Threats, Extortion, Fist Fights and Murder in Malaysia

Auto repossessions occur every day and all over the world. But the self-help repossession laws, as we have here in the United States, are rare elsewhere. Although it is far from perfect, everyone should count their blessings that it isn’t as bad as Malaysia, where murder, assault, and threats from competing “repo gangs” have become the dark underbelly of the system.

In an expose of the Malaysian repossession industry in The New Straits Times (NST), we get an interesting view of a repo industry that is a stark contrast from our own. Where here in the USA, the biggest dangers come from the public, in Malaysia, it is the other agents who pose the most risk.

With repossession fees ranging from about RM3,000 ($36 USD) to RM12,000 ($144 USD) per case, the need for supplemental income has created an industry more resembling the mob than contracted professionals serving the lending community.

Protection

Aside from income derived from repossessions, a reportedly large number of repossession agents in Malaysia sell repossession protection to the public. For their fees of $25 to $425 dollars American per month, not only do these gangs ignore repossession orders on protected cars, but they also protect them from other repossessors.

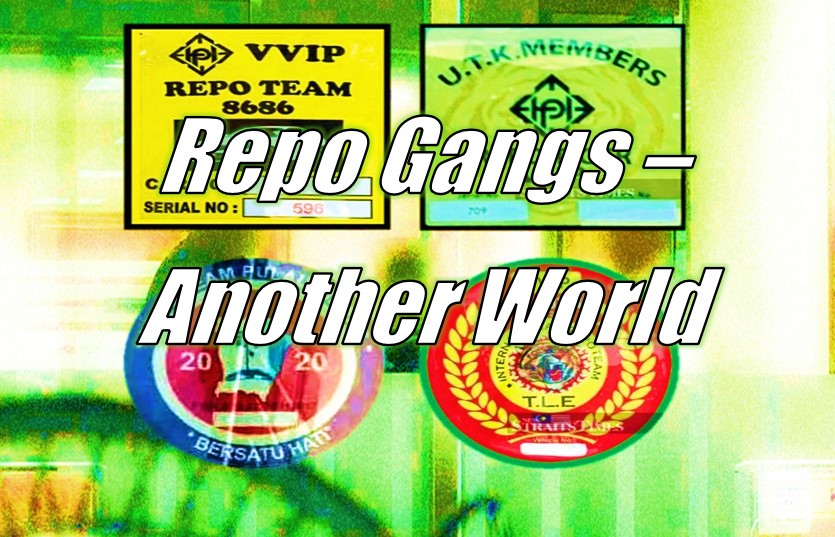

At least one hundred different gang protection stickers in circulation across this nation about half the size of Texas. An estimated 50% of all cars out for repossession have a protection decal on them. These gangs are aggressive and as brazen as to threaten the lenders themselves in demanding repossessions be returned to their protected customers.

Kumar, who operates in Selangor, said he once stopped a loan defaulter who had gotten off the hook for 126 months (10½ years) with the use of these stickers. “The car was in default for nine years and the rest were interest charges, but I can’t repossess it because it had a protection sticker.”

He said the stickers were only effective in certain areas — those under the control of the secret society — and vehicles that operated  beyond would then be at higher risk of being repossessed.

beyond would then be at higher risk of being repossessed.

“They promise buyers that they will ‘close’ the data (remove repossession orders from their database), but that is just a lie. “They may allow you to use the car for a while, but once they need money, they will go after the car or get their associates to do it,” he said.

Repossession notices issued by banks have a validity of 14 days and if the initial repossession panel fails to recover the vehicle, the notice will be reissued to another panel. (Sound familiar?) This explains why buyers of this protection JT often enjoyed a few weeks of respite before being harassed by another repossessor.

Kumar said protection stickers were once prevalent in suburban areas such as Kuantan, Kelantan, Perlis and parts of Johor Baru. Now they have become common in urban areas nationwide.

Rigging the System

Repossession protection doesn’t end in the streets, the repo gangs can go to extremes to take the cars back. These threats can climb all the way from the receiving depot to the lender who ordered the repossession themselves.

The post repossession process of storage and liquidation is similar to here in the USA, but there are differences. Once a vehicle is repossessed, it is taken to a “depot”, similar to an auto auction.

Ahmad (not his real name), who admitted to being involved in this business some time ago, claimed that the rising reputation of rogue repossessors due to their job’s inherent dangers and the networks they built over the years, particularly with the authorities, might eventually allow them to affix their own protection stickers.

