EDITORIAL

GM Financial has been paying $25 fuel surcharges, which is low for a bank that large, but it’s better than nothing. They’ve also been paying a $100 processing fee on redeemed repossessions, which is okay considering how much personal property that agencies have to return to borrowers for free. So now, GM Financial has decided to do away with the surcharge and increase their $400 repossession fee to $475 and that’s great, except they cancelled the $100 redemption processing fee. A total bait and switch.

Gee, thanks, I guess you should say. Now they’re willing to pay you what they’ve been paying forwarders for the past ten years. They must think the industry is as dumb as a box of rocks.

If you’re an agency that is fortunate enough to have a direct assignment contract with GM Financial, you were probably taken back by this. According to several agency owners, they’d pushed back on this and were told that they could simply take it or leave it.

The deadline for signing this has since come and gone. I’m sure some have signed and believe that by virtue of the fact that It solidifies the surcharge into the fee, it’s a positive step.

But if you look at it with some historical perspective, you can see that they have been progressively paying less for a repossession year over year for decades. A $75 increase would have been nice a decade ago, but with 8.6% inflation and average national gas prices at record highs, this is a bit of a joke.

Histocial Perspective

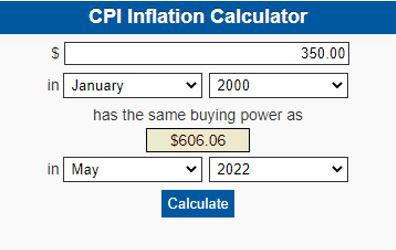

Keep in mind, in the 90’s, GMAC, use to pay $350 a repo, non-contingent the current equivalent of $606.06 according to the Bureau of Labor Statistics. Yes, that number keeps moving up, and it always will. Back in 2017, I argued that it should be $500 and people scoffed.

Keep in mind, in the 90’s, GMAC, use to pay $350 a repo, non-contingent the current equivalent of $606.06 according to the Bureau of Labor Statistics. Yes, that number keeps moving up, and it always will. Back in 2017, I argued that it should be $500 and people scoffed.

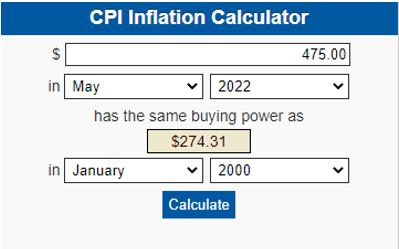

Now, even at $475, they are offering to pay you the 2000 equivalent of $274.31. And of course, that’s contingent and now, without reinstatement handling fees or any fees whatsoever to the borrower.

Now, even at $475, they are offering to pay you the 2000 equivalent of $274.31. And of course, that’s contingent and now, without reinstatement handling fees or any fees whatsoever to the borrower.

In the course of research for “Repo Blood – A Century of Auto Repossession History” I have found quotes of repossession fees going all the way back to the 1920s. Almost without exception, when adjusted for inflation, they have been $350. And that is not counting close fees, storage and every other fee now done away with for the lenders benefit.

And so now, with all of the technological requirements of the business and the addition of insurance, which lenders used to cover themselves, this is a good fee? It’s progress, but it’s a long way from fair.

Lipstick on a Pig

No hard feelings for the vendor relations reps whose jobs it is to try to put lipstick on this pig. Afterall, these fees are being dictated from above where the constant pressure to keep fees down is never ending. Its just the nature of the beast.

These reps are friendly, but this is the “repossession business” and not the “friend business.” The bean counters in their finance department and the vendor management department have been getting fat bonuses on cost reductions for years. Bonuses based on keeping you from earning your worth.

For those of you who chose not to accept this contract, good for you. You could see the bait and switch that this represented and are probably feeling a little insulted by it. For anyone on the fence, I merely suggest that you know your worth and demand to get paid for it. This is the mentality that that every agency must adopt and practice on a daily basis in order to survive these times.

Week after week, and month after month, I hear from agency owners who are closing down. They couldn’t outrun the low net income with volume.

In the meanwhile, GM Financial and most lender’s profits climb, year after year. Some of that is thanks to everyone who says “Yes” to substandard fees. This has been going on for years now and the industry is dying a slow death of its own making. Death by decisions, bad ones.

Know your worth and demand it. For your staff, your family, your business and for yourself. [ays_poll id=12]

Fight for Fair Fees!

Kevin

Related Articles:

Contingency – The forgotten battle

An Agency Letter to Capital One – Golf? We’re just trying to survive!

Florida, the beginning of the “Great Repo Resignation”?

From the ARA President – Putting ourselves out of business

Alliance of Illinois Repossessors enforcing fuel surcharges

Repo Forwarding – the road to nowhere

Eagles United – Don’t pretend you didn’t hear us

Facebook Comments