In our second annual survey, even more of you spoke up, and what we found was sometimes similar to last year, but still often surprising. This is the first part of several releases of the survey, which covers topics such as Company Trends, Contingency Assignments, Associations, ALPR, Forwarding and Violence in the industry.

Last year was the first of its kind and a little eye opening but this years results seem in many ways to mirror last years in many ways. While the results may be askew by the relatively small number of respondents, they suggest that the economics of scale are favoring larger companies over the small ones just as they are in most businesses in our economy.

Participants

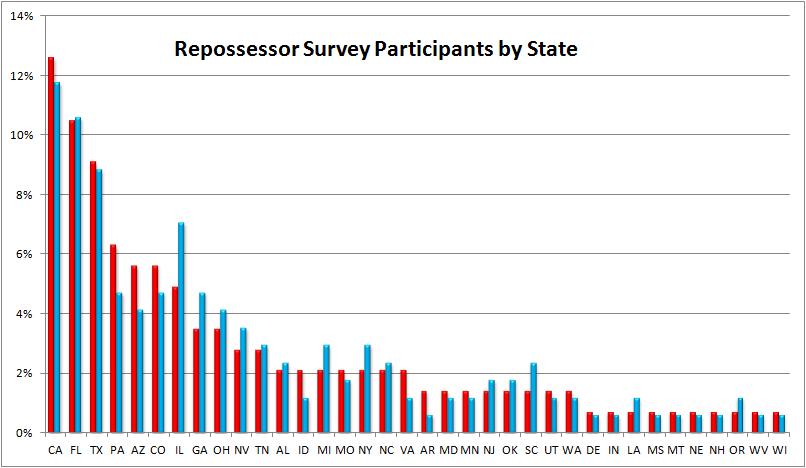

Just as with last year, we are starting the results of this survey with the demographics of our 170 respondents which was up from 2011’s 143. Just as with last year, the highest amount of participation came from California, Florida and Texas. This was again no surprise to me as these coincide with the sites most frequent readers. What was nice, was to see and increase in Illinois, Michigan and New York. While there was once again little or no participation from most of the 50 states, I still feel it gives a fair representation of the industry.

Repo Company Age

With an 11% drop in agencies that have been in business from 1 to five years, I can’t help but wonder if a fair number of newcomers have shuttered their doors and chose a new occupation. While it may be just a matter of survey participation, those over that threshold increased by 11%.

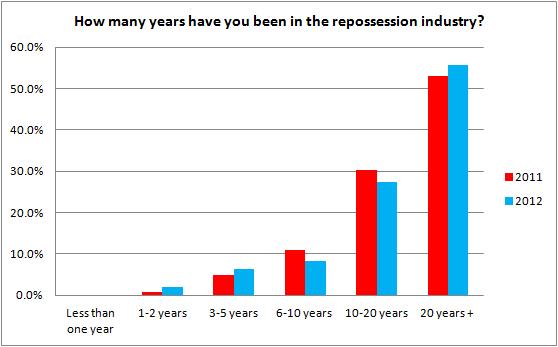

Respondents Years in the industry

There is clearly nothing here to suggest a surge in new companies or workers but the reductions, but the 5% reduction in respondents with 6 to 20 years experience makes me wonder.

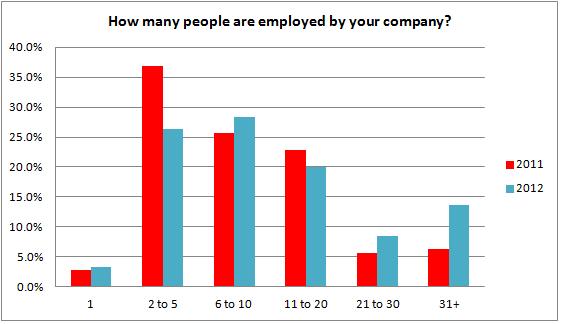

Employees per Company

While smaller company respondents seem to be showing a minor decrease in employees, the larger ones made up for it with a 10% increase suggesting that the economics of scale favor them just as within other businesses. We’ll see how that holds up over the next year as new reforms hit small business.

