Important teaching points for all agents, agency owners and lenders

In May of 2019, 71-year-old Albert Nduli of Houston awoke to find his car being repossessed. Minutes later, his head was crushed under the tire of his own vehicle being towed away. From lender to agent to agency owner, this incident is the stuff that nightmares are made of. In October of 2022, the wrongful death lawsuit settled and, in its aftermath, we have the evidence of this tragedy whose prevention appears as murky as the testimony and videos of the incident we are about to share.

A lot can go wrong during even a simple repossession. Wrongs that everyone can criticize in the aftermath, which everyone did back in May of 2019. But without actual evidence at the time, all of it was mere speculation.

As I am sure you will soon agree, this case is special. It brings up some strong opinions. And at the forefront of these opinions were industry legends and Expert Witnesses Ron Brown and Mark Lacek, on opposing sides. And both have some very strong feelings on this case which will also be shared.

So please, read this article and view the video evidence with an open mind and learn from it. If it could save even a single life, it will be well worthy of your time.

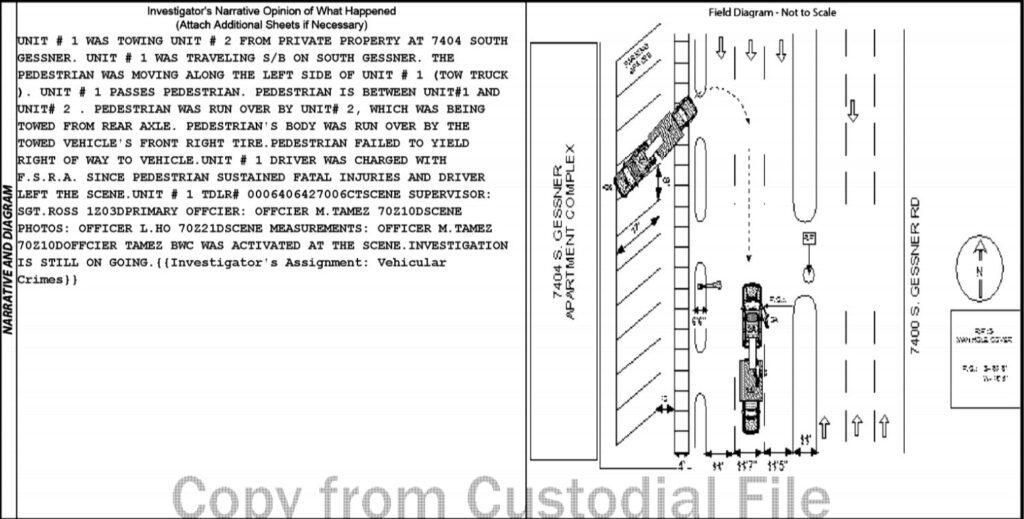

May 2nd, 2019

Houston, TX – It was just about 7:28am when Albert Nduli, a Congolese immigrant residing in the US for twenty years, was awoken by a knock on the door. It was a neighbor telling him that his 2005 Lincoln Navigator was being towed. Mr. Nduli rushed downstairs from his apartment at 7404 South Gessner St. wearing only a white t-shirt, gray plaid underwear and a pair of flip flops.

Just below the balcony of his apartment, Nduli confronted the recovery agent, Oscar Lee Harrison Jr., an employee of Harris County Impound. The vehicle was being repossessed for TitleMax from a PlateLocate LPR hit.

According to the first recorded interview of recovery agent, Mr. Harrison, Mr. Nduli was very agitated and was yelling in his native language back to the apartment. Mr. Nduli allegedly turned to go back to the apartment and Harrison chose this time to leave with the vehicle in tow.

Read The Medical Examiners Report Here

At this point, five minutes had lapsed since Harrison initiated the repossession. As seen in the later video, at no point did they appear hurried.

As the tow truck pulled out of the parking lot (with the SUV in tow), it crossed two lanes of traffic. At the time, Mr. Nduli was at the driver’s side window with a pamphlet in his hand, yelling, jumping, and waving his arms at Harrison as he was driving away.

