Three twenty-five. It’s just a number until you assign a value to it. A value that seems to have gotten lost over the past decades. It’s been a few months since I’ve beaten the dead horse on fees. So, I guess it’s overdue.

$325 has been tossed around as a baseline for repossession fees for some time now. While some forwarders pay less, that is not to say that $325 is a good fee. Especially when it’s missing all of the other ancillary fees that used to come with it.

So for anyone who had a father or grandfather that used to talk about how a candy bar only cost a nickel when they were a kid, here’s the repossession fee equivalent.

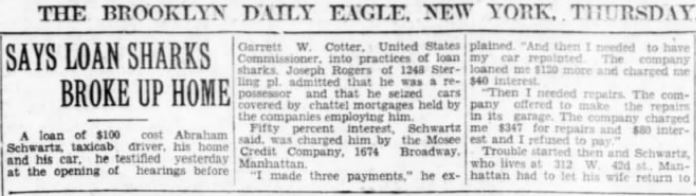

1926

The first known documented public outcry against the repossession process was editorialized. On November 13, 1926, “The Evening Independent” of Massillon, Ohio, reported that three men were held in custody by the local magistrates for being “Loan Sharks” and charged with demanding usurious interest rates. In these hearings, the first known testimony from an unnamed repossessor, states that he was being paid $25 per vehicle for repossessions.

$25 per vehicle = $420.92 – 2022

No insurance. No Trucks and probably no lot. This unknown wildcat agent was doing considerably well considering he likely had little or no overhead. Almost a century ago, they were making more for a recovery than most do now.

1949

In a Washington DC Evening Star article titled “We Stole 10,000 Cars“, NAAFA co-founder Ray Barnes, shared several “war stories” from the repossession field. At that time, he claimed to make $35 to $250 per recovery. $35 to $250 per recovery = $334.09 in 2022 to $3,340 in 2022 value

Again, no insurance and probably one truck used rarely. Just over $325 in value plus storage, property, transport and locksmithing fees on top of that.

Also in 1949

Charles Clark of National Auto Recovery Bureau (NARB) of Oakland, California from a March 1949, tell all posted in the Pitssburgh Press, stated; “His fee ranges from $10 to $500 depending on the amount of effort involved.”

$10 to $500 = $125.22 to $6,260.76

Once again, no insurance and probably one rarely used tow truck. $10 was probably the price of an in town voluntary. Of course, there were charges for storage, keys, delivery and positive resolution (Closing fees.)

1960

Jess B. Krug, a St. Louis agency owner and then President of the NFA, reported to the Miami Herald member in an article on the National Finance Adjusters meeting at the Deauville Hotel on

August 20th – $35 ($352.38 in 2022 currency) cars, $50 ($503.40) for light trucks and $75 ($755.10) for heavy trucks and trailers – August 21, 1960 -The Miami Herald – (Miami, Florida)

Once again, a currrent value north of $325 plus all of the otther fees. These fees were the association set fees and included $.08 cents a mile ($.81 in 2022 value.)

Note: The last three agency owners quoted were members of an association. Associations that provided guidance and uniformity in fees. This is an important detail that I’ll get back to shortly.

1965

In 1972, veteran repo man from Colorado, Bill “The Cadillac Repo Man” Bowser published “The Man Came and Took it Away.”

In this autobiography of his 20 years in the industry he stated that in 1965, he was making $15 a repossession. $15 a repossession = $141.91

Bill owned a small local agency and was in fierce and sometimes violent conflict with his local competitor who used to flaunt Bill’s young criminal record against him to competitors and he claimed would slash tires and damage vehicles to keep his agents from the field. In the book, he stated that “he would raise his fees but was afraid that his competition would benefit from it.”

This fear is one that I very aware of coming into the business in 1989. Agents were known for slashing each other’s tires and cutting fluid hoses on slide in tow units for similar reasons.

