepossession.

]]>Texas Comptroller on the Hunt

Taxes on repossession activity in Texas are nothing new. While over 500+ of the known 800+ agencies and collectors here are in some level of compliance, the Texas Comptrollers Office is on the hunt for Accredited Companies instead of companies that are not accredited or registered with the State. Those found to be out of compliance put their agencies at risk and can have their assets seized by the state. This includes the stored collateral of their lenders and forwarders!

The Texas Comptroller is targeting accredited repossession agents, agents that are registered and paying sales tax. Repossession agents are considered debt collectors in Texas, every service they offer outside of transport is Taxable.

The Texas Comptroller is targeting accredited repossession agents, agents that are registered and paying sales tax. Repossession agents are considered debt collectors in Texas, every service they offer outside of transport is Taxable.

Many of the TexasARP members have been called for a sales tax audit, an undue burden on the repossessor that is actually complying with state law by collecting and paying sales tax. Although a pass-through fee from the clients to the state we as agents are accountable for charging, collecting and then surrendering to the state every month.

What about the non-accredited repossessor in the State of Texas or repossessors in another state that are operating in Texas?

Sales tax on debtor collections is to be charged in the state of Texas even if you’re operating outside the state. If a repossession company is not registered with the state for Sales Tax, Franchise Tax, Client beware!!!

All of this may sound like it’s a problem for the agencies to deal with, but if a lender of forwarder is using an agency deemed to be out of compliance by the state, all of the agencies assets can be seized by the state. That includes every vehicle stored on that agencies lot.

Getting the state to release seized collateral could be time consuming, costly and cause numerous consumer litigation issues including possible FDCPA, UCC and UDAAP violations should the seizure inhibit or prohibit the vehicle’s redemption or reinstatement.

This is not a matter to take lightly.

What is Taxable in Texas?

To put it plainly, EVERY charge from a repossessor is taxable to the lender or forwarder, and considered part of the debt collection process. Taxable Services:

- Voluntary Repossession

- Involuntary Repossession

- Impound Repossession

- Bail-Out/Fronted Fees – Even if funds are provided by the client and not borrowed from the agency

- Close Fees

- Key Fees

- Flatbed/Dollie/Go-Jack Fees

- Mileage Fees

- Fuel Surcharge Fees

- Skiptrace Fee

- Stake-Out Fee

- Oversize Fees

- Storage Fees

From the State Comptrollers Office these are all of the taxable services in Texas: https://comptroller.texas.gov/taxes/publications/96-259.php

Typically, the Comptroller’s office will take the following collection actions to protect the state’s interests and collect past due taxes: Require the taxpayer to post a security bond. File a tax lien in applicable counties. Freeze and/or seize non-exempt assets.

What happens if you don’t pay sales tax in Texas?

Depending on the amount of unpaid sales tax, the offense could be up to a second-degree felony, which carries a prison sentence of 2 to 20 years and a criminal fine of up to $10,000. Additionally, a person convicted of failure to pay sales tax owes 5% of the total unpaid tax as a penalty.

Clients can check the status of a vendor-repossession agent by searching the agent through TexasARP’s website at TexasARP.org

TexasARP checks members status with the State every quarter. If they do not qualify to conduct business in the state they are removed from the website until they are active.

Or they can search their repossession agent by visiting both websites:

Texas Sales Tax- https://mycpa.cpa.state.tx.us/staxpayersearch/

Texas Franchise Tax- https://mycpa.cpa.state.tx.us/coa/

Texas repossession agents MUST be registered with both entities above and have an active TDLR- in order to conduct business.

Thank you,

Stephanie Findley

President, TexasARP

TexasARP – 9203 Hwy 6 South #124 Houston, TX 77083 / info@TexasARP.org / (281) 507-4513

Repo Taxes in Texas – A Risk to Lenders and Agencies Alike – Repo Taxes in Texas – A Risk to Lenders and Agencies Alike – Repo Taxes in Texas – A Risk to Lenders and Agencies Alike

Repo Taxes in Texas – A Risk to Lenders and Agencies Alike – Texas Accredited Repossession Professionals – TexasARP – State Repossession Associations – Repossess – Repossession – Repossession Agency – Repossessor

The post Repo Taxes in Texas – A Risk to Lenders and Agencies Alike first appeared on CURepossession.

]]>The post Fight for Fair Repossession Fees Hits the Wall Street Journal first appeared on CURepossession.

]]>

May 3, 2023 – As written about last week, Harley Davidson blamed a large portion of their increased loan losses on their inability to find enough repossession agents to repossess their bikes. Following interviews with ARA President Vaughn Clemmons, and Jeremy Cross, the Wall Street Journal helped straighten out Harley’s real problem. Low repo fees!

As mentioned last week, the Wall Street Journal (WSJ) who conducted interviews with Vaughn Clemmons and Jeremy Cross of the ARA. Wednesday morning, WSJ journalist John Keilman’s story was published. The article, titled “Repo Men Haggle With Harley-Davidson Over Recovery Fees” dove into the issue, and a little more.

For those of you who are not subscribed to the Wall Street Journal, you should subscribe for this article alone. But for now, I’ll feed you some quotes. It is a good and balanced article.

This is probably the most read worthy article on the condition of the repossession industry since the 2012 Huffington Post article; Repos Gone Bad: Are Big Lenders To Blame For Driveway Violence? And a very good read that I hope will open some eyes to persons outside of the repossession industry.

“They expect the work for free, and that’s what we’re trying to get away from,” said Vaughn Clemmons, who is president of Automobile Recovery Bureau in Houston and head of the American Recovery Association.

In response; “Harley said it values its relationship with the recovery industry. We recognize that in many cases, repossession within our sector is more complicated than within the auto sector,” the company said. “However, aligned with industry standards, we pay above and beyond including surcharges to recognize the complexity of the work undertaken.”

Their tone is understandably respectful and diplomatic but does not address their fees structure that existed before their recent charm offensive launched over the past few week.

The Wall Street Journal added; “Harley last week said that its credit loss rate was 3.2% in the first quarter, up from its typical rate of about 2%. The company said the first quarter is usually the worst for such losses because some customers tend to make their payments during the spring and summer riding season only to become delinquent later in the year.

Harley Treasurer David Viney said Thursday during a conference call with analysts that while the delinquencies weren’t especially high, the declining residual values of motorcycles and “a weaker repossession industry” led to more severe losses in the quarter. Mr. Viney said many recovery agents left the industry during the Covid-19 pandemic.”

No one in the repossession industry will dispute that the pandemic caused an exodus of agencies to leave the industry, A point the writer made below.

“People in the repossession business agree, saying their employee base shrank by as much as 40% over that period. They said work dried up as stimulus payments and enhanced unemployment benefits helped consumers stay current with their bills, and as some states imposed temporary moratoriums on repossessions.

