GUEST EDITORIAL

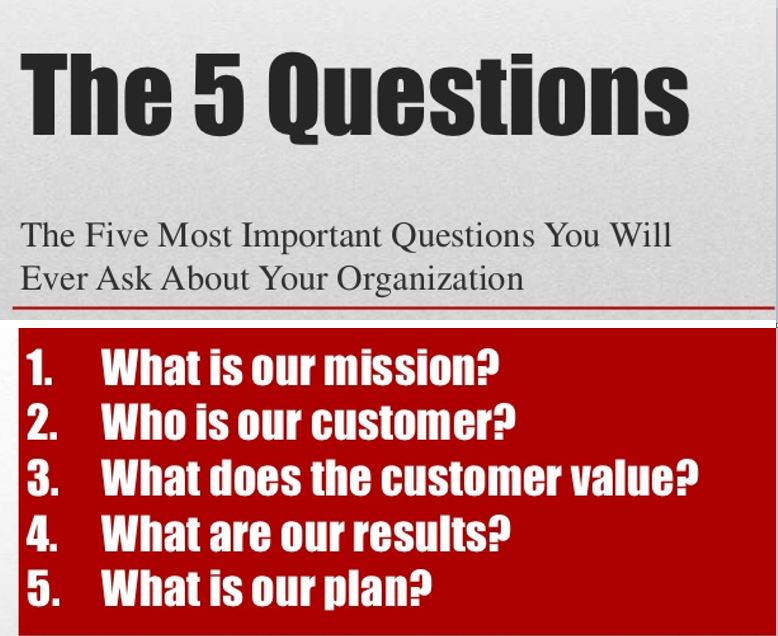

Back in the early 90’s while sitting on the board of National Finance Adjusters (NFA) I happened across this organizational self-assessment tool. This self-assessment tool allows us to question: “What is our Mission?” “How are we doing?” “Are we headed in the right direction?”. This “Tool” was developed by Peter Drucker, Drucker is revered as the “Father of Modern Management”.

With the present Unity Movement taking place in our Industry and the concept of a Unified Industry looming a self-assessment of our respective associations is appropriate. Should either association choose there are a number of consulting companies that can be hired to act as a facilitator in the process. Any opinions of mine expressed here come from my 34 years in this Industry and experiences I’ve had in about a dozen different Trade Associations along the way.

respective associations is appropriate. Should either association choose there are a number of consulting companies that can be hired to act as a facilitator in the process. Any opinions of mine expressed here come from my 34 years in this Industry and experiences I’ve had in about a dozen different Trade Associations along the way.

- WHAT IS OUR BUSINESS (MISSION)?

The mission of any NonProfit Organization is to make a difference in society and the lives of our members. The American Collection Association (ACA) mission is to “contribute to the success of its members and the positive reputation of the credit and collection industry through education, advocacy, and services”. We have had little success and a lot of unrest in our Industry, this unrest revolves around, “What are the trade associations doing for us?”.

For years I’ve been hearing that old Nancy Regan saying “Just say NO” to client demands. “Just say NO” isn’t education. Did the Trade Associations ever teach members “How to negotiate service contracts”? Present and Past Association management has failed miserably to make the lives of its members (customers) better.

Historically the Trade Associations in our Industry revolved around a “Book”. The membership in the Trade association gave you a bond and credibility. The “Book” was advertising that brought you business, you didn’t need a sales team, you didn’t need to negotiate a contract because in the 60’s rates were published in the “Book”. Their mission statement was simple, “We make your life better, we publish a directory that is sent out nationwide, we get you business”.

Allied Finance Adjusters (AFA) was the premier trade association to belong to back in the 50’s and 60’s. Allied granted exclusive territories, only one member to a territory. Sadly, what was their strength became their Achilles heel. Members became lax (they had no competition in their territory) and did not listen to clients needs, lenders moved to other books.