At this time, Bill was not a member of an asociation and merely took whatever fees the local lenders would pay. But he also made icome on strorage, keys and everything else.

1972

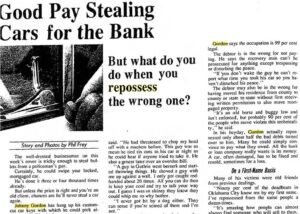

In an April 9, 1972, article on the repossession industry published in the Daily Oklahoman, fifty-one-year-old, Johnny Gordon claimed to have been repossessing cars since 1945 and in 1972 claimed to be making -$12.50 a recovery. ($89.12 in 2022) in town and $25 ($178.24) for out of town plus mileage.

Neither Bill Bowser nor Johnny Gordon are known to have ever been, at least during these years, association members. This limited their marketing reach for client volume and created a very cut throat market for assignments that clearly suppressed their fees.

1978

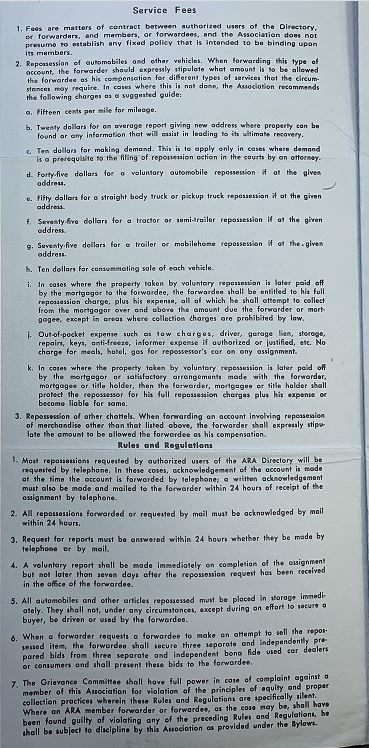

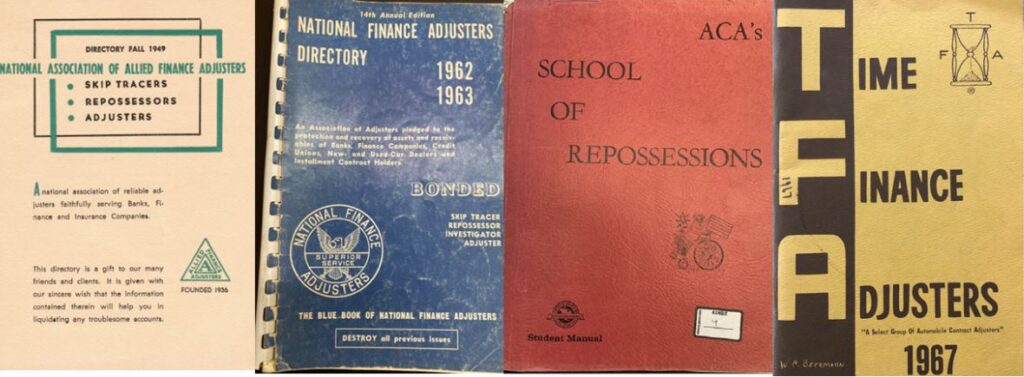

Being in an association before 1980, there were suggested fees posted in the association directories. These directories were issued nationwide to large lists of lenders. The associations themselves published what the “suggested fees” were so that clients knew what to expect and agency owners maintained some control over their incomes.

Being in an association before 1980, there were suggested fees posted in the association directories. These directories were issued nationwide to large lists of lenders. The associations themselves published what the “suggested fees” were so that clients knew what to expect and agency owners maintained some control over their incomes.

ARA Service Fees Schedule

Fifteen cents per mile. (Don’t laugh, that’s $0.69 in 2022 value)

$20 for developing a new address that results in a recovery. ($91.41)

$10 for making a demand for collateral. ($45.71)

$45 for a Voluntary Repossession ($205.68)

$50 for a truck repossession ($228.54)

$75 for a tractor trailer ($342.81)

$10 for selling repossessed collateral. ($45.71)

While these fees were “suggested”, there were consequences for failing to abide by them.

