The post Time Running Out To Win a Dynamic Slide In Unit first appeared on CURepossession.

]]>

There are only a few days left until the drawing for the Dynamic Slide In Unit is done at the American Towman Baltimore Tow Show exposition! You don’t need to be present to win, but you do need to buy some tickets to get your chance and to support the Recovery Agents Benefit Fund! Go online any time until 3pm on Saturday the 23rd and buy your raffle tickets online to support the RABF!

RABF has been helping repossessors and their families since 2002 and 2024 is already in the top 3 years of having the most paid out since the beginning of the fund and the year isn’t over yet.

To date the RABF has helped over 135 families disbursing over three quarters of a million dollars in assistance to repossession industry families in need of our support.

Will you step up, take a chance to win a Dynamic Slide In Unit and support the Recovery Agents Benefit Fund?

Scan the QR code below or click this link to buy your tickets now!

All federal, state and/or local taxes, fees, and surcharges are the sole responsibility of the prize winner. Charity makes no representation or warranty concerning the appearance, safety or performance of any prize awarded.

About the Recovery Agents Benefit Fund

About the Recovery Agents Benefit Fund

To date the Recovery Agents Benefit Fund has RABF has helped over 135 families disbursing over three quarters of a million dollars assisted over 120 families with disbursements totaling over $677,000. This amazing accomplishment would not be possible without the support of the repossession industry.

Giving to and supporting the RABF can happen in many different ways and the Board of the RABF and our advisory committee sincerely thanks every person, company, and organization that finds it in their heart and business culture to help. Organizations like Recovery Specialist Insurance Group, Allied Finance Adjusters Conference Inc and American Recovery Association host events annually that provide the RABF opportunities to fundraise and for attendees to give back.

At these events there are often auction events or raffles where companies and individuals like DRN, Dynamic Towing & Equipment, Miller Industries, Martin Giles from Atlanta Wrecker Sales, Detroit Wrecker Sales, Midwest Auto Auctions, BB Towing & Recovery in Hawaii, and others, donate items for auction or raffle which are what drive the donations from these annual events.

Recovery Agents Benefit Fund

(A 501(c)(3) Charitable Organization)

PO Box 4102

Manassas, VA 20108

Tax ID: 26-4434353

Phone: 703 ● 365 ● 0409 Fax: 703 ● 365 ● 0753

Time Running Out to Win a Dynamic Slide In Unit – Time Running Out to Win a Dynamic Slide In Unit – Time Running Out to Win a Dynamic Slide In Unit

Time Running Out to Win a Dynamic Slide In Unit – RABF – Recovery Agents Benefit Fund – Recovery Specialist Insurance Group – RSIG – Repossess – Repossession – Repossession Agency – Repossessor

The post Time Running Out To Win a Dynamic Slide In Unit first appeared on CURepossession.

]]>The post DRN Issues Statement on LPR Staging first appeared on CURepossession.

]]>From Jeremiah

There’s been a lot of discussion in the industry recently about LPR staging and the best timing to initiate it. I’d like to share my perspective on this important topic. Recovery agents who \receive first-placement assignments directly from lenders are among those most impacted by this issue. These direct assignments are critical to their operations, helping them offset the thinner margins they face with non-direct volume. While it’s not our place to dictate how lenders, forwarders, or agents should run their businesses, we strive to foster a balanced dialogue that benefits everyone involved.

That said, we recognize that only 12% of our active agents work with direct lenders, and the other 88% that do not are fine with staging happening at any point in the cycle. For them, the LPR process creates opportunities they might not otherwise have. Our goal isn’t to pick sides but to facilitate meaningful conversations between lenders, agents, and forwarders to find solutions that work for all parties.

Moving forward, we’ll be engaging in these discussions with a clear priority: ensuring the safety of agents and we hope that others will join us, driving towards this common goal.

– Jeremiah Wheeler,

President DRN | MVTRAC | SCM

Related Articles:

ARA and DRN Meet to Discuss LPR Safety

DRN Issues Statement on LPR Staging – DRN Issues Statement on LPR Staging – DRN Issues Statement on LPR Staging

DRN Issues Statement on LPR Staging – License Plate Recognition – LPR – Digital Recognition Network – DRN – Repossess – Repossession – Repossession Agency – Repossessor – Repossession Violence

The post DRN Issues Statement on LPR Staging first appeared on CURepossession.

]]>The post ARA and DRN Meet to Discuss LPR Safety first appeared on CURepossession.

]]>This week in Dallas, several ARA board members met with DRN to continue discussing the concerns of many recovery agents.

The group discussed several topics that ARA believes are negatively impacting the space which LPR technology is contributing to — reminding DRN that ARA’s main purpose will always be to enhance agent safety and minimize data manipulation which could lead to someone being hurt in an agent-on-agent interaction, including improved processes where only vetted agencies have access to LPR data.

While ARA plans to meet with DRN again in the near future to continue problem solving, DRN did state that they “will not support staging before day 10,” which is a benefit to the industry.

ARA is committed to keeping its members and the recovery industry updated with its progress in this area.

