Late last month, the American Recovery Association (ARA) launched this survey with the goal of better understanding the current landscape surrounding License Plate Recognition (LPR) technology and its impact on the agent community. The survey aimed to provide a platform for agents, forwarders, lenders, and service providers to voice their perspectives, challenges, and ideas for improvement. While the survey was conducted prior to DRN’s recent announcement of major changes to their LPR practices, the responses gathered offer valuable insight into longstanding concerns and emerging needs across the industry.

We want to take a moment to extend our sincere gratitude to both DRN and Insight LPR for their willingness to engage in meaningful, ongoing dialogue with the ARA. Their openness to conversation and commitment to listening to agent concerns represents an important shift toward greater transparency and collaboration. We recognize and appreciate their time, their effort, and their continued participation in shaping the future of LPR within our industry.

Survey Results

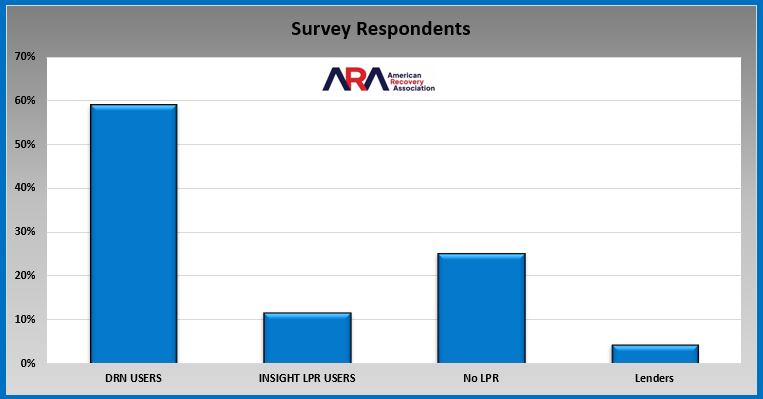

- Respondents

The ARA LPR Survey brought in a total of 163 respondents.

- 59% were active DRN users.

- 12% were Insight LPR users.

- While 25% claimed to not use LPR at all, their comments in open text areas eludes to past experience with it and with specificity. DRN.

Of the non-LPR-user respondents:

- 7 lenders participated.

- 16 were forwarders.

- 3 reported that they work for one of the LPR providers.

From an end user standpoint, these portions of the data pool are kept apart from the primary LPR user groups due to differing experiences, needs and perspectives.

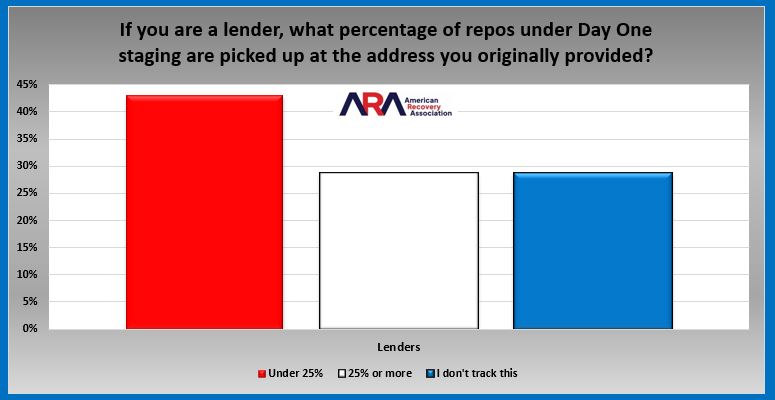

- If you are a lender, what percentage of repos under Day One staging are picked up at the address you originally provided?

- Under 25%

- 25% or more

- I don’t track this

Summary: With a pool of 7 lenders, the results were mixed. Only 3 of the 7 claimed that less than 25% of their units were recovered from the primary residence of assignment and 2 claiming that more than 25% were.

Most startling was that across the board, in all user groups, there was little or no reported tracking of this. Considering the high levels of technology adoption, there seems to be little emphasis on efficiency tracking by any parties in the respondent pool.

- How long have you worked in the repossession industry?

- Less than 5 years

- 6-10 years

- 11-20 years

- Over 20 years

Summary: This is a well-seasoned pool of respondents. Amongst LPR users, more than half of each group has been in the repossession industry for more than 20 years and about 90% have been in it for more than 11. DRN users showed that 92% of them have been in the industry for greater than 11 years compared to 68% on Insight LPR users.

The non-user and lender groups were of equally lengthy experience.

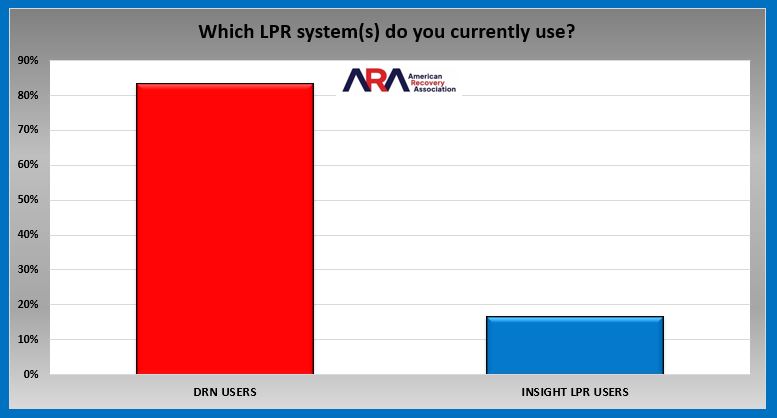

- Which LPR system(s) do you currently use?

