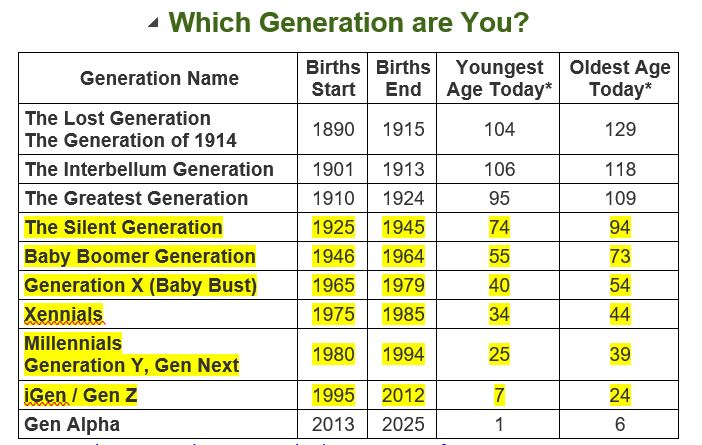

Doing a quick check of pool of our insured drivers, we have individuals from 6 different generations represented. We have individuals from the Silent Generation, Baby Boomers, Generation X, Xennials, Millennials/GenY/GenNext, and iGen/GenZ – meaning we insure drivers born in the 1930s to those born in the late 1990s.

In 1930 the car radio was first introduced commercially – and it wasn’t until 1979 that FM radio surpassed AM radio popularity. Today – satellite radio makes the world feel smaller than ever and some don’t even bother with the radio, while they have wireless ear buds in while driving jamming to Apple Music.

Think about that… that is 70 years of changes in technology that some of your drivers are now experiencing and may be experiencing at an older age. On the flip side for those iGen/GenZ individuals, many have never known life without a cell phone and internet in the vehicle they are in is common place – and a world without these luxuries is considered ancient.

Insurance providers already require medical statements on any driver over 65. Why? To see if there are any underlying medical conditions that could increase risk that may be more common or more likely in older drivers. Things like eye sight, hearing, heart conditions, diabetes, blood pressure, history of seizures are questioned. Reaction times for older drivers can be longer and when you add distractions to the mix, it could be problematic. (Older drivers may also be less likely to embrace change and technology so learning how to use these distracting devices could be problem; or it could be a blessing inasmuch as an older driver may be less likely to use some if not all of distractions that are becoming more common place.)

As a side note – as an employer you may want to consider asking some of these medical questions yourself regardless of a prospective employee’s age. We have seen more than our fair share of drivers in their 30s/40s/50s have heart attacks, complications due to diabetes, seizures while driving because of the lack of self care many in the industry experience.

So how do you discuss distracted driving and get your employees to buy in to any corporate policy you may have when you may have to span 70 years of an age gap? Many experts suggest, you make it personal. Get information and statistics on the dangers and costs associated with distracted driving. Put things in perspective – reminding drivers of their own mortality and what it would do their families, or their ability to have a family in the future, or the guilt they may personally experience if they cause an accident because of distracted driving. Have systems in place that acknowledge and reward safe drivers, have policies that hold drivers (regardless of age) accountable for their driving behaviors.

RSIG has been providing the repossession industry top quality repossession insurance for more than 30 years with the industry’s most stable insurance program available. We are able to do this by evaluating the needs of the industry, meeting those needs and offering an exceptional insurance product and service along the way. If you want more information about distracted driving, follow our FB page at www.facebook.com/RSIGInsurance or visit our website www.rsig.com.

Facebook Comments