Risk Emerging in Repossessions from the Gray Area of the “Essential Worker” Definition

EDITORIAL

Shelter in place restrictions are being loosened in more than twenty states in the nation and, as evidenced by the emails being delivered by numerous lenders and forwarding companies “chomping at the bit” to get the industry back into the field, and in some cases, for reduced fees. Under more reasonable and clear conditions, this wouldn’t be that big of a deal, but alas, there are still many major lingering issues that have not been clarified by either the federal governments or the states themselves. This is the issue of clear authority to perform repossession activity as an “essential worker” and, as evidenced by a recently received pre-legal lawsuit threat letter, there is high risk that even an activity as reasonable as a voluntary repossession could land a repossession agency in court over a breach of peace.

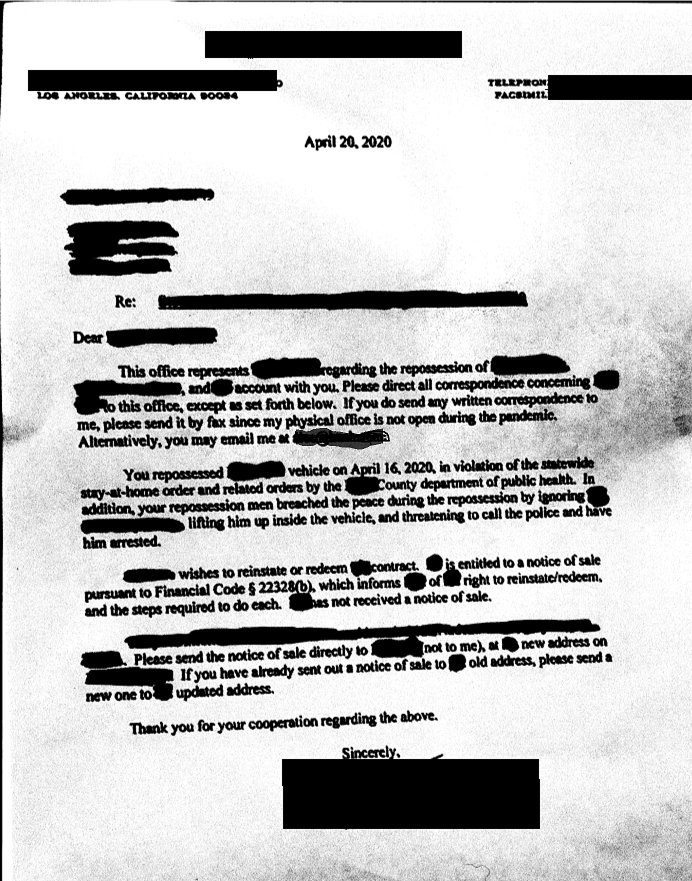

Brought to our attention in form of recently received pre-legal letter to a California repossession agency, was an attorney’s implied threat relating to the repossession of a vehicle during a shelter in place (SIP) in the county of recovery. We suspect that this may become a point of contention for future litigation as a source of breach of peace. Included in the letter is this paraphrased claim of the incident.

As far as the allegations of lifting the vehicle with the borrower inside, I’m going to avoid that for the sake of focusing on the new element of threat that preceded it. While not a lawyer, I can easily see the emerging separate legal complaints that could arise in the near future on this and other situations as evidenced by the redundant mentioning of the shelter in place.

- State level SIP violation

- County level SIP violation

- Breach of peace

- Emotional distress

The second of these two issues are common and problematic enough, but the first two could be seen as compounding to the other issues. These are smarter men and women than me and this an obvious opportunity that you can be sure they have already considered and we are not teaching them anything new.

This may turn out to be the tip of the iceberg for what could be the next legal onslaught of lawsuits against the lenders, forwarders and repossession agencies as business resumption commences. These attorneys know the mood and tolerance of their court systems down to the judges and weigh their prospects for success in even the most stable of environments are usually quite strong.

