~You may find this article easier to understand than the field service company finds day to day operations, so if you think this is complicated, welcome to our world!~

The complexity of operating a field repossession service today cannot be overstated. The contracts are complex, the software is complex, and companies are forced to work out of multiple software systems (often on behalf of the client on one assignment). A simple issue of what a customer should or should not pay when redeeming their vehicle at a storage facility is likely to drive at least two people insane, result in 3 bad reviews on the internet, one complaint to the lien holder, one to the broker (forwarder of repossession services), and generate numerous documents, statement of facts, and compliance findings. This complaint could also result in expensive legal action for your company and the lien holder depending on how your team handled the situation.

Computers, cameras, and internet are in every wheel lift vehicle you have and your field team uses a multitude of systems: maps, portals, and several different apps to check if the account is still open before they “hook it” (the requirement being; to click “on hook” button within 15 minutes of checking the open status to ensure the recovery happens before the customer can make a payment electronically).

Your CSR’s work with 2 or more computer monitors on their desks and use multiple software systems with numerous tabs open at a given time while answering phone calls and managing chat sessions. Nothing around billing is easy either. From numerous software systems to the complexities of the different relationships clients have with lienholders, billing is now separated into “accounts receivable (pending and denied),” “receivables,” and “accounting” just to be able to track the various pieces associated with getting paid for services provided.

Relationships between company CSRs and clients are rare because of turnover at the company and client level. A Company’s reputation largely depends on the owner’s ability to “keep the vendor manager happy” and/or on their online reviews. However, a company’s reputation rarely has anything to do with how they manage their business. CSRs fielding complaints from customers at the lien holder level rarely understand the complexities of the relationships the field service company is forced to manage or the confusion it causes for the customer and the field service repossession company.

This results in customer concerns being viewed through a skewed filter. A filter ignorant or unaware of the complexities set in place by decisions made up stream of the field service company’s influence. A filter that fails to capture a single non-standardized or “stop gap” compliance measure inserted by the lien holder or any one of the many broker/forwarders muddling the industry. A filter dirtied by intentional or unintentional practices that turn consumer’s misfortune into profits for the lien holder and/or broker/forwarders. (“Repossession Obsession – What Questions Consumers, Legislators and Lawyers May Want to Start Asking” – a read for another day).

As you will see, complex problems can never be solved with “stop gap” measures. These issues can only be compounded by the logic the “stop gap” creates. Complex issues need real solutions that examine the root of the issue and insert true processes aimed at solving rather than managing the problem.

Removing unnecessary logic instead of insisting on more is much less costly and leads to clarity.

Take for example, the complexity of what a customer should pay at the lot when redeeming their vehicle and think about the variables. They are: CFPB Rulings and Opinions, State Laws, Lien Holder Contracts with the customer, Company Contracts with the Lien Holder, and Company Policies and Rates. If you add the broker in the mix you add the additional complexity of variables brought into the mix by the Broker’s Contract with the Lien Holder.

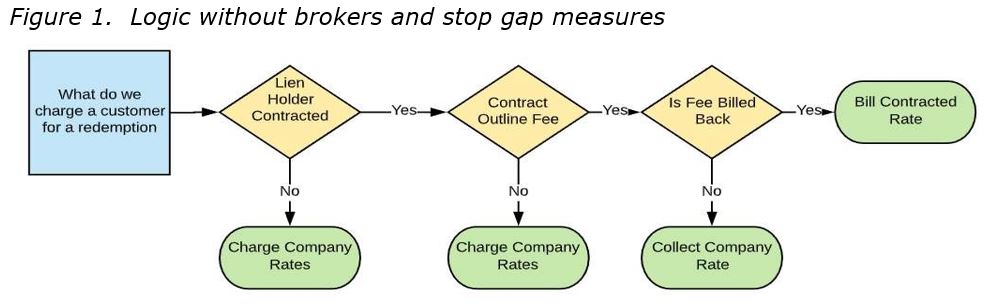

Before all the confusion of recent years it was simple (and yes, I am aware of the recent rulings by the court but stick with me as this is more about “stop gap compliance” than about billing property/redemption fees). What did your contract with the lien holder say about charging the customer for the redemption? If it said nothing, then you charged your standard fee. – See Figure 1

Your CSR has 3 decision points and thus has 3 chances for error (statistically inaccurate statement but simply true).

