How Many Cars Were Repossessed in 2023?

How Does That Stack Up to The Past?

How many cars were repossessed last year? That’s a damn good question with no exact way to know, but the auto industry experts at Cox Automotive seem to have a pretty good handle on it. What their data says paints an interesting picture of where the repossession industry is, has been and may be going.

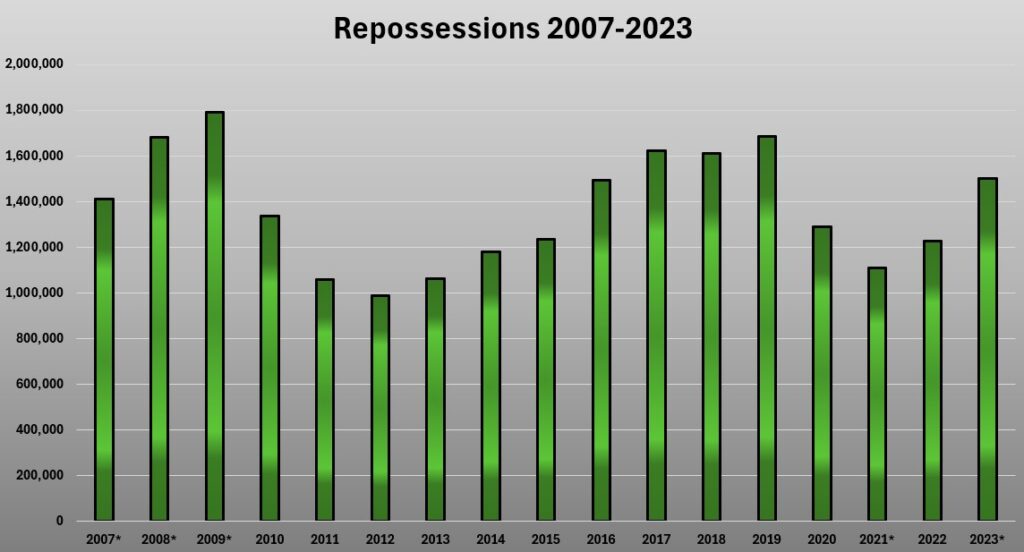

Let’s start with 2023. In a February 22 article in Consumer Affairs, they posed the question of How many cars are repossessed each year? 2024. In their article they offered data that quoted their source as Cox Automotive; *Estimate; precise figure not reported.; Source: Cox Automotive, 2021 and 2023. They furthermore quote that 2022

Assuming this data to be as reliable as available, it illustrates the ebb and flow of the tides of repossession volume over some very tumultuous years. But that data ends in 2022 and leaves the question of last year.

In a March 6 article on a Repossessions page in Debt.org, they quote Cox Automotive as; Approximately 1.5 million vehicles were repossessed in 2023. Again, assuming their source reliable, we’ve got a pretty good chunk of time, but I found more!

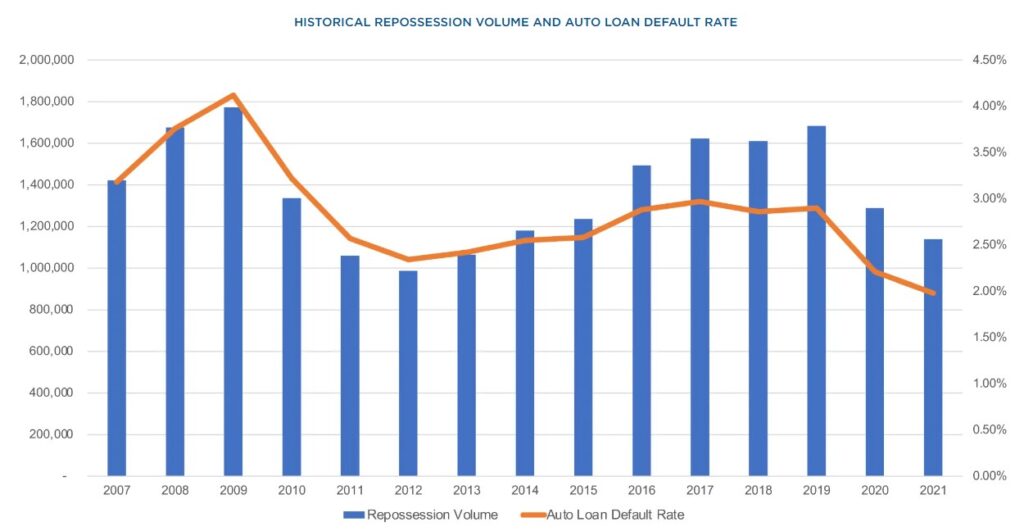

In August of 2022, Cox Automotive published an article titled Auto Loan Defaults Are Increasing, But We Are Not Heading Into A Repo Crisis. In this, they posted the above chart that went back to 2007.

Unfortunately, it does not provide a data table, but it’s fair to make estimates. Since there is no exact way to count the numbers of repossessions nationally, Cox Automotives estimates are likely to be the best available.

They report that they develop this data using the following methodology;

Unfortunately, there is no government or third-party source that officially and accurately tallies repossession volumes. As the country’s largest auto auction, Manheim repossession volume trends serve as one proxy for the overall market. Working with Equifax data, Cox Automotive has also established a view of auto loan defaults to track the basis for repossessions. We define defaults as auto loans that are beyond 120 days past due but exclude loan accounts in bankruptcy proceedings.

Historically, the default volume is larger than the actual repo volume, as approximately 20% of auto loans in default never become a repossession. There are many reasons for this, including situation when the lender chooses not to pursue a repossession, such as when the vehicle value or default amount may not be worth the effort or when the consumer and lender work out some other plan.

It’s interesting to see it all charted. Hard to believe that the repossession volume hasn’t even recovered to the pre-pandemic years, but then again, those were better years than a long stretch after the great recession. Perhaps its the reduced number of agencies that is making things look different.

Looking at the trend that is developing in auto loan delinquency and how it’s been moving consistent with repo volume, it seems certain that 2024 will exceed its last peak of 2019.Could it make it to the 2009 levels? Time will tell, but I don’t see the economy improving much if at all this year.

Kevin Armstrong

Publisher

More Stories

Rising Fuel Costs Are Impacting Repossession Operations

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most