Keeping Order

Keeping Order

Long before the internet, word of mouth and local marketing were the primary way that agencies developed business. That is, unless they could get into one of the then four associations; the AFA, NFA, TFA or the ARA,

Being a members of one of these associations granted you a place in “The Book” or directories as they were known. These were mailed out cross country and provided that agency owner a secured territory in it. This territorial exclusivity gave them access to lenders their local competition could never have access to.

Up until the 1980’s the repossession associations flourished. Annual conventions were held in places as far away as Hawaii and the Bahamas. Owners made enough money to divest their profits into everything from real estate to auto franchises.

Up until the 1980’s the repossession associations flourished. Annual conventions were held in places as far away as Hawaii and the Bahamas. Owners made enough money to divest their profits into everything from real estate to auto franchises.

They controlled the fees and the lenders didn’t bat an eye in paying them. The repossession fee was only the vehicle for other fees. Fees, like storage, keys and transport that had very little overhead involved or at least cover most of it.

Of course, the association kept strict control over the “suggested fees.”

Anyone known to breech these covenants was subject to the potential of a typo on their phone numbers or addresses that could rob them of any value to their membership.

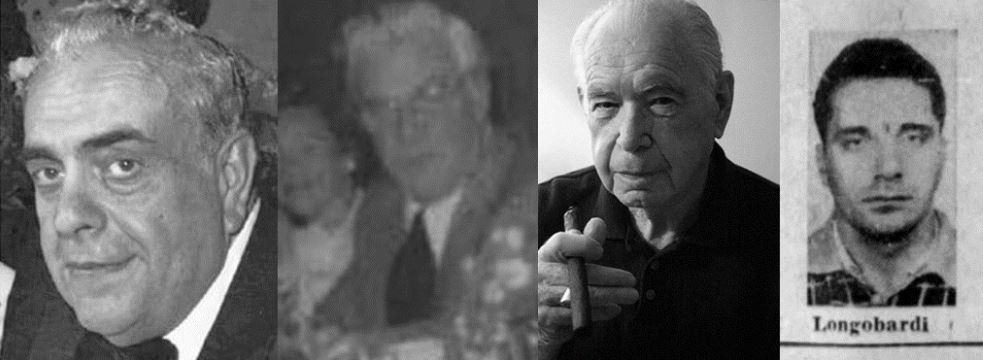

And if the threat of losing the value of your place in “the book” wasn’t enough, the association leaders were very influential amongst the member base. Failure to comply with the “suggested fee” program could run you afoul with men such as the NFA’s Frank Mauro of Chicago, a sharp dressed man of six-foot one and 300 pounds or his best friend from Detroit, Art Lamoureux. Both rumored part owners of “The Sands” Hotel/Casino in Las Vegas in the 1960’s.

And in the TFA, of course there was “The Godfather” Harvey Altes, whose influence spanned across all four associations. And by his side was Carmine “Chuck” Longobardi, an often coarse and vulgar man known to keep a .38 revolver strapped to his ankle and carried a supply of gas cans and road flares kept in the trunk of his car.

This was a world absent of cell phones and cameras everywhere. When these men suggested something, you listened.

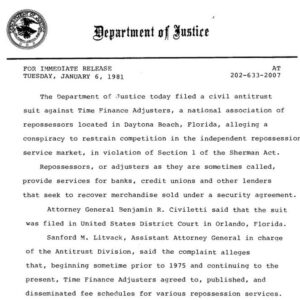

1981

Enter the DOJ – Stemming from a New Mexico agency owner disgruntled by his inability to join any association, he filed an anti-trust lawsuit against the AFA. This caught attention of the Department of Justice, who on January 5, 1981, filed a charges against all of the national associations for conspiracy to fix prices, restrict territories and limit membership in violation of the Sherman Act, 15 US.

