this “I’m going to take my ball and go home” strategy sounds like a threat, and one that doesn’t hold up to the math.

EDITORIAL

Last week, Scott Jackson penned a rebuttal to the Alliance of Illinois Repossessors editorial “Attention Lenders – Contingency Doesn’t Work” and followed up with a very interesting interview on Repo America with J. Patrick Altes. At the core of Scott’s concerns for the future of the repossession industry were the potential of lenders abandoning the self-help recovery process for the legal route of replevin. As promised to provide last week, I’ve got my own opinion.

Just as a little background on myself, I’ve done a little more than just write about this industry. I spent seven years in it before going into the lending world. I’ve spent twenty years as a VP of Collections and Director of Lending in four different banks and credit unions. So, I do have a little experience with the entire cradle to grave back-end process.

Replevin, historically

This strategy is not new. In fact, self-help repossession has been challenged legally at all levels since the 1920’s. Hanging their hats on the 14th amendment, many courts ruled against self-help repossession stating that it deprived the borrower due process.

As the first known repossessor, or Car Snatcher, as he was called, George D. Wright reported in 1925, using the legal system for collateral recovery was not often done, and time and expense were the same reasons a century ago as they are now.

For decades, self-help repossession laws varied from state to state so much that police would routinely arrest repossessors for auto theft when they attempted a non-court approved repossession across states lines. Losing their rights to expeditious remedy of default, General Motors, Ford, Chrysler and many banking lobbies, began challenging these judicial decisions in 1972 and by 1974, mandatory replevin laws began unraveling.

And of course, most of us remember the April 2010 paper published by the National Consumer Law Center titled “Repo Madness- Dangers, Developments, and Calls for Change in Auto Repossession.” They had proposed that borrowers be provided fundamental protection in the form of a prohibition of repossessions undertaken without court order and that only trained law enforcement carry out repossessions. Of course, the lending community scoffed and dismissed not only the premis of their proposal but the proposal of replevin only repossessions. The reasons for dismissing these proposals were as clear then as they are now; replevin was neither time nor cost effective.

There are good reasons why they fought so long, hard and diligently for the right of self-help repossession. It’s the most efficient, expedient and financially sound method of recovery. So why would they have such a change of heart?

ALL and GAAP

Much of this is a little dry, so please forgive me if I’m not more colorful. It’s banking and is governed by accounting standards and regulations. Not very exciting stuff.

Scott is spot on in his understanding of the mandates of a lender’s CFO in establishing the loan loss and recovery budget. This is indeed tasked down the food chain to hold the line with. It is usually based on a gross estimate of expected delinquency, recovery and losses drilled down to a per unit average estimate of expense. This where they suppress the fees and have been for decades.

- Allowance for Loan Loss (ALL) – A standard generally accepted accounting practice (GAAP) requires that lenders reserve from their general fund loan loss expectations. As a conservative approach, many lenders reserve at 100% of the loan balance once a vehicle exceeds a specific point of delinquency and it is declared an “impaired” asset. There are various reserve strategies, but this truth is consistent across the lending world.

- Once a vehicle is repossessed and liquidated, the funds are applied against the reserved loss expectation as a “recovery.” This is a recovery of profit, a very important element of the loan loss cycle.

- To stop repossessing and lean into these legal letters requires a greater deal of time. Time that reduces recovery through depreciation of collateral value through mileage, wear and tear and abuse. Time that both reduces and extends the length of time for a lender to receive recovery funds to return as profit.

- The end result; Profit is diminished and delayed.

The “Letter” Strategy

Scott reported that the unnamed lender claimed that on their test case they received payment on 90% of all the letters. Not doubting what Scott heard, but the only pool of delinquency that I can imagine would respond so well would be in a 5-10-days delinquency tranche where “self-cure” is dominant. The reasons this is implausible at a more realistic repossession assignment stage of 60-120 days delinquent you’ll see below.

- Bad addresses and skips probably account for 30-40% of all later stage delinquencies. On these accounts, letters have as much impact as a fart in a hurricane.

- Of the remaining 60-70%, some will pay current, but as is the nature of many delinquency cures where the borrower stole from Peter to feed Paul in order to make payment, there is a very high level of recidivism and most will return to their former status requiring more letters. Letters that eventually lose their affect.