Allegedly grabbing the tow truck’s driver side mirror, Mr. Nduli climbed onto the truck’s running board and grabbed the door handle. As the truck door opened, Mr. Nduli, wearing only flip flops, slipped and fell.

The agent, Harrison, later reported that he saw Mr. Nduli getting back up but lost sight of him as he turned the corner. According to both Harrison and his Driver in the passenger seat, Esteban Diaz, this interaction was very brief.

Mr. Nduli was dead very soon after this.

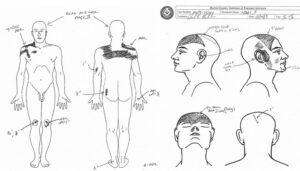

Autopsy reports showed that Mr. Nduli died from multiple blunt force injuries. Namely; an exposed fractured skull. Its intracranial space was near empty according to the coroner’s report. In addition, there were multiple abrasions and lacerations across to body, which according to the coroner, were consistent with his having been run over by the towed SUV.

The aforementioned and unidentified pamphlet was reported as still in Mr. Nduli’s hand at the time of the Coroners examination.

Read the Coroners Exam Here

The Videos

Video #1 – Now, these are just some of the basics of the incident. The clearest of the video evidence taken from across the street is mysteriously missing the moments of the incident, but does show Harrison and his interpreter, driver Diaz before the confrontation.

As the video shows, they took a great deal of care and time on the location. Diaz can be seen taking photos of the vehicle as per the instructions of either PlateLocate or TitleMax, which is unclear and unaddressed as part of the scope of the lawsuit.

As they go about their careful recovery, neighbors can be seen watching them go about their duties, while at the same time you can see activity begin in the upstairs apartment balcony where Mr. Nduli and his family resided. Due to the angle of the camera on the clearest of the videos, the interactions between Harrison and Nduli are mostly blocked by the red tow truck backed into the Navigator.

Up to the point Harrison pulls the tow truck up to the curb and prepares to enter the street, no activity between the two can be seen. The video the abruptly cuts forward nineteen seconds and is missing the actual incident.

20 vehicles pass before a yellow school bus and white van appear in the video. These vehicles appear in a later and separate video. The traffic doesn’t slow until 7:26.21. Over a minute and thirteen seconds after the tow truck left the driveway. No one can be seen slowing or stopping before this.

Images afterward show people slowly begin to emerge and go toward the incident and traffic slowing down.

Video #2 – While this video is not of as good quality as the first, in this video you can see a person in white, as Mr. Nduli was wearing at the time, running alongside the red tow truck as it entered the roadway. The blurry contrast of white against the side of the red tow truck is easy to identify.

There is a third video taken from a school bus dashcam which recorded the moments after the incident which shows Mr. Nduli’s body in the second lane next to the median. Just ahead of his body is a stopped silver compact car with the emergency flashers on. The white van on the right is shown just ahead of the yellow school bus from which this video was captured. Other than the silver compact car, none of the other twenty vehicles seen driving past the scene of the incident stopped to render aid.

As a matter of respect to the family and of common decency, I have chosen not to show this video, but will instead provide the following blurred out image at that moment.

The tow truck, Navigator and Mr. Nduli left the apartment parking lot at 7:25:13 according to the last image of the truck on the lot on Video 1. Nineteen seconds pass with no video until 7:25:32.

Not until 7:26:21 into the video does the traffic shows signs of slowing. Over a minute and thirteen seconds after the tow truck left the driveway. No one can be seen slowing or stopping before this. The yellow school bus and white van appear in the first video approaching the scene at 7:27.05.

Note; According to Mark Lacek, this video was supplied by TitleMax’s attorneys. When asked about the lapse, the plaintiffs’ attorney was told it was lost during editing. According to Ron Brown, TitleMax’s attorneys allege the video was supplied by the attorneys for the Nduli family.