- DRN

- Insight

- I don’t use an LPR system

- Other (please specify)

Summary: DRN users accounted for 58% of all responses versus 12% on Insight LPR users. Given DRN’s tenure in the LPR space and their until recent one-year non-competition clause, this is not surprising.

7 of the 16 responses from forwarders reported that they use DRN and 2 reported using Insight LPR. 3 of the 7 lenders claimed to work with DRN and 2 reported to use both Insight LPR and DRN.

A good follow up question would have been to ask both the DRN users and Insight LPR users if they had ever used a different LPR provider. Many of the responses provided may have been based upon prior experience and not those of their current provider.

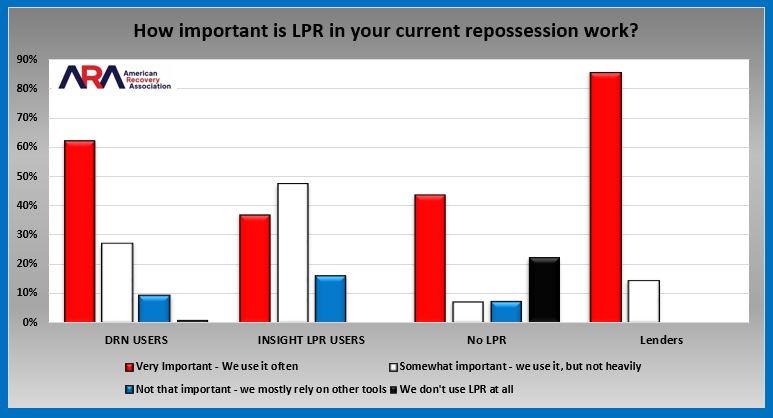

- How important is LPR in your current repossession work?

- Very Important – We use it often

- Somewhat important – we use it, but not heavily

- Not that important – we mostly rely on other tools

- We don’t use LPR at all

Summary: A whopping 90% of all DRN users felt that LPR was at least somewhat important to their repossession operations with 63% saying it was very important. In comparison, 84% of Insight users felt it was above that line with only 37% claiming it was very important.

While only a pool of 7 lenders, 86% felt it was very important.

ARA LPR Survey Results Are In!

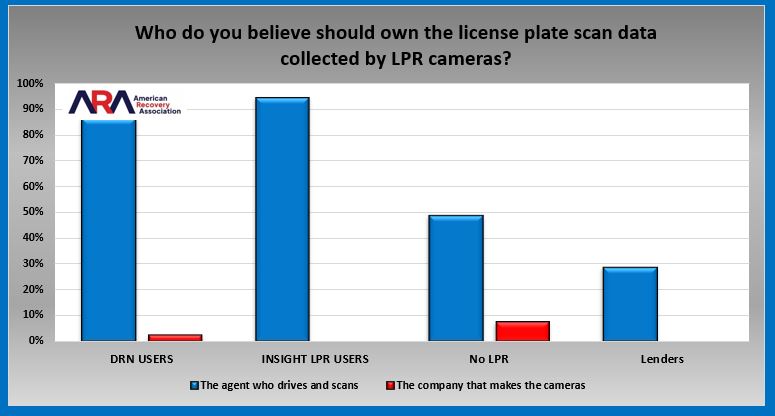

- Who do you believe should own the license plate scan data collected by LPR cameras?

- The agent who drives and scans

- The company that makes the cameras

- The lender who owns the account

- Other (please explain)

Summary: For both DRN and Insight LPR users, the answer to this question was almost unanimous. Even amongst the 10% that responded with “Other” they suggested that the agency and the LPR provider should share equally in the ownership.

Lenders and forwarders on the other hand, had a differing view. Only 29% of the lenders believed that the scan should be owned by the agency and 14% reported that the believe it should be owned by the lender. Another 43% believed likewise in a share concept of ownership between agency and LPR provider.

On the other hand, 49% of forwarders and persons in the LPR space believed the agencies should have control while 20% favored a mostly shared ownership.

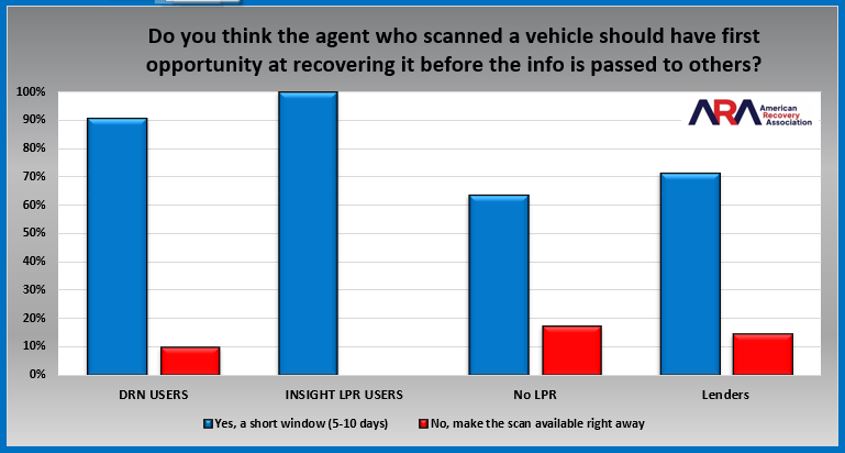

- Do you think the agent who scanned a vehicle should have first opportunity at recovering it before the info is passed to others?