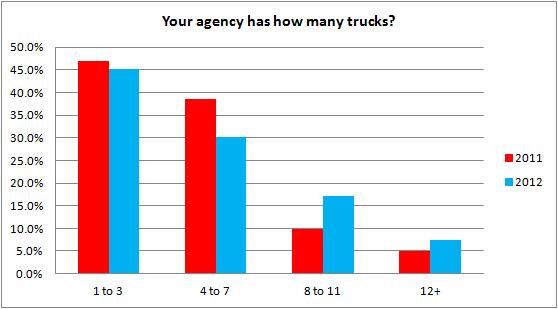

Number of Trucks

Once again, it appears as though only the larger companies can afford new trucks or that this is reflective of the aforementioned reduction in small companies.

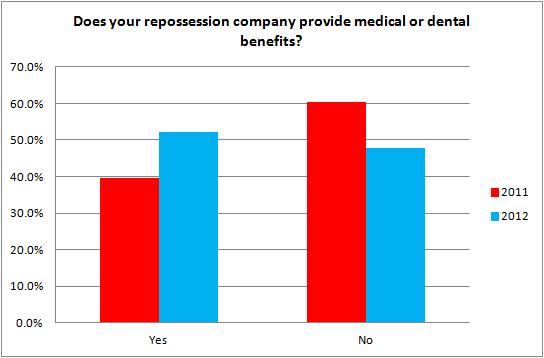

Dental and Medical Benefits

While it’s encouraging to see a 12% increase in medical and dental benefits within the industry respondents, it’ll be interesting to see if this goes away over the next year or two as “ObamaCare” comes into play.

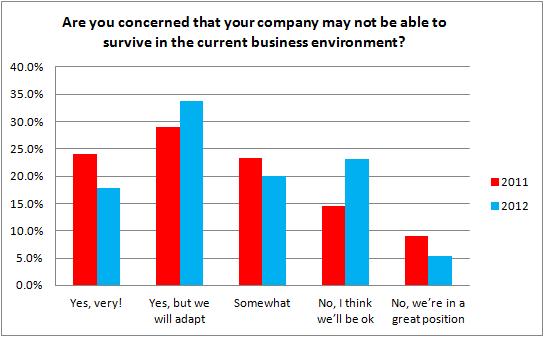

Survival

I’m actually surprised to see a 5% increase in the number of respondents who seem fairly optimistic on their ability to adapt and overcome the many obstacles facing them. In this pessimistic industry this notion is rarely spoken with any positive conviction. But then again, the only easy year is the one behind you.

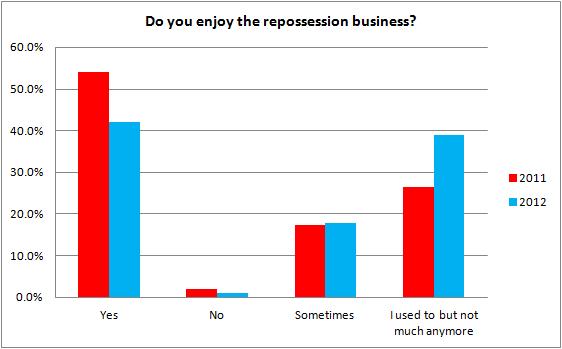

Happiness

One thing is clear here, everyone seems to yearn for the past. Respondents who enjoy the business are down 12% while those who used to but don’t much anymore is up 12%.