Mr. Clemmons said the pandemic prompted some of his colleagues to put their tow trucks to less stressful and more profitable use, such as roadside assistance.

“Who wants to back up in a driveway at 3 a.m. and get shot at?” he said. “You can make the same money doing something else.”

The story shifts gears to some valid higher level topics surrounding repossession volume over the past three years that supports the point made of an issue existing in the reduction of repossession volume as exemplified by a statement from one of the auto industries topic experts.

“Cox Automotive, which tracks auto industry data, said that car, truck and SUV recoveries, by far the biggest part of the repossession business, have declined over the past three years. About 1.6% of the loan base was subject to repossession over that period. Over the 12 years before that, the average was 2.4%, according to the firm.”

Again shifting gears, but staying on topic, the reporter, Keilman, brought up a tiny tidbit of the CFPB’s Junk Fees proclamation, but stopped at their estimate of average repossession fee expenses. A sore point that Vaughn made a point of, as well as closing fees.

“The Consumer Financial Protection Bureau has estimated that agents are paid an average of $350 for an auto repossession, and recovery executives said that hasn’t changed in decades. Mr. Clemmons said that Harley has been paying extra fees, but that the amount still isn’t enough.

He said he spoke with Harley representatives last week and pressed for a “close fee,” which would cover a repo man’s costs even if he strikes out.

“It’s a conversation,” he said. “It’s a good thing that we’re conversing.”

According to the reporter; “Harley declined to comment on the fees. The company said during the conference call that it is making enhancements to its repossession strategy and expects the credit loss rate to drop.”

Wow what a shock…

While the writer explained the complexities of repossession motorcycles, I leave that for your later reading as most of you are already very experienced in this fruitless joy. And while they had a much deeper conversation with Jeremy Cross, one of the most analytical minds in the business, they disappointedly stayed somewhat topical.

Those situations don’t always go smoothly, said Jeremy Cross, owner of International Recovery Systems in suburban Philadelphia.

“Have you met some of the people who ride motorcycles?” he said. “They care more about their motorcycles than their work trucks or their family vans.”

Mr. Clemmons said one memorable case came when a Harley rider he had pursued for months finally agreed to give up his bike.

“We get to the guy’s house, and it was in 3,000 pieces,” Mr. Clemmons said. “It took us 2 ½ hours to get all those pieces cataloged and delivered back to the lot.”

Getting interviewed for the press is always a guessing game as to what they’re truly going to report. While WSJ journalist John Keilman’s well written article may not speak as loudly or vehemently as me, that is because he writes to a wider audience than me. I could cut what he does!

Let’s face it, it’s very unlikely anyone in the main stream press is ever going to be able to explain to the general public or business world the minutia of details that have suppressed repossession fees for all these years. The fact that they are paying attention at all should be satisfaction enough.

The reason they are paying attention, is because the repossession industry does matter to the business world. Let’s also hope that Harley’s sudden realization spreads and we start to see some dramatic improvements in fees.

Great job’s Vaugh and Jeremey and thank you John Keilman and the Wall Street Journal for taking the time to bring this topic on to the world stage.

Kevin

Fight for Fair Repossession Fees Hits the Wall Street Journal – Fight for Fair Fees – Repossess – Repossession – Repossession Agency

The post Fight for Fair Repossession Fees Hits the Wall Street Journal first appeared on CURepossession.

]]>The post The Death of Repo Forwarding? first appeared on CURepossession.

]]>Now that the Consumer Financial Protection Bureau (CFPB) has clarified their position on UDAAP fees charged by repossession forwarding companies, many questions come to mind. I am sure that in the days that followed, most lenders and forwarders have been meeting to discuss how to manage this. But the lingering question of the survival of the forwarding model plays into this. Is this the death of repo forwarding?

In short, I wouldn’t count on it. With the economy veering toward its first recession in almost fifteen years and a bubble formed in auto loan affordability, no one is likely to throw in the towel on the repo forwarding model anytime soon. But with all of the questions created by the CFPB’s declaration, one thing is clear. The old business model won’t work.

In the short term, it does not appear that there has been any major interruption the orderly flow of operations by the lenders. Likewise, I’ve heard of no indication that the assignments coming from the forwarders has slowed down. For now, it looks like lenders have resigned themselves to “biting the bullet” on the “Junk Fee” portion of the bills coming in from the forwarders, or simply taking a risk and doing business as normal.

I seriously doubt that any lender under the CFPB’s supervision is choosing to ignore this. The CFPB has a history of levelling some pretty hefty fines. I imagine there may be some lenders not under CFPB supervision that feel immune to the CFPB’s ruling and to save the internal expenses, are ignoring making any changes to their NOI reporting methods until some other issue comes along to make them. And those issues very well could come along in different forms other than the CFPB themselves.

Examiners of all types, state, FDIC, NCUA, etc., frequently follow the guidance of the CFPB and these “Junk Fees” could at very least, appear as exam finding requiring lender remedy. And worse yet, who knows how the vast and opportunistic network of consumer advocate attorneys across the nation will leverage this proclamation in repossession related cases big and small.

The CFPB

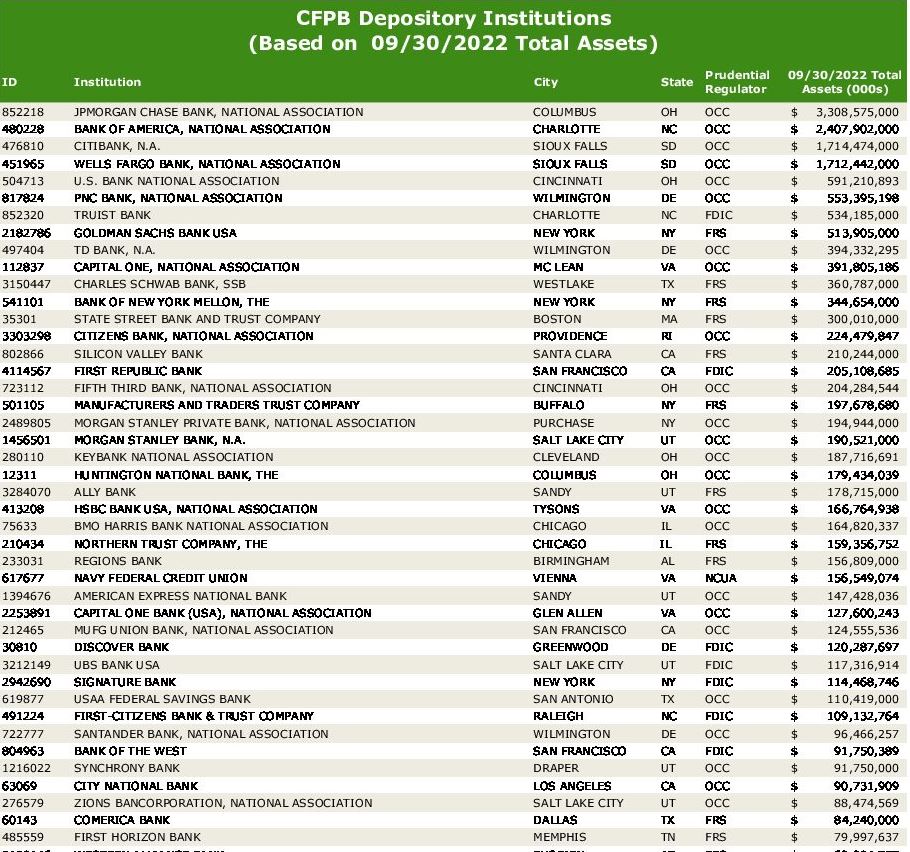

Let’s start with the CFPB’s reach. The CFPB examines over 100 financial depository institutions and non-bank entities. In addition, last year, they’ve expanded their supervision via a previously dormant authority that includes the supervision of non-bank entities and loan service providers for those lenders. This is a significant portion of the auto lending world.