ARA and DRN Meet to Discuss LPR Safety – ARA and DRN Meet to Discuss LPR Safety – ARA and DRN Meet to Discuss LPR Safety

ARA and DRN Meet to Discuss LPR Safety – American Recovery Association – ARA – License Plate Recognition – LPR – Digital Recognition Network – DRN – Repossess – Repossession – Repossession Agency – Repossessor – Repossession Violence

The post ARA and DRN Meet to Discuss LPR Safety first appeared on CURepossession.

]]>The post Ohio Association of Repossessors Expands Upcoming 2024 Convention first appeared on CURepossession.

]]>Special Thanks to Sponsors for Their Support

On behalf of the Ohio Association of Repossessors (OAR), we are thrilled to announce the expansion of our highly anticipated annual convention, now scheduled for October 14 & 15, 2024. Originally planned as a small, member-focused gathering, the event has garnered significant interest across the repossession industry, transforming into a two-day event packed with exciting opportunities for networking, education, and collaboration.

We extend our appreciation to our generous sponsors; their support ensures that this event will be a memorable experience for all attendees:

- MV TRAC/DRN: Headline Sponsor

- Iron City Recovery: Cocktail Party Sponsor

- Location Services: Breakfast Sponsor

- Primeritus: Lunch Sponsor

- Iron City Recovery: Lanyard Sponsor

- InsightLPR: Snack Sponsor

- Resolvion: Beverage Sponsor

- MBSI: Hurricane Helene Fundraiser Sponsor

- Harding Brooks: Closing Party Sponsor

In addition, we would like to give special recognition to Clearplan, RDN and Royal Key Supply for their generous donation to the RABF (Recovery Agents Benefit Fund) silent auction, and to the American Recovery Association for their continuous support.

As part of our commitment to giving back, 10% of all sales and sponsorships from the event will be donated directly to RABF, helping to support recovery agents and their families in times of need.

How You Can Get Involved: For those interested in contributing to the silent auction or supporting the event, please contact OAR at President@OHIOAR.ORG . We encourage you to act fast, as tickets are limited. To register or learn more about joining the Ohio Association of Repossessors, visit our website at OhioAR.ORG.

We look forward to seeing you there and appreciate your ongoing support of the Ohio Association of Repossessors and the repossession industry.

DEFENDING & PROMOTING THE RIGHTS OF REPOSSESSORS IN OHIO

DEFENDING & PROMOTING THE RIGHTS OF REPOSSESSORS IN OHIO

About The Ohio Association of Repossessors (OAR)

Our mission as the Ohio Association of Repossessors is to foster strong connections among all Ohio repossession agencies. Through advocacy and education, we aim to create unity and advance all Ohio companies, promoting compliance and ethical practices. We strive to create a culture of continuous improvement throughout the repossession industry.

Ohio Association of Repossessors

PO Box 470092

Broadview Heights, Ohio 44147

Ohio Association of Repossessors Expands Upcoming 2024 Convention – Ohio Association of Repossessors Expands Upcoming 2024 Convention – Ohio Association of Repossessors Expands Upcoming 2024 Convention

Ohio Association of Repossessors Expands Upcoming 2024 Convention – State Repossession Associations – Repossess – Repossession – Repossession Agency – Repossessor

The post Ohio Association of Repossessors Expands Upcoming 2024 Convention first appeared on CURepossession.

]]>The post TONIGHT! Live Show – What is the Value of a Repossession Association? first appeared on CURepossession.

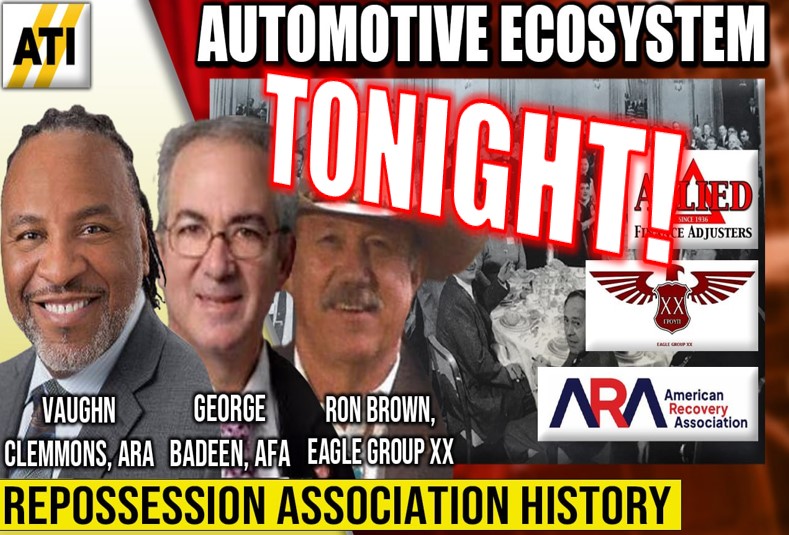

]]>ATI Live Show!

Tues Sept 24th, 8PM EST – 5PM PST

Once upon a time, the repossession associations ruled every aspect of the industry. From fees to marketing and exclusive territories, being an association member was a gold mine for their members. Fast forward forty years and all of that is gone which has been a frequent question of “what’s in it for me?” Join us for a very special episode of ATI where we are meeting the heads of the last three national repossession associations where they will answer this as well as reveal more details of the new ARA/AFA collaboration.

