EDITORIAL

In case you missed it, on May 1st, The American Recovery Association presented to an audience of hundreds of agency owners, a webinar presenting a series of new proposed industry best practices designed to “Develop a Sustainable Business Model that can Withstand any Crisis.” During this webinar, an extensive series of questions was presented to the attendees in regards to what is felt to be some new standard industry contract “Best Practices” that should be implemented in order to create a more sustainable and equitable business environment as the industry moves on into the immediate post-pandemic period.

The “Best Practices Proposals” presented were;

- Reverse Indemnification – The liabilities in existing indemnification clauses place the entire burden upon the agencies. This is backward and must be reversed.

- Force Majeure – Agencies should not be liable for damages done to collateral caused by natural disasters. Auctions aren’t, and neither should agencies.

- Request to violate a law or regulation – It should be a violation of contract for any lender or forwarder to demand or pressure an agency to violate and law or regulation.

- Storage of Collateral – Lot space costs money. Storage fees should be paid by both lenders and borrowers.

- Personal Property Inventory and Storage – This is one of the most time consuming and dangerous duties to perform, especially in a pandemic environment.

- Specialty Fees – Dollies, flatbeds and all additional equipment necessary for the safe recovery of collateral must be paid. The equipment used has limited usage or requires additional fuel and maintenance.

- Managing State Mandates – No lender or forwarder should demand an agency violate any state mandates, such as shelter in place mandates and non-essential duties.

- Programming and Key Fees – Modern locksmith equipment is expensive and requires compensation.

- Technology Fees – Agencies paying the fees for accepting a lender or forwarders assignments are unfair, especially when accounts are closed and opened repeatedly.

- Handling Fees – Bringing out collateral for transporters and borrowers during reinstatements is time consuming and interruptive of production and requires compensation.

- Recovery and Handling of Hazardous Materials – Handling materials such as oil, pesticides, cleaning fluids and paint present toxic hazards to the persons doing removal and sometimes require outside professional assistance which all must be compensated for.

- Compliance Education Requirements – Agencies should be allowed to choose which compliance program they offer and which one should not be mandated by the lender or forwarder.

- Dual Assignments for direct placements within same coverage area – This dangerous activity must stop. It is a cause of wasted time and can result in serious injury and sometimes death.

- Release of Previous Repo information/Hostile Debtor info – Lenders and forwarders should be contractually required to advise an assigned agency when they have knowledge of threats made or of previous violent incidents occurring during either the collections process or prior recovery efforts.

- Payment Terms – All submitted invoices should be paid within 30 days.

- Post Repo Reporting Requirements – Punitive withholding of invoice payments for late reporting must cease. Reporting times must be based upon the local times of the agency and only counted by standard business hours.

- Removal of Invoicing Research Restrictions – Agencies should not be forced to endure restriction placed upon research requests for unpaid invoices.

- Collateral Take Backs (vehicles that have left the care, custody and control of the agent) – This time consuming and often acrimonious duty is litigious and should be assigned as and compensated for as a standard repossession as the risks are equivalent and insurance otherwise does not cover it.

- Repossession Accounts Placed on Hold – Reasonable periods of hold before automatic cancellation need to be established.

See the Poll Responses to These Topics Here!

These proposals were all nearly unanimously agreed upon and the ARA will be taking these items into action through the creation of a standard contract addendum that all agencies are strongly suggested to incorporate as a counter addendum to their future contracts. These are intended to help the surviving recovery agencies to be better able to serve the financial services sector while providing safer work environments in what is likely to be increasingly dangerous enough during the loosening of restrictions.

After the webinar, the ARA sent out a post webinar survey intended to develop some understanding of the current state of the industry at this time and to further understand the implications that this national emergency will have on the future of the auto recovery industry.