Depending on how heavily impacted your area of operations is, I assume that you can imagine that the general public would be opposed to repossession activity out of normal sympathy. It can also be assumed, that you can understand that the optics of repossessing a vehicle during a shelter in place is not a positive one. Now, take that into what is usually an already unsympathetic and consumer friendly courtroom environment and I trust that you can see that this is almost stacked deck against any repossession agency and you may have slim to no chance of being granted a dismissal, even if you believe that repossession activity is an “essential” service.

At the root of the problem are the state and federal definitions of “essential worker” for Financial Services. While, if you squint at these terms and put on your most favorable interpretation of the provided guidance to your own self-interest interpretations, you can easily assume that repossession activity fits within these guidelines. But, if you put on your “touchy-feely” consumer friendly hat, which is how most courts rule, you can easily see what a trap this is.

According to the Department of Homeland Security, Guidance on the Essential Critical Infrastructure Workforce: Ensuring Community and National Resilience in COVID-19 Response Version 3.0 (April 17, 2020) (page 17) , a “critical infrastructure worker” is one that fits into one of the prescribed critical infrastructures necessary for “maintaining both public health and safety as well as community well-being. The term “workers” as used in this guidance is intended to apply to both employees and contractors performing the described functions.”

FINANCIAL SERVICES

• Workers who are needed to provide, process, and maintain systems for processing, verification, and recording of financial transactions and services, including payment, clearing, and settlement; wholesale funding; insurance services; consumer and commercial lending; public accounting; and capital markets activities.

• Workers who are needed to maintain orderly market operations to ensure the continuity of financial transactions and services.

• Workers who are needed to provide business, commercial, and consumer access to bank and non-bank financial services and lending services, including ATMs, lending and money transmission, lockbox banking, and to move currency, checks, securities, and payments (e.g., armored cash carriers).

• Workers who support financial operations and those staffing call centers, such as those staffing data and security operations centers, managing physical security, or providing accounting services.

• Workers supporting production and distribution of debit and credit cards.

• Workers providing electronic point of sale support personnel for essential businesses and workers.

While bullet points 1 and 2 contain language, that in my humble opinion, may be reasonably interpretive as qualifying, these are easily contradicted by the root purpose of the necessity of these allowances eg; for maintaining both public health and safety as well as community well-being. Public Health (No), Safety (No), Community Well-being (Good luck!).

While every state and some cities by now, have enacted their own guidance, they for the most mirror the federal guidance. For demonstrative purposes, I will refrain from an exhaustive list of numerous states and refer to the state of California, often a blueprint of national restrictive consumer legislative guidance on the matter.

On April 28, the California State Public Health Officer designated the following list of “Essential Critical Infrastructure Workers” to help state, local, tribal, and industry partners as they work to protect communities, while ensuring continuity of functions critical to public health and safety, as well as economic and national security. I’ll skip over the first two continuity functions, because I’m sure you get it by now, but the additional national security is an obvious (No!). That leaves us with “Economic” continuity. Let’s dig deeper into the applicable item 10 “Financial Services Sector”.

Sector Profile

The Financial Services Sector includes thousands of depository institutions, providers of investment products, insurance companies, other credit and financing organizations, and the providers of the critical financial utilities and services that support these functions. Financial institutions vary widely in size and presence, ranging from some of the world’s largest global companies with thousands of employees and many billions of dollars in assets, to community banks and credit unions with a small number of employees serving individual communities. Whether an individual savings account, financial derivatives, credit extended to a large organization, or investments made to a foreign country, these products allow customers to: Deposit funds and make payments to other parties; Provide credit and liquidity to customers; Invest funds for both long and short periods; Transfer financial risks between customers.

There is not one even perceivable hint to the need for repossessions in here.