Click Here to See The Full List

As exemplified by their actions against Nissan Motor Acceptance for allowing repossession agencies to charge personal property fees in October of 2020, their reach can expand into every aspect of the repossession industry should they so desire. So, for anyone thinking that this can’t affect their repossession or forwarding company, that is probably wishful thinking.

The Problem for Agencies

For many agency owners, the CFPB’s UDAAP forwarder repossession fees proclamation creates an assumption that the “direct assignment” model will increase in volume, and it could, but I’ll get into that shortly. For some agency owners, there is the assumption that they will be able to increase their fees once freed from the fixed forwarder fees, and it could, but that’s another issue that I’ll also cover later.

I know many out there may have assumed that this could spell the end of the forwarding industry. And if that were the case, I suspect that how good this is for an agency could depend greatly on their current reliance on repossession forwarders. If it is anywhere near where it was when I did my September 2020 “State of the Repossession Industry Survey”, it is significant and at least 50% by now.

One major problem that this could create is a simple fact that some of you won’t like. Many, if not most of you, are not great salespeople or marketers. There, I said it. The reason for this is a simple lack of practice. Decades of over reliance on the forwarders to spoon feed your agencies assignments has given many of you little motivation and no practice to do so.

With that said, if you have not been doing so all along, it would be wise, to make the effort. There are still many credit unions, community banks and buy here pay here dealers with whom you can strike up a good relationship. Afterall, the relationships between the lenders and their repossession agent networks was for the vast majority of the history of auto lending, a close one.

Unfortunately, absent the ability to market themselves well and develop direct relationships, many small agencies could go out of business without their forwarding partners. Their overreliance on the forwarding companies and inability to effectively market their companies could be a death blow. Let’s face it, the forwarding model is something many agencies cannot survive without.

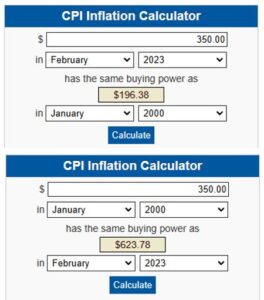

Now as far as raising fees. I suspect that will occur. At very least, there may be some improvements in storage fees now that the forwarders can no longer bill for charges that they didn’t pay the agencies. But there is a one hurdle to raising fees. The CFPB’s statement on the average repossession costing $350.

They are correct, but they’re reinforcing on to the lenders that this is adequate and the norm. It completely ignores the fact that this fee has been held at this level for over twenty years by the forwarding model. I repeat, the average repossession fee has remained unchanged for over 20 years.

They are correct, but they’re reinforcing on to the lenders that this is adequate and the norm. It completely ignores the fact that this fee has been held at this level for over twenty years by the forwarding model. I repeat, the average repossession fee has remained unchanged for over 20 years.

The average $350 fee has the current value of $196.38 when compared to the year 2000 according to the US Bureau of Labor Statistics. Adjusted for inflation, it would have to be $623 in order to have the same spending power. Sad but true and I don’t see it reaching that level anytime soon.

With the CFPB’s $350 statement, a form of precedence has been set, a standard that will be frequently held up as the norm. That could become a frequent talking point that comes back to haunt the industry for years.

The Middleman

Obviously, the forwarding industry has been going through a lot of changes. Any assumption that their assignment volume from lenders would just dry up as the result of all this appear to be wrong from what I have been told. According to two forwarding company CEO’s that I have spoken with, they have received no blow back and it’s business as usual, and actually still on the rise.

While I am not privy to the conversation going on between the forwarders and lenders, I’ve heard of no discourse or animosity for their prior billing practices. Lenders from all that I have heard, are simply modifying their fee reporting on their notices of intent to dispose of collateral (NOI).

That is not to say that all is well in forwarding world. The CFPB’s ruling has stripped the forwarding companies of a lot of income charged to the borrowers and unpaid to the repo agencies. Fees like storage, surcharges and other fees that likely padded their incomes significantly. Even with increases in volume likely to come, the profit margins per recovery will be taking a hit.

In the short term, I have heard of no forwarding companies contemplating any major changes to the forwarding model of old. But to survive a changing market and to be more competitive, it may require revisions to their business models.

With reduced income there may come a point where there are layoffs and internal cost cutting measures but the forwarding model is far from dead. They still provide services that the lenders and repossession agencies need.

Forwarders already have established vendor management departments to satisfy the lenders requirements. These are skills and staff that at this point, the lenders likely have little or none of and probably won’t staff up for. Compliance management of a repossession agent network is something that the lenders would gladly pay out of pocket for.

Skip tracing is another service that forwarders provide as well and are not likely effected by the CFPB’s decree which speaks specifically of repossession related fees. Those forwarders with a strong remarketing arm could do well in the incoming swell of repossessions likely to hit this summer. While these revenue streams help, they are unlikely to make up for all of the extra income lost.

One way or another, most forwarding companies will survive. Most, but probably not all. As far as lenders migrating away from this relationship anytime soon, I wouldn’t count on any major changes unless the forwarding model becomes a greater expense burden on the lenders than would be if they brought those same services back under their own roofs.

The Hardest Hit

As far as the lenders go, some may eventually jump ship from the forwarders and dip their toes deeper into the direct assignment model to comply with the CFPB’s declaration without having to absorb the forwarder portion of the fees. But I would wager that few are adequately staffed to jumped in much deeper than they currently do if at all. In the short term, from what I’ve been hearing most are just billing the borrower for the agent paid fees and sucking up the difference.

The reality is, like the repossession agencies, most lenders have become far too dependent on the repossession forwarders. Few, if any, are adequately staffed to manage repossession at the current volume let alone possess the same skill sets to manage a direct assignment model. With monetary pressure created by rising rates, liquidity will likely be a big obstacle to hiring, so, in the short term, abandoning their repo forwarders is unlikely.