Joining us are George Badeen for the Allied Finance Adjusters (AFA), Vaughn Clemmons for the American Recovery Association and the legendary Ron Brown, founder of the Eagle Group XX. Co-hosting with Jay Wertzbereger is me, Kevin Armstrong, publisher at CUCollector and CURepossession.

We will be discussing the recent historic announcement of the shift toward greater cooperation between the two organizations, which have traditionally operated unconnectedly, to say the least. In addition, we be talking about:

- Forwarding

- Fees

- Difficulty discussing fees in specificity

- Most Common Objections to Joining?

- Benefits

- Writing Our Own Rules and Standards – Take control or others will do it for the industry

- Divisions Created by Vendors – contracts, terms and conditions used to divide and conquer the industry

- LPR Antitrust – DRN Contracts, what can be done?

- Association Merger?

We will be monitoring the live chat and may from time-to-time dip into your questions, so please come join tonight, Tues Sept 24th, 8PM EST – 5PM PST

Click HERE to Join us!

TONIGHT! Live Show – What is the Value of a Repossession Association? – TONIGHT! Live Show – What is the Value of a Repossession Association? – TONIGHT! Live Show – What is the Value of a Repossession Association?

TONIGHT! Live Show – What is the Value of a Repossession Association? – American Recovery Association – ARA – Allied Finance Adjusters – AFA – Repossess – Repossession – Repossession Agency – Repossessor

The post TONIGHT! Live Show – What is the Value of a Repossession Association? first appeared on CURepossession.

]]>The post GALR 2024 Conference Wraps Up with Record Attendance first appeared on CURepossession.

]]>The Georgia Association of Licensed Repossessors (GALR) 2024 Conference exceeded the expectations of its organizers. “We registered 77 people as of last night,” commented GALR Treasurer Clayton Merritt on the first day of the event, held at the scenic Lanier Islands Resort in Buford, GA. Attendees came from across Georgia as well as from North Carolina, South Carolina, Tennessee, Florida, and Texas, more than doubling last year’s attendance.

Lanier Islands Resort, a 1,200- acre retreat, offers a variety of activities, including golf, water sports, and snow tubing. The Lodge Hotel, where attendees stayed, is an ornately decorated venue featuring a rustic cabin theme, complete with multiple restaurants, bars, and a poolside fire pit. But I digress…

Day 1 Highlights

Day 1 featured a half – day program, starting with GALR’s annual business meeting and elections. No changes were made to the board, as all current members were re-elected to their respective positions.

Following the meeting was a scheduled 2.5- hour locksmith training session led by Jessica Merritt of Artis Recovery. Jessica demonstrated the programming of two universal remotes for different makes and models of vehicles, offering insight into how today’s advanced equipment is used. After the demonstration, she spent over an hour answering attendees’ questions about equipment and how automotive locksmithing can be integrated into repossession services.

Day 2: A Full Schedule of Events

Day 2 was packed from 8 a.m. to 6 p.m. “We apologize, but the program kept expanding,” Clayton Merritt explained, referencing the growing interest and the volume of information GALR felt was essential to share with the industry.

If the goal was to deliver a wealth of valuable information, GALR certainly succeeded. Numerous topics were explored from multiple angles. Contracts, for instance, were examined from an insurance perspective by Jon Pollard and Renee Lowe of Harding and Brooks, a legal perspective during Mark Howk’s session on frivolous lawsuits, and in the Client Panel Discussion. Each session built upon the last, ensuring attendees gained a comprehensive understanding of the subject matter.

If the goal was to deliver a wealth of valuable information, GALR certainly succeeded. Numerous topics were explored from multiple angles. Contracts, for instance, were examined from an insurance perspective by Jon Pollard and Renee Lowe of Harding and Brooks, a legal perspective during Mark Howk’s session on frivolous lawsuits, and in the Client Panel Discussion. Each session built upon the last, ensuring attendees gained a comprehensive understanding of the subject matter.

While it’s difficult to cover every session in detail, GALR acknowledges the invaluable contributions of all participants. “We couldn’t have had a convention without their willingness to share their knowledge,” said GALR President John Newberry of Eagle Eye Recovery.

Here’s a quick look at some of the key sessions and presenters:

- Locksmith Demonstration – Jessica Merritt, Artis Recovery

- Contract Review – Jon Pollard and Renee Lowe, Harding and Brooks Insurance Agency

- Client Panel Discussion

Moderator: Wes Carico, Artis Recovery

Panelists: Bill Sheehan (COO, Trinity Financial Services), Jason Clark (Managing Partner, Resolution Management Group), Jeremy Turner (Director, Vendor Management, Location Services), Keith Daymond (Executive VP, Victory Recovery Services), Ryan Medina (VP Vendor Management, MVRecovery MVTRAC)

- GA Personal Property Law and Frivolous Lawsuits – Mike Howk, JD, Risk Manager, RSIG

- MBSI Software Update – Ray Peloso

- Preventing Breach of Peace – Mark Lacek, Repossession Litigation Consultant

- Improved Relations Between MVTrac & Vendor Network – Ryan Medina, James McGee, Josh Harley, and Johnnie Renfro of MVRecovery MVTRAC

Panel Discussion

“People are worried about getting ambushed,” Clayton Merritt shared when discussing the process of organizing the panel. To ease concerns and build credibility, the format, objectives, topics, and sample questions were sent to the panelists well in advance. This approach allowed for deeper exploration of complex issues, explained Moderator Wes Carico.