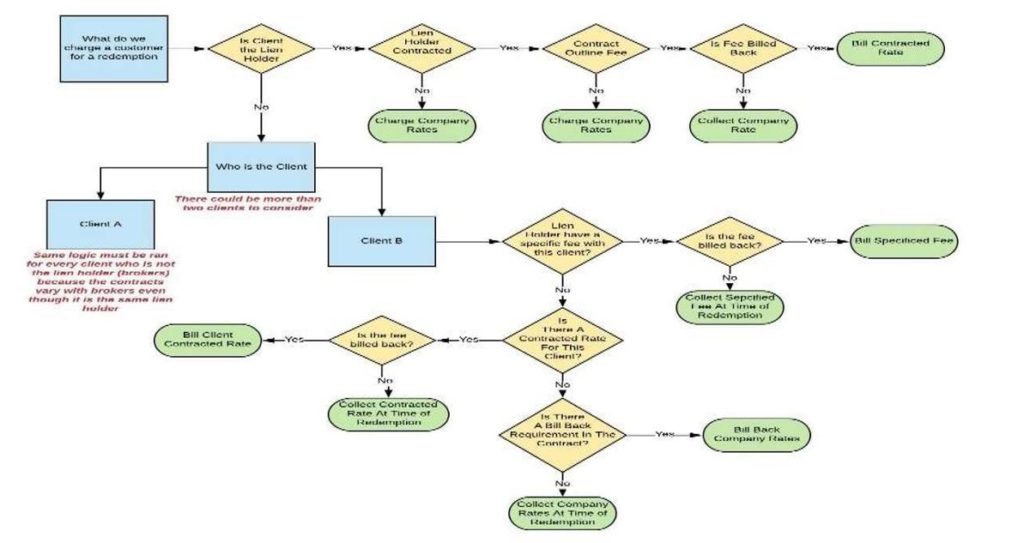

Notice how clean and visible this chart is? Figure 2 takes up more space and is much harder to read and understand. Perfect illustration of the complexities of what today’s repossession companies are dealing with compared to years past. Same metaphorical space, just much more to execute. This space could represent people, financials, or any resource. More to do without any additional resources.

Today what you do with a lien holder under your direct contract with them may differ from what you do for their customer if that assignment comes from broker/forwarder “A” and may even vary again if it comes from broker/forwarder “B.” – See Figure 2

Figure 2. Logic with brokers and a single stop gap “bill back” measure

Figure 2 – Depending on how your company manages their client list, the difference between Client A and Client B may be the difference in the system the client communicates with you. For example – Client Mother Broker may use Repo Software Pro and Best Repo Software to send accounts so your company may have a Client called Mother Broker – Repo Software Pro and a Client called Mother Broker – Best Repo Software. Your CSR may pick the incorrect system and evaluate the logic incorrectly based on a software system adding yet another chance for error.

All client’s processes differ so the first step in evaluating any process is client identification then determining if that client has a specific requirement for that lien holder. The CSR can then decide on the next steps based on the hundreds of “stop gap compliance” measures the client/lien holder may have injected into the relationship throughout the years. The older the relationship the more “stop gap compliance” that has likely been injected.

How many times to brokers/forwarders change these processes in a year? Do not get me started on digging through the hundreds of daily emails just to keep up with those.

For every yellow triangle inside the logic there is a chance for error. As you can see (See Figure 2), we tripled the number of chances for an error by adding the broker and a single “stop gap” measure of billing the fee back to the client. The errors compound themselves in either situation as the number of people involved in the process increases. Because the process is now evaluated at the broker/forwarder level initially, the number of people further increases the chances for error as the broker/forwarder CSR now has opportunity to make an error before the company CSR.

If the lien holder is contracting directly with the field service repossession company, it is only the people involved in the decision-making process on the lien holder side and the company side running the logic.

When the broker/forwarder is involved, who controls the narrative when a customer calls in a concern to the lien holder? Is there a benefit for the broker/forwarder to ensure the lien holder does not understand the responsibility the broker/forwarder may have had in causing the error?

This same type of logic can be applied to releasing collateral to auctions, requiring keys, cleaning of collateral, storing, releasing and disposing of personal property, assigning orders, compliance, service expectations of every type, and billing. The more brokers/forwarders the lien holder has relationships with the more difficult it is for the field service company. The field service company may work for many of the broker/forwarders and therefore have different expectations for the same lien holder depending on which broker/forwarder the field service company is handling the account for.