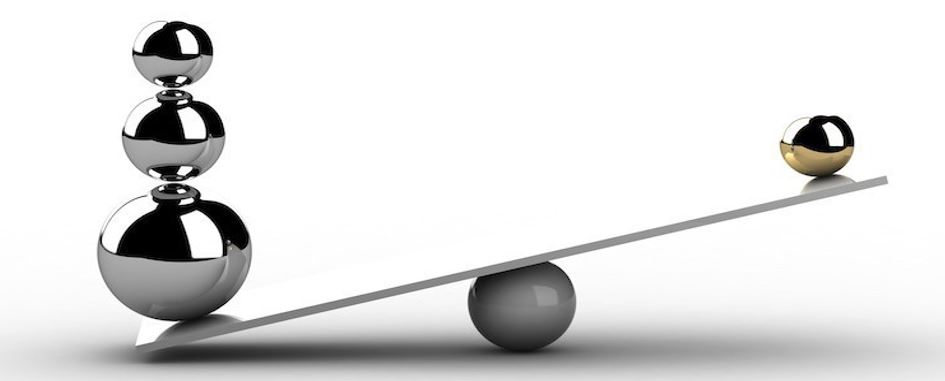

Over the last few decades, the repossession industry has endured a flat and stagnant fee environment further exasperated by a never-ending slanting of contract terms and punitive service level expectations that have been continuously eroding, already thin, profit margins. These conditions had already endangered the sustainability of the industry in the pre-pandemic world and as the regional restrictions and lender holds begin to lift, you will quickly find that the “take it or leave it” terms of old will be unmanageable and toxic to your businesses livelihoods. With the rising risk and costs associated with operating in this new post pandemic environment, it is critical that all repossession agencies initiate new contractual best practices to both account for these liabilities and expenses as well as correct past forwarder and lender practices that have been both unfair and damaging to your company’s survival.

On social media, it has been widely discussed and near unanimously agreed on by the vast majority of repossession agency owners that they must raise their repossession fees in order to sustain operations in the post-pandemic world. With the CDC and OSHA requirements that employers provide a safe work environment, the expense of providing the necessary materials to function will additionally stress the already stressed price point. It has already suggested that the industry adopt a new fee structure based upon inflationary costs from 1980 to current using the consumer price index (CPI) as the basis. It is only fair considering every other expense of the running an agency has increased since then and modern technology has added additional expenses.

We have already seen legal threats made by attorneys claiming that recovering during these restrictive times represents a breach of peace, and we expect that this claim will be asserted with great frequency in the months ahead. Under the current standing forwarder indemnification clauses, these liabilities are all on you and this a risk and probable expense that places undue burden and expense to agencies under the prior contract terms and fees and it is time to correct this imbalance.

The ARA did not discuss fees or any other form of financial compensation in monetary terms, as this could be construed as an anti-trust issue, which is an old issue brought against all of the national associations by the Department of Justice in 1981. The aftermath of these actions set the stage for cut throat competition and resulted in the stagnant wage environment that has been unfairly maintained by the largest lenders and forwarding companies ever since. This near monopolistic stranglehold business environment has not only created a fee environment in which agencies make the same per repossession now as they did in 1980, it has even further reduced income through the eradication of almost all ancillary fees.

While lenders and forwarding companies are eager to pressure everyone into signing new agreements under the same old terms, we urge you to not sign these and strongly suggest that you cancel your existing contracts with all lenders and forwarders pending the new suggested best practices. To assist you, below is the link to an editable cancellation letter for you to use and customize as you feel fit.

Download Cancellation Letter Here!

These “Best Practices” addendums would require all agencies to cease to offer “All Services Included Fees” and address long standing and inequitable deficiencies in the pricing and service models demanded by the repossession forwarding industry which have become their standard, but have eroded at the survival and sustainability of the repossession industry as a whole.

We urge you all to address the needed recovery fee disparity with increases.

We need you to adopt the soon to come addendum to all of your contract agreements.

Please put away your skepticism and distrust. This is the time to stand united as an industry of repossession professionals. These are YOUR industries best practices and are needed by ALL for the survival of both you and all of the industry. Please forward this to every agency owner you know. This must get immediate attention.

This is the time for taking control of your future. Do not waste it!

Will Your Company Enforce this New Best Practices Addendum? – Take our Poll!

Facebook Comments