- Yes, a short window (5-10 days)

- No, make the scan available right away

Summary: Amongst both Insight LPR and DRN users, the short window opportunity was almost unanimous. With Insight LPR users it was at 100%. While lenders and forwarders mostly favored this, there was an average of 16% that felt the scan should be made available immediately to other agents.

ARA LPR Survey Results Are In!

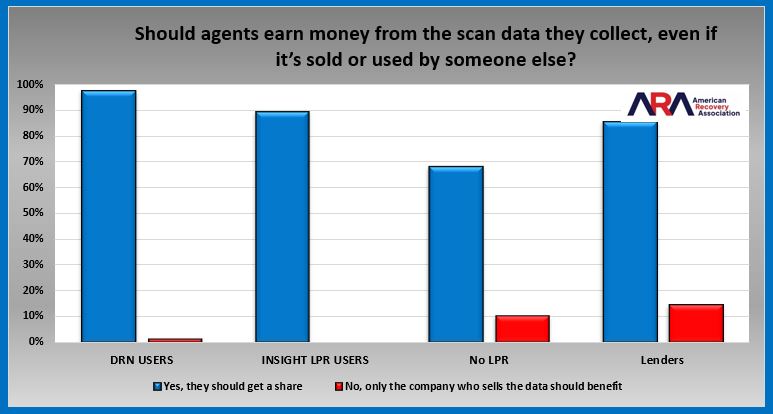

- Should agents earn money from the scan data they collect, even if it’s sold or used by someone else?

- Yes, they should get a share

- No, only the company who sells the data should benefit

Summary: Again, it was an almost unanimous agreement by LPR users that they deserve a share of the revenue. Among the lenders and forwarders, the feeling was also strongly felt.

Of interesting note, of the 3 claimed LPR Providers to this poll, 2 of them agreed and both claimed to be DRN users. Of course, their identities and employment can not be verified as this is an anonymous survey.

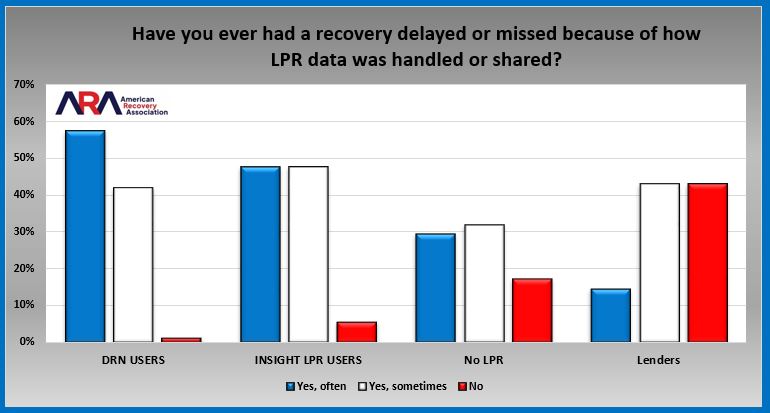

- Have you ever had a recovery delayed or missed because of how LPR data was handled or shared?

- Yes, often

- Yes, sometimes

- No

Summary: For LPR users, this is clearly a problem. 99% of DRN users claim to have encountered this between sometimes and frequently with 57% claiming it was a frequent issue. For insight users, it was likewise an issue, although an even split.

For non LPR users, it almost was almost split across the board. But for lenders, 43% claimed to have experienced no issues.

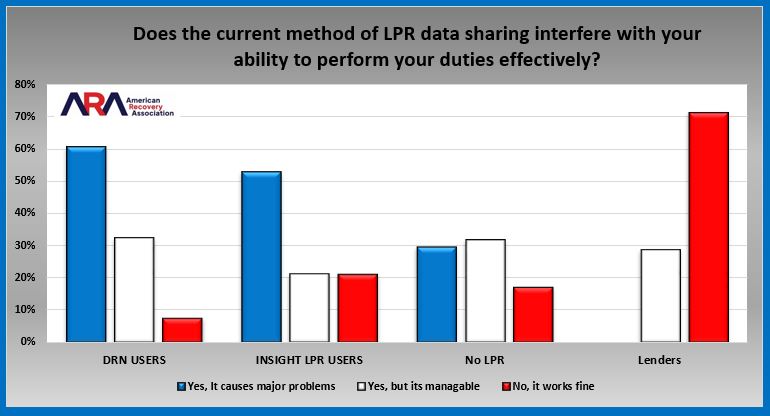

- Does the current method of LPR data sharing interfere with your ability to perform your duties effectively?

- Yes, It causes major problems

- Yes, but it’s manageable

- No, it works fine

Summary: This is clearly a problem for the LPR users but appears to be significantly less of an issue for Insight LPR users than DRN. For non-users, it was again split and for lenders, it was clearly a non-issue.