Immediately After

It was obvious to Harrison that something serious had happened, as he called his office and spoke to both the company owner, John Heaslett and his daughter who managed Harris County Impounds, Robin.

According to Harrison; he was told that he should just come back to the lot. After dropping off the vehicle at the lot, Harrison received a call from a police sergeant who advised him that they were investigating the incident as a homicide and needed him to return to the scene.

After a forty-five-minute drive back, Harrison was placed in the back of a police cruiser and advised that he was being taken in for old warrants from four years ago. He then was told that he was being charged with failure to render aid. A felony with a maximum sentence of twenty-years.

Harrison was released on bond on May 5th.

On May 14th, Harrison was interviewed by the Texas Department of Licensing and Regulation (TDLR). During this interview he gave his earliest account of what happened that tragic day.

Read the Report Here!

Harrison stated that he’d lifted the vehicle after verifying it’s vin when he noticed a neighbor observing him shortly before running away to notify the borrower. Mr. Nduli soon emerged and Harrison began to explain to him “what was going on with TitleMax.” According to Harrison, Mr. Nduli (screaming at family in foreign language) was not happy and began yelling back toward the residence in “his native language” and he began having “a bad feeling”, as he put it.

Harrison stated that at this point he got into his truck and pulled both vehicles out into the street when he heard a loud “Boom” as he pulled up to the light at the intersection. It was then, according to Harrison, that Mr. Nduli came up on his left side and he heard a loud boom (unsure if is a second or the same) then Nduli climbed onto the running board of the truck and opened up the driver side door.

Once the door began to open, Nduli, wearing only flip flops, slid off the floor rails and fell down. Harrison reported that he saw Mr. Nduli getting back up but lost sight of him as he turned the corner.

Harrison then called into the office of Harris County Impound and spoke to owners, Robin and her father John Heaslett explaining what had just happened. According to Harrison, he was told that “this happens all the time” and that he should just come back to the lot.

Mr. Harrison then claimed that while enroute back to the lot he called and reported the incident to 911 requesting an ambulance to the scene.

According to the 2020 deposition of Robin Heaslett, her father, who was at that time sick and elderly, was so traumatized that he abruptly closed the company that day.

A lawsuit was later filed by the Kherkher Garcia Law Firm against TitleMax, Oscar Lee Harrison Jr., and Harris County Impound by the Nduli family seeking unspecified damages. As is the legal custom to spread the misery and increase the settlements, several other lesser involved parties were also named in the lawsuit. In order to keep focused on the incident itself and the most relevant parties, I have chosen not to muddy the water with mostly mundane testimony.

I have chosen not to include to publish the actual depositions for legal reasons and because there is too much personal information on the defendants that could be used illegally.

Oscar’s Deposition

In deposition on December 7, 2020, Over a year and a half after the incident, Oscar still did not know the status of his criminal case. Nowhere in the deposition did the actual event get discussed with any detail of the exact incidents leading up to the death. Harrison did not even recall Diaz taking photos of the Navigator which can clearly be seen on the first video.

Q··So it wouldn’t surprise you if Mr. Diaz took photographs of the Lincoln Navigator before you left the premises that day.··True?

A· · ··True.

Q· · ··That would have been part of what HCI expected him to do, right?

A· · ··True.

In deposition, Harrison’s qualifications to repossess came into question. To his defense, he’d been in the business for about four years. He reported that at his first recovery job in 2015 with Diversified Recovery, where he claimed that he did receive CARS certified training. However, at none of his later jobs at Clay’s Recovery, Recovery Pros nor at Harris County Impounds did he recall receiving any safety training.

Q· · ··Okay.··Do you recall how long ago it’s been that you saw the CARS manual?

A· · ··No, sir, I don’t.

Q· · ··Do you recall if you ever saw the CARS manual prior to working at Harris County Impound?

A· · ··No, sir, I don’t.

Q· · ··Do you recall Harris County Impound ever providing you the CARS manual or otherwise training you about it?