ARA was spun off from ACA in the mid 60’s, apparently ACA narrowed their focus. Problem was ARA was spun off to an Industry that revolved around a “Book” mentality and ARA became another book. ACA has never published a “Book”. As the Lending Industry consolidated, lenders needs changed, yet trade associations still revolve around the “Book” mentality and compete against each other to get business for their members. It is well overdue for all Trade Associations to review their mission and ask:

- What are we trying to achieve? Why do you do what you do?

- How is performance for this association defined?

- Identify the associations Strengths and Weaknesses.

- Refine the association mission statement.

- WHO IS OUR CUSTOMER?

If you are thinking that the customer of AFA, ARA, or TFA is the Lender you are only half right. Everyone has more than one customer type. The member of the Trade Association is the Primary Customer, the Lender is the Secondary Customer. Both types of customers must value our service and both must be satisfied. Both customers must want what we deliver. The true total number of repossession companies in this country is unknown.

In 2014 I asked that question online. Rob Lovelace of RepoSystems stated that there were a little over 4800 of which 96% had 1-3 employees. Adding up all of the members of the various trade groups and RSIG and you still have under 1000. 80% of the Industry does not belong to a Trade Association. What does that say about how primary customers value membership in a trade association in our Industry. If you think that was dismal now ask yourself how secondary customers view the Trade Associations.

80% of the Lending Industry sends their business to Forwarders. Trade Associations began losing Direct Clients that use to use the “Books” exclusively 25 years ago. At a CBA Auto Finance conference in 1997 Stuart Angert (CEO Remarketing Services 0f America, RSA) told me “Repossessors are a commodity, Remarketers/Forwarders such as he were specialists”.

Forwarders are now our largest secondary customer in this Industry and we Trade Associations refuse to acknowledge them (AFA excludes Forwarders from being members), and if a Trade Association attempts to acknowledge Forwarders they are severely criticized, NARS is considered by many a betrayal to Industry members because it allows Forwarders to exhibit and attend. The NARS mantra is “a place at the table for everyone”. Why have Lenders left the Direct Model provided by Trade Associations?

- WHAT DOES THE CUSTOMER CONSIDER VALUE?

What is the most important question, but it is the least asked? WHAT IS VALUE TO THE CUSTOMER? “Value may be defined as quality or price, but you must keep in mind that the customer never buys a product. By definition, the customer buys the satisfaction of a want.” For years our Trade Associations have made assumptions based on our own interpretations of our supporting customers wants.

All that time the Trade Associations never had a supporting customer sitting on any board in an active position. Years ago, the “Book” gave you credibility and business. You didn’t have to negotiate a contract or have a salesperson.

Value today to our customers (members) would be to educate them on sound business principles of determining profit, negotiating a contract, conducting a sales call. Without these basic business skills, one is doomed in today’s marketplace. Supporting Customers have always valued the positive image of someone who is a member of a professional trade association.

Our shortcoming in recent years has been “a failure to communicate” a positive image of a professional repossessor, as such reality TV and a liberal agenda media have painted a picture to the public of repossessors through “Operation Repo”, “Lizard Lick” and through print media with “Repo Madness”. We have lost the positive image, due to a lack of inaction on the part of professional trade associations in our Industry.

When Lenders began to consolidate in the late 80’s their values changed. Collections consolidated to the state, then regional, then nationwide. At each step of the way lenders were looking for someone who could handle a larger geographic footprint, someone who could offer more services in conjunction with repossessions such as liquidations(remarketing).

In the early 90’s Bob Gibson of U.S. Bank wanted this and approached a young repossessor, he gave him a $100,000 (no payback loan if he failed). Along the way the young repossessor met Bob Wilson and together they formed United Auto Recovery. Eventually that young repossessor Chad Latvaaho (Repo Inc) parted ways with Bob and went back to his own company, both are now two of the largest repossession companies in the country.

Likewise, Patrick Willis at one point sold his company P.K. Willis to United Road Services only to buy it back and create American Recovery Service. All three have been successful because they understood what the customer considered as value. Does this mean you have to get big to survive? No, it just means small primary customers will have to learn the business skills that allows them to take a murky situation and make it transparent.