Essential Workforce, if remote working is not practical:

1. Workers who are needed to process and maintain systems for processing financial transactions and services, including payment, clearing, and settlement; wholesale funding; insurance services; and capital markets activities

2. Workers who are needed to maintain orderly market operations to ensure the continuity of financial transactions and services.

3. Workers who are needed to provide business, commercial, and consumer access to banking and non-bank financial and lending services, including ATMs, lending money transmission, and to move currency, checks, securities, and payments

4. Workers who support financial operations, such as those staffing call, data and security operations centers, managing physical security, or providing accounting services.

5. Workers supporting production and distribution of debit and credit cards.

6. Workers providing electronic point of sale support personnel for essential businesses and workers.

Bullet point number 2 is the most relevant argument that I can see in any of the offered guidance and, I honestly do believe that it is applicable. How can it be argued that repossessing and liquidating delinquent collateral is “not” an essential activity in the credit cycle? The entire preservation of the credit market is critical to the public interest and the ability to recover freely and liquidate collateral offsets losses that keep loan terms reasonable and underwriting available to the general public.

This sentiment was just agreed with by Judge Richard G. Stearns in the United States District Court of Massachusetts under the ACA International requested temporary restraining order against Massachusetts Attorney General Maura Healey’s emergency rule, who stated in the “Order”;

“Finally, the court recognizes the argument advanced by ACA that a capitalist society has a vested interest in the efficient functioning of the credit market which depends in no small degree on the ability to collect debts.”

Now, I am not a lawyer, but I can see the argument that repossession activity is an extension of collections activity and that the repossession industry should be deemed an essential function and vendor of the financial services industry.

Unfortunately, it doesn’t matter what I think and it really doesn’t matter what you think in the eyes of a courtroom. The general intent of these applicable guidelines appears to be geared toward giving the public access to financial transactions and maintaining public safety. It is most probable that this will be the standard under which all cases of this matter lie.

Keep this in mind while the many lenders and forwarders attempt to coerce agencies into accepting these loose and “gray” interpretations as gospel and pressure them into exposing themselves to all of the additional layers of risk surrounding this national emergency. As you dwell on this conundrum and pressure, do not forget the “Reverse Indemnification” clauses in all of those contracts ie; “If we get sued you pay. If you get sued you pay.” The risk is all yours.

I want everyone to get back to work as much as they do, but at very minimum, two things would be helpful to reduce these risks to more reasonable levels.

- The definitions of “Essential” and “Critical” workers needs to be explicit to include “ALL” repossession activity. The ACA, ABA, CALR and NCUA and many others have been pressuring the states to recognize repossession activity as “Essential” and “Critical” duties worthy of inclusion and response if hoped to me eminent. At the federal level, the ACA, ABA and NCUA have been working behind the scenes for the same and the joint national repossession associations and insurance companies are in the midst of discussing the hiring of an experienced lobbyist for similar representation on this and other legislative matters.

- “Reverse Indemnification” clauses in all of those contracts ie; “If we get sued you pay. If you get sued you pay.” Must be flipped around the other way. For years agencies have been insuring the lenders and forwarders against their very own actions on their own dime. Game over.

- Fees must be dramatically increased – With new CDC and OSHA guidelines requiring agencies to provide adequate protection for their employees, additional expenses will be incurred.

The reward for absorbing these additional risks and expenses just isn’t there for the same old $300 fee, these expenses need to be compensated for. In 1926, a repossession adjuster was paid $25 per unit. That is the modern equivalent to $364.00 in 2020 currency and they had no trucks, no insurance, laptops, networks, wheel lifts, practices consumer lawsuit attorneys or COVID-19 to deal with!

I know everyone is under a lot of pressure now, but this may not be a good time to go back to business as usual if you are operating in a SIP state or county. The terms of contracts and legal environment are not currently conducive to a safe, financially viable and sustainable business model. Think the terms of your work over carefully.

* This is not intended to be taken as legal advice and you are strongly encouraged to seek proper legal counsel before making any legal decisions. *

Facebook Comments