Regardless, as a basic best practice, ALL LENDERS, owe it to themselves to test the water. Do a champion challenger comparison between an equal number of direct assignments and forwarded assignments. Grade them on speed of recovery, recovery ratios, service level agreements or more. For a great example of this score carding, you should go take a peek at Resolvion’s article “Vendor Scorecarding Techniques to Improve Collateral Recovery Results.”

As bad as the liquidity and monetary pressures are, the biggest issue that could arise for lenders under the CFPB’s supervision is recompensating overpaid fees. Should the CFPB require them to do an audit for a specific period of time and refund to borrowers those excess forwarder fees that were paid for repo redemptions and reinstatements, this could cost millions of dollars.

But possibly the biggest threat to all lenders is the CFPB’s statement that the forwarders portion of fees are an UDAAP. The simple act of having used those numbers could be used as an argument that the notices of intent to dispose of the repossessed vehicle sent to the borrowers and could be ruled as improper by a debtor sympathetic court. These issues could start small and result in waiving a deficiency balance and credit reporting or could become the source of class action lawsuits.

This could get dragged into allegations of FDCPA and FCRA violations as well. The CFPB really opened a nasty Pandora’s box of risk for everyone with this statement.

New Billing Models

I had initially imagined that the forwarders would immediately begin exploring different billing models to reduce or minimize the new expense to their lender clients. So far, I have heard of none, but should they go down that road, I can imagine that some of these models might emerge.

Flat Forwarder Fees – One idea that I consider, might be that the forwarders get paid a flat fee from the lenders for the assignment. To supplement this, they could, don’t laugh, charge the agencies a flat fee for recoveries or assignments. But if the agencies increase their fees to accommodate that, it could perhaps appear disingenuous and equally a violation. The funny part of this idea is the agencies having to pay the forwarders invoices. I doubt that the forwarders will be allowed to manage the transactions between the lenders and the agents due to the issues that arose from them having done it in the past, but I could be wrong. Their reputations may have taken a big hit with the CFPB and perhaps some lenders because of all of this. With the CFPB stating that they can only quote to the borrower what the agent paid, logic would tell us that the lenders would want to see the agency bills directly. This is a solution that two forwarding companies have told me that they adopted immediately. This is transparency and an honest and step in the right direction.

Commission – Another billing model that I thought might get tossed around is that the forwarders receive a commission on the agencies billing to the lender. This idea creates a similar problem to the flat fee in that it not only encourages agencies to add to their billing but does so with encouragement of the forwarder.

Lender Pays – With a change from the new model of lenders paying forwarder fees would come a reversal of fortune. How long until we hear the forwarders complain about agents being 90-120 days past due on payments or having invoices declined over minor accounting issues? I guess what comes around goes around, but two wrongs don’t make a right, even if it is funny.

Whatever direction all of this goes, it is pretty clear to me that this long imbalanced business relationship between lender, forwarder and agency is in the midst of major transformation toward required transparency. And the lack of transparency is what caused all this mess in the first place. I had hoped that someone in the forwarding or lending world would have stepped forward to remedy this issue on their own before things came to this, but it just didn’t work out that way. But now, transparency is the requirement.

Now that we have a better understanding of the spirit of the CFPB decision, perhaps the repossession industry, lenders and forwarders alike, can find a new balance. And in that, a business model and practices that are transparent and fair to the consumer. This is far from an unreasonable request. It’s the law.

Kevin Armstrong

Publisher

Related Articles;

CFPB Provides Clarity on UDAAP Repossession Fees

CFPB’s Response to Questions on UDAAP Repo Fees

CFPB Labels Repossession Forwarding Fees as UDAAP?

CFPB; How is this not an UDAAP?

The Death of Repo Forwarding? – Fight for Fair Fees – UDAAP – Repossess – Repossession – Repossession Agency

The post The Death of Repo Forwarding? first appeared on CURepossession.

]]>The post There’s Something in the AIR first appeared on CURepossession.

]]>

Tired of having to provide free storage? Tired of being told “no” to getting paid for legitimately- incurred personal property storage expenses? Most of all, surprised to discover that third party forwarders are getting paid huge fees for their services and paying the actual service provider around a 1/3rd? Yes, we all are. One state association is making some noise about that.

In case you haven’t had the chance to listen to J. Patrick Altes’ most recent episode of Repo America, you will be enlightened with a frank conversation very relevant to the state of affairs in the repossession industry. Joining Pat are, David Johns of Done Rite Recovery Services, Santino “Sonny” Datoli of Armor Recovery Solutions and Ryan Miller of Northwest Repossessions of Chicago, Illinois who discuss their creation, struggles and successes with the newly formed Alliance of Illinois Repossessors (AIR).

If you are a member of a state or national association or are considering joining one, this is an episode well worth listening to. Even if you have no interest in joining or creating a state association, you owe it to yourself to get a good listen to the value that a state association can have to your business.

If you haven’t been following Repo America with J. Patrick Altes, you’ve been missing out on getting the inside track on the real discussions going on inside the automobile repossession industry in America. No war stories, no repo politics, just discussion about the struggles and victories in this most difficult and fascinating business.

Related Articles;

Indiana Puts Major Lenders and Forwarders on Notice

GALR Intends to Follow the AIR Lead

AIR Now Rejecting Four Major Lenders and One Forwarder Over Storage

Lead or Follow, But Don’t Get Out of the Way

Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

PAID IN FULL – Primeritus pays up

Alliance of Illinois Repossessors enforcing fuel surcharges

There’s Something in the AIR – Fight for Fair Fees – Alliance of Illinois Repossessors – Repossess – Repossession – Repossession Agency

The post There’s Something in the AIR first appeared on CURepossession.

]]>The post AIR Sounds the Alarm first appeared on CURepossession.

]]>Illinois started to sound the alarms on October 11, 2022, in regard to the storage crisis on the horizon. On January 1st, 2023, AIR members began declining four major lenders along with one forwarder and only after thousands of cases were declined, conversations began with the majority of the parties involved. While there have been some resolutions to the issues addressed, others have refused to begin the conversation even after being providing factual data regarding the crisis on hand. The conversations have finally brought some transparency to all in the space, but some of the facts discovered are truly concerning.

Facts that AIR has discovered:

– Forwarders are collecting storage from some clients that is not passing through to the agent network

– Some lenders are paying spiffs/ bonuses that are not passed on.

– Repossession fees charged by the forwarders are well over $1000 and agents who actually recovered the vehicle are only being paid $275.

– Some lenders kept vehicles stored on agents’ lots for extended periods because auctions do not hold the same insurance coverage recovery agencies do.

– Invoices that were meant to be sent to the lender but were accidently sent to the agent show that declined items, such as flatbed fees, were still being billed to the lender.

AIR is seeking a transparent relationship with the forwarding network. This is by no means is an attack on the forwarders, as AIR recognizes they are a vital part of our industry. However, the agent network has been left in the dark for way too long and it’s time to shine light on some of the discrepancies in billing.