A· · ··Possibly.

As far as leaving the scene of the incident goes, he said that he was only doing what the owners told him to do.

Oscar testified that he made $62 a repossession and that his employment with Harris County ended that day and that he never received a final check. After all of this, at the time of deposition, Harrison testified that he had been unable to find work since and was still unaware of the status of his criminal charges.

The deposition ended without the questioning attorney bringing up any in-depth questions of the incident itself. The primary focus of the deposition appeared to be focused solely on qualifications and safety training. This became even more apparent when the agency owner testified.

The Owner’s Deposition

Next to testify was Robin Heaslett, daughter to the owner John, elderly, still sick and excused from testimony. I have chosen not to publish the actual deposition because there is too much personal information on the defendants that could be used illegally.

Harris Impounds opened about 2002 by her father John who was an independent car dealer operating without a formal sales lot. They operated with only two trucks and three employees.

Oscar Harrison’s qualifications very soon became the focus of the deposition. Robin Heaslett reported that she didn’t know exactly when he was hired or of Harrison’s multiple speeding tickets that the arrest warrants were issued for on the day of the incident. Harrison was actually convicted for one on the very same day as the death of Mr. Nduli. She further admitted that she did not have a file for him and that it was lost.

Q.· ·No photos, no documents or any personnel file,

A.· ·No, sir.

Q.· ·All right.··And Mr. — there — there is no personnel file for Mr. Harrison, right, we’ve established that that’s been lost, right?

A.· ·Yes, sir.

Q.· ·Do you think there would be a possibility it might be recovered or found?

A.· ·I — I don’t know.

When asked how she vetted his driving background, Robin testified that their insurance carrier, Hatch Insurance, did the background check on Harrison according to her sick father. She claimed they never would have hired Harrison if Hatch Insurance would have given them a correct MVR.

On the topic of breach of peace, Robin pushed back on compliance guidance from the CARS manual.

Q.· ·So you disagree with the CARS manual on that particular point?

A.· ·On the objection.··On them just simply objecting, sure, I — I disagree with CARS on that.··I mean, an objection is just a word.··I mean, you can say, you know, don’t take my car all day long.

Q.· ·All right.

A.· ·If it — if the car — if cars are dropped just because someone objects, nothing would be repo’d.

Under deposition, Robin stated that Harris County Impounds closed almost immediately. She also disclosed that within a couple of months she began the paperwork to start her own company, “Harris County Seizures” which still showed in business as recent as 2021 and according to one Houston agency owner, is still in operation.

PlateLocate

Since the vehicle was assigned through PlateLocate on an LPR hit, Tim Mauz, former Vice President of Vendor Management for PlateLocate, was deposed. While having no on the ground knowledge of the incident, he did face a series of questions related to the agency vetting process as well as the taking of photographs at the scene of the repossession.

Q.··(By Mr. Haynes)··Okay.··So are the repossession agents supposed to take photographs while the repossession is going on?··In other words, when the vehicle’s lifted up? Or anything like that?

A. ··They’re not required to.

Q. ··Do you have any knowledge — go ahead. I’m sorry. I didn’t mean to cut you off?

A. ··That’s not a standard practice.

Mr. Mauz further testified that neither PlateLocate nor TitleMax received the photos taken of the Nduli Navigator from Harris County Impounds that were taken the day of the incident.

The Experts

Expert testimony in the matter was hired by both TitleMax and the Nduli family’s attorneys. Hired by the Nduli family was Mark Lacek. TitleMax hired Ron Brown. Parts of the plaintiffs of the Nduli family settled the case before the other parties. Only Ron Brown was deposed in person for the second part. There were no depositions for the first settled claims.

Read Ron Brown’s Entire Opinion Here

Ron Brown’s Opinion

In addressing the issues, in summary, Ron Brown addressed three major issues;

- Did TitleMax of Texas, Inc. exercise due diligence and utilize practices consistent with the standards of care in the hiring of Harris County Impound to locate and repossess vehicles recovered by a defaulted security agreement?

