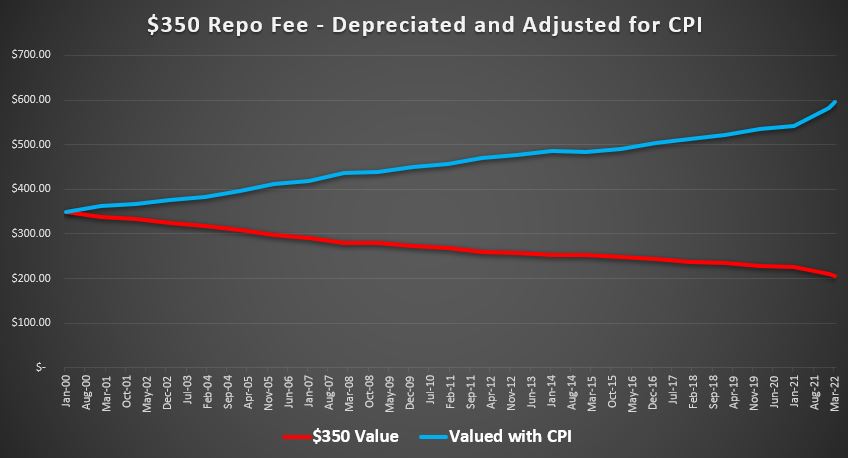

$350 in 2000 = $205.49 Today

EDITORIAL

Yes, it’s that time again. Time for my monthly truncheoning of how bad the repossession industry has gotten, and it’s never been worse.

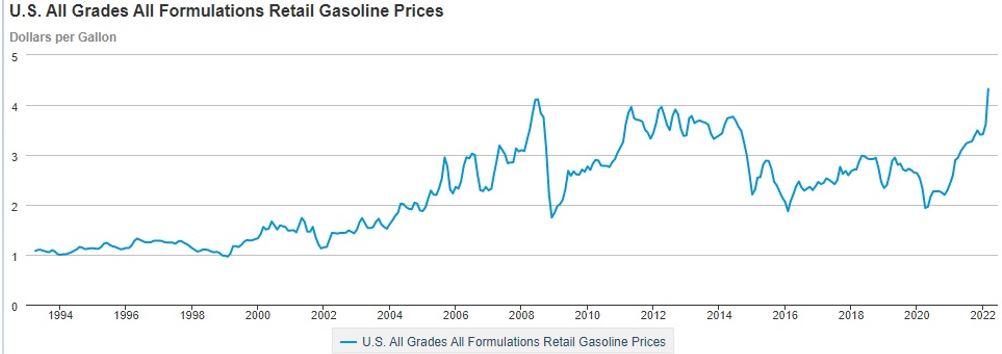

FUEL

Unless you’ve been living in a cave, you’ve clearly noticed fuel prices have skyrocketed to an all time. In late March, The US Energy Information Administration (EIA) reported that the national price for all grades fuel was $4.32. Here in California, it’s been holding steady at $5.73. This is the highest that the EIA has on record. Obviously, this has consequences on, well, everything.

INFLATION

Of those consequences, the annual rate of inflation has reached a 40 year high of 8.5%. Anyone over the age of 50 can remember what America looked like the last time inflation was like when it was that high. It was the second recession of the late 1970’s under President Jimmy Carter. For those of you too young, get ready for a long rough ride of shortages, high unemployment and high interest rates and high loan delinquency rates.

like when it was that high. It was the second recession of the late 1970’s under President Jimmy Carter. For those of you too young, get ready for a long rough ride of shortages, high unemployment and high interest rates and high loan delinquency rates.

RECESSION

For America, a recession is coming and don’t let anyone try to tell you otherwise, it’s being felt everywhere and it’s only just begun. Great for the repossession industry, right? WRONG!

The repossession industry has been in a form of recession for decades now.

Traditionally, a recession is defined as; a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

WAGE INFLATION

For over twenty years, the repossession industry has been stuck in what is known as a form of “Wage Inflation.” Wage inflation is what happens when the workplace incomes rise at a slower rate than inflation. Unless anyone in the repossession industry has seen an 8.5% increase in gross fee income, they have been mired in this for the last year. Truth be told, with repossession fees steady at $350 since at least the year 2000, it is precisely this form of inflation that is killing it.

THE CPI

With adjustments for the consumer price index (CPI), in as recent as January 2022, a $350 repo fee was worth $210.14 in year 2000 income. Fast forward to March and it’s dropped to $205.49. That’s a $4.65 drop in just two months.

Had the industry kept pace with the CPI over that same period of time, a repossession fee would be $596.13 and I’m not even going to get into the ancillary fee situation.

THE ASSOCIATIONS

The national associations tend to get a bad rap when it comes to standing up for higher fees, but this is not their faults. Their hands are essentially tied by a consent decree with the Department of Justice over a 1980 federal price fixing lawsuit that prohibits them from making any attempt to set standards or establish fair fees. Prior to then, they did a fine job of keeping the industry profitable. “Justice” is hardly what I would call this now that the tables are turned and it is the big banks who have been fixing the prices for the last 20 years or more.

The state level associations have actually been doing a good job, but even they have limitations.

This industry is just too fractured and loaded with a never-ending supply of bottom feeder agencies who enter the market thinking that they can undercut the local competitors fees and steal the market. As was written about in “The Man Came and Took it Away” by Bill Bowser in 1971, this “fear of missing out” is the way it has always been. The only way that it was suppressed was by a fist, a gun, a can of gas and a road flare or a rash of slashed tires. We live in an era of security cameras and smart phones and the tactics of old won’t work. You’re on your own folks.

Only you can stand up for your company and your survival. Only you can set that price and it had better be one that you can survive on because you are all in for a long ride that no volume of $350 repossession fees will pay for.

Stand up for yourself. Fight for your business and fight for your family and employees.

Fight for fair fees!

Kevin Armstrong

Editor

Related Articles:

Florida, the beginning of the “Great Repo Resignation”?

From the ARA President – Putting ourselves out of business

Alliance of Illinois Repossessors enforcing fuel surcharges

Repo Forwarding – the road to nowhere

Eagles United – Don’t pretend you didn’t hear us

Facebook Comments