It is time to knock down the wall that has been built between agents and the lending network.

David E Johns Jr.

Vice-President, Alliance Of Illinois Repossessors

About The Alliance of Illinois Repossessors

The Alliance of Illinois Repossessors is a gathering of Repossession companies that will unite for the progression of the repossession industry within our state. AIR is composed of licensed members operating repossession agencies with the State of Illinois. The purpose of this Association is to strengthen understanding between licensed Repossessors, law enforcement, financial institutions, regulatory agencies, and the consumer.

The Alliance of Illinois Repossessors

We are stronger together

Related Articles;

Indiana Puts Major Lenders and Forwarders on Notice

GALR Intends to Follow the AIR Lead

AIR Now Rejecting Four Major Lenders and One Forwarder Over Storage

Lead or Follow, But Don’t Get Out of the Way

Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

PAID IN FULL – Primeritus pays up

Alliance of Illinois Repossessors enforcing fuel surcharges

AIR Sounds the Alarm – Fight for Fair Fees – Alliance of Illinois Repossessors – Repossess – Repossession – Repossession Agency

The post AIR Sounds the Alarm first appeared on CURepossession.

]]>The post Indiana Backs AIR on the Storage Fight first appeared on CURepossession.

]]>We commend AIR on their unwavering commitment and strength, as they followed through with their plan to stop accepting work from clients who have not met the given deadline. Make no mistake, the storage crisis affects us all, therefore in the weeks to come INPRA plans to use the formulas that AIR has designed to help us determine how the storage crisis affects us in Indiana.

Using this time to do our due diligence will allow us an opportunity to formulate and present an educated plan that works for us in our market. We hope that our clients will look at this as an opportunity, not an ultimatum.

We understand we have a long road ahead of us and encourage everyone to get involved. If you are in Indiana and interested in helping or becoming a member, please visit www.indianapra.org or email members@inpra.org for more information.

Todd Case

President

Indiana Professional Repossessors Association

About The Indiana Professional Repossessors Association

Repossession companies in the State of Indiana have joined together to form the Indiana Professional Repossessors Association – INPRA. Collectively we perform nearly 90% of the repossession efforts in the State of Indiana. Our goal is to ensure industry progression through education and communication with industry vendors, financial institutions, regulatory agencies, local government, and the consumer.

Together, we can make positive changes that will ensure safe and effective collateral recovery across the state. We shall endeavor to reduce liability and bring uniformity to the repossession industry in our state, so that clients and consumers alike know each repossession is handled in the most professional manner possible. This means ensuring each agency performs their duties while maintaining the highest level of compliance and in accordance with the law.

INPRA is the beginning of great things to come to the State of Indiana and the repossession industry.

Related Articles;

Meet Indiana’s New State Repossession Association

TexasARP Statement on Free Storage and More Developments

AIR Now Rejecting Four Major Lenders and One Forwarder Over Storage

Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

PAID IN FULL – Primeritus pays up

Alliance of Illinois Repossessors enforcing fuel surcharges

Indiana Backs AIR on the storage fight – Fight for Fair Fees – Repo Blood – Repossess – Repossession – Repossession Agency

The post Indiana Backs AIR on the Storage Fight first appeared on CURepossession.

]]>The post Add “The Volunteer State” to the List of State Repossession Associations first appeared on CURepossession.

]]>

We would like to introduce you to the newest and upcoming state association, Tennessee Association of Accredited Repossessors, TAAR!

Press Release

Introduction!

Unity is the best concept to make extensive strides. There are only two options: Make progress or make excuses. We are here to let you know TAAR is excited to join the other state and national associations to make progress and positive changes for our space and our industry. TAAR is diligently working to be fully formed by the end of February. Our goal will be to represent and market TAAR at NARS 2023.

WHAT MOTIVATED US?

We have witnessed AIR (The Alliance of Illinois Repossessors) achieving outstanding goals of which the most substantial is their campaign about no free storage. TAAR is backing and supporting AIR in full. Today, the word “free” does not belong in our industry. In addition, we want to applaud and thank the other newly formed state associations. Together, the associations are impacting the repossession industry like never before by holding tight, staying strong, and remaining united.

MOVING FORWARD:

Tennessee will be following AIR’s calculations and formula in determining what the daily average storage cost is in our market. To make this effort and other goals TAAR has as successful as AIR has been, we need more Tennessee agents to act now! Join the association and make your voice heard. We are currently charging no dues to members to join; we only ask for your participation and time.

QUICK GOALS:

We need to elect board members, and we need to vote on and enact our bylaws!

To follow suit, we need the agencies to take a stand and join the upcoming association NOW!!!

Please email Lauren Kimbrell with BSR, lauren@repotn.com to get involved. Lauren is fully invested to see this through and has been working hard to bring the Tennessee space together by being the team. Don’t miss being a part of the sweeping changes to our industry. Again, the goal is to have the association fully formed by the end of February and accept new member applications at NARS 2023. TAAR is counting on you to support this effort and get involved!

LONG-TERM GOALS:

Full disclosure, we all know there are too many “NEEDS” in our industry to make a list here. Effectively, TAAR wants to tackle the most pressing issues our companies and industry face and we want our members to guide us on what is important to them so that we can support them and solve these issues together.

First and foremost, TAAR believes that standing behind and supporting AIR in the no free storage campaign, enforcing fuel surcharges, and being a resource to provide education to all parties involved are priorities. Implementing compliance, providing education, and ensuring our agents are working under the highest possible safety standards, are highlights that TAAR intends to pursue.

GET INVOLVED!

In addition to introducing the upcoming Tennessee State Association, we would like to bring your attention to the already established and well-known Tennessee Tow Truck Association, TAAR. We encourage each company to be a part of TTTA as well. Tennessee Tow Truck Association (TTTA) is mainly focused on the towing industry but will overlap with what TAAR is wanting to accomplish by providing education, a standard of professionalism across the board, and lastly BETTERING the industry. TAAR intends to show TTTA the same support! To contact TTTA please email administrator@tenntowtruckassoc.com.

TAAR will differentiate from TTTA, because this association will be strictly focused on the repossession industry. We will be uniting with the current and future repossession state associations to effectively to change in the industry as a whole. The goal behind this is unity.

Thank You,

Lauren Kimbrell

President of BSR

Website Coming Soon!

Add “The Volunteer State” to the List of State Repossession Associations – State Repossession Associations – Repossession History

The post Add “The Volunteer State” to the List of State Repossession Associations first appeared on CURepossession.

]]>The post Lead or Follow, But Don’t Get Out of the Way first appeared on CURepossession.

]]>

If not you, who? If not now, when?

EDITORIAL

For over a decade I’ve been hearing agency owners say, “What has an association ever done for me?” Of course, these are owners who are not members of any association at the national or state level. This logic resembles the analogy of someone who complains about never winning the lottery when they never buy tickets. The truth is, you will never win if you don’t try.

