GUEST EDITORIAL

~ “I want to express that this conversation has nothing to do with today’s COVID crisis and has been avoided for several years by your colleagues. Our company can no longer function at the required service levels at a rate under $xxx and the crisis just crushed our company, so there is really nothing to lose now. We can simply dump our gross dollar requirements by downsizing and work with clients that understand the value of our service and see greater returns. It is cheaper to park the trucks than to run under $xxx.” A communication with one of our clients about our request for a rate increase during the current crisis. ~

Background is always important so to set the stage understand that I sent my first article to curepossession.com (https://curepossession.com/hot-topics/11592-2/ancillary-fees-the-associatedissues-with-safety-and-quality) on 2-17-20 and this was a few weeks before COVID became a thing. I believe I wrote that article in November 2019, however wanted to work with our clients a bit before starting to publish. I would have likely had to bite my tongue if our broker/forwarder clients would have participated in a conversation around rate increases in December and January when I sent out communications to them and our team made follow-up calls.

Before the Ancillary Fee reductions, we sought increases but could adjust these ancillary fees to offset increased costs so we could afford to be ignored by our clients. Over the last three years we have seen the crush of inflation and loss of those fees destroy the profits of our company. For the last two years I

have not been able to rely on our repossession business for any reliable income. The adverse is actually true as we have, like a lot of owners out there, had to find unique ways to supplement our personal income, relieve the pressures of the business losses, and financially prop up our repossession business.

The point is this. The COVID Crisis of today has nothing to do with your need for clients to increase your rates, it just provided the breakover that your courage needed to show up.

I believe I have a bit of a knack for articulation of ideas, concepts, problems, and the like. Everyone reading this understands the problems of this industry as good as I do if not better. I put them into words a bit better than most, so I want to offer some help to frame conversations with your clients around increases.

~ Every company in the industry is coming after me about increases and you all are just going to have to let us evaluate it for 30 days. Paraphrase from one of our clients in the last couple days. ~

It is illegal to attempt to conspire to set rates, increase rates, etc. That is not what this is, but apparently, as I said earlier, everyone reading this understands the problem as good or if not better than I do.

The COVID shutdown provides unique challenges, opportunities, and times for us all. My team’s conversations about rate increases can be documented with our broker/forwarders (especially the lowest paying ones) going back 3 years. If the shutdown would not have happened, it would have been business as usual (see https://curepossession.com/intentional-destruction-or-ignorance-who-profitswhen-a-mature-field-service-repossession-company-folds) and that comment from that client would have never happened because the conversation would not have happened.

We all would have been too busy chasing the gross dollar amount to meet our fixed cost, dealing with the flex costs as cash flows allowed, and focusing on profits would have been a side conversation with our vendor managers that barely registered in their busy day as it was a constant hum they heard all the time. That hum was background noise to the issues, client demands, meetings, etc of the normal workday in the broker/forwarder day.

As I said, the COVID crisis provided unique challenges, opportunities, and times for us all. For our vendor managers, there is enough quiet to hear the hum and it is louder than anything else in your business because it is the only thing flowing at this point.

For the owner of a Field Service Repossession Company, it is a unique time as well. The safety of your team, government controls, lockdown, and the like have literally put you at a “new business starting point” when you start thinking of reopening.

You have taken in the breath of family, learned your kid’s names, and perhaps made it back to your poker game or church (social distancing of course). The pressure of having to get it right in order not to fail your employees and family has been taken away by choices you were not in control of.

It is a time for learning, reading, connecting, and understanding your business and the industry. You now see the invoice denials as you have nothing else to do but search accounts receivable. You have gotten to know how difficult some of the processes and logic are that your team has been struggling with as you have been handling a lot of the day to day after laying off most of your team. As you analyze your business you begin to see that it does not make sense to provide the services you have been providing at the rates you are doing it for. You are now doing what everyone else is doing and trying to figure out what the real value of your service looks like.

Use your historical rates and adjust up. Chances are, the rate you originally contracted with your client(s) at were reasonably fair against that market and the dollar at the time they were set.

Remember, it is why the new guy down the block gets better rates if you read my other articles.

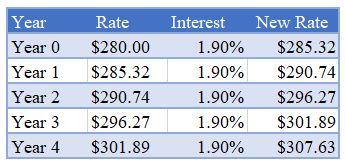

Inflation average is easy to find online. Look it up. If you have had a contract with a client for 5 years, annualize the rate this way to see where you should be based solely on inflation.