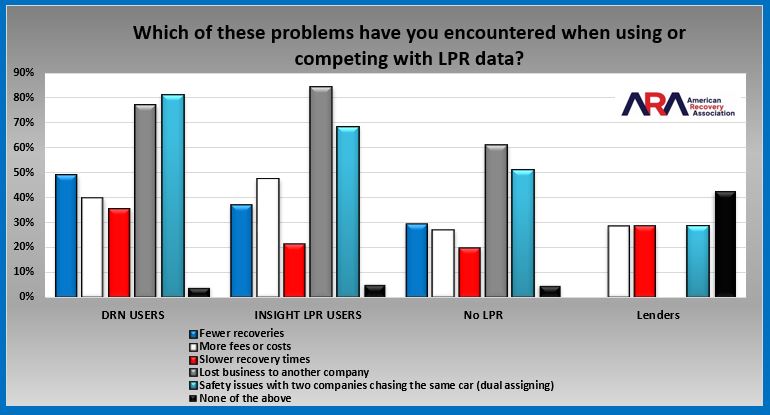

- Which of these problems have you encountered when using or competing with LPR data?

- Fewer recoveries

- More fees or costs

- Slower recovery times

- Lost business to another company

- Safety issues with two companies chasing the same car (dual assigning)

- None of the above

Summary: With these many problems, DRN seemed to have higher ratios of safety issues than Insight LPR by a 13% difference. However, a higher ratio of Insight LPR users (85%) claimed to have lost business to a competitor. Whether or not their responses were from prior experiences with other LPR vendors or current experience is unknown.

Non-LPR users also claimed to have lost business due to LPR. 7 of these are repossession agencies who no longer use LPR. For the lenders, there were no significant issues above any of the other respondent groups.

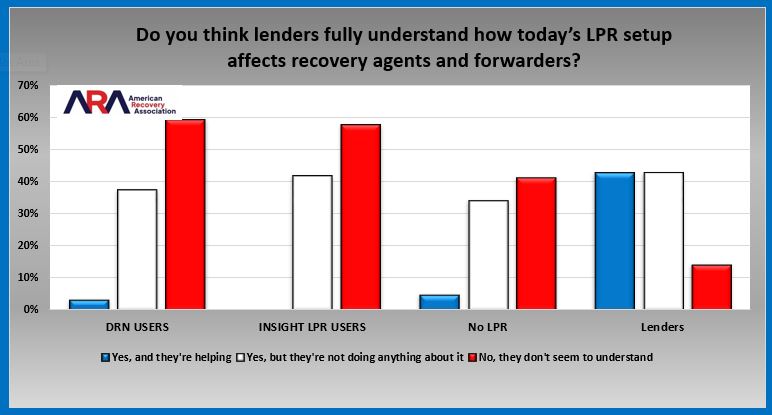

- Do you think lenders fully understand how today’s LPR setup affects recovery agents and forwarders?

- Yes, and they’re helping

- Yes, but they’re not doing anything about it

- No, they don’t seem to understand

Summary: Other than the lenders, no one seems to feel that lenders have an understanding of the impact on current LPR processes effects the repossession industry. Worse, across the board, an average of 39% feel that they know but just aren’t doing anything about it.

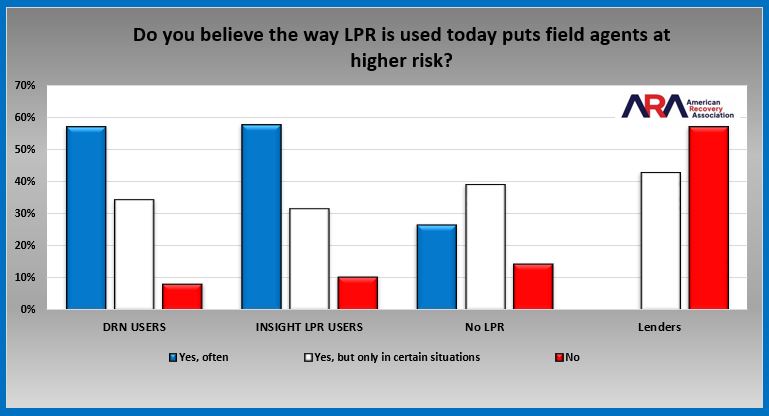

- Do you believe the way LPR is used today puts field agents at higher risk?

- Yes, often

- Yes, but only in certain situations

- No

Summary: Amongst both user groups, they almost unanimously agree that current LPR processes and strategies are creating higher levels of risk with almost 58% across the board feeling it often does.

On the flip side, the non-LPR users were pretty well split and 57% of the lender group did not see this as an issue.

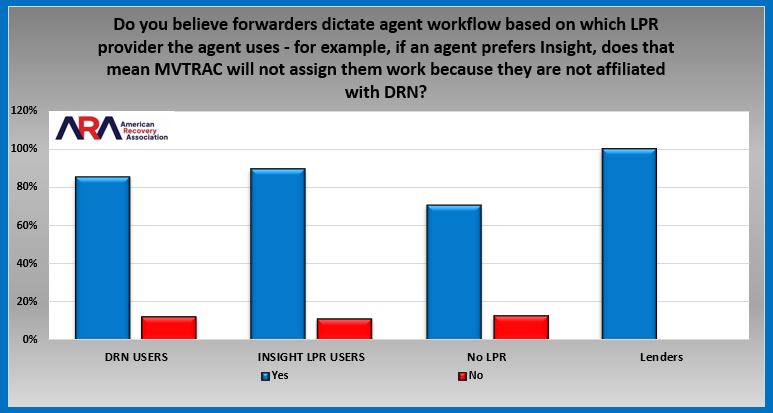

- Do you believe forwarders dictate agent workflow based on which LPR provider the agent uses – for example, if an agent prefers Insight, does that mean MVTRAC will not assign them work because they are not affiliated with DRN?

