ARA Past Due Forwarder Invoice Survey Results

We had an overwhelming response to the survey presented last month and would like to extend our gratitude to all participating members. Your feedback remains the cornerstone of our collective growth.

In our continuous effort to elevate industry standards and practices, we recently undertook a survey to gauge the performance and reliability of various forwarders. We are delighted to present the insights, which are based solely on information provided by agency owners and have not been independently verified.

Participants:

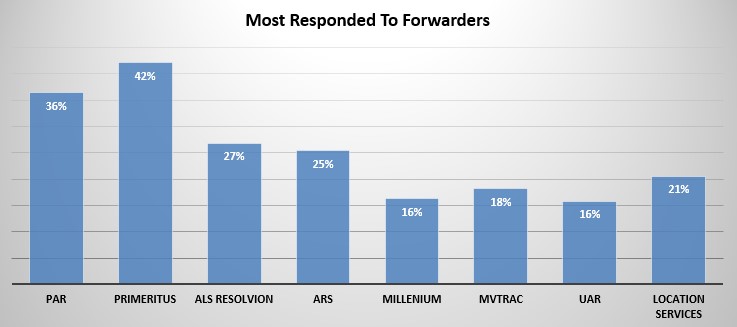

As mentioned, we had an outstanding response to our survey. As a percentage of all responses, below are the results.

While not every one of our 200+ respondents reported having payment processing problems with their forwarder partners, an overwhelming 85% did.

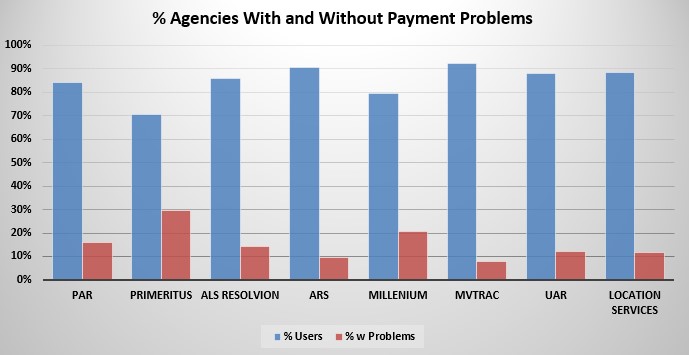

Let’s delve into the initial observations from the chart displaying the percentage of respondents’ positive and negative experiences with each forwarder.

Key Findings:

- Amount Owed by Forwarders:

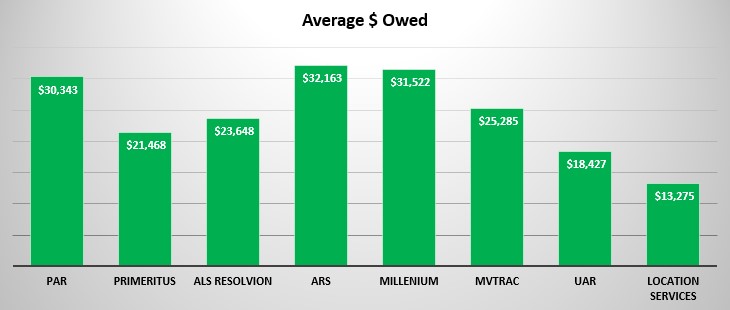

- Total average dollars past due reported by our respondents indicated that PAR, ARS and Millennium maintained the highest average outstanding amounts past due.

- Overall, the amounts past due averaged $24,516. While some responses were in the low thousands, some were in the high tens of thousands.

- The highest combined reported past due invoice holders were reported to be PAR, ARS and Primeritus. Locations Services and UAR were reported to owe the least.

- The combined total balances past due were reported to be $7.3M.

- Days Out on Receivables & Days Past Due:

As important as how much an agency is owed is how many days past due it is. While not all past due invoices are the same days past due, it can be assumed that respondents reported the highest number of days past due.

- Although Millennium was reported to have the highest number of days past due, it must be remembered that only 16% of responses claimed to work for them over the past six months. As such, a few more extreme situations could overstate the overall results.