Add “partial” integrations into the industry software the field service company uses that changes how a company interacts with the software based on client demands and now you have even more complexity. The software now works differently for the field service company depending on the client relationship in the system. This effectively eliminates the opportunity for the field service company to implement any standard process for their company using the software. A “close,” for example may be handled differently depending on the integration or lack thereof.

Consumers are likely to get stuck in the cross hairs of logic madness when attempting to do something as simple retrieving their personal property. It causes stress having to call this lien holder, that broker, and then the field service repossession company only to be told “I am sorry, we do not have a release from your client so we cannot release your property to you.”

Why do lien holders not consider reducing their costs and consumer complaints by reducing the amount of logic they are injecting downstream? How many of their daily consumer complaints can be eliminated by the measuring how much the downstream logic accounted for generating the complaint? Are the companies used by brokers poorly performing companies? If the metrics used to measure a repossession company’s performance is failing to calculate the increased error rates a broker/forwarder injects into the process, how can lien holders who use broker/forwarders to administrate their assignments understand if the choice to use a broker/forwarder is actually beneficial? Do they care? Is there a benefit for them not to care?

The crisis of today’s repossession industry has as much to do with the failure of lien holders, regulators, and compliance agencies not taking the time to understand the harm caused by their own Manufactured Crisis of Stop Gap Measures than it does with field service repossession companies not having integrity toward compliance and service level expectations. This practice of control by expectation places increased stress, costs, and confusion on field service repossession companies. It increases the cost and understandability while decreasing the service level any company can provide to the consumer as well.

Lien holders will likely find themselves dealing with higher volumes of customer complaints as a result of their choices and failure to consider how using brokers/forwarders can impact the downstream performance of field service repossession companies. The cost of handling claims, settling suites, and answering to regulatory agencies is likely to be much higher with every “stop gap” injection, additional forwarder/broker expectation and/or every company inserted between the field service company and lien holder.

So, who benefits? Does anyone? What if you are the “savior and regulator” of compliance and service expectations? What if you can control the conversations that take place between the lien holder and field service repossession company? What if you command the narrative, the conversation, as well as inject your own stop gap measures into the equation to ensure your significance to the process? What if you are a “manager these Wild West Repo Companies” and their poor service by confusing compliance with service expectations. Do you create chances for additional error and then take a simple complaint and make a level 3 investigation out of it to ensure your relevance?

Any mid-stream business that is not necessary to a service adds complexity, confusion, and can harm anyone downstream of that business. This can be actual harm, or the lurk in the shadows kind of harm that is difficult at best to understand. It may show itself in inflating prices, decreasing profits, liable (which the field service company may never be aware of or have the opportunity to defend), and/or increased stop gap measures which inundate companies with un-necessary costs.

With the injection of these complexities, the lack of clarity, the additional costs for the administration of repossession assignments, one could make the argument that consumers suffer financially and especially from a service stand point when the choice is made to use a broker to manage the repossession assignment. The chance for error and thus liability also increases for the lien holder and field service company, not to mention the increase costs for handling the confusion and complaints.

Field Service Companies are left with very few options when dealing with consumers in today’s world. The best you can do is to reassure the customer, ensure you have calm and patient customer facing employees, and remember that the more control your client exerts in the process, the more liability exposure they may have. Ensure your team is articulate and well versed on how the industry works. Train them to assist the customer in reaching their lien holder for the answers rather than feeling like they must answer the question.

When all else fails, ensure your compliance manager understands how to assist the consumer in understanding how to resolve the issue and why the issue exists in the first place. By way of the customer is likely the only chance your business will have to show its knowledge, service, and professionalism to the lien holder.

Beware! The more complex the day to day operation is for the field service repossession company the fewer resources they can devote to watching business health items such as billables, receivables, and day to day accounting practices. It becomes much easier to miss a billable opportunity regarding property, mileage, or other ancillary fees as well as deadlines for invoicing period. These misses result in revenue opportunities for the client. It may be necessary for survival if you are a broker/forwarder and there may be even bigger reasons to ensure these denial opportunities exist if you are a company like “I Got Money Financial.” Be sure to see if you can follow the money with me next in “Repossession Obsession – What Questions Consumers, Legislators and Lawyers May Want to Start Asking”.

Wes Carico

Nostalgic Towing

Facebook Comments