In the repossession process did Oscar Lee Harrison Jr.;

- Breach the Peace by continuing to repossess over protest?

- Exercise accepted caution and safety procedures during the repossession process?

From Ron

In forming my opinion, I first looked at the contracting relationship between TitleMax of Texas, Inc. and Harris County Impound. Based on my education, experience, training, and observations, I would conclude there was no set “industry standard” as to what lenders requested by way of information and required for compliance from repossession agencies when the initial contract was initiated with Harris County Impound in 2014.

However, based on the year being 2019 when the accident occurred, I reviewed the numerous requirements which TitleMax required of asset recovery vendors in the December 29, 2017 contract and to ensure safety and full compliance on the part of their contracted agencies hired to recover collateral

Itis my opinion, based on my 50 years of background, education, training and experience in the asset recovery industry as well as my extensive experience dealing with consumers, lenders, and automobile dealers, that TitleMax and its employees exercised full due diligence, exercised a practice consistent with accepted standards of care and followed industry protocol in the year 2014 when initiating the original contract with Harris County Impound and that TitleMax and its employees continued to follow accepted industry standard protocol and accepted standards of care during the entire first contractual period through 2017 and again exercised full due diligence, exercised a practice consistent with accepted standards of care and followed industry protocol in the year 2017 when initiating the second contract with Harris County Impound.

In the repossession process did Oscar Lee Harrison Jr.

2) Breach the Peace by continuing to repossess over protest?

3) Exercise accepted caution and safety procedures during the repossession process?

In forming my opinion, I first I took into consideration if there was a “Breach of Peace” by “TRESPASS”. Did a “TRESPASS” occur during the act of the repossession. Clearly, from all accounts of people deposed thus far in this case the mortgaged Lincoln Navigator was in an open private parking area and not secured by any gate or other obstacle and there was no mention by any deposed party of “No Trespassing” signage.

To quote the National Consumer Law Center publication “REPOSSESSIONS”, ninth edition, section 6.4.6.2 Public Street, Private Driveway, or Garage: “One of the most frequent self-help methods used is seizing a vehicle while it is parked on a public street or private driveway. Courts have found no breach of the peace when the repossessor surreptitiously seizes a vehicle from a public street, the parking lot of the debtor’s apartment building late at night…”

OPINION Therefore, based on My 50 years of background, education, training, and experience in the asset recovery industry as well as my extensive experience with various recovery agencies and lenders I would conclude with the opinion that there was no Breach of Peace as related to a trespass.

OPINION It is my opinion, based on my 50 plus years of background, education, experience, training, and observations in the asset recovery industry and without consideration of either Josphine Mali’s or Oscar Harrison’s conflicting and contradicting statements during deposition, it is evident from the recorded video taken from across the street that Oscar Harrison, recovery agent for Harris County Impound representing TitleMax had already attached the Lincoln Navigator to the tow truck raised the wheels off the ground, moved the vehicle forward from the parking spot to enable lifting the wheels even higher off the ground and strapped the wheels down before Albert Nduli and Josephine Mali approached the vehicle.

It is my opinion that even if there was protest by Albert Nduli and/or Josephine Mali to the repossession of the Lincoln Navigator the objection was of no legal consequence and factor of a breach of peace would be considered neutral, because, it would have been lodged after Oscar Harrison, acting as a recovery agent for Harris County Impound had completed the repossession. Thus, applying the previous rulings, a reasonable finder of fact would have no choice but to conclude that Harris County Impound employee, Oscar Harrison acted reasonably from the moment he initiated the repossession at 7:11:59, until the moment he completed it at 7:16:00 and that neither he nor his helper committed any act which would be considered a breach of peace.

The second part of this opinion was Did Oscar Lee Harrison Jr. exercise reasonable and accepted caution and safety procedures during the repossession process?