- These metrics are pivotal when evaluating the efficiency of a forwarder’s payment processes. While every agency may experience payment processing delays, there are many reasons for this that are far too numerous to account for without a full examination of both forwarders and agencies

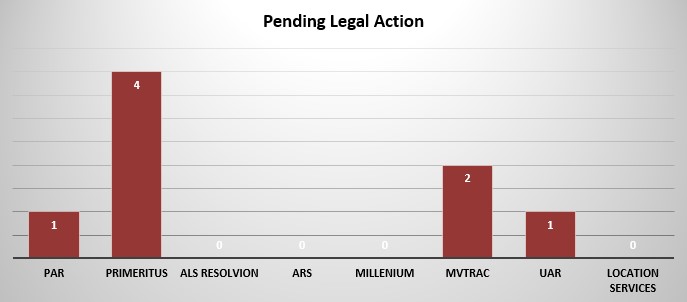

3. Pending Legal Actions & Outstanding Payments:

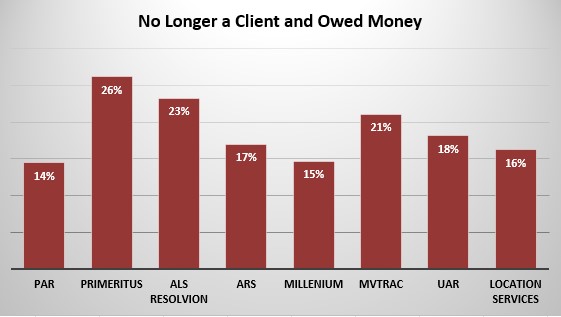

Of the responding agency owners, an average 19% have quit doing business with their forwarder partners over past due invoices. It is safe to assume that these are amongst those owed the most and for the longest.

- Despite the 19% cancellation rate with their former forwarder partners, only a surprising few responding agency owners report that they have initiated or are pending legal actions related to unpaid invoices. While legal action can be costly and lengthy, aside from a cessation of services, it is the only remedy to these problems.

Recommendations:

- Due Diligence: Before partnering with a forwarder, it’s imperative to conduct comprehensive research. Assess their financial stability, payment history, and any potential legal challenges.

- Formalize Relationships: To ensure clarity and protection, always cement business relationships with written contracts.

- Stay Updated: Regularly engage with industry reports and updates to remain informed about forwarder performance.

- Open Dialogue: Foster open communication with forwarders to address concerns and collaboratively enhance industry standards.

When considering the feedback provided by agency owners about their experiences with various forwarders, it’s important to note that these insights are based on individual perceptions. The data may not reflect the complete picture of each forwarder’s performance, and the results should be interpreted with caution.

Finally, we will extend an invitation to the forwarders in this survey for an opportunity to meet with the ARA board to discuss the survey results. This meeting will give the forwarding companies the chance to respond and present feedback, we will report these conversations back to the industry. As we aim for industry excellence, informed decision-making, collaboration, and transparency are key.

Warm regards,

Warm regards,

Vaughn Clemmons

President, ARA

About American Recovery Association

Originally chartered on July 22, 1965, and located in Dallas, Texas, American Recovery Association (ARA) is a membership organization made up of more than 260 repossession business owners providing service from more than 500 locations to more than 27,000 national and international cities. As the world’s largest association of recovery professionals, ARA strives to be a leader and advocate for the recovery industry by providing member support, education, and certifications; fostering relationships between the lending community and repossession agents; and hosting the North American Repossessors Summit (NARS), an annual two-day summit – the largest repossession conference in the industry. For more information, go to repo.org or call (972) 755-4755.

ARA Past Due Forwarder Invoice Survey Results

ARA Past Due Forwarder Invoice Survey Results – ARA Past Due Forwarder Invoice Survey Results – ARA Past Due Forwarder Invoice Survey Results

ARA Past Due Forwarder Invoice Survey Results – American Recovery Association – ARA – Repossess – Repossession – Repossession Agency – Repossessor

More Stories

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong

Impound Repossessions and the Risk of a Two-Tier Compliance System

Recovery Agent Protection Committee Seeks Input