Likewise, I hear them brag about how this lender or that is paying them $400 a repo and how they’re picking up all these units. Well, that’s great, but you are forgetting another basic truth, you are still earning far less than an agency was making two decades ago. I’ve been beating on these numbers for over ten years and if you need a refresher, please go read my article “Three-Twenty-Five, Beating a Dead Horse.”

This is a time to “Lead, follow or get out of the way”, but not exactly, and I’ll get to that shortly. Although many believe General George Patton was responsible for the quote, it was actually 18th century American revolutionary war patriot and writer, Thomas Paine, who penned this famous inspirational quote.

It is a personal statement of persistence, independence and accomplishing something, and of not simply accepting status quo and doing what you’re told and merely bumping along in life. It is meant to inspire people to become leaders, actively follow other leaders, or to step aside and get out of the way of progress.

But this is not the time to step aside, this is the time to contribute to progress.

Placating

While the lenders have heard the outcry over fuel costs over the past year, their responses are tepid and temporary. Like Band-Aids on bullet holes, they placate you with short term solutions for long standing issues. Issues that they have created for their own benefit. And why? Because you’ve let them.

What’s worse, is you’ve been letting the forwarders claim all or a portion of these surcharges. And it all adds insult to injury when a borrower shows up to reinstate a loan and shows you how much the forwarder charged them for vehicle storage, on your lot, covered with your insurance, on land that you pay for. Tell me that doesn’t make you feel like a sucker? Tell me that doesn’t embarrass you in front of your staff?

For all the facetious, kabuki like feigned benevolence most everyone has been distracted with by $40 fuel surcharges, there seems to be a lack of memory or an ignorance to all that has been taken away. Closing fees, that were $75 thirty years ago, personal property fees, which earned about $10 removal and $5 a day storage and of course vehicle storage, that averaged $5 a day in the 1990’s. Of course, these were incomes that you earned on top of an average $325 repossession fee.

But that was three decades ago and now, you’re satisfied with $350-$400 for a repossession? And over those DECADES, many seem to have forgotten your never ended rises of expense. Seriously? This is the direct result of a fragmented industry, divided and simply doing what you are told.

Darcy Case of Indiana Recovery Services recently said in the ATI “Repo Bunch” podcast, that she knows of no other service industry where the service provider allows the customer to tell them what they’ll pay. She was 100% right! Can you imagine calling a plumber and telling them that you’ll only pay $50 for a job and they just put up their arms in surrender and agree? Well, that is exactly what you have all been doing.

It doesn’t have to be this way.

Excuses

“If I don’t do it, someone else will.”

Whether anyone has the honesty with themselves to admit it openly or not, this fear has always been present. It comes from the intelligent rationale of being competitive and has always been an overwhelming fear that hovers over this industry, and it is exactly what those who control you want you to believe. And all the while their profits grow by the hundreds of millions of dollars while yours erode, day by day and month after month.

This defeatist mentality has crippled the repossession industry for over thirty years. It needs to end.

At the root of it is fear and mistrust. And while most of the industries largest and strongest agencies have been engaged and involved in associations, there are still that 60%-70% of the industry who sit on the sidelines looking at the associations with mistrust. All the while, forgetting that most of these large agencies were once, small agencies just like them. But the majority of them, discovered the one thing that helped them grow and prosper; Engagement.

It is Coming

Over the pandemic, over 20% of the industry closed its doors. There are far fewer of you out there than their used to be. That means far fewer agencies to undercut you and be used against each other by the divisive tactics of lenders using forwarders against each other to keep the fees down.

In Illinois, the Alliance of Illinois Repossessors discovered that this attrition in competition had weeded out majority of the disengaged competition. What was left were the agencies responsible for over 85% of all repossessions conducted in the state. Once they banded together, they were able to take actions to improve their business operations and profitability. The lenders and forwarders for the most have given in to them, they have little other choice.

Now imagine if your company was represented by an association capable of pressuring the forwarders to pay your past due invoices, demand storage fees and stand up for you. This is no longer an unrealistic vision. It is happening and your participation can bring it to reality quicker than you can imagine.

Delinquency has risen back to pandemic levels and all signs are pointing to what could be the highest repossession volume since the Great Recession. Soon, every agency will be able to pick and choose their assignments rather than just accepting what is given to them at the terms offered. And now is the time to make those first steps toward what can be the greatest period of growth, professionalism, and prosperity the industry has seen since the resumption of auto lending at the end of World War II.

Time

The time is now, for agencies of all size and in all states, to unite and engage with their fellow agency owners in the betterment of their companies, selves, and employees. But this requires the casting away of the skeptical nature of the industry and embracing unity.

It is time for you to at very least join a state association. If you don’t have one, reach out to one of the others and they’ll point you in the right direction to either join one of the still many new ones in the development process.

Joining a state repossession association is not expensive and is probably one of the greatest investments that you can make in your business at this time. They require very little investment and little time if you choose not to invest too much energy in it. But your potential profits are enormous and your mere presence in their membership gives it strength. And in that strength, the leverage to create meaningful change from which your real success lies.

And while so many ask, “What has an association ever done for me?” I urge you to reconsider this perception and ask yourself, “What could an association do for me if everyone in my state was a member?” I assure you, if a mere 70% of your state were members, it could move mountains, and a rising tide raises all boats.

If not you, who? If not now, when? There will never be a better time than now for you to invest in your future and join an association.

Kevin Armstrong

Publisher

CURepossession and CUCollector,

Author of Repo Blood, A Century of Auto Repossession History

Below are the web links to the most current state associations.

California – www.calr.org

Carolinas – www.racarolinas.org

Georgia – www.galr.org

Illinois – www.air-repo.com

Indiana – www.indianapra.org

Michigan – Website under construction. Please contact President Jenny Liagre (RockwoodRecovery@gmail.com)

Minnesota – www.mnarp.org

Nevada – Website under construction. Please go to https://www.facebook.com/NevadaRepo/

Oklahoma – Oklahoma Association of Professional Repossessors (OAPR) – Contact Lisa Hancock , lisa@alscotulsa.com

Texas – www.texasarp.org

Lead or Follow, But Don’t Get Out of the Way – Repossession History – Fight for Fair Fees

The post Lead or Follow, But Don’t Get Out of the Way first appeared on CURepossession.

]]>The post AIR Now Rejecting Four Major Lenders and One Forwarder Over Storage first appeared on CURepossession.

]]>

“A.I.R expects this list to grow”

PRESS RELEASE

On November 14th of 2022, the Alliance of Illinois Repossessors issued a press release stating that on January 2nd, 2023, their members, would start rejecting cases that do not provide a daily storage rate to be invoiced to help offset the escalating cost recovery companies accrue to safely store their units on their storage facilities in Illinois. That day has come.