- Yes

- No

Summary: This was a hands down yes. All of the lender responses agreed it was. Only 11% of respondents thought otherwise.

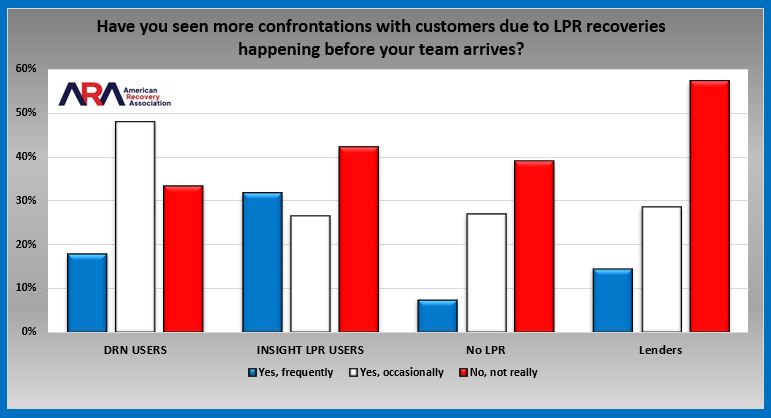

- Have you seen more confrontations with customers due to LPR recoveries happening before your team arrives?

- Yes, frequently

- Yes, occasionally

- No, not really

Summary: Both user groups seemed to believe that confrontations due to LPR have significantly increased with 66% of DRN users saying it has from occasionally to frequent and 58% if Insight LPR users.

Non-LPR users saw it as far less of an issue. Lenders reported a 57% non-issue. Neither of these two groups reported it as a frequent issue with any great volume. 27% of the non-users did not respond to this question.

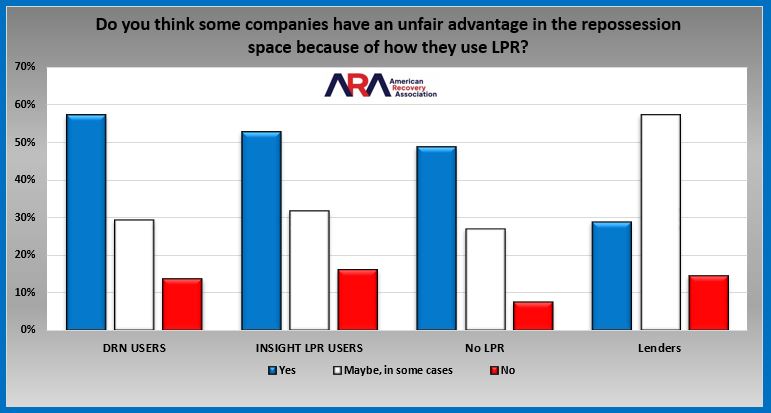

- Do you think some companies have an unfair advantage in the repossession space because of how they use LPR?

- Yes

- Maybe, in some cases

- No

Summary: By varying degrees, more than 50% of LPR users and non-LPR users felt that there was an unfair advantage being used in the LPR space. In contrast, and average of 13% of all respondents believed there was not.

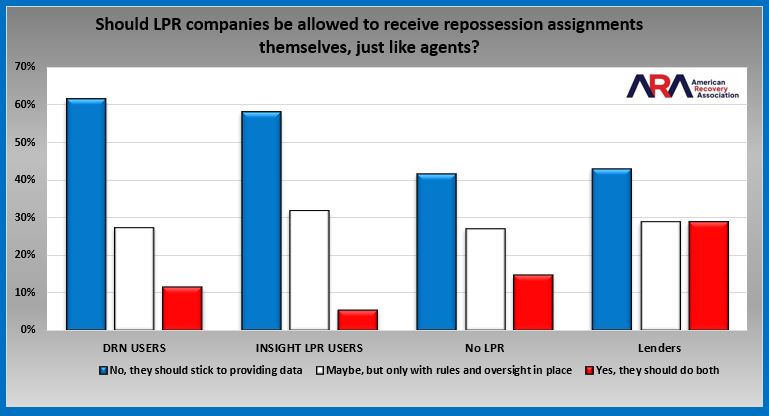

- Should LPR companies be allowed to receive repossession assignments themselves, just like agents?”

- No, they should stick to providing data

- Maybe, but only with rules and oversight in place

- Yes, they should do both

Summary: No one seems particularly in favor of this except the lenders who were basically split with 57% believing they should with at least some oversight in place.