You begin to do that by learning “Volume is vanity and profit is sanity”. You learn also by listening to your customers. James Day of Dakota Adjusters is a small family run operation in Sioux Falls, SD and he dominates in his marketplace which is part of a region in which Repo Inc dominates on the national map. He accomplished that by listening to his customers. His business model which also includes an online remarketing auction, involves personally knowing every lender within a 100 miles radius of Sioux Falls. He accomplishes that by making calls on Lenders while he is in their area working accounts in his tow truck. James (Dakota Adjusters) has been in business for over 30 years and previous to that he worked for a collection agency.

- WHAT HAVE BEEN OUR RESULTS?

Adding AFA, ARA, TFA, and RSIG together and over the last 20 years 80% of our supporting customers have gone to Non-Association affiliated companies (Forwarders). Associations now hold up Forwarders as the source of all of our problems. By doing this it allows them to justify their dismal results over the last 20 years. Then there is the BOND, back in the day it was $100,000, then $250,000, then $500,000, then $1M and finally $5M. Back in the day it did protect clients should the member abscond with funds from liquidated collateral. Claims never ever did exceed $100,000, but it was bragging rights for the “BOOK”, “Who had the Biggest ______”.

The Bond had to be replaced because state Insurance regulators refused to accept it as valid, so now agencies/associations are required to purchase a $1M fidelity insurance policy. The policy is being required by large national clients. The $1M question is when was the last time an agency handled liquidated funds for a major client? But rather than working in unison to get major clients to come to reality and do away with the requirement, we continue to use it against each other as bragging rights.

When associations should have been moving forward together on education and advocating a positive public image of the professional repossessor we were squabbling among ourselves and trying to figure out how to get more business for the members of our brand.

Reality TV and the Liberal agenda media have painted us as buffoons and scoundrels and the courts now agree with them because association leadership had no clue how to deal with the Liberal News Media. In my 34 years in this Industry I view the combined Repo Industry’s failure to respond to the NCLC white paper “Repo Madness” as the all time low point in our Industry. The only person to take the NCLC to task over “Repo Madness” was attorney Tom Hudson and no association has ever acknowledged or thanked him.

- WHAT IS OUR PLAN?

We as an Industry need to Unify and speak with one voice moving in the same direction. We need to CONCENTRATE on bringing everyone under one banner. We need to COLLABORATE with other organizations. The National Auto Finance initiative on finding common acceptable certifications for Lenders is a great example of where we build National Collaborations. We alone cannot solve the issues we face in this Industry.

About 15 years ago I realized a problem with Impounded vehicles in Nebraska, the heart of the issue was a problem law. I brought the issue to the Nebraska Independent Auto Dealers and suggested the law needed to be revised. They liked the idea. In collaboration with them I reached out to the State Towing Association and the Nebraska Independent Community Bankers. What came about was LB82, it didn’t get to the voting stage in the first year but we came back the following year and passed the law. The law contained provisions for every group that participated, and we worked together.

We all need to learn how to collaborate with other groups on state and Federal levels on legal issues. We need to collaborate with other organizations on our public image at state and Federal levels. Field agents are First Responders for Lending Institutions but yet are viewed as car thieves and thugs by the liberal media. A unified Industry can ADVOCATE for the positive image of field agents in the same manner that law enforcement and fire departments have since 9/11.

With the advent of the CFPB, EDUCATION and certifications has become in vogue with every group and private enterprises rolling out their own brand, further splintering a fractured Industry. A reality check is needed in this area, presently compliance programs can range in price from thousands of $ per year or down to the “summer special” price of $149.95.

EDUCATION that is needed in this Industry revolves around good business principles and not the premise “if I don’t my competitor will”. We need to teach people to listen to the customers needs and remind customers that VALUE IS NOT PRICE, IT IS THE SATISFACTION OF A WANT BY OUR CUSTOMER.

Mike Nikolas

Mike Nikolas

President

Certified Recovery Specialist

Facebook Comments