Again, it appears that the best way to answer this question is to observe the video taken from across the street which chronicles the actions of all involved parties. In my opinion the actions performed by Oscar Harrison in the four minutes from his arrival at the repossession site at 7:11:59 until the repossession was complete at 7:16: 00 appear to be standard and accepted procedures, He approaches the Lincoln Navigator in a slow and cautious manner using his helper to assist.

He lifts the vehicle just enough to get the rear wheels off the ground and move the vehicle forward enough to raise it without damaging the front end on the parking bump. Immediately upon raising the rear drive wheels to a safe position he and his helper secure the rear wheels with tie down straps and at that time you can observe Oscar Harrison securing the steering wheel. These are standard safety procedures, and it appears they were performed in a diligent and slow manner.

From 7:22:05 when movement is observed on the balcony above the vehicle until 7:22:14 when a person in a white shirt is seen approaching the tow truck there are no actions visible other than the helper taking photographs.

At 7:25:05 the helper is visible entering the passenger side of the tow truck and the truck begins to slowly, and cautiously, move toward the street. As the front wheels of the tow vehicle enter the street at 7:25:13 there appears to be someone in a white shirt approaching the driver side of the vehicle.

This is where the missing and unexplainable lapse of 19 seconds in the video from 7:25:13 to 7:25:32 occurs. This portion of the video should show the tow vehicle completely exiting the property and the position and actions of the person in the white shirt positioning and the actions of Oscar Harrison.

Without this portion of the video there can only be speculation as to what occurred based on Oscar Harrison’s deposition and the statement of his helper, Estebano Diaz.

OPINION It is my opinion, based on my 50 plus years of background, education, experience, training, and observations in the asset recovery industry that Oscar Lee Harrison Jr. exercised reasonable and accepted caution and safety procedures during the repossession process of Albert Nduli’s Lincoln Navigator.

It is also my opinion, and I can say with certainty, that if Albert Nduli or any person chased a tow truck into a busy street clad only in their underwear and flip flop shoes, if they attempted to jump on the running board of a moving vehicle while clutching some type of “pamphlet” in their left hand and wearing only shower shoes, and if they grabbed the door handle of a truck causing it to fly open, I would consider that they were the major contributor to any tragic accident which might occur, not the driver of the vehicle.

Ron was later deposed and stood firm to his testimony. Firm and convincing enough to bring TitleMax and the Nduli family’s attorneys to bring the matter to a close.

Mark Lacek’s Opinion

Read Mark Lacek’s Entire Opinion Here

Opinions

Repossessor Oscar Harrison breached standard of care when he did not retreat when Albert Nduli and his wife both told him to stop. At the moment Harrison was told to stop, a breach of the peace occurred. Harrison had a duty to retreat when the debtor objected to the repossession. Oscar Harrison breached the standard of care if there was damage to the Nduli vehicle when he failed to hook the vehicle properly during the repossession attempt.

A self-loader tow truck is designed to help the repossessor lift and remove the auto in less than one minute. As seen in the video of his actions during the repossession attempt, Harrison put the beacon flashing lights on as he attempted to back into the Nduli vehicle which brought attention to his actions. Harrison then needed the actions of his helper to guide him during backing up effort. Proper training on relevant industry standards would have provided Harrison with the training and knowledge to hook up to and repossess the Lincoln Navigator in less than 60 seconds without exiting the cab of the tow truck.

Harrison was negligent when he failed to follow relevant industry by hooking up and leaving the scene immediately. Harrison did not follow accepted industry standards when he chose to stay at the scene of the repossession to take photos and conduct an onsite condition report. A reasonably trained repossessor would have known to leave the scene as soon as possible before a confrontation with the debtor would occur. A professionally trained repossessor would have taken the repossessed vehicle to a safe location to complete the property inventory and vehicle condition report.

