Guest Editorial

First, I hope everyone and their families are doing well, all things considered. No one knows what the future holds for any of us, especially in this crazy industry we all live in. From coronavirus, to collection moratoriums, to statue toppling protests, to Kanye West running for POTUS; we, now more than ever, have to expect the unexpected.

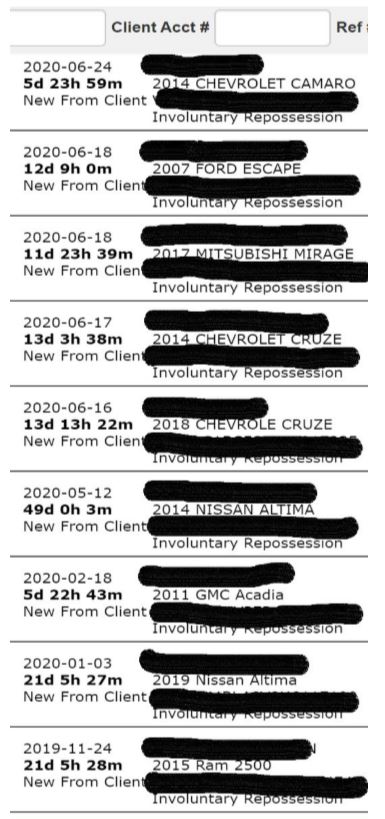

Secondly, all laughter aside, I would like to bring a bit of confusion, as well as concern, to everyone’s attention, especially those reading this on the lending side of the table. The following image was a screen shot taken from my company’s RDN “New Web” queue on June 30, 2020. This is a screen I’m sure we are all too familiar with. This queue shows several stats, the one I’m speaking of here, is of course, the time elapsed since assigned (but not accepted).

Yes, three of those assignments are “reopens,” but the remaining six are brand new assignments to my company. What you’ll notice though, is that the time in the queue is from 5 days to 49 days. Of course, now we’re at 55 days as of me writing this article.

Some of you might be asking me, “hey, you dummy, you’re turning down work?” My response to that is, well, I have reached out to these particular clients, all nine assignments are assigned by two clients, specifically two forwarding companies. These two clients were carry-overs from the days of the previous owner of my company (my mother) who initially signed the contracts.

As we all were working to reopen in a “post” COVID world, I placed ALL assignments on hold with every client, and reached out to discuss proper reopening procedures. This was purely from a liability standpoint as I wanted to make sure my company, and theirs (direct lender and forwarder), were on the same page with responsibilities and expectations. Overall, this went fairly well. I was not asking for the moon and the stars, but I was asking, at the very least, for a mutual understanding with regards to employee and consumer safety. We are delaying personal property inventorying, as are most of you. We are scheduling appointments where we do not have multiple customers in our lobby at the same time. You know, those kinds of procedural things that sometimes do not properly translate between our operation and someone else working from home, or in an office building 1000 miles away.

These two particular forwarding clients never responded to my email or RDN updates to discuss post-pandemic (at this point, mid-pandemic) operating procedures. Several forwarding clients did, and we had very nice, thoughtful, productive discussions. My direct clients had already put their plans into place and we were agreeable on the terms.

I would now like to ask the lending community a few questions…

- When you assign an account for repossession to a forwarding company, what is your expectation of a time frame for that assignment to actually be worked?

- Are you being charged for working an assignment when they do not have a vendor in that area?

- Are you assigning accounts so you can perform your “due diligence” in recovery, so the account can charge off and you no longer have to worry about it? (e.g., bundled up and sold off as bad debt)

- Do you care if the account is directly assigned to a 3rd party agency as long as the account is on the LPR “hot-list”?

If I were a lender, and I saw accounts sitting in a queue, for the only reason being that my forwarding company vendor did not respond to one of THEIR agents requests, I would be rethinking my entire supply chain and begin a deeper inspection into the timeline of compliance of my network.

At a time when unemployment is high, income is scarce, and defaults are being kept falsely low by the way of “deferments”, which really doesn’t mean a damn thing since your finance agreement is not seeing positive cash flow (just because I call a cow a dog, isn’t going to make the cow bark.) I would imagine that the approximately $81,000 in collateral value from those nine vehicles, would go a decent way towards keeping your bottom-line solvent. And that $81,000 is probably a low figure considering I took base model values from a major auction house report that I have access to.

Just something to think about since having more people in your chain of custody and one more WEAK LINK in your vendor network is obviously helping to manage your bottom line. Or has it?

Be safe out there,

-Danny L. Redding, Jr.,

CARS, MPRS

CEO Recovery Columbus, Inc.

ARA, Eagle Group XX, NAFI, NASTF, TRAG, TRAA

Facebook Comments