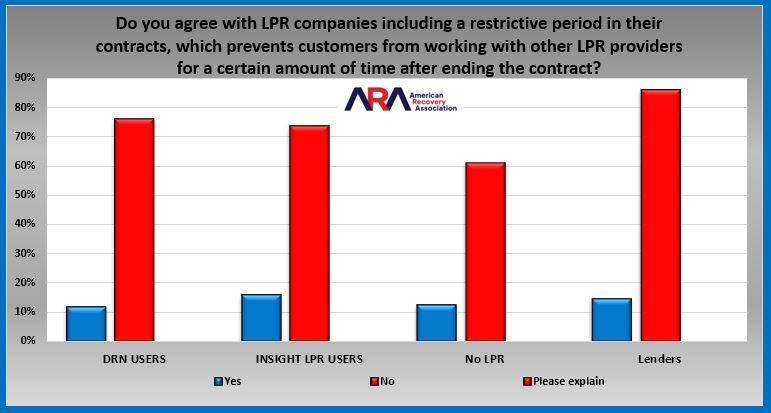

- Do you agree with LPR companies including a restrictive period in their contracts, which prevents customers from working with other LPR providers for a certain amount of time after ending the contract?

- Yes

- No

- Please explain

Summary: On average, 74% of respondents were not in favor of these restrictions. Odd enough, 86% of the lenders agreed. In light of DRN’s recent change in their exclusivity clause from 1 year to 90 days, many of these responses are late to the changes that have occurred. We did not sort this survey out by date to look for any changes in this perception after DRN’s announcement.

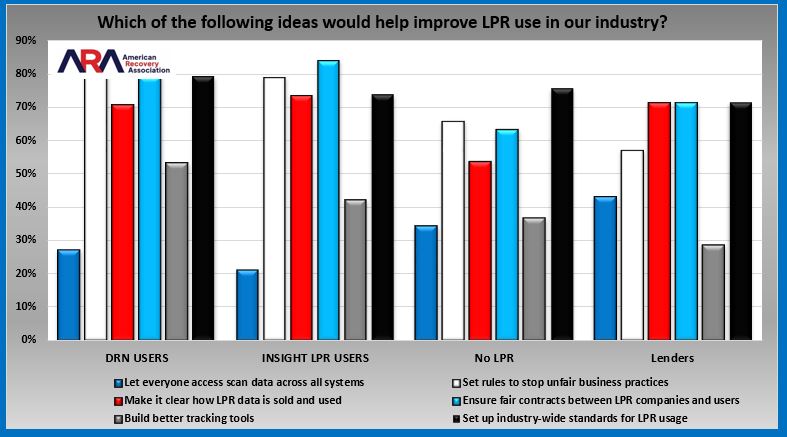

- Which of the following ideas would help improve LPR use in our industry?

- Let everyone access scan data across all systems

- Set rules to stop unfair business practices

- Make it clear how LPR data is sold and used

- Ensure fair contracts between LPR companies and users

- Build better tracking tools

- Set up industry-wide standards for LPR usage

Summary: Regardless of respondent group, all appear to have had some strong feelings of a need for improved fairness and transparency with improved tracking tools being the least of their needs.

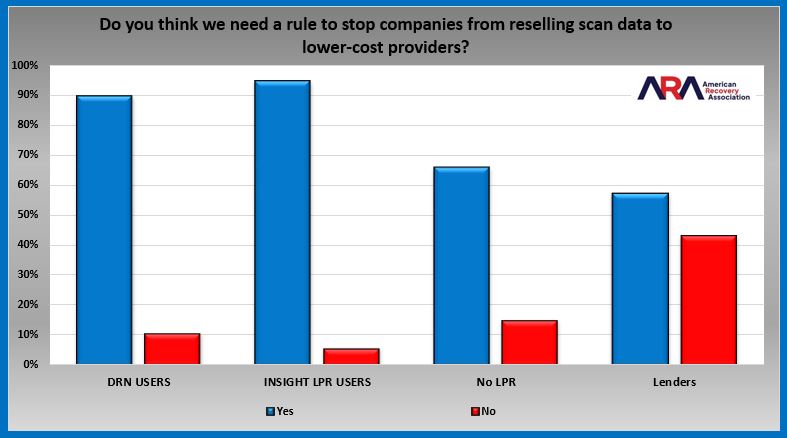

- Do you think we need a rule to stop companies from reselling scan data to lower-cost providers?

- Yes

- No

Summary: Both DRN and Insight LPR users had very strong opinions about this. Likewise with the non-LPR group. Lenders on the inverse were almost evenly split by a 14% difference in favor of.

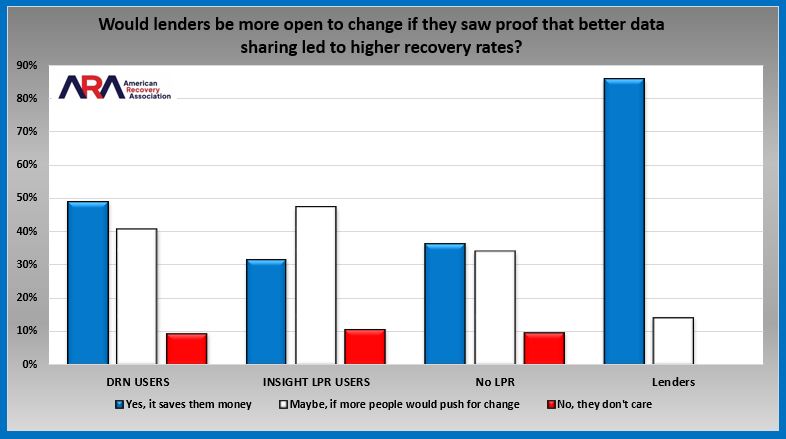

- Would lenders be more open to change if they saw proof that better data sharing led to higher recovery rates?

