EDITORIAL

As if finding a person to work nights, weekend and in often less than safe neighborhoods wasn’t hard enough, larger scale national economic conditions have caught up to the 30 year flat repossession fee industry to the point that it is almost comparable with working minimum wage.

With all of the national talk about wages finally showing some vertical improvement in the nation’s booming economy, the repossession industry is one where it has remains virtually unchanged in over 30 years. Way, way back when I worked in the field, further than I care to admit, I was paid $75 per unit repossessed contingent. Sad enough, this has changed very little if at all nationwide. I’ve heard of agents being paid $100, some up to $125, but considering the massive increases in inflation, this is barely enough to live on unless you’re picking up 100 units a month.

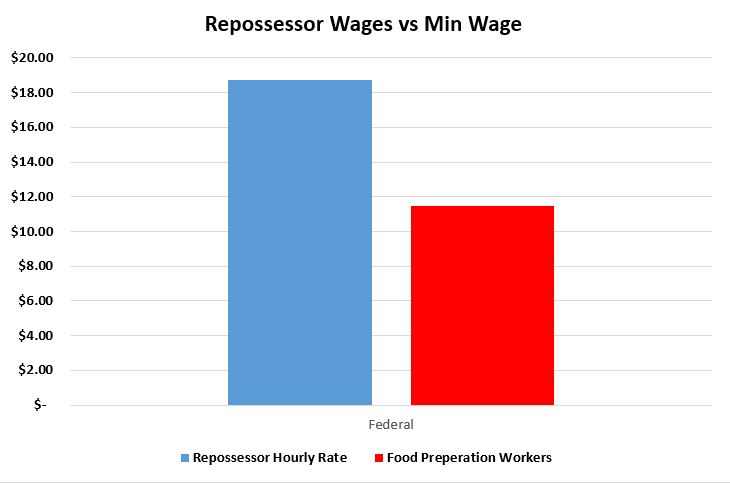

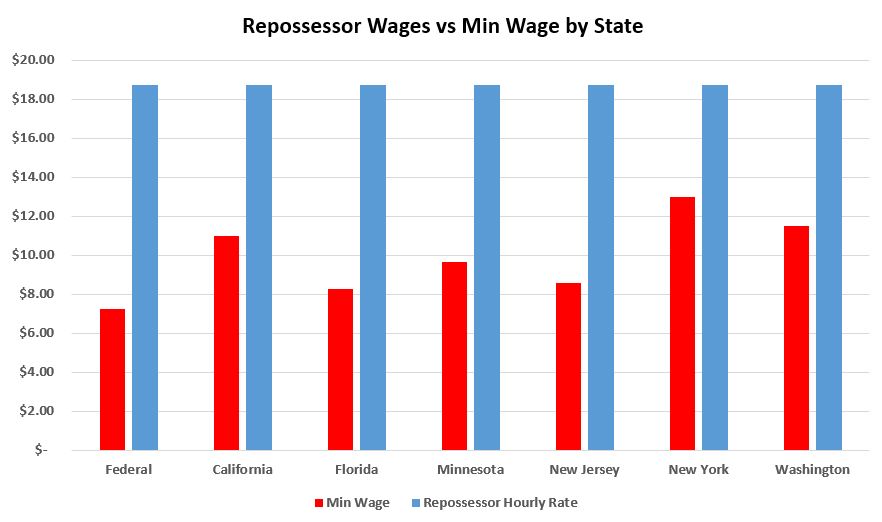

Let’s suppose that the average field agent brings in 10 cars in a week. In a perfect world, where they only worked 40 hours a week, at $75 per unit, they would be making $18.75 per hour. According to the Federal Bureau of Labor Statistics, Food Preparation Workers, including fast food workers, make a national average of $11.49.

Based upon state and federal minimum wages, they make 2.6 times the national minimum wage of $7.25 and a mere 1.78 times the average state minimum wage.

Is this a minimum wage job? Let’s be honest. This is a job that is the front line defense in loan losses for lenders all over the nation. This is a job with long hours under dangerous situations where many men and women are injured annually and some lose their lives. On commission, contingent and without benefits in most situations.

As housing costs soar in some areas of this nation, we find a rounded average of $1,200 per month is spent on rent in the charted areas. That is almost 40% of the gross income at $36,000 and 43% at that average tax rate net. In some areas, like the San Francisco Bay Area, this income is completely unsustainable with the average rent at $3,000.

With these statistics and high regional costs of living in major urban centers (which is where the largest numbers of repossessions occur), finding qualified repossession agents has become a major problem.

Let’s face it, most people aren’t cut out for this profession. No benefits, no vacation pay, no overtime, no 401K or pension and occasional encounters with very unhappy people.

This is not an indictment of the repossession agency owners. As I’ve written about repeatedly through the years, the agencies themselves are being squeezed out of the industry by rising costs, flat incomes and a constant decaying of ancillary fee income which makes any form of commission increases impossible.

The fault in all of this lies in some obvious factors. First and foremost, repo fees. I’m not going to beat this dead horse much more. As long as the majority of the industry accepts flat contingent repo fees from the major lenders at $275-$325 per repo, the industries nosedive will continue.

Another driving factor in all of this is the low barrier to market entry in most states creates a “scab” agency environment where new agencies, just thrilled to find work, will accept just about anything. This removes almost any leverage that more established professional repossession companies would have for higher wages.

The flat rate environment to agencies will leave only the poorest quality agencies remaining to serve them and the consequences will be seen in the national press when they start reporting about borrowers being dragged to death by unqualified agents. Put a few dead children in there and they will be the guests of congressional hearings and countless depositions.

As lenders, you would think they would expect to have knowledgeable, experienced and professional repossessor in the field. Men and women who serve as an extension of the lender and representing the values expected of the lender themselves.

But let’s face it, the drive for the bottom line is really running the show and everyone else pretty much just turns a blind eye to who is doing the work. The vetting is become a joke and is more of a check box on a web form than an actual review of qualifications.

If this weren’t true, I wouldn’t be receiving photos of repossessed cars for national lenders sitting in cow pastures behind a five strand barbed wire fence next to a broken down trailer or hear stories about agencies run out of rented houses and apartments where borrowers pick up their property from a living room with walls lined with property bags.

If the lenders of this world want to be protect their brand and keep themselves out of court, they would only hire professionally run and operated agencies and not just pretend that because they relied on a third party to perform the vetting function that everything will end up fine.

But let’s face it, under the current fee environment and the erosion of income, which is no better for the owners than the agents, the repossession industry will continue to have a difficult time attracting new and retaining experienced agents. The future industry will be dominated by novices and real liabilities on the streets performing the most litigious banking function and without a doubt, the most dangerous to the borrower and the agent, in the lending world.

As my good friend Ron Brown has said repeatedly through the years,

“If you pay peanuts, you get monkeys.”

Professionals only hire professionals. Be a professional!

Editor

Facebook Comments