Oscar Harrison breached the standard of care when he failed to immediately bring the HCI owned tow truck to a complete stop when he noticed Albert Nduli at the side door of the tow truck. At all times from when the breach of the peace began, Harrison should have stopped the repossession attempt. Harrison should have unhooked the vehicle and attempted the recovery effort at another time or another place. Harris County Impound (HCI) failed to protect the public when they did not train or certify Oscar Harrison on professional industry standards prior to sending Harrison to repossess the Albert Nduli Lincoln Navigator.

HCI breached the standard of care when they failed to check the drivers license history of Oscar Harrison before placing him in a tow truck and sending him out onto the public streets to perform repossessions. HCI failed to educate Harrison on the meaning of retreating when the debtor objects to the repossession.

HCI failed to seek out training for themselves and their employees by not attending repossession industry conferences or joining the Texas Repossession Association which is located just a few miles from their office in Houston Texas. The Texas Association as well as the yearly repossession conference in Dallas put on seminars, training, certification as well as safety awareness. Highlighted at the yearly conference are sessions on relevant industry standards, professional courses on repossession and towing safety.

HCI does not follow applicable repossession industry standards when the personal property inside of a repossessed vehicle is left at the TitleMax designated location. It is the responsibility of the repossessor and repossession agency to take custody and control of personal property located inside of a repossessed vehicle. Applicable industry standards are to remove the personal property, inventory the property and place the property in safe storage. The debtor then contacts the repossession company and makes an appointment to pick up those personal belongings.

This industry standard was created to protect the consumers property from theft. Protecting the personal belongings inside of a repossessed vehicle is another step in minimizing anger from a debtor when the debtor sees that a repossession company protected his/her belongings. TitleMax failed to properly check if individuals and companies conducting repossessions on TitleMax liens had any training on relevant repossession industry standards.

No documentation has been provided for my review to show TitleMax employees have been properly trained, instructed or certified to protect the public from untrained or non-certified persons performing self-help repossessions. No documents have been provided showing TitleMax management or their employees have ever attended any repossession industry association conference. The last Yearly repossession “summit” in Dallas Texas had over 30 clients in attendance. TitleMax failed to protect the public when they authorized HCI to send an untrained individual to repossess the Albert Nduli auto which resulted in the death of the consumer.

TitleMax failed to protect the public by not having a proactive approach in training their management and staff on the laws pertaining to breach of the peace. The TitleMax executive Jose Urbaez commented “a reaction is better than no reaction” when asked if TitleMax has a proactive plan to laws pertaining to the self help repossession process. TitleMax has not provided documentation showing they made any effort to make sure their vendors follow compliance policy and procedures required by TitleMax.

CONCLUSION I have offered many examples of the failure of Oscar Harrison, HCI and TitleMax to follow relevant repossession industry standards. Excerpts from the three sources of training and certification I have included in this report clearly indicate the duty to retreat when the debtor objects to the repossession. Excerpts from the three training guidelines clearly indicate a duty to retreat if there becomes an impending chance of violence. Excerpts from all three of the training guides show that a breach of the peace did occur as soon as Albert Nduli and his wife verbally objected to the repossession.

Applicable standards are to err on the side of caution and return at another time. The term “wait for another time, another place” is a relevant industry standard. This is a case where TitleMax, and Harris County Impound failed to protect the public from an untrained, non-certified and unqualified person when he was sent out to repossess the Albert Nduli Lincoln Navigator. Oscar Harrison had multiple traffic citations which if his driving record had been checked, he would not have been hired as stated by HCI manager Robin Heaslett.

TitleMax failed to verify the credentials of its vendors who are sent to repossess mortgaged collateral on their behalf. With an abundance of certified recovery agents trained on applicable industry standards working the City of Houston Texas every night, HCI & TitleMax chose to send Oscar Harrison to the Albert Nduli residence.

I have received no documentation showing HCI, TitleMax and Oscar Harrison received any training on the applicable repossession industry standards regarding the self-help repossession process. TitleMax representative Jose Urbaez and HCI representative Robin Heaslet sent Oscar Harrison into the streets to conduct repossessions without any knowledge of the repossession process.