- Yes, it saves them money

- Maybe, if more people would push for change

- No, they don’t care

Summary: Considering a slide from 41% to 27% in recovery ratios as reported by the CFPB over their 2019 to 2022 period study and a likewise similar current 27% reported by RDN in 2024, it would seem that increasing the recovery ratios would be a major issue. But according to these responses, other than for lenders, it’s pretty moderate and leads to believe that there is a high amount of ambivalence to this issue across the industry at this time.

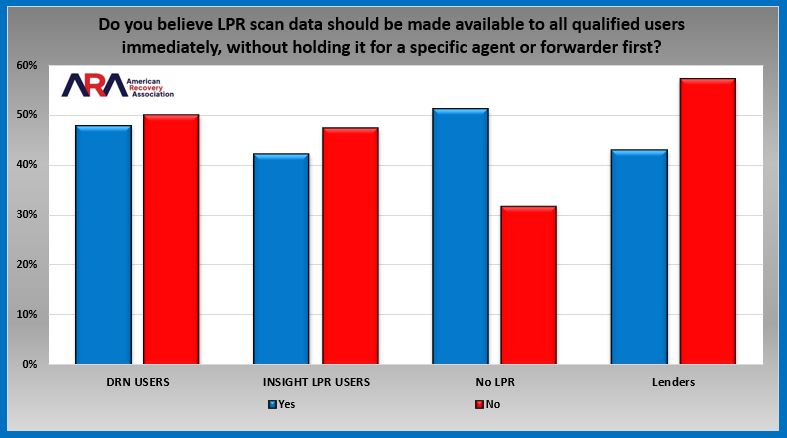

- Do you believe LPR scan data should be made available to all qualified users immediately, without holding it for a specific agent or forwarder first?

- Yes

- No

Summary: All respondent groups were almost evenly split on this topic, which is odd, because this is essentially the same question as #7 “Do you think the agent who scanned a vehicle should have first opportunity at recovering it before the info is passed to others?”. When posed with this question, it was almost unanimous.

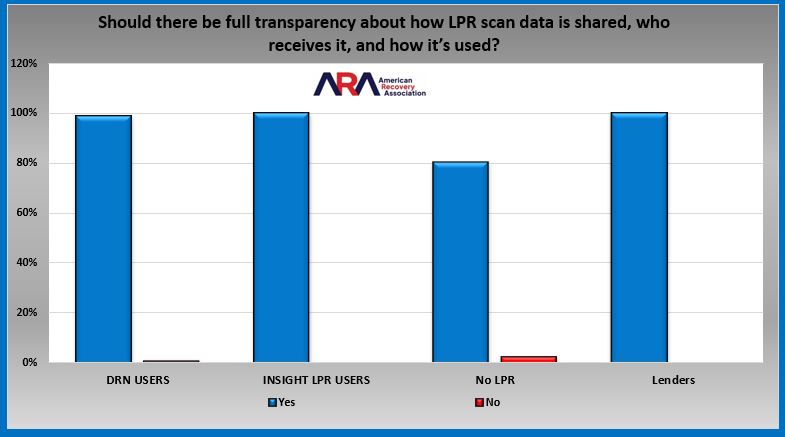

- Should there be full transparency about how LPR scan data is shared, who receives it, and how it’s used?

- Yes

- No

Summary: It is crystal clear. EVERYONE wants to see full transparency on how LPR data is shared.

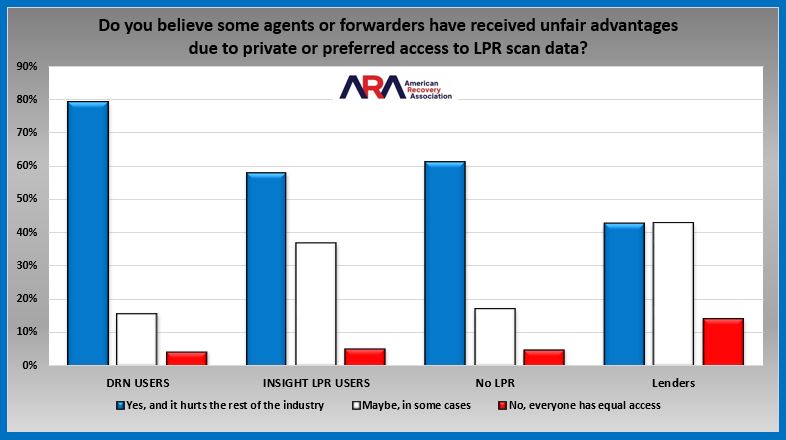

- Do you believe some agents or forwarders have received unfair advantages due to private or preferred access to LPR scan data?

- Yes, and it hurts the rest of the industry

- Maybe, in some cases

- No, everyone has equal access

Summary: Outside of the lenders, the vast majority of respondents felt that LPR data is being used to the unfair advantage of some agency or forwarders and that it is doing harm to the industry. Only 2 of the 16 forwarders felt it wasn’t and 86% of the lenders seeing some level of harm above maybe in some cases.