The discussion covered several pressing topics, including stagnant rates, contractual language, and agent safety. Each panelist shared insights into how their businesses viewed and addressed these challenges. A few key takeaways emerged:

Wes highlighted the unique role forwarders play in the industry as both clients and competitors. He suggested that repossession companies should observe and emulate forwarders’ successful business practices.

Negotiation was another common theme. Both pricing and contract language, panelists emphasized, can and should be negotiated. “We ‘red-line’ every word of our contracts,” one panelist remarked, stressing the importance of scrutinizing terms. Another panelist reminded attendees of the need to review contracts annually, especially to request adjustments for inflation if such provisions aren’t already built in.

Safety was a major concern for all panelists, who recognized the role of forwarders in keeping dangerous or rogue companies out of the industry. The implication was clear: providing opportunities to these risky organizations not only threatens the industry’s reputation but also diverts funds from legitimate clients (lien holders) and supports potentially harmful activities. Though I’m no expert in liability, this seems to be an area where many in the industry need to tread carefully.

There was also a call for industry software providers to improve their tracking tools for identifying potential risks in high-risk accounts or addresses. “You are their revenue stream,” Wes explained, urging forwarders to push for better solutions. The panel also agreed to explore ways to support the Recovery Agents Benefit Fund (RABF) so Ed Marcum and his team can continue to assist families impacted by their loved ones work in the repossession industry.

Overall, the panel addressed sensitive topics, provided valuable insights, and fostered commitments around safety and industry support.

GALR wanted to extend its deep appreciation to the panelists for their participation and dedication. These five individuals are among the most successful leaders in the industry, and their willingness to share their viewpoints on key issues was a tremendous benefit to everyone in attendance.

Liability in the Industry

Liability was a central theme throughout the conference, with several presenters offering insights from their areas of expertise. Jon Pollard emphasized the importance of reviewing Garage Keepers policies, noting a disturbing trend where Direct Primary Garage Keepers policies exclude coverage for acts of God, such as rain, hail, or wind damage. This exclusion, he explained, negates the purpose of Direct Primary coverage and leaves insureds exposed.

Renee Lowe stressed the need for every repossession company to have a contract in place with its clients, even if it’s just a simple one-page agreement. She also highlighted the importance of ensuring that contracts with brokers or forwarders extend coverage to their clients as well. Both Renee and Jon encouraged attendees to reach out with questions and review contracts. “We can’t give legal advice,” Renee clarified, but she explained they would point out where contract language might negatively affect your coverage.

Mike Howk, RSIG’s Risk Manager and a national expert in repossession law, warned of a troubling new trend: “You cannot insure against a crime.” He explained that if you’re sued and the allegations are purely criminal, your insurance will not cover the case. However, if there’s at least one civil allegation, the insurance will help defend against all claims under a “commonality of defense” principle.

In a side conversation, Ed Marcum further explained that this trend is becoming more common in states where possession laws are being more clearly defined. “It eliminates the common civil allegation of breach of peace,” leaving lawsuits to focus on criminal sections of state code or parts of the FDCPA (Fair Debt Collection Practices Act) considered criminal. He cited a case in California where the insured will likely not be covered, as no civil allegations were made, and the way the law is written leaves no room for one to be added.

As more associations consider sponsoring or proposing legislative changes, this should serve as a cautionary tale: poorly considered legislation can have unintended consequences, so it’s crucial to involve all industry stakeholders in the conversation.

Repossession Litigation Consultant Mark Lacek delivered dynamic content on the importance of policies, documentation, and employee training. He began by holding up a copy of Nostalgic Towing/Artis Recovery’s “No Follow, No Chase” policy recommending everyone adopt a similar policy.

Repossession Litigation Consultant Mark Lacek delivered dynamic content on the importance of policies, documentation, and employee training. He began by holding up a copy of Nostalgic Towing/Artis Recovery’s “No Follow, No Chase” policy recommending everyone adopt a similar policy.

He also urged attendees to consider how their company’s image could impact potential litigation, recalling a case where a defendant’s company was named “Rambo.” “Who do you think the jury is going to believe?” he asked.

Mark’s overarching message was clear: credibility and image stem from every aspect of a business, including its name, policies, procedures, equipment, attire, and documentation. These elements all contribute to how a company will be perceived in court, even though most cases never go before a jury.

Experts like Mark are often hired to assess a company’s professional and operational standards as they relate to any case. Throughout the conference, the recurring message was that failing to maintain professional standards increases the frequency of claims. Jon Pollard summed it up: “Frequency breeds severity.”

My takeaway – Illegal, improper, or improperly motivated actions lead to claims, poor image and documentation lead to larger payouts directly from your profits!

Fundraising and Fun

GALR also welcomed four new members during the event. The day ended with a lively fundraising e ort that began with a raffle and auction. The real excitement, however, came when an anonymous donor pledged $600 if Ed Marcum, CEO of RABF, would jump into the pool. Ed enthusiastically accepted, declaring, “Anything for the cause.”