TitleMax and the Nduli family settled for an undisclosed amount. What became of the ancillary lawsuits against Harrison and Harris County Impound is unknown and irrelevant.

No Winners

There were absolutely no winners in this. Everyone lost something.

Mr. Albert Nduli, a Congolese immigrant in the US for twenty years lost his life. His seven children lost their father, his wife her husband and their many grandchildren a loving grandfather.

It is difficult to feel much sympathy for the Heaslett’s as their own lack of diligence contributed greatly to this death, however, John Heaslett, a veteran car salesman and agency owner of Harris County Impound, lost his business and suffered heart attacks following the incident according to his daughter’s testimony.

Robin Heaslett, however losing her immediate means of a living managed to open her own company soon after. A company, I might add, still likely trying to hide the knowledge of this tragedy. A reputation like this is one that I am certain she would prefer clients were not made aware of.

Oscar Harrison Jr. lost not only his job and livelihood, which he will never be able to recommence, but he also lost his freedom. While the final results of his felony failure to render aid case appears closed without conviction, his conscious is still likely to be imprisoned by the fatal events of that day. Right or wrong, no reasonable person lives easily in the aftermath of such a tragedy.

What do we learn from this?

Like Ron Brown, I saw and heard nothing in the testimony or video that Harrison could have done to avoid this tragedy. It sounds and appears as though it all happened very quickly. No, he shouldn’t have left the scene, but he claimed that he only did so because he saw Mr. Nduli rise from the ground and was also told by the owners of the company to come back to the office. Otherwise, it was a very slow and orderly repossession up until the incident.

Aside from Harrison and his possibly driver, no one else knows with any certainty that Mr. Nduli didn’t get up from the ground as claimed. If the Harris County DA’s office believed otherwise, perhaps they would have charged Harrison with Manslaughter instead of the failure to render aid charge that they have handled with the zeal of a sloth on valium.

While we can all agree that the background checks performed on Harrison were probably as non-existent as his employment file, aside from him not being on the road that fateful day, it’s otherwise impossible to say that any safety and compliance training would have prevented this.

Compliance training is not a panacea and cannot alone overcome all of the variables that occur in the field. Often things come down to uncontrollable factors like poor judgement and bad luck. But regardless, it is not something that you want to walk into a courtroom or deposition without having had recently.

And while it is unfair to blame the victim, it all could have been prevented if Mr. Nduli had never made it downstairs in time to meet Oscar Harrison.

From Ron Brown to Mark Lacek and myself, we all agree on one thing: if Harrison had simply lifted the vehicle and left, instead of spending an entire 5 minutes at the scene taking pictures and what not, Mr. Nduli probably never would have made it down the stairs in time to meet them and might very well have lived beyond that terrible day.

But instead, for reasons no one deposed seems too know, they wasted time at the scene of the repossession that probably increased the likelihood of borrower contact and conflict. In most situations, this would be irrelevant but on this occasion it was deadly.

In my first reading of all of this, I had made the assumption that Diaz and Harrison had taken these pictures as a lender requirement. But in deeper review, can find no evidence of this. Not the lender, the forwarder or the agency owner can explain this. But Harrison seems to have known something about this.

While in deposition Harrison claimed that he didn’t know that Diaz was taking photos, he also did state that it didn’t surprise him that it did happen and that Harris County Impound expected them to do that.

In a century of auto repossessions, stealth and speed have been the methods most commonly used to avoid contact and conflict. Agents wasting time at the scene of a repossession taking pictures works against this.

I can only hope that everyone can learn from all of the mistakes made by Harris County Impounds and Oscar Harrison and pray that they are not repeated. And I urge all lenders to only hire professionals and vet them carefully. Otherwise, it might be you sitting in a deposition just like this. And just like Harris County Impounds, having all the wrong answers.

This is just my opinion and I know most of you will have some strong opinions on this case.

Kevin

Facebook Comments