Surcharges – band-aids on bullet holes

EDITORIAL

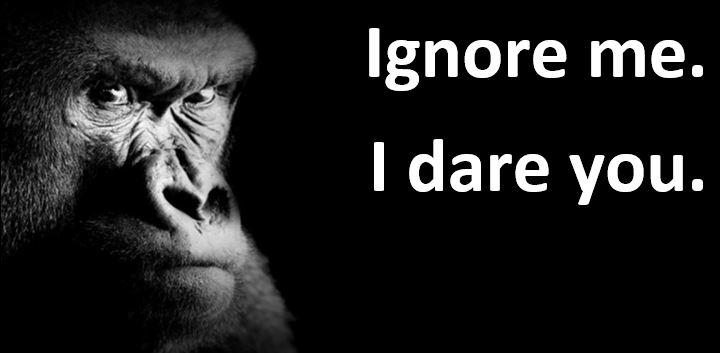

Last week, with the average national gas prices at $4.30, most everyone had something to say about it and more important, people were actually addressing it. From PAR to Primeritus, to the AFA, ARA, Eagle XX Group and the AIR, everyone made a statement or presented a course of action. While addressing the issue of fuel expenses is admirable progress, aren’t fuel surcharges a bit of a band-aid on a bullet hole solution compared to the 800-pound gorilla in the room?

Jump back to 2020 when Covid was raging and everyone was demanding Covid-19 handling surcharges. Begrudgingly, many of the nation’s lenders and forwarders eventually succumbed to this reasonable request. But as the pandemic ran its course, these surcharges began to fizzle. Why, because these surcharges were deemed merely temporary and everything pretty much went back to business as usual.

Now, in response to record inflation and skyrocketing fuel prices, everyone is back to talking about surcharges.

The AIR

The AIR

Perhaps one of the most dramatic announcements of the week was the announcement made by the Alliance of Illinois Repossessors. That agency owners representing an estimated 80% of all assignment recoveries in the state of Illinois would band together and make a united demand for a $25 fuel surcharge, is indeed dramatic.

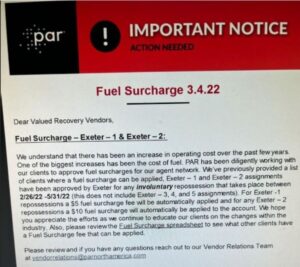

PAR

Last week, PAR announced that Exeter Financial would pay an additional $5 to $10 fuel surcharge on type 1 and 2 assignments pending recovery. While it’s nice that they are at least having that conversation, the figures offered are almost insulting. Regardless, give credit where credit is due regardless of the net effect.

But in all honesty, they aren’t doing out of the goodness of their hearts. This is a clear response to a poor assignment acceptance rate by their agent network.

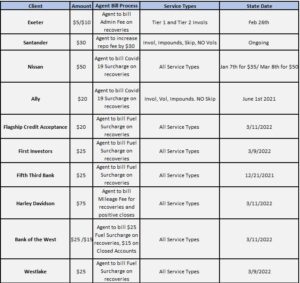

Primeritus

And of course, Primeritus joined in with a menu of different fuel surcharge options from various lenders that range from $5 to $75. It is progress and I’m not going to knock it. They see the writing on the wall and they are addressing it.

Eagle Group XX

Let me start with saying that if you’ve pissed off the Eagle Group XX, you’ve really screwed up. These are some of the most professional, patient and direct men and women in the repossession industry. So for them to come out with an open letter to lenders and forwarders like they did last week, things have clearly reached a breaking point.

It was the forwarders and lenders own faults. To tell agency owners that “You are the only one asking for an increase” or “No one else is requesting an increase” is pretty insulting. To pretend that they are being unreasonable or that there is no bigger problem is an insult to the intelligence of anyone with a heartbeat and half a brain.