This sparked a series of challenges, with several professionals in business attire attracting everyone’s attention by diving into the pool. Credit Acceptance Corp’s Tiny Sebastian and MVRecovery MVTRAC’s Johnnie Renfro wrapped up the plunge, raising an impressive $3,000 combined. The event raised over $11,000 for GALR and the Recovery Agents Benefit Fund (RABF), although the exact allocation was not known at the time of this release.

Networking and Industry Connections

As with any great conference, some of the most valuable exchanges took place during breaks, meals, and evening gatherings. GALR provided an ideal platform for vendors to meet new clients. Clayton Merritt worked closely with client representatives to address coverage gaps, while many new business relationships were formed through casual introductions. This reflects the growing credibility and influence of GALR, especially considering this was only its second annual conference.

While it’s uncertain whether GALR will o er deeper dives into any of the sessions, you can stay updated by following their Facebook page (search for “Georgia Association of Licensed Repossessors”) or visiting their website at https://galr.org .

In Closing

GALR extends its heartfelt thanks to all the participants and speakers for making the 2024 conference a memorable and successful event. A special thank you to the staff at Lanier Islands for providing excellent facilities and support.

Thank you to all the sponsors:

Gold – DRN, MVTRAC, Trinity, Harding Brooks, MBSi Corp, RDN

Silver – Loss Prevention Services

Bronze – Resolvion

Kudos to the entire GALR team for their hard work and dedication in organizing this event. Having attended numerous industry events over my 17- year career, this one struck the perfect balance of education, camaraderie, and business. Well done, GALR!

Wes Carico

Nostalgic Towing

Artis Recovery

GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance – GALR 2024 Conference Wraps Up with Record Attendance

GALR 2024 Conference Wraps Up with Record Attendance – State Repossession Associations – RABF – Recovery Agents Benefit Fund – Repossess – Repossession – Repossession Agency – Repossessor

The post GALR 2024 Conference Wraps Up with Record Attendance first appeared on CURepossession.

]]>The post Recovery Industry Mastermind Armor Update first appeared on CURepossession.

]]>Dear friends and colleagues,

The Recovery Industry Mastermind (RIM) Committee met again on Thursday August 29th. The primary objectives were to:

Finalize the structure of the organization

Finalize the structure of the organization

Determine how funds would be collected and distributed

Determine how funds would be collected and distributed

Vote on the qualification requirements to receive financial assistance through RIM

Vote on the qualification requirements to receive financial assistance through RIM

Determine next steps

Determine next steps

Here’s an update on the progress the Committee has made so far:

Entity Organization: The RABF has graciously offered to allow RIM to “roll up” under their existing entity. This would eliminate the need for RIM to apply on its own to qualify for non-profit status. It would also allow us to collect and distribute funds jointly on the RABF platform, while ensuring the funds are kept appropriately separate. We are working out the details now.

Entity Organization: The RABF has graciously offered to allow RIM to “roll up” under their existing entity. This would eliminate the need for RIM to apply on its own to qualify for non-profit status. It would also allow us to collect and distribute funds jointly on the RABF platform, while ensuring the funds are kept appropriately separate. We are working out the details now.

Qualifications: The committee voted on the eligibility requirements to receive financial assistance through RIM:

Qualifications: The committee voted on the eligibility requirements to receive financial assistance through RIM:

- To be eligible to receive assistance, the agent must be a member in good standing with the ARA, Eagle 20, AFA or other approved and recognized industry association or group.

Equipment: The committee has identified a safety equipment manufacturer who has expressed interest in joining with RIM to provide body armor and potentially light truck armor. Due diligence is currently in the works.

Equipment: The committee has identified a safety equipment manufacturer who has expressed interest in joining with RIM to provide body armor and potentially light truck armor. Due diligence is currently in the works.

See photos!

Next steps: RIM committee members are working on contract verbiage and will provide it to RABF for redlining, then schedule a follow up meeting with RABF to take place within 30 days.

Next steps: RIM committee members are working on contract verbiage and will provide it to RABF for redlining, then schedule a follow up meeting with RABF to take place within 30 days.

Once again, a huge THANK YOU to the committee members for investing their time, energy, effort, and financial resources. This is a very real commitment and deserves to be recognized.

Vaughn Clemmons, Automobile Recovery Bureau

Vaughn Clemmons, Automobile Recovery Bureau

Amy Bednar, Relentless Recovery

Amy Bednar, Relentless Recovery

James McNeil, Daybreak Metro

James McNeil, Daybreak Metro

Richard Grosvenor, Speedy Recovery

Richard Grosvenor, Speedy Recovery

Jeremiah Wheeler, DRN, MVTRAC & SCM

Jeremiah Wheeler, DRN, MVTRAC & SCM

Ron Brown, CSI Group, Eagle Group, NAFI

Ron Brown, CSI Group, Eagle Group, NAFI

Starr Sawalqah, Alpha Recovery

Starr Sawalqah, Alpha Recovery

Dave Baker, PK Willis

Dave Baker, PK Willis

We expect things to move along more quickly moving forward, and we will keep you up to date when we have info to share.

If you would like to share your ideas, please join the conversation on the RIM Facebook page.

Thank you for your support!

Related;

Recovery Industry Mastermind UPDATE

Recovery Industry Mastermind – Join Us Tomorrow!