All of the associations paid fines and entered into agreements without an admission of guilt. The agreed upon terms of the settlements were sweeping. No longer could they discuss fees, let alone mandate or “suggest” them. This is why you never hear the national associations speak very loudly about fees. A red line was drawn that they, to this day, dare not cross.

The race to the bottom had begun.

1989

This is when I entered the business as a field adjuster for A-1 Adjustment Service, first out of Sacramento,

CA under Steve Dove and then back home in Santa Clara, CA under Terry Carter. At this time, the average cost of a repossession was $325, a current value of $781.08, plus storage, keys,

delivery, personal property. Of course, we also received closing fees of $75, a current value of $180.25. Soon before this, agencies began buying their own insurance, which in earlier years, they charged the lenders for. Even by this period, that had become a lender requirement and no one charged the lenders for.

1993-1997

I’d worn weary of the field and took a back-office skip tracing job with National Auto Recovery Bureau of San Jose, CA (NARB) under longtime NFA

member A.M. “Bud” Krohn. NARB was previously owned by Charles Clark mentioned above until Bud bought it in the mid-seventies.

Bud, like most every legitimate agency owner did not work contingent. “Contingent work is for suckers.” He used to say. I finished my time in the repossession industry here as a manager and at that time, the average cost of a repossession was still $325 a current value of $603.45, plus storage, keys, delivery, personal property. Of course, we also received closing fees of $75.

As you can see, the value of $325 dropped in spending power almost $180 in that short span of time.

Even then, Bud saw the writing on the wall and complained that the lenders wanted everything for free and was getting ready to leave the business which he finally did about 2004.

I moved on into collections and eventually the credit union world and barely looked at what was going on in the industry for many years. I wanted nothing more to do with being in the business and was content watching it from a safe distance. I never balked at a reasonable increase in repo fees above $325 nor the ancillary fees, but I was unaware of what had been going on in my absence.

2010

Years rolled by when I started CUCollector. I had never intended it to be about repossessions but quickly found myself leaning into it. Especially after learning how prevalent contingency had become and how the forwarding industry had driven a wedge between the agencies, associations and the lenders.

Harvey, Frank, Art and Chuck had all passed away or walked away from the industry. There was no one left to intimidate the association members from drinking from the Guyana Grape flavored cyanide trough of forwarding. And out of a lack of unity or cohesive concerted effort to fight for reasonable fee increases, there were none.

At this time, agencies were barely making $325 a repo, but at least they still got paid some storage and personal property fees. But unfortunately, in 2010, a $325 repo fee had the value of $184 compared to when I entered the business in 1989.

And so, my rantings began.

2022

Twelve years have rolled by since I started my almost monthly tirades and the problem has only gotten worse. And so, my rantings persist.

It’s maddening. I don’t have a dog in this hunt, but I do have an opinion. But opinions are like… well, you know.

Show me one thing in this world that costs the same now as it did thirty years ago. I dare you!

In 1989 $325 was once a reasonable value for a repossession. But that was thirty years ago, Thirty years!

Unfortunately, as usual, everyone will read this and agree, but collectively, for the most, put up with it. It is utterly bizarre.

But for those of you who fight for your worth and stand united in doing so, I salute you and only wish that there were more like you. Because that is the only way to turn this around, to right this wrong. And the only way to shut me up.

And those of you standing on the sidelines hoping that by some miracle the lenders will just out of the goodness of their hearts throw you a bone, don’t hold your breathes. That’s just not how it works, anywhere or for anything.

Like I’ve said a thousand times before. The lenders will never pay more than they absolutely have to in order to get the job done. And it is YOUR jobs as business owners to set that limit, not theirs!

Stand together, know your worth and fight for it. You deserve better.

Kevin

Much of this is from my Book “Repo Blood” A Century of Auto Repossession History. Order soon to assure delivery before Christmas!

Facebook Comments