Client Contract Rate in past article of $280 ~ Annual Inflation Average @ 1.9% ~ 5 Years:

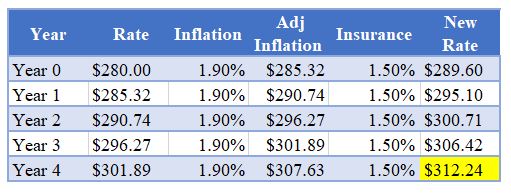

We saw an increase in our insurance this year. We took the dollar amount of the increase and divided by our annual recoveries to get the average increase per recovery. We divided this number by the client rate we are considering and at $280 we come up with another 1.5% to adjust against that same $280 rate.

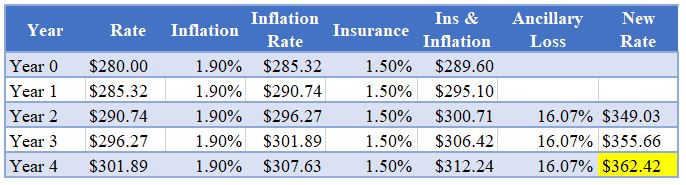

Now Consider how much you lost in ancillary billing over the last three years per repo on average. I will use the math from the previous article of $45. To get the percentage of loss for the specific client divide the loss ($45) by the rate ($280). This gives us a loss calculation of 16.07% to be passed back to the client. We only apply this to the last three years where the offset occurred.

I will say it before it is asked, this math comes straight from a previous article and can be considered real to the extent we have had contracts at $280, have lost $45 on average in ancillary billing over the last 3 years, and inflation over the last 5 years has an average around 1.9%. I believe contracts 5 years ago were signed at a better rate than $280 and I do not propose that you set rates based off these numbers. Each company should evaluate their own numbers based on their offsets, understanding of inflation, and insurance increases. I am suggesting that you can mathematically come to a number using the formula above.

Just analyzing these three items alone with a $280 contract over 5 years you can see it is not unreasonable to consider a new rate of $362.42. Fuel usually runs higher than inflation as does equipment so you may or may not want to plug those in the same manner.

Your business is different from mine and again, I only show the above numbers to demonstrate the ability to frame any conversation with any client about your need for a rate increase should you deem it necessary. If you are like me, you have been asking for that increase for a while but are just now being heard.

What the client quoted above was experiencing has nothing to do with any kind of organized or suggested organized movement, conspiracy, or attempt to fix prices, COVID just slowed the industry, your business, and your vendor managers enough to hear the issue. It is not new; it has nothing to do with COVID and it can be mathematically supported while leaving the emotion out of it.

I hear the conversations that echo “we have to be patient,” “the industry doesn’t work that way,” and the like. My response to those is “what the heck do you think I have been doing for the last three years and if the industry can’t get it together any faster than that then get the hell out of the way and let the Field Service Company Owners find the solution. We are pretty good at finding solutions on a budget.”

I also hear a lot of chatter about “holding cars.” I would discourage this behavior. It gives creditability to the arguments the broker/forwarder makes about “reining in” or keeping compliant the “repo companies.” Remember, you are not in control of how they broker frames the conversations with the lien holder and this can-do real damage to your company without you ever knowing about it.

A less damaging idea is just moving that client on auction pay until they catch up their past due balance. In other words, our team will release that collateral with payment in full from the auction and any other collateral for that client will have the same auction/release pay requirement until such time as the past due balance is taken care of. At that point we can go back to releasing all collateral based on payment promises and invoicing.

This way the auction frames the initial conversation. Do not discuss why with the auction, only to that the bill needs to be settled on release. They will call the lien holder who will call the client and then accounting, or your vendor manager will return the call they have been dodging. No harm to the client as they can save face and say it was a CSR error or they can own up to it with the lien holder and say they are overnighting payment to schedule the release.

How you frame the conversations around the value of your services and handling difficult clients can make the difference between survival or not. The good part about all the compliance BS over the last several years is the cost and difficulty in opening a business in today’s industry. Add that to the attrition over the last couple years and the broker/forwarder will finally see what the fuss has been all about over the last three years.

Wes Carico

SEI ~ Nostalgic Towing

Facebook Comments