For the first and only time ever, agents have the opportunity to be a part of a national forwarding-style model and actually have control of their future.

FOR IMMEDIATE RELEASE

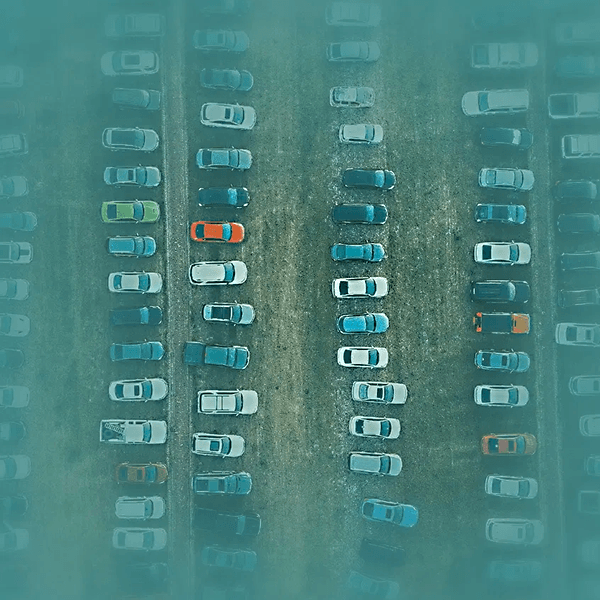

Genoa, NV – Trynity Financial Services (TFS) is excited to announce their newly formed repossession management company to the lending and repossession industry. TFS, is a repossession agency Co-op and not a broker or forwarder in industry terms. Formed with the principal of leveraging existing technology to improve efficiency, TFS adds value proposition by agency owner investment, participation and transparency to take back control of the industry from the major national forwarders.

TFS knows what it takes to run a repossession agency and has built a model that puts Partner Service Providers (PSP) first and gives PSPs direct opportunities they would not have with a forwarder. TFS is currently seeking additional PSPs to add to its exclusive network. PSPs are agency owners who have opted to purchase a block of shares in Trynity. TFS will offer no more than 300 PSP opportunities, which will comprise the entire network to cover the continental US. Interest from agency owners is high and available spots are filling up quickly.

In addition to the obvious benefit of the cooperative structure, Trynity Financial Services offers their Partner Service Providers;

- Faster Pay

- ACH payment every Friday for all completed repossessions through the Friday prior

- More Pay

- Instead of being contracted at a specific rate, PSP’s are compensated a percentage of the fee collected by Trynity from its clients.

- Additional Fees paid for skip accounts

- Full Transparency

- No hidden technology fees or “padding” of other fees

- Integrity and honesty

- The assignment volume of a national company with a direct feel

- Annual Dividends to PSP’s

- PSP’s are not owned by Trynity, so they are free to run their business as they have been

- Annual PSP party

- Annual Awards and prizes

Trynity Financial Services President, John Fountaine states; “We are not looking for “investors”. Rather, we are looking for dedicated, hard working agency owners who operate their respective business with a high degree of ethics and integrity. The idea behind the share buy-in is to offer real opportunity to agency owners, but also incentivize them financially, while concurrently creating operating revenue for the company, in much the same way as any public company might do.”

While PSP’s are shareholders and not “owners”, PSP’s have voting rights for anything effecting the company on the grand scale. Aside from this, PSP’s are freed up to manage their own day to day operations while the TFS Executive management teams tackles the otherwise the day-to-day operations.

For more information on Trynity Financial Services, please view our Agent Opportunity Deck or contact us at; trynityfs.com

Facebook Comments