As previously discussed, with rising insurance rates, and some of the highest property taxes in the country, we can no longer provide storage for free. An analysis done by members of our alliance, demonstrated that the average per unit cost for storage in Illinois is between $12.00-$14.00 per day, depending on monthly recovery volume.

We had requested, and received, data from Harding Brooks to further look into this issue. Their data disclosed that in 2022, as of that date, there were 254 claims filed for lot incidents, 118 of which were for theft, with a total of $1.6 million paid out.

These figures were for claims filed. Every member of the A.I.R has had incidents. Incidents that were not submitted as a claims, in fear of premiums rising above sustainable rates.

All this information brought us to the answer to the question; is free storage really free? We have for too long been accepting all of the risk with none of the reward. This cannot and will not continue.

Over the last thirty days we at the A.I.R have met with several lien holders and forwarders to discuss this issue. We, at the A.I.R presented comparable factual data reflecting each lien holders average time on lot and the cost agencies accrued to store these units.

While many of the discussions have been productive and continue, several have shown a complete lack of concern to the A.I.R member’s requests. Based upon these conversations, we, the members of the A.I.R have a compiled a list of these clients’ and their companies and will no longer be accepting repossession assignments from them.

To date, A.I.R members, have reported four large lenders and one forwarder from whom we will not be accepting cases from until further notice. Based upon our analysis of 2022 figures, A.I.R expects this list to grow from its members in the next couple weeks

About The Alliance of Illinois Repossessors

About The Alliance of Illinois Repossessors

The Alliance of Illinois Repossessors is a gathering of Repossession companies that will unite for the progression of the repossession industry within our state. AIR is composed of licensed members operating repossession agencies with the State of Illinois. The purpose of this Association is to strengthen understanding between licensed Repossessors, law enforcement, financial institutions, regulatory agencies, and the consumer.

The Alliance of Illinois Repossessors

We are stronger together

Related Articles;

Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

PAID IN FULL – Primeritus pays up

Alliance of Illinois Repossessors enforcing fuel surcharges

AIR Now Rejecting Four Major Lenders and One Forwarder Over Storage – Fight for Fair Fees – AIR

The post AIR Now Rejecting Four Major Lenders and One Forwarder Over Storage first appeared on CURepossession.

]]>The post 2022 – Top Ten Stories first appeared on CURepossession.

]]>

With 2022 coming to an end, it’s that time of year when we tend to look back at the year as it was. I know, you’re probably thinking, “here’s another one of those stupid best of the year articles” that drags out old news for holiday season filler content. Well, I guess it is, but rather than just wax on about my own views of the past year, I thought I’d rather share with you the stories that you, the readers viewed the most in order of site volume.

So, away we go!

#10 – Hard times for repo forwarding founder

#10 – Hard times for repo forwarding founder

Okay, I confess. This article was a little facetious. No, Patrick Willis, founder of ARS is probably not going broke. It was just an odd article to find.

It’s rare that the repossession industry gets the opportunity to see the wealth that was built on a forwarding operation. And to be perfectly honest, Patrick Willis’ income comes from real estate development and other forms of investment.

Patrick comes from old school repo blood and started his empire with one small agency decades ago. While he has amassed a small fortune

ARS, like most forwarding companies, are lightning rods for industry discourse. To their credit, they are one of the industries biggest contributors to the Recovery Agents Benefit Fund and the Vendor Relations VP, Dave Baker even sits on the RABF Board of Directors.

But that doesn’t mean that their name didn’t come up a lot in 2022 as evidenced by a scathing guest editorial by ARS cofounder John Lewis and the number nine most read article of 2022.

#9 – An agency letter to ARS – I don’t think so…

#9 – An agency letter to ARS – I don’t think so…

Guest editorials are always one of the most read. This one, came on the heels of John Lewis’s article titled “ARS Founder Speaks Out on Repossession Fees” and echoes the ever-persistent issue of fees.

This contribution came from Jason Karns, General Manager at Quality Recovery Service. His direct and to the point editorial well illustrated his opposition to the fee structure of American Recovery Service (ARS).

Perhaps the most powerful statement in it to me was; “How in the world can ARS still offer the same low-ball fee they did in 2009? It’s an Insult.:”

#8 – Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

#8 – Alliance of Illinois Repossessors to Require Storage on ALL Assignments!

I was a little surprised that this story wasn’t bigger than it was. It could just be a matter of timing as this announcement by the Alliance of Illinois Repossessors (AIR) was late in the year and didn’t get the benefit of later re-reads as some of the top three have.

Regardless, it did show a monumental stand against lender/forwarder demands for free storage by one of the newer state repossession associations that, by December at the time of this writing, , the same proposal was being taken into consideration by all of the other nine state associtaions .

How this all pans out across the nation is hard to say, but the AIR had already flexed their collective muscle in demanding fuel surcharges earlier in the year as well as demanding Primeritus pay up in their past due invoices. Both of which they were successful in achieving.

The AIR claims to be responsible for over 85% of all repossession activity in the state of Illinois and holds a greater amount of leverage than probably any other state at this point. They spearheaded the fuel surcharge initiative and are leading the way with storage as well.

While still relatively new, the AIR is without a doubt, the strongest of the state repossession associations that has ever existed. Their storage mandate is now being taken up by eight other state associations as well. This is growing quick and every agency owner should know by now, and there is no excuse for sitting on the side;lines now! those who who are putting this up for vote still.

#7 – A fly on the wall – Ally discusses new repossession strategy

#7 – A fly on the wall – Ally discusses new repossession strategy

Scouring through Ally Bank’s investor meeting transcript, I’d stumbled across a veiled reference to their adoption of a new repossession strategy that they had hoped would help to fend off delinquencies. This was, at least, the excuse for an increase in delinquency that was brought up by one investment writer.

Their stated intent to give borrowers just a little more time to pay became a source of speculation from both me and Scott Jackson who suggested that perhaps Ally intended to cease their repossession assignment strategy and opt for the legal process of replevin.

Reasonable minds differ, which we did and I later responded in an editorial of my own which we’ll get to later.

#6 – Assignment declines and low recovery ratios – A simple solution

#6 – Assignment declines and low recovery ratios – A simple solution

As previously mentioned, guest editorials tend to be some of the most heavily read. This one from Jeremy Cross, of International Recovery Systems, almost made the top five. In his writing. Jeremy pointed out some of the ever-growing problems persisting in the industry, inflation, staffing and fees.

Jeremy lays out a fairly simple solution to help combat these issues. One that already made the list. It seems to have caught on; Storage,

#5 – Pricing Risk to Prevent Loss

#5 – Pricing Risk to Prevent Loss

Wes Carico of Nostalgic Towing has continued to provide some of the most informative and most read editorials through the years and definitely hit the mark with this one. Wes addressed many of the problems plaguing the industry such as non-payment for fees, adjusting rates to account for slow pays or no pays, and negotiating with forwarders.