“When you work in this industry long enough, there will be a point where you will make your name because our work is hardcore; we don’t care who you are, we will repossess your vehicle.

“So there’s a 50 per cent chance that they end up providing protection stickers because they know all the work processes.

“They know which bank issued the repossession orders, the officer in charge, how to deal with the police, the depots where the cars are kept, and the market price.

“So should the cars be repossessed by other agents, we know which depot they’ve been taken to, and we can block them to return it or ask the depot not to accept the cars.

“We can even blackmail the banks,” bragged Ahmad, who has almost two decades of experience.

Threats and Demands

The New Straits Times (NST) reported a disturbing incident, in which one of the syndicates launched an audacious ambush on a bank headquarters, demanding the release of a repossessed vehicle.

“A few of them went up to level 12 to see the person in charge while others were lingering in the lobby,” a source with knowledge on the matter said, adding that police had to be called in to control the situation.

Brickfields police chief Assistant Commissioner of Police Amihizam Abdul Shukor confirmed that a report was lodged and that the uproar at the bank headquarters was due to dissatisfaction with a car being towed. It is learnt that the car involved had a protection sticker issued by the 8686 Repo Team.

NST also reported another report lodged by a 28-year-old towing agent, who was stopped by some 20 men. “They said they will never let me go until they get hold of the repossessed car and I will never be able to see my children and wife.

“I was told to follow them to a restaurant to talk, but I refused. They then tried to force me into a van,” he said, adding that he was threatened not to lodge a police report.

Murder

Meanwhile, Ahmad (not his real name), a repossessor who has been in the industry for 15 years, shared how an acquaintance was stabbed to death after recovering a car with a protection sticker. “After he managed to repossess the car (in Johor), the repossessor was heading for Kuala Lumpur when he was followed, intercepted and stabbed to death on the highway,” he said.

The agent was referring to a case involving the killing of a repossessor on Dec 20, 2020. The 34-year-old man was reported to have been killed by members of a secret society group known as Ngo Seik Kee or “5 colours”. A few members of the group were arrested and charged in court over the killing.

Fist Fights

Ahmad said fights often erupted between repossession groups offering protection stickers. “When we repossess their cars (with the protection sticker), they will also repossess our cars.

“So after a while, we get into fistfights,” he said, adding that he and others had also been arrested for getting into fights. Another repossessor called Kumar (not his real name) had his car and tow truck set on fire after repossessing a car with a protection sticker.

“My tow truck was set on fire in 2018. I had a hard time putting food on the table. My house was broken into and my car batteries were also removed. I couldn’t do anything. I was so angry that I wanted to get revenge.”

“I lodged a report and hired a lawyer. I was ready to go to jail for as long as I was able to get revenge on them. After I showed them my true colours, they toned down,” he said. He also had his house smeared with red paint and his car windows were broken.

“My house was splashed with red paint and all my neighbours saw it and asked what type of job I was doing. My good name was smeared.” “I had to repaint my house on my own. The banks didn’t help me. Even when I lodged a report, there was no action taken, so I am stuck in between and can’t do anything,” he said.

He claimed to have also been chased by machete-wielding rogue repossessors. “When I reported this to the police, they asked if I suffered any injuries. I said, no, and they said, ‘Then it is okay’.

“But I told the police that they threatened me with a weapon, and they replied ‘Who asked you to enter their area?’ “So when you get that kind of answers, what else could I say? They wanted to wait until I suffer injuries then only act,” he claimed.

Kumar, who has been in the industry for 11 years, questioned why the police didn’t take any action to weed out secret societies and crack down on the use of protection stickers.

Repo Gangs Here

Kids don’t try this at home. It might have been possible fifty years ago, but there’s no way on earth anyone in the repossession industry could get away with that in this day and age. That’s not to say that it couldn’t emerge as a future threat here. With crime running rampant and as brazen as we see on an almost daily basis, it’s not impossible that it couldn’t become a criminal gang enterprise in large inner cities.

Source: New Straits Times

More Stories

Repo Agent Wrestles Shotgun from Borrower

Bad Apples in the Repossession Industry

Breaking the Routine – Finding the Sweet Spot in Weekend Recoveries

Repo Rampage in Rural Texas

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

ARA Served Letter of Inquiry by Senator Warren