- A small percentage of these, feeling the pressure, will file for bankruptcy while still in possession of the collateral. Once filed they are protected by an automatic stay prohibiting further recovery activity or contact for months. 70-80% of these never follow through with their bankruptcy plan and are dismissed. This can hinder a resumption in recovery efforts by months and upon dismissal, repossession traditionally is assigned, but in this new process, the legal action resumes.

- As per the FDCPA, if a lender threatens a borrower with legal action, they are required to follow through or they are in violation of law. So, a lender’s hand is to a point, forced.

Action

So, for the letters that don’t work, the lender must take action. And that action takes time. Time that, again depreciates collateral value delays recovery profit.

- Forced to move forward with writ of possession, they must file for replevin with the county court. Court calendars are packed and getting in front of a judge in many states and counties could take anywhere from 3 months to a year. A time frame that will only worsen as the case load increases through the increased use of this strategy.

- Once the court date is received, the lender has to have them served, no later on average than 15-20 days before the hearing. And of course, there are continuance requests from debtors that can be achieved and drag it out for months more.

- But of course, what if they are unable to serve the debtor? The lender then must move for a continuance of the hearing to later date and initiate skip tracing and incur more time and fees.

- So, suppose that eventually the borrower is relocated, but to a different county or state, then what? Wash, rinse repeat steps 1 through 3 all over again. More time lost, more depreciation and more money lost.

- So, the lender is lucky enough to get proper service and has their day in court. If opposed or unopposed by the defendant, they are able to obtain a judgment, unless the borrower makes arrangements at that time, the lender must obtain the writ of execution.

- From there, the writ goes to the sheriff for execution (repossession.) 10-60 days depending on county. Let’s face it, repossessing cars is probably one of the things law enforcement enjoys least. Hell, they probably wouldn’t even notice of the car they were going after was parked in the street two doors down.

- Recovery for sheriffs is not 100%, so even that is diminished by as much as 60%.

Expense

As all of this is going on, the collateral depreciates and the lender’s recovery is forced to wait and is diminishing. All the while, expenses are being incurred. While Scott is correct in that there are “puppy mill” law firms who punch these letters out on the cheap, the “cheap” ends there. Action costs money and, with the agonizingly slow wheels of justice, a lot of time.

- Replevin Bond – Courts will typically require the lender to acquire a replevin bond. These vary and are refundable, but still hold a temporary expense of 1%-2% of the amount of the requested judgement.

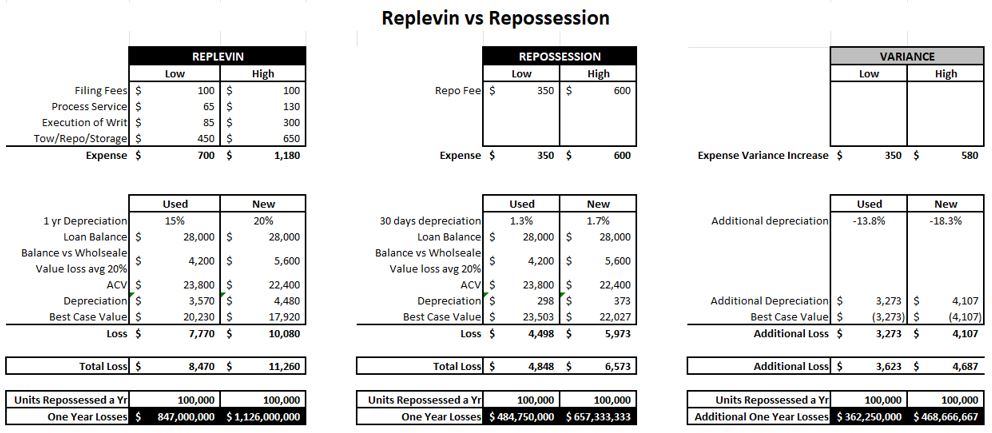

- Filing fees – vary by venue. Here in California, for lenders filing more than 12 claims in 12 months, it is $100.

- Process service – $65-$130.