A re-read of Wes’s articles would be time well spent for any agency owner from time to time. While Wes is busy working on his new Orca repossession workflow and business management application, I hope to hear something new from him before long.

#4 – Anatomy of a Repossession Death

#4 – Anatomy of a Repossession Death

This story was brought to me by industry experts Mark Lacek and Ron Brown, who both found themselves serving as expert witnesses in the wrongful death case in the May of 2019, case of 71-year-old Albert Nduli of Houston who was run over during a recovery.

This article took a while to write because there were a lot of lessons to be learned in it. Lessons that could save lives and businesses. I still feel that the story of this tragedy should be required reading by all agents, owners, lenders and forwarders.

#3 – The mythical repossession explosion, and the real data

#3 – The mythical repossession explosion, and the real data

Over the summer, click bait alleging that repossession volume was soaring ran through the internet through various news sources. While the industry was still suffering from a repossession volume drought, these catchy headlines didn’t seem to hold any veracity to me. So, I dug into the data.

What I did find, was that delinquency was showing signs of growth at the end of Q2, 2022, it was at that point, still far lower than even the pre-pandemic period, which wasn’t that high to start with. Taking the existing growth trends, I forecasted that we wouldn’t get back to pre-pandemic delinquency levels until the end of Q1, 2023.

Well, it’s already been a couple of months since I wrote this and we’ve already surpassed my projecrions. I think it’s safe to say, the dam cracks opeen by March. I’m not sure how the industry will handle the staff issues, but I still feel that a serious volume surge is coming.

#2 – Another FINAL NOTICE to Primeritus

#2 – Another FINAL NOTICE to Primeritus

As well documented, Primeritus had a rough year. But not as rough as the agencies who’d been waiting for past due invoices to get paid. Some as much as $75K and as long as a year.

This didn’t sit well with first, the Alliance of Illinois Repossessors announcement making a final demand for all invoices 45+ days past due to be paid no later than Friday September 9, 2022. This was later followed by the Georgia Association of Licensed Repossessors (GALR) who made a similar demand.

Other announcements from the TexasARP, CALR and a joint memo with Primeritus by the ARA, but this article appears to have had a greater impact, or at least garnered greater attention.

On a side note, the AIR reported that Primeritus did meet their demands and last I heard, progress was made in Georgia. But there was never any admission of how much in past due invoices was owed or how much was paid out.

#1 – Replevin vs. Repossession – A snowballs chance

#1 – Replevin vs. Repossession – A snowballs chance

As previously mentioned in number seven, I had written a response to Scott Jackson’s editorial titled “Be Careful What You Wish For” suggesting that Ally Bank may opt to cease involuntary repossessions and refer all delinquency for replevin/claim and delivery.

I’m not sure that I really countered all of Scott’s points in my editorial, but I feel that did a decent job of illustrating the negative financial impact that such a course of action would create.

I’m honestly a little surprised this was as heavily read as it was. Perhaps it just picks up good search engine clicks. After all these years of writing this stuff, I am still often wrong about what will bring in traffic.

Left Out

When I first saw the results, I was taken back by some of the stories that didn’t make the list. Especially many of the guest editorials and association contributions. These articles get a lot of views and reads each and I’m sure that if I added the combined views for every contribution from Ron Brown and the Eagle XX Group, the ARA or The Alliance of Illinois Repossessors, they would easily exceed any of these articles.

I look forward to sharing all of your editorials, press releases and announcements in the coming year, so if you have something to share with the industry, just reach out to me at editor@cucollector.com.

On to 2023!

As big a year as 2022 was, with rising delinquency and a probable recession coming next year, I expect that 2023 will be huge. I would like to thank you all again for your support and wish you all the most successful year the repossession industry has seen in decades.

Thank you all again and,

Kevin Armstrong

Publisher/Writer

2022 – Top Ten Stories – Repossession – Repossession History

The post 2022 – Top Ten Stories first appeared on CURepossession.

]]>The post Alliance of Illinois Repossessors to Require Storage on ALL Assignments! first appeared on CURepossession.

]]>

All the risk with none of the reward – Is FREE storage really free?

Over the last two years our industry has worked aggressively to build a transparent relationship between agent, forwarder, and lien holder. Many of us had thought we’d reached that goal. The Alliance of Illinois Repossessors (A.I.R) recently held an emergency Zoom meeting to discuss the security measures many agencies in Illinois have put in place with regard to the recent string of catalytic converter thefts in the area. After finishing that discussion, the conversation shifted to other issues needing to be addressed.

One company disclosed they had come across repossession notices, uploaded to multiple orders by a forwarding company, that were likely meant for the lien holder only. These documents included fees charged by the forwarder to the lien holder for services that were never performed by the repossession agency.

The agency was paid one third of what the lien holder was invoiced by the forwarder. Raising frustration levels further, the contract with this forwarder dictates agencies may not invoice storage fees, while at the same time billing the lien holder daily storage. All agencies in attendance agreed that secured storage is one of their greatest monthly losses.

With rising insurance rates, and some of the highest property taxes in the country, storage can no longer be provided for free. After a recent analysis done by members of our alliance, it was discovered the average per unit cost for storage in Illinois is between $12.00-$14.00 per day, depending on monthly recovery volume.

A.I.R requested, and received, data from Harding Brooks to further look into this issue. In 2022, to date, there were 254 claims filed for lot incidents, 118 of which were for theft, with a total of $1.6 million paid out. These figures were for claims filed. Every member of A.I.R has had incidents, that were not submitted as a claim, in fear of premiums rising above sustainable rates.

All this information comes back to the question, is free storage really free? The Agent network across the country are accepting all of the risk with none of the reward. This cannot continue.

On November 11, 2022, members of A.I.R unanimously voted on, and have agreed, that beginning January 1st, 2023, all members of the Alliance Of Illinois Repossessors will begin rejecting cases where a daily fee is not collected to offset the cost incurred to safely and securely store lien holders’ collateral and customers’ personal property.

A.I.R has always remained transparent to the industry and invites forwards and lien holders to contact them to discuss the need for this industry change.

The Alliance of Illinois Repossessors is a gathering of Repossession companies that will unite for the progression of the repossession industry within our state. AIR is composed of licensed members operating repossession agencies with the State of Illinois that together account for over 85% of the repossessed volume secured within the state, the purpose of this Association is to strengthen understanding between licensed Repossessors, law enforcement, financial institutions, regulatory agencies, and the consumer.

The Alliance of Illinois Repossessors

We are stronger together

Related Articles;

PAID IN FULL – Primeritus pays up

Alliance of Illinois Repossessors enforcing fuel surcharges

Alliance of Illinois Repossessors to Require Storage on ALL Assignments! – Fight for Fair Fees – Alliance of Illinois Repossessors

The post Alliance of Illinois Repossessors to Require Storage on ALL Assignments! first appeared on CURepossession.

]]>