Recovery Industry Mastermind Armor Update – Recovery Industry Mastermind Armor Update – Recovery Industry Mastermind Armor Update

Recovery Industry Mastermind Armor Update – – Repossess – Repossession – Repossession Agency – Repossessor – Repossession Violence – Repossession History – American Recovery Association – ARA

The post Recovery Industry Mastermind Armor Update first appeared on CURepossession.

]]>The post A BIG Thank You from the Tennessee Repossessors Association! first appeared on CURepossession.

]]>There’s still time to register!

September 28, 2024

Dear Supporters,

On behalf of the Tennessee Association of Accredited Repossessors, we are pleased to extend our deepest gratitude to our sponsors for their support of our upcoming event scheduled for September 28, 2024.

The board wishes to express our sincere appreciation to our sponsors for their generous contributions, which play a vital role in ensuring the success of our annual convention. Your dedication and support to our association is truly appreciated!

MV TRAC/DRN: Presenting Sponsor (Gold)

Harding Brooks: Speaking Sponsor (Gold)

Flying A: Lunch Sponsor (Gold)

Flying A: Lanyard Sponsor (Gold)

Resolution Management Group: Badge Sponsor (Silver)

Repo IQ: Door Sponsor (Silver)

Location Services: PM Break (Silver)

Primeritus: AM Break (Bronze)

If you have not registered yet, we encourage you to do so ASAP! The board is working tirelessly to prepare for the event and ensure there is enough food for all attendees, speakers, and sponsors! 10% of member and non-member sales will be donated to RABF! Click here to register: https://www.zeffy.com/ticketing/791ca5a7-e91a-44cd-a11b-7d0270d134b7

In addition to the 10% ticket sales we will also be having a silent auction to provide more monetary support for RABF! We are still looking for a few more donations! We would like to give a huge shout out to RDN/Clearplan for donating 3 months free for each! Contact Lauren Kimbrell if you would like to contribute to the silent auction at 615-516-9918!

To join the Tennessee Association of Accredited Repossessors please click here https://www.zeffy.com/ticketing/1952d4b3-73ec-471e-a563-fe30a18d020f

There are several different levels of memberships, and we need YOU! Join today!

Sincerely,

Lauren Kimbrell

President

615-516-9918

The Tennessee Association of Accredited Repossessors (TAAR), the State association for the repossession and collateral recovery industry in Tennessee. As a collective voice for our members, we are dedicated to advancing the interests of professionals in this vital sector. Our association strives to promote excellence, integrity, and compliance within the repossession industry while fostering a supportive and collaborative community.

At TAAR, our primary focus is to provide our members with the support, resources, and representation they need to thrive in their repossession businesses. We understand the unique challenges and complexities faced by professionals in this industry, which is why we offer a range of benefits designed to assist you every step of the way. From educational programs and training sessions to legal guidance and compliance updates, we are committed to keeping our members well-informed and equipped with the knowledge and skills necessary to navigate the ever-evolving landscape of repossessions in Tennessee.

Compliance and ethical practices are at the core of our association. We are dedicated to upholding the highest standards of professionalism, integrity, and legal compliance within the repossession and collateral recovery industry. By adhering to our code of conduct, our members demonstrate their commitment to conducting business with honesty, respect, and fairness. Through advocacy efforts, we strive to shape favorable policies and regulations that support the growth and success of our members, while ensuring the rights of all parties involved are protected. Join TAAR today and become part of a dynamic community committed to excellence in repossession and collateral recovery in Tennessee.

Member Support and Representation

TAAR aims to provide support and representation to its members, who are professionals in the repossession industry. This involves offering resources, guidance, and assistance in dealing with challenges and issues specific to the field. The association acts as a collective voice for its members, advocating for their rights and interests at both the state and national levels.

Compliance and Legal Awareness

Another important goal is to promote compliance with all relevant laws, regulations, and industry standards. The association plays a crucial role in keeping its members informed about changes in legislation, regulatory requirements, and legal precedents that impact the repossession industry. It offers educational programs, training sessions, and access to legal expertise to ensure members operate within the boundaries of the law.

Professionalism and Ethics

The association strives to elevate the professionalism and ethical standards within the repossession industry. It establishes a code of conduct that members must adhere to, promoting honesty, integrity, and respect in all aspects of their work. By setting high professional standards, the association aims to enhance the reputation of its members and the industry as a whole.

Industry Advocacy and Networking

This goal focuses on advocating for the best interests of the repossession industry. The association actively engages with government entities, regulatory bodies, and other relevant stakeholders to ensure that the concerns and perspectives of its members are heard and considered. It also fosters networking opportunities among members, encouraging collaboration, knowledge sharing, and business growth within the repossession community.

P.O. BOX 332783 MURFREESBORO, TN 37133

A BIG Thank You from the Tennessee Repossessors Association! – A BIG Thank You from the Tennessee Repossessors Association! – A BIG Thank You from the Tennessee Repossessors Association! – A BIG Thank You from the Tennessee Repossessors Association! – – A BIG Thank You from the Tennessee Repossessors Association!

A BIG Thank You from the Tennessee Repossessors Association! – Repossess – Repossession – Repossession Agency – Repossessor – State Repossession Associations – TAAR

The post A BIG Thank You from the Tennessee Repossessors Association! first appeared on CURepossession.

