Repossessions – 2023’s Third Biggest CFPB Complaint

CFPB releases 2023 Consumer Response Annual Report

Last month, the Consumer Financial Protection Bureau (CFPB) announced their intention to begin collecting repossession data from a select number of lenders to get a better understanding of their repossession practices. Perhaps we now know why.

On March 29th, the CFPB released their 2023 Consumer Response Annual Report. Within the report, which gathered an approximate 1,657,600 consumer complaints over the period of January 1 to December 31st, 2023, repossession related complaints accounted for the third most common complaint.

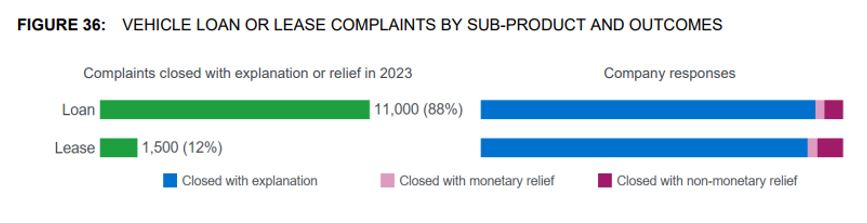

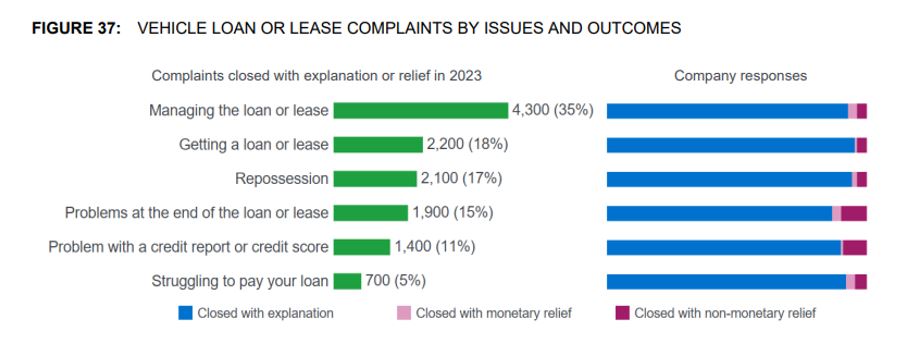

Reported in section 4.7 (page 51), The CFPB reported that in 2023, they received approximately 17,700 vehicle loan or lease complaints. In response, the CFPB sent 13,000 (73%) of these complaints to companies (lenders) for review and response. Another 21% were referred to other regulatory agencies and another 6% were found not to be actionable.

As of March 1, 2024, 0.1% of vehicle loan or lease complaints were still pending with the consumer and less than 0.1% were still pending with the CFPB.

Read the Entire Report Here!

Vehicle loan or lease complaints closed with explanation or relief volume increased in 2023. The January 2023 spike in complaints was mainly driven by the CFPB’s enforcement action against Wells Fargo that, in part, addressed CFPB concerns about its repossession mismanagement, incorrect payment processing, and failure to ensure guaranteed asset protection (GAP) product refunds to consumers (Figure 38). The spike in August complaints was partly due to a portfolio transfer between two companies, leading to various servicing issues for consumers.

For example, following transfer, consumers reported incorrect payment histories, unauthorized add-on and repayment agreements, and unauthorized charges. In some cases, these servicer errors resulted in late fees and repossessions.

In 2023, the monthly average for the top issue, Managing the loan or lease, increased 77% compared to the monthly average for the prior two years (Figure 39)

Consumers reported vehicle repossessions without notice. Other consumers stated that they were never offered the opportunity to reclaim the vehicle after paying off or catching up on their loan (known as redemption or reinstatement) following the repossession of their vehicle.

Some consumers argued that their car was repossessed despite on-time payments or protections they should have been given pursuant to the Servicemembers Civil Relief Act (SCRA). Some consumers expressed frustration that they were actively working with their lender on a new repayment plan that better fit their financial needs; nevertheless, they found their car repossessed.

Some company responses recommended that the consumer reach out to the towing company responsible for carrying out the repossession. In other company responses, the companies indicated they could not provide any further assistance, asserting that all available options had been exhausted.

Consumers’ complaints detailed incorrect loan balances and difficulties with payment processing. Consumers reported late fees on their account despite on-time payments.

Consumers also expressed confusion about deficiency balances after receiving insurance claim payments, or voluntarily surrendering, or reselling vehicles. Company responses typically stated that balances were correct and provided explanations of additional fees or interest requirements.

Companies sometimes explained remaining balances that occurred due to a lack of full balance coverage on the part of insurance companies or following repossession or resale. In some instances, companies did admit to delays in payment processing and appropriately adjusted balances.

Related Articles;

CFPB Orders Repossession Data from Lenders

More Stories

Tragedy Strikes Benchmark Recovery Family – Help Needed!

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo

National Dealer Association Responds to Senate Repossession Probe

AFSA – Setting the Repossession Records Straight