This question does not clarify to which LPR vendor this is suggested of, but with many of the Insight LPR users having been prior DRN users, there does seem to be some finger pointing.

ARA LPR Survey Results Are In!

- What do you think should happen next to improve how LPR is used in the repossession industry?

Here are just some direct quotes pulled from all the responses to this question:

- Data Ownership & Control: “The agency who invests in and gathers the data should benefit from the fruits of their labor and efforts. The data should be limited to their use exclusively for a certain amount of days.”

- Transparency & Fairness:“Full transparency from LPR and lenders re data—who and when, timing clients and agents receive, preferences to agents who are higher scanners.”

- Monopoly & Market Manipulation:“The unfair monopolization of LPR by a few is causing issues across the board.”

- Fair Assignment Practices: “The agent that was initially assigned the account should always have first chance at the repossession.”

- Compensation & Revenue Share:“Repossession companies should be paid better for the LPR rates. The risk is still taken, and the work still done.”

- Open Market & Choice:“There should be choice—for both the agent to choose which system they want to run, and which forwarder to pick up the unit for.”

- Regulation & Oversight:“Required vetting for agencies who offer LPR services.” “We regulate—or someone else will.”

- Industry Collaboration:“Come together from the entire ecosystem and chart a path that will benefit everyone fairly.”

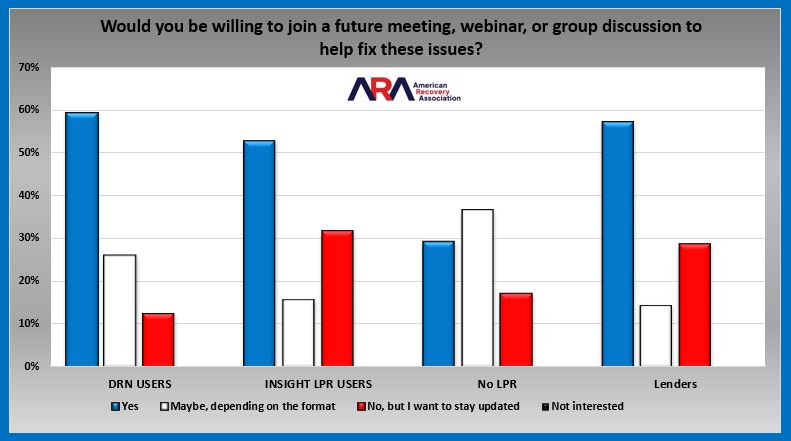

- Would you be willing to join a future meeting, webinar, or group discussion to help fix these issues?

- Yes

- Maybe, depending on the format

- No, but I want to stay updated

- Not interested

Summary: Amongst LPR users and lenders, there appears to be a great deal of interest in becoming more engaged in the issues surrounding the LPR process as it exists. Not one respondent said they didn’t care.

In Closing

As previously noted, some of the survey responses are based on prior terms and conditions that DRN has since acknowledged and committed to improving. Regardless, the feedback remains vital. It reflects real experiences and underscores the urgent need for transparency, shared solutions that strengthen the LPR ecosystem while protecting and empowering agents on the front lines.

ARA remains optimistic that the recently announced changes to DRN’s practices will help alleviate many of the challenges that have persisted. However, progress must be monitored and guided with continued engagement from all corners of the industry. We must remain vigilant and involved to ensure unresolved issues are addressed, and that a more accountable, inclusive system emerges.

To that end, we invite both DRN and Insight LPR to join us for a summit at a time and place convenient for all parties to review these survey results together. The intent is to explore collaborative next steps that support the requests of the industry and deliver meaningful, positive outcomes for every stakeholder in the recovery space.

Finally, to everyone who took the time to participate—thank you. Your input, honesty, and dedication to this industry are driving the conversations that will define our future.

Sincerely,

American Recovery Association (ARA) LPR Committee

ARA LPR Survey Results Are In! – ARA LPR Survey Results Are In!

Related:

From the ARA to DRN; A Very Sincere Thank you!

Your Input is Needed: Shape the Future of LPR Practices

A Letter to the Recovery Industry from DRN

Changes to Exeter’s Photo Requirements for Flatbed Fees

The Impact of LPR Exclusivity on the Repossession Industry Part II

The Impact of LPR Exclusivity on the Repossession Industry – Part I

ARA Letter to the Industry – Lender Overreach

ABOUT AMERICAN RECOVERY ASSOCIATION

ABOUT AMERICAN RECOVERY ASSOCIATION

Originally chartered on July 22, 1965, and located in Dallas, Texas, American Recovery Association (ARA) is a membership organization made up of more than 260 repossession business owners providing service from more than 500 locations to more than 27,000 national and international cities. As the world’s largest association of recovery professionals, ARA strives to be a leader and advocate for the recovery industry by providing member support, education, and certifications; fostering relationships between the lending community and repossession agents; and hosting the annual three-day North American Repossessors Summit (NARS) – the largest repossession conference in the industry. For more information, go to repo.org or call (972) 755-4755.

More Stories

Bad Apples in the Repossession Industry

Have You Cast Your Vote?!

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

Resolvion Announces Appointment of Ronald Eubanks as Executive Vice President of Client Strategy

A Necessary Distinction: Financial Oversight vs. Financial Control

TexasARP Is Looking for You!