]]>The post Life Imitates Art on TV Repossession first appeared on CURepossession.

]]>Benson, NC – June 7, 2024 – They say that sometimes life imitates art. If you consider cartoons to be art, then I suppose a 28-year-old Rent-A-Center employee was perhaps channeling Barney Rubble from the Flintstones when he allegedly broke into a home to repossess a TV.

On May 29th, Brenton Jaekwon Mosley, 28, of Four Oaks was charged with felony breaking and entering and felony larceny. His alleged crime according to the Johnston County Sheriff’s Office; forcibly entering an apartment to repossess a TV set.

Charges against Mosley claim that on May 11th, Mosley went to an apartment on Jarvis Lane in an attempt to repossess a TV from a customer that had fallen behind on their payments.

The unnamed 32-year-old victim claims that no one was at home when Mosley arrived and that the accused forcibly entered the apartment and repossessed the TV set. He also claims that a $1,500 laptop was missing from their apartment.

Investigators report that they found suspected damage to the front door where entry had been made. Ring doorbell camera video was also seized as evidence.

Mosley was given a $30,000 bond on the two criminal charges.

Source: Johnston County Report

Way back in October of 1960, when the Flintstones aired, episode 4 was the infamous episode “No Help Wanted” episode where Barney gets a job as a Repo Man. His first assignment; repossessing Fred’s TV. While Barney doesn’t actually break into Fred’s cave/home, he does blatantly trespass.

What few in the repossession industry may remember is that decades ago, Repossessors used to have to work their way up to cars by repossessing TV’s, radios, tires, batteries and furniture (sticks as they were called back then.) Even then, incidents like the one reported above were not uncommon.

If you ever want to hear some great stories about what the repossession industry was like during the 1950’s-1960’s, you should read Bill “The Cadillac Man” Bowser’s book; The Man Came and Took it Away. Jeremiah at DRN gave me an original copy a couple of years ago. It’s really a great read.

If you ever want to hear some great stories about what the repossession industry was like during the 1950’s-1960’s, you should read Bill “The Cadillac Man” Bowser’s book; The Man Came and Took it Away. Jeremiah at DRN gave me an original copy a couple of years ago. It’s really a great read.

Related Articles:

Repossession history – the 50’s-60’s memoirs of Bill Bowser

Repo history’s most gruesome murder

Motor City – The Cradle of the Repossession Industry

Tales From a Repo Industry Pioneer – 1949

On this day in repossession history, 1994 – John Henry Peters murder

The History of Auto Repossession in North America – The 1920’s

The First Repo Man and First Auto Repo in History

Life Imitates Art on TV Repossession – Life Imitates Art on TV Repossession – Life Imitates Art on TV Repossession

Life Imitates Art on TV Repossession – Repossess – Repossession – Repossessor – Repossession History

The post Life Imitates Art on TV Repossession first appeared on CURepossession.

]]>The post Recovery Industry Mastermind UPDATE first appeared on CURepossession.

]]>Dear friends and colleagues,

Since our first Recovery Industry Mastermind event, we have formed a committee to help accomplish the established initiatives and to facilitate getting the needed infrastructure in place.

To clarify, our first initiative is to get body armor and body cameras into the hands of the smaller recovery businesses who may not have the financial ability to purchase this important safety equipment for themselves.

The committee will be responsible for several tasks:

- Setting qualification parameters

- Collecting donations

- Navigating any tax and legal requirements

- Getting the equipment into the right hands

We would like to introduce you to the RIM committee members and extend a big THANK YOU for their willingness to step in and help.

Vaughn Clemmons, Automobile Recovery Bureau

Amy Bednar, Relentless Recovery

James McNeil, Daybreak Metro

Richard Grosvenor, Speedy Recovery

Jeremiah Wheeler, DRN & MVTRAC

Ron Brown, CSI Group, Eagle Group, NAFI

Starr Sawalqah, Alpha Recovery

Dave Baker, PK Willis

The first committee meeting will be Friday, April 26th, and the agenda is lengthy. It’s going to take some hard work, but we are committed to addressing the problems plaguing our industry. Now is the time to act.

If you would like to share your ideas, join the conversation on the RIM Facebook page.

Thank you for your support!

Related;

Recovery Industry Mastermind – Join Us Tomorrow!

American Recovery Association · 1400 Corporate Drive Suite 175 · Irving, TX 75038 · USA

Recovery Industry Mastermind UPDATE – Recovery Industry Mastermind UPDATE – Recovery Industry Mastermind UPDATE

Recovery Industry Mastermind UPDATE – American Recovery Association – ARA – Repossession Violence – Repossession – Repossess – Repossession – Repossession Agency – Repossessor

The post Recovery Industry Mastermind UPDATE first appeared on CURepossession.

]]>The post Vaughn Clemmons: The State of Our Industry Preview first appeared on CURepossession.

]]>A Word From ARA President

Vaughn Clemmons

Vaughn Clemmons, ARA President, shares a word about why this NARS marks an inflection point in our industry. He’ll be sharing much more in his State of Our Industry address on Friday April 12th at 8:45 am EDT – here’s a preview!