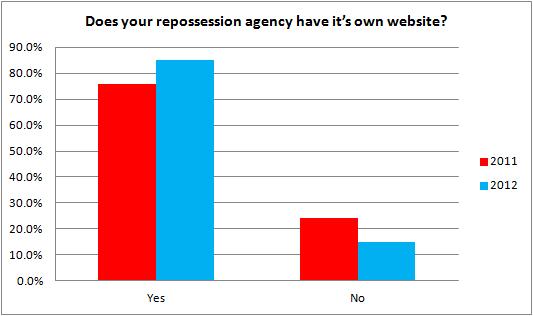

Website

With 85% of respondents having their own website, this 9% increase illustrates clearly the importance that this portal has for marketing and communication. Folks, if you don’t have one, get on the ball. It’s really cheap and easy.

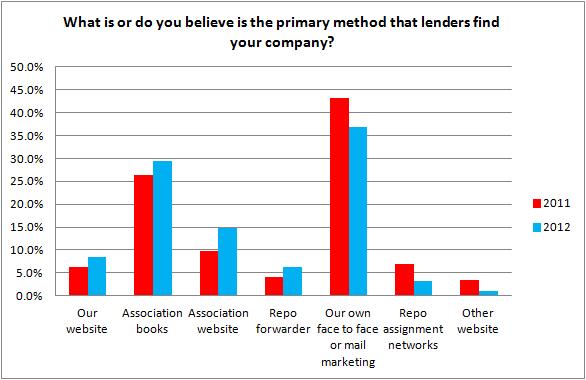

How do Lenders find you?

There appears to be a growing perception that the associations books and websites are the best way to get business. I don’t doubt this one bit but there is still a large number of you that believe in your own marketing.

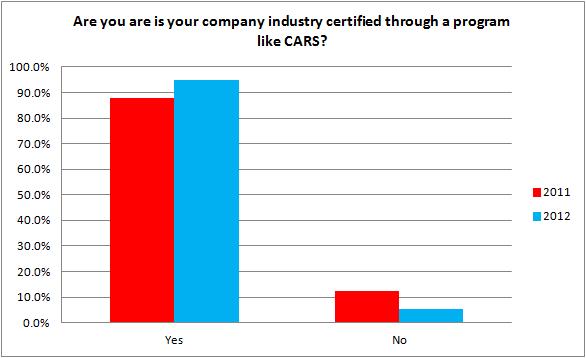

Repo Certification

It’s overwhelming the amount of support the respondents show to certification. I think the rise in compliance training over the last year supports this very much and it is good to see this swell in professionalism.

Contingency and Forwarding

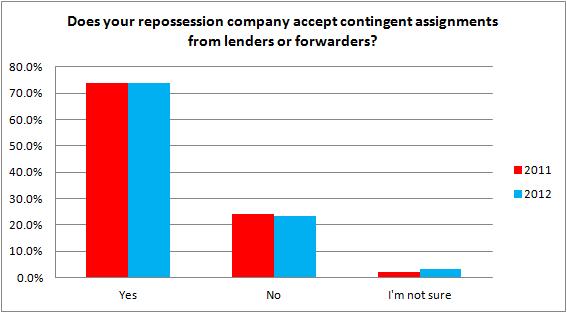

Do you accept contingency assignments?

Wow, everyone complains about contingency assignments but nothing has changed. Almost 74% of the respondents accept them while only 23% have the intestinal fortitude to say “NO!”

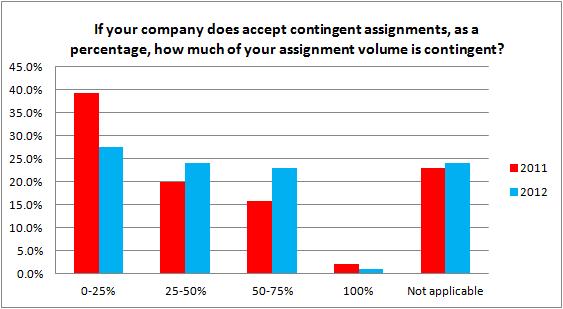

How much of your business is contingent?

Once again, it appears as though our respondents are only getting in deeper with the contingency assignment providers as there’s been a 7.3% increase in companies who claim that 50-75% of their work is contingent.

