EDITORIAL

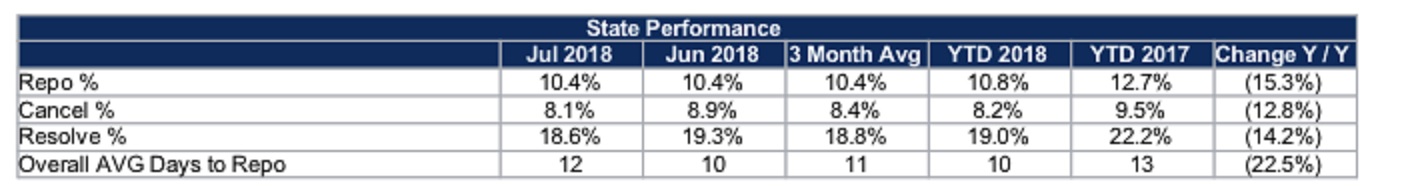

A reader recently provided me a screen shot from a statistics report from a forwarding company that they work with showing a very detailed accounting of their assignments, recoveries, etc. Part of the report showed the forwarding companies average repossession recovery rates for the state of Georgia. 10.8%?!?

Now, I come from the repo industry way back and the bulk of my career was in lending and collections for a large west coast credit union who did direct assignments. Our average repossession recovery rate was 40-60% with a 5 day average recovery.

According to the provided screen shot, this forwarder’s agencies only recover 10.8% average YTD and, have a 10 day average time to recovery. How sad.

According to the provided screen shot, this forwarder’s agencies only recover 10.8% average YTD and, have a 10 day average time to recovery. How sad.

To boot, the agent looked up the list of repossession agencies that the forwarder is employing and found that they had 33 agencies covering the state of Georgia in 2018. This is up from the 17 they had in 2017. Where did these agencies come from? Sure some legitimate agencies may have signed on with them since 2017, but I’m sure several have closed or quit working this sub-performing paper. So where did they acquire 16 new agencies?

I imagine the forwarder is employing low level tow companies, body shops and every swinging Richard with a sling boom and an attitude just to keep their accounts covered. What a sorry state of affairs.

As a lender, I would be looking at my vendors very closely with poor recovery rates like these and would very likely be looking for new solutions. As a collector, I would be frustrated by the slow repossession turn times.

As a repossessor accepting a mere $300 per repo with a mere 10.8% repo rate, I would have serious questions about the value of spinning  wheels on my trucks, burning fuel and wasting man hours on assignment quality so poor. In my day, a client with a recovery rate of less than 20% would be questionable and at $300 per, even in 1996, I would likely cut them off or simply put them on a “2 run and done” list.

wheels on my trucks, burning fuel and wasting man hours on assignment quality so poor. In my day, a client with a recovery rate of less than 20% would be questionable and at $300 per, even in 1996, I would likely cut them off or simply put them on a “2 run and done” list.

Considering that $300 is the end of the line in fees, unless the agency is lucky enough to get delivery fees that are actually worth the time, what is the net profit on this relationship? When did these become reasonable to anyone?

I suppose the quality of the assignments is the root cause of this. Delinquency aging could be a culprit and how many agencies have worked it could be another. Either way, why would any self-respecting repossession agency owner put up with this. Volume? What kind of volume is that? It’s like Hamburger Helper. Imitation meat or, imitation assignments to supplement better performing clients.

I am constantly amazed at how much technology has improved data quality and communications all around us. From this, efficiencies are improved all the time. Why is it that in the repossession industry, technology and efficiencies intended to improve service levels and profitability only seems to make things worse?

I suppose the answer to that can be found by following the paper trails of who is really making a real profit in the industry. It certainly isn’t the agent in the field or the repossession company. Sad.

Editor

Facebook Comments