- Execution of writ – $85-$300 (estimate) not including tow, which ironically is often a repossession company, so you can tack on another $450 to $650. Yes, more than they want to pay to start with!

- On the low end, a la carte, excluding the replevin bond, the total expenses run from $700 to $1,180. There are law firms that specialize in replevin actions nationwide and their all-in-one services start at $1,500.

- Of course, none of these services are contingent. They know better.

Depreciation

So, as the months fly by and the delinquent debtor is pouring on the mileage, skipping maintenance, driving it like they stole it, blowing the engine or transmission and generally running it into the ground until it no longer runs or is parted out, the collateral value starts its nose dive.

- Depreciation – estimate 20-30% in the first year to 15% to 18% a year after. Average auto loan $28,000 (conservative est.) = $5,600 New to $4,200 Used in year one after financing. More money lost waiting for the wheels of the legal process to run their course.

- On the low end, this comes up to @ $4,855 in expenses and depreciation loss before even talking about the attorney fees which could easily double the actual expenses.

In closing

In most major metropolitan counties, the courthouses are understaffed and their case loads are heavy. Here, in California, the number one auto market in the nation, the judges typically do not hold a favorable view of lenders and are typically very consumer friendly even in unopposed default cases. Obtaining a default deficiency balance judgement can be a fifty-fifty shot.

So, what do you think those same judges are going to think when their court calendars start filling up with replevin cases? Better yet, at some point they will come to ask a simple questions; Did you offer a loan modification, or did you even attempt to use self-help repossession first?

I am not an attorney, but even for their hourly rates, I wouldn’t want to be the lawyer answering that question. The ringing in the ears of the smack of the gavel as a judge declares a case dismissed can cause a painful shudder of defeat down the spine. I know the feeling far too intimately. No one likes losing in court.

Does anyone, as a lender, really want to subject all of their recovery efforts to the whim and opinion of an overburdened legal system who already views them with suspicion? It would likely go poorly, even in more friendly venues than California once they come to realize that you are trying to make the courts do extra work for your benefit. They might also choose at some point to increase their fees to off set their increases in workload.

According to two different agency owners I’ve spoken with, I am pretty sure that “Capital One” is the lender that discussed this and as I had heard, both “Chase” and them were sending “Out for Repo” warning letters to borrowers at the same time as assigning accounts to their agencies.

Do lenders like feeling leveraged by agency owners trying to get fee increases? No. But this “I’m going to take my ball and go home.” strategy sounds like a threat, and one that doesn’t hold up to the math. Math, that drives the financial motor of every lender whose primary driver is maximization of profits.

But just how long do you think those CEO’s and CFO’s who set these budgets are willing to wait for these diminished recovery figures to come in? A year? A year versus three months?

Would they remain profitable? Yes. The majority of bank income is derived from interest and fee income combined with investment incomes. But the very nature of banking is not just to remain profitable, but to maximize those profits. The replevin only strategy clearly fails to do this at every level.

You can crunch these numbers any way that you want, but they just don’t hold up against the self-help repossession process. There are far too many variables to address in financial modeling of this and if anyone would like to challenge me on the relative profitability of this, I will gladly publish your rebuttal.

Could it happen? Over the past two and a half years we’ve seen repossession moratoriums, schools and churches closed while marijuana dispensaries and liquor stores were allowed to remain open, a sitting Supreme Court Justice state that she wasn’t qualified to define what a woman is, Joe Biden received a higher popular vote count than President Obama and the government confirming the existence of UFO’s. It’s hard to completely count anything out these days.

So, while they could try this, will it work? In my humble opinion, NOPE! Not a snowballs chance in Hell.

Kevin Armstrong

Editor

editor@cucollector.com

Related Articles;

Attention Lenders – Contingency Doesn’t Work

Contingency – The forgotten battle

An Agency Letter to Capital One – Golf? We’re just trying to survive!

Florida, the beginning of the “Great Repo Resignation”?

From the ARA President – Putting ourselves out of business

Alliance of Illinois Repossessors enforcing fuel surcharges

Repo Forwarding – the road to nowhere

Eagles United – Don’t pretend you didn’t hear us

Facebook Comments