So, in response, they penned their editorial and official proclamation, Eagles United – Don’t pretend you didn’t hear us. In it they published their formal notice of these demands. Coast to coast, representing just about every state and multiple agencies in many states, dozens of agency owners put their name on the stage in demanding fee increases. In fact, after posting, even more agencies requested to be added to it.

While for legal reasons of avoiding claims of price fixing or collusion, they sidestepped any specific fee demands. Regardless, fuel was a consideration, but not the only one.

The AFA

The AFA

And of course, there was the response by the Allied Finance Adjusters in Wade Argo’s editorial “Repo Forwarding – the road to nowhere.” While discussing the fuel situation, Wade spent a much greater amount of attention to the flaws of the forwarding model itself. While he made no mention of fuel surcharges, his editorial seemed to recognize the true root of the problem, the forwarding model’s effect of suppressing fees on the behalf of the lenders.

The ARA

On March 10, the American Recovery Association posted their response to the issue which we republished earlier this week titled; Putting ourselves out of business. Dave Kennedy, with the help of probably the industries best data analyst, Jeremy Cross, really drove home some of the statistical facts that the industry faces, and that is that fuel and truck costs. Dave focused some of his ire upon the never-ending parade of compliance programs and software expenses that keep sapping away at profitability.

The CPI

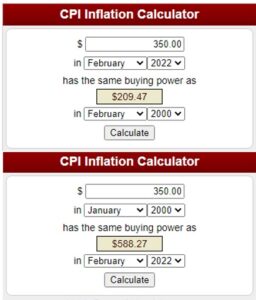

Yes, I’m going to beat the dead horse of fees and the Consumer Price Index again. Why, because with all the short-term discussion of surcharges, the 800-pound gorilla in the room demands its attention.

Back in 2017, I wrote about the $500 repo fee. Well, fast forward to last January, and I wrote about the $600 fee. These are what fees would look like if repossession agencies enforced their own fees based upon the Consumer Price Index application of a year 2000 fee of $350.

A $350 fee in the year 2000 would now be worth $588.27 had annual CPI increases been applied. Instead, it is still $350 and that is a $350 fee with the year 2000 spending power of $209.47. And the gap between these numbers keeps growing, month by month and year by year.

Last January it was worth $212.56. The fall continues and I’m not even going to get into the ancillary fee situation. In a nutshell, a short-term fuel surcharge will not make up for this. Unless the root cause of the issue is addressed, the industry will continue its slow fall into oblivion.

I’ll dumb this down to a Kamala Harris level; Most assignments pay about $350 contingent, just as they did in 2000. $350 no longer holds the spending power that it did in 2000. The industry has been losing profitability by the day ever since, and, as Kamala would say; that’s bad.

Inflation is at a 40 year high of 7.9%. Prices all around us are rising. Everything from food to durable goods respond to this in the form of service and price increases. These prices are unlikely to ever go down much further. You will soon be unable to exist in a year 2022 economy with a year 2000 income.

Surcharges are nice, but not a solution to the larger problem. The only solution is compensation in the form of sustainable fees and contract conditions.

Unfortunately, there’s always someone out there to carry water for the lenders thinking that they’ll make it up in volume. That is until it costs more to earn $350 than it’s worth. Then, they’ll close shop too.

Everyone I mentioned above has their heart in the right place. Most of them are at least partially right and are at least taking action, for which they deserve to be commended, including the forwarding industry. Unfortunately, the associations and forwarders don’t control the price point, the lenders do.

But here’s reality. The lenders will not pay one penny more than they have to until they can no longer obtain the services they need. It’s not personal, it’s just the nature of the beast. It’s business

If the repossession industry is to survive without hitting rock bottom, it will require a fight. And like in all fights, you sometimes make some sacrifices and get hit. But isn’t putting up a fight with a chance of survival better than being slowly beaten to death?

I don’t have a dog in this hunt. I’m just a writer, an observer who gives a damn. The fight is yours.

Kevin Armstrong

Editor

Facebook Comments