And there’s a whole lot more in store for you at NARS – here’s a snapshot of the session topics:

Decode The Silent Threat: Mastering the Art of Body Language with Keynote Speaker Joe Navarro, The Body Language Academy

Decode The Silent Threat: Mastering the Art of Body Language with Keynote Speaker Joe Navarro, The Body Language Academy

Electric Vehicle (EV) Repossession Training from Recovery to Storage

Electric Vehicle (EV) Repossession Training from Recovery to Storage

The Agents’ Solution to the Storage Nightmare

The Agents’ Solution to the Storage Nightmare

What I Wish I’d Known … A Cautionary Tale for Small, Medium, & Large Recovery Companies

What I Wish I’d Known … A Cautionary Tale for Small, Medium, & Large Recovery Companies

QuickBooks Deep Dive: Understanding the Financial Health of Your Business

QuickBooks Deep Dive: Understanding the Financial Health of Your Business

Surviving the Streets: An introduction into Situational Awareness for Today’s Repossessor

Surviving the Streets: An introduction into Situational Awareness for Today’s Repossessor

The Most Important Business Metrics You’re Not Tracking

The Most Important Business Metrics You’re Not Tracking

A Breach of Peace Dramatization

A Breach of Peace Dramatization

Recovery Masters’ Safety Training for Your Agents

Recovery Masters’ Safety Training for Your Agents

And a LOT more!

If you missed out on registration for the Harding Brooks and DRN Closing Party, all is not lost!

Stop by DRN’s exhibitor booth to pick up a free ticket to EPCOT (75 available, only for those who were not able to register for the closing party).

You may also purchase discounted EPCOT tickets HERE.

And if you have questions about EPCOT tickets or need help, call Disney directly at (407) 566-5600 and provide group code G0837486.

Check out the full agenda and line-up of speakers

See you April 10th for the 60th ARA Convention (ARA Members only), then April 11th and 12th at the 15th Annual NARS in Orlando!

Vaughn Clemmons: The State of Our Industry Preview – Vaughn Clemmons: The State of Our Industry Preview – Vaughn Clemmons: The State of Our Industry Preview

Vaughn Clemmons: The State of Our Industry Preview – NARS – North American Repossessors Summit – American Recovery Association – ARA – Repossess – Repossession – Repossession Agency – Repossessor

The post Vaughn Clemmons: The State of Our Industry Preview first appeared on CURepossession.

]]>The post Class Action Lawsuit Against DRN Goes to Court in May first appeared on CURepossession.

]]>Plaintiff’s lawyers describe DRN’s actions as a “mass surveillance program.”

Fort Worth-based License Plate Recognition (LPR) company Digital Recognition Network (DRN) is apparently heading to court in California this May. On trial are allegations that their capturing of license plate data violates California’s Automated License Plate Recognition (“ALPR”) statute. At risk are potential payouts of $2,500 to up to 23 million Californians. That’s a potential $57B!

In 2021, California resident Guillermo Mata sued Texas-based DRN for selling location data of people’s vehicles to marketers, repo agencies, and insurers. Last September, the lawsuit was granted class action status. The lawsuit alleges that the actions of DRN violate California’s Automated License Plate Recognition (“ALPR”) statute regulating the use of automatic license plate readers.

The class action lawsuit alleges that DRN used a series of cameras to record the license plate data of millions of vehicles. The database is said to include the plate number, along with the date, time, and GPS location of where it was captured. Before including this data in its database, the company allegedly did not provide the required notice to the vehicle owners, nor did it follow the relevant laws regarding data protection.

Unless they opt out, all California residents whose license plate data was collected at least 15 times since 2017 are automatically designated as class members. Those who request to exclude themselves by March 7, 2024, will not be part of the class action, and will retain their right to sue DRN separately. However, they will miss out on their share of a monetary settlement, should one be obtained.

The lawsuit alleges that DRN’s LPR cameras have been used on public roads to scan license plates in a manner violating a 2016 California law requiring notice to the vehicle owners as well as relevant laws regarding data protection.

The law stipulates a $2,500 minimum payout for each victim. The total number of affected vehicles is estimated to be about 23 million. That could be as much as $57B if awarded the full estimate. The plaintiff’s lawyers describe DRN’s actions as a “mass surveillance program.”

You can check whether you qualify as a class member by going over to the case website.

In a statement to SFGate, Eli Wade-Scott, a lawyer for Edelson PC, the firm representing the class members, said that DRN’s actions violate California’s privacy laws and peoples’ civil liberties. According to him, “DRN is capturing a pretty detailed picture of people’s lives … That could be capturing you at home, at work, at your school, your house of worship, at your doctor.”

DRN, refutes the allegations that its actions violated any California law. They maintain that “neither Plaintiff nor any similarly situated person has suffered any harm,” and claims that the law in question “does not prohibit the collection or storage of ALPR information.” The trial is scheduled to begin on May 17th in San Diego County Superior Court. That is, barring an early settlement.

Source: Techspot

Class Action Lawsuit Against DRN Goes to Court in May – Class Action Lawsuit Against DRN Goes to Court in May – Class Action Lawsuit Against DRN Goes to Court in May

Class Action Lawsuit Against DRN Goes to Court in May – Repossess – Repossession – Digital Recognition Network – DRN – Lawsuit – Lawsuit

The post Class Action Lawsuit Against DRN Goes to Court in May first appeared on CURepossession.

]]>