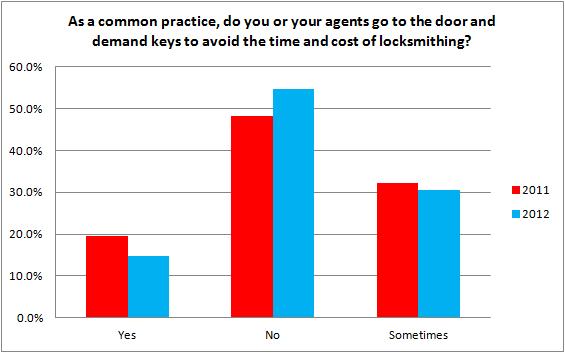

Keys

Well, at least there’s been a 10% decrease in companies that go to the door demanding keys. It’s good to see some people reducing the unnecessary conflict.

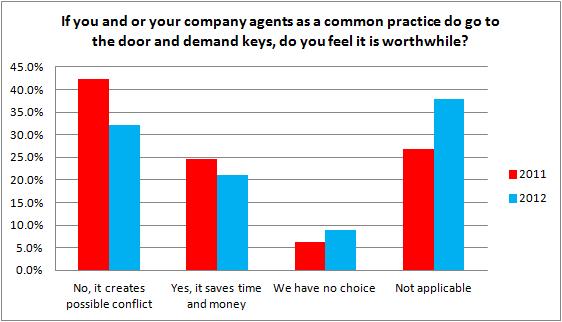

Keys, Are they worth it?

Here’s where the cream rises to the surface. The response to the last question seems to suggest that this is becoming a growing requirement by either the lenders or the companies themselves who may be attempting to reduce locksmithing costs and time by demanding keys.

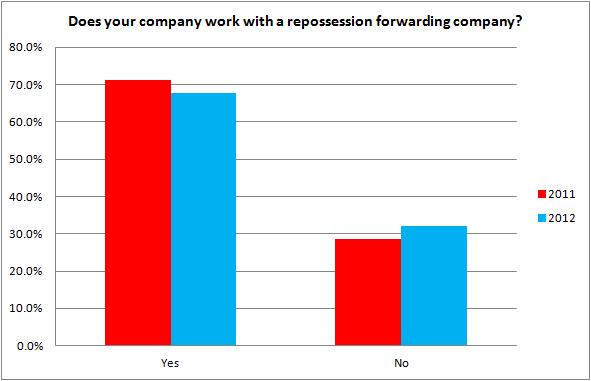

Does your company work with a repossession forwarding company?

Not a dramatic change, but perhaps some of you are feeling less inclined to work for the facilitation or forwarding companies.

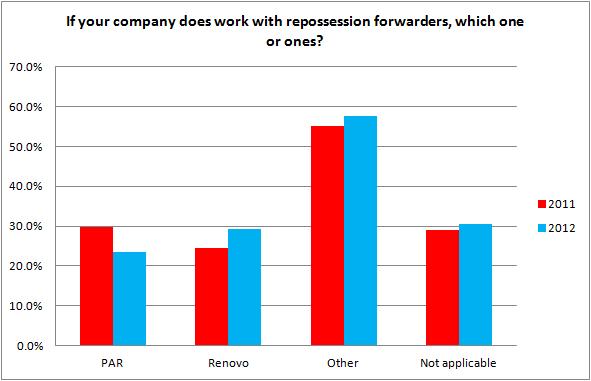

If your company does work with repossession forwarders, which one or ones?

Since the creation of ARMS and the Relliance groups, I fear I may have provided too few choices on the list as almost 58% of the affirmative respondents chose other. Regardless, our respondents did show a -6.2% reduction in their participation with PAR and a 4.8% increase with Renovo.

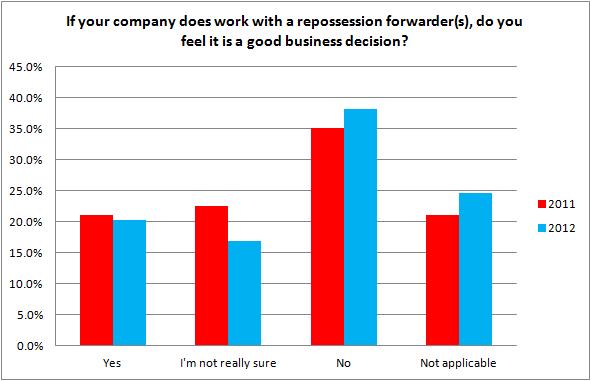

If your company does work with a repossession forwarder(s), do you feel it is a good business decision?

As expected, the decision to participate with a forwarding company is still a questionable one in the minds of the industry.

If you do accept repossession forwarder assignments, as a percentage, how much of your account volume do they represent?

While an overwhelming number (76%) of the respondents claim that forwarded accounts only account for 30% or less of the assignment volume, a surprising 19% claim that forwarded assignments account for 50% or more of their work. Sounds like some of you are running a risky business model via such dependency or perhaps you have figured out a way to financially make it work.

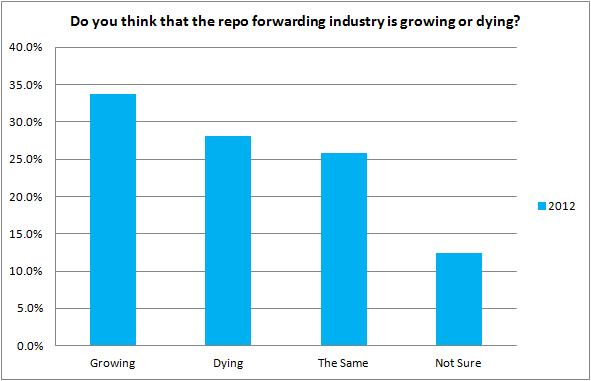

Do you think that the repo forwarding industry is growing or dying?

This is a new question to the survey, but it does appear as though very few believe the forwarding industry is going away anytime soon. I strongly suspect they are right.

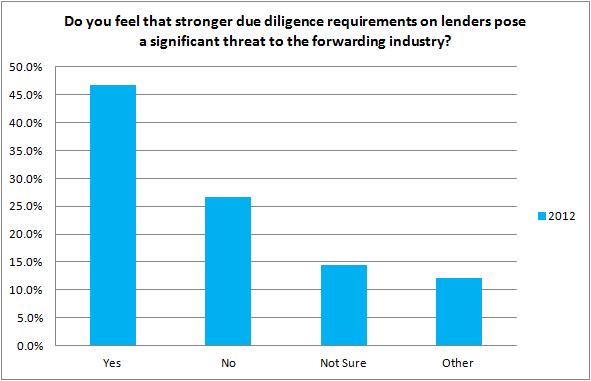

Do you feel that stronger due diligence requirements on lenders pose a significant threat to the forwarding industry?

Almost half of the respondents suspect that via regulations or Federal supervision, the forwarding industry will have some challenges.

We’re not done! Our next release will be on Associations, Skip Tracing and LPR. Click Here to see Part II!

Thanks Kevin. Again it is interesting!

You’re welcome Tom. It’s interesting to see how the industry is evolving.

Kevin,

Great job and the format is excellant.

Kevin, thank you for the survey and results. I find them highly useful in seeing where our agency places in terms of the rest of the industry. Great work!

Kevin, great job!

Listen, I obviously have a proverbial dog in the fight, so I do have a question. Nearly 30% of the responders state that the primary method that lenders find them is through association books. That’s already an impressive number, and up from the previous year But…

Not all of the responders are in an association, so as a result many of the responders wouldn’t ever get an assignment from an association book.

Wouldn’t that skew the numbers?

Pat,

You are correct, but with only 11% claiming to not be affiliated with an association, it only changes the ratio by 1.